Global Climate Survey - The fossil fuels dilemma

Investors face a dilemma in wanting to transition from fossil fuels while also needing to retain exposure to oil and gas companies. This contradiction was one of the takeaways of the Robeco Global Climate Survey, which included the aftermath of the energy crisis triggered in 2022.

まとめ

- Investors raise allocations to oil and gas to avoid index underperformance

- Divestments continue amid greater belief in expanding renewable energy

- Net-zero campaigns continue while use of engagement gains in importance

One of the few beneficiaries of the Russia-Ukraine war was the energy industry, as oil and gas prices hit record levels last year. Since the energy sector accounts for 5% of the two most frequently followed benchmarks, the MSCI World Index and the S&P 500, avoiding the fossil fuel behemoths would have caused equity portfolio underperformance in 2022.

Asset managers were subsequently forced to maintain or even increase their holdings in the energy giants, lest they broke their fiduciary duty to earn returns for clients, while also endeavoring to meet commitments to net-zero carbon emissions by 2050 at the same time.

But the good news is that the Ukraine crisis has increased investors’ belief that renewable energy, particularly from solar power and green hydrogen, can both end reliance on fossil fuels and their related emissions, while also improving energy security by reducing dependence on Russian gas.

And the longer-term trend committing to portfolio decarbonization remains undimmed, backed by a large increase in using active ownership techniques such as engagement to encourage oil and gas companies to switch to renewables.

“The energy crisis of 2022 showed in a very tangible way something we knew all along: that the road to net zero is non-linear, uneven and disruptive,” says Lucian Peppelenbos, Climate and Biodiversity Strategist at Robeco.

“The energy price hikes, in conjunction with post-Covid recovery and other factors, triggered a cost-of-living crisis that will need to be carefully managed in order to maintain popular support for the green transition.”

“It showed very clearly that we can’t phase out fossil fuels without reducing the demand for them. There needs to be a proper balance between supply and demand measures in order to sustain a successful transition to net zero that avoids excessive shortages and inflationary pressures.”

Fear of missing out…

The energy price spike throughout 2022 resulted in 38% of European investors admitting they have actually been allowing higher allocations to oil and gas companies in the short term to avoid underperformance. This rose to 48% in North America and 59% in the Asia-Pacific region. Higher exposure to fossil fuels were though viewed as being only temporary, while the energy crisis lasts.

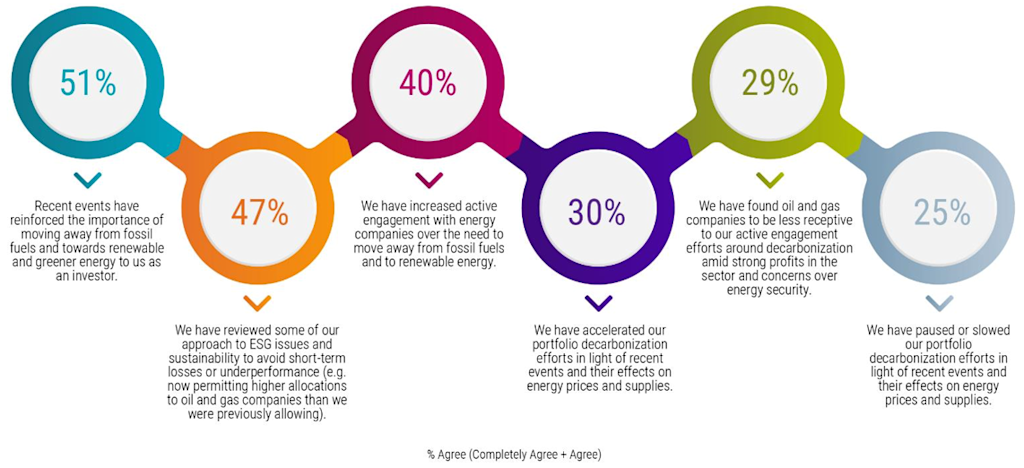

What, if any, impact have the increases seen in energy prices had on your organization’s approach to portfolio decarbonization so far?

Only 30% of the 300 global investors surveyed have accelerated their portfolio decarbonization efforts in the light of recent events, partly to avoid the higher energy-related costs, while 25% have paused or slowed it. Almost half of investors said they had reviewed some of their approaches to ESG to avoid short-term underperformance.

Investors did, however, feel they should make a bigger effort to use their positions as shareholders to change business models. Some 40% have increased engagement with oil and gas companies over the need to transition towards renewables, though 29% said they found them to be less responsive due to the strong profits they were making, and amid the wider need for energy security.

… but still divesting

The underlying trend remains that average divestment levels from carbon-intensive assets have increased, in line with net-zero pledges. Institutional investors have on average dumped 13% of high-carbon assets over the last 12 months, while wholesale investors using traditional model portfolios have divested an average of 27%. Both figures have risen from 7% for institutional and 8% for wholesale investors in 2022, perhaps as a result of playing catch-up on reducing exposures to thermal coal.

Understanding which firms are credibly transitioning is critical to identifying investment opportunities, engagement activity and divestment decisions. However, only 27% of investors said they have obtained a forward-looking view of what emissions pathway their investee companies are on. These forward-looking metrics will become more important in navigating the energy transition, as they provide a more accurate view of not only the supply of fossil fuels, but also the demand for them in sectors such as heavy industry, transport and buildings.

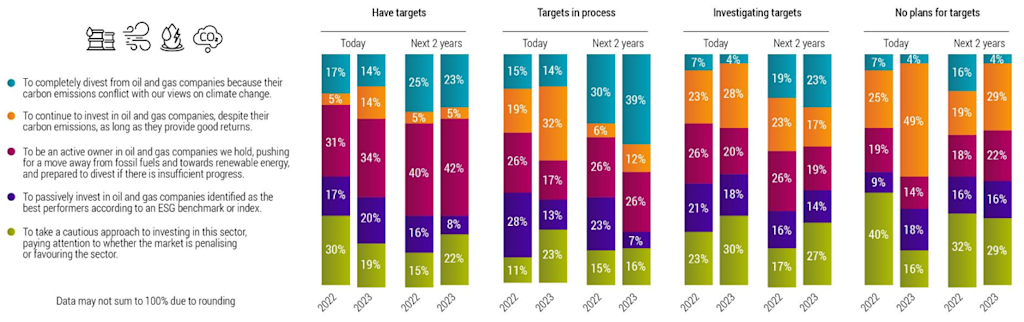

The biggest increase in divestments from oil and gas is set to come from investors who are in the process of committing to net-zero targets, rising from 14% divesting today to 39% planning to do so over the next two years. More than a quarter of this latter group are also set to become active owners of oil and gas companies, using engagement as a carrot for phasing out fossil fuels.

Which of the following is closest to your organization’s investment approach to investing in oil and gas companies using fossil fuels today, and in the next two years?

Investors with no net-zero plans were the most likely to continue investing in oil and gas companies, so long as they provide good returns today. But in the next two years, an increasing number said they will take a cautious approach to this sector and become an active owner, pushing for a move away from fossil fuels and towards renewable energy.

The sun shines out of solar

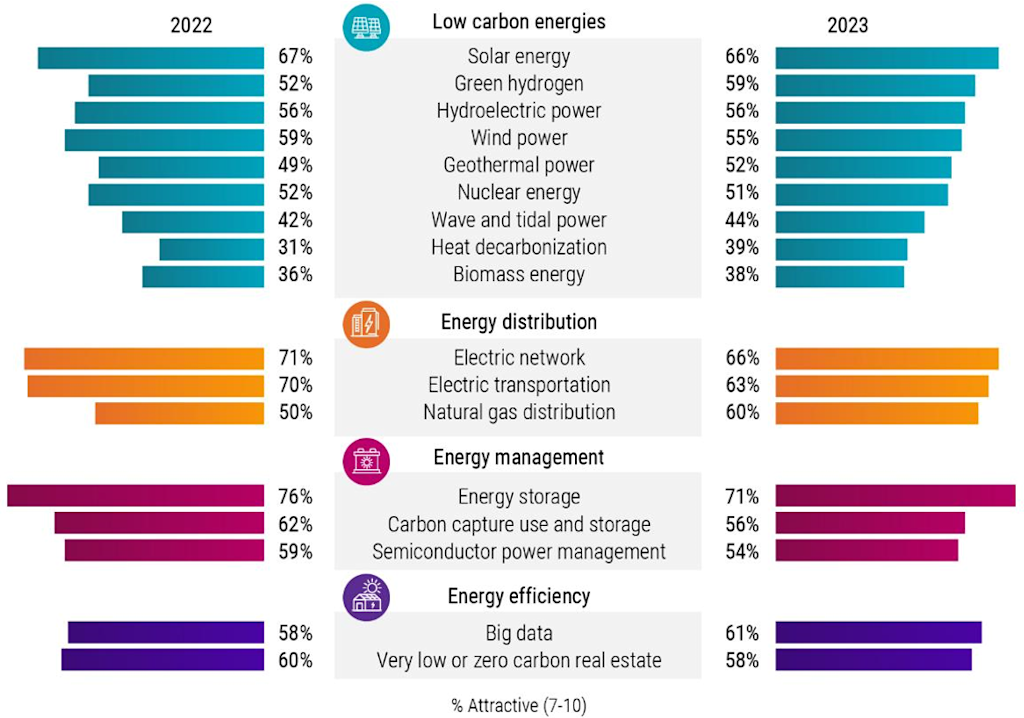

Some 51% of global investors said the Russia-Ukraine war has reinforced the importance of moving away from fossil fuels and towards renewable energy. This belief is higher in Europe (54%) and APAC (60%). Solar continues to be the preferred source of renewable energy by two-thirds of global investors, followed by green hydrogen, traditional hydroelectric power and wind power.

Green hydrogen, where the fuel is created using electrolysis powered by renewable energy, is particularly seen as a long-term solution for heavy transport including HGVs and shipping. Nuclear power remains popular among half of all investors, and interest in biomass energy has increased.

Investors are also looking to invest in energy networks, storage systems and efficiency rather than in energy production, the survey revealed. In the energy distribution sector, more investors are identifying opportunities in natural gas distribution. This is driven most by 69% of investors in North America, where production is set to reach record highs in 2023, and by 66% in APAC, where growth in demand is expected to be greatest over the next two decades. Only 46% of European investors viewed this area as a strong source of investment opportunitie.

Which of the following is closest to your organization’s investment approach to investing in oil and gas companies using fossil fuels today, and in the next two years?

Scope 1, 2 and 3

Meanwhile, the march towards net zero by 2050 requires portfolio decarbonization of about 7% per year, cutting Scope 1, 2 and 3 emissions. Scope 1 emissions are generated by the company; Scope 2 are caused by the energy needed to make the product. Scope 3 occurs across the lifetime of the product, such as the exhaust fumes from a car, and are much more difficult to measure.

While all industries generate Scope 1 and 2 emissions, the energy industry is responsible for a significantly high proportion of Scope 3. These primarily emanate from domestic gas appliances and petrol-driven transport. A house gas boiler or a family car, for example, will generate Scope 3 emissions for decades. Turning to electric appliances and cars is seen as the long-term solution.

A significant number of investors have now conducted portfolio carbon impact assessments and portfolio footprinting. Some 57% of European investors are doing this for Scope 1 and 52% for Scope 2, compared with 46% in North America for the former and 33% for the latter. However, only 20% of global investors are measuring the more important Scope 3 emissions.

Accessing data on Scope 3 remains difficult, given its complexity and voluntary disclosure requirements – but the International Sustainability Standards Board (ISSB) has announced plans to make Scope 3 disclosures mandatory in its new directive due later in 2023.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会