Having it both ways with long/short investing

Fears that the stock market rally is overdone, or that the US could be heading for an economic downturn, are rekindling interest in long/short investing.

まとめ

- S&P 500 valuations are stretched after nearly three years of double-digit gains

- Uncertainty over trade and tariffs worldwide has led to a less certain outlook

- Shorting offers a means of generating returns when share prices fall

Most equity investment strategies are long only, meaning they generate positive returns when the share prices of the companies held in the portfolio rise. Stock prices can go up for a number of reasons, but over the long term the most reliable driver of equity performance has been earnings: when a company’s profits rise, its share price tends to rise with it.

However, sometimes equity values can get ahead of earnings, and after a three-year rally in the S&P 500, some investors are beginning to wonder whether certain parts of the market are now overvalued. That’s especially true of the handful of giant tech firms known as the Magnificent Seven: Alphabet (Google), Amazon, Apple, Meta (Facebook), Microsoft, Nvidia and Tesla.

“For more than two years, US equity market performance has been driven by an unusually small number of high-flying tech stocks, the so-called Magnificent Seven,” says Josh Jones, Portfolio Manager of the Robeco Boston Partners Global Long/Short strategy.1 “One result of the S&P 500’s lopsided performance has been the concentration risk the market now carries.”

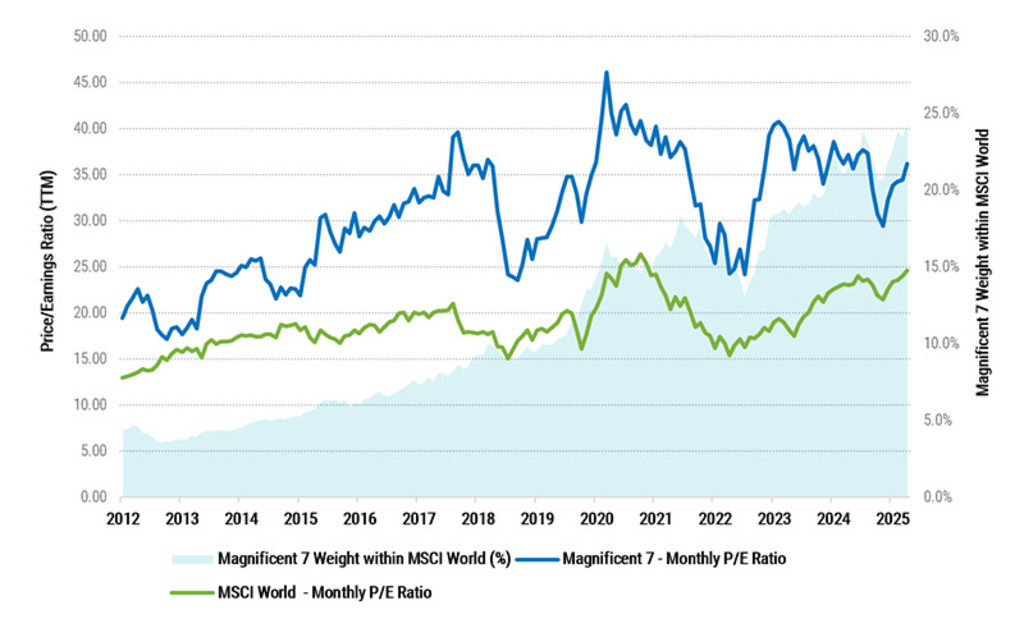

Figure 1: The price/earnings ratios of the Magnificent Seven are much higher than the MSCI World

Past performance is no guarantee of future results. The value of your investments may fluctuate. For illustrative purposes only. Source: Morningstar, 30 September 2025.

“This unusually high concentration risk means a downturn in the tech sector or disappointing earnings results from just a handful of companies would have severe implications for investors – particularly those tracking the S&P 500 or with growth-oriented positions.”

Just how significant are those concentration risks? Today, the Magnificent Seven make up almost 30% of the S&P 500 Index and more than half the Russell 1000 Growth Index. Nvidia recently became the world’s first USD 5 trillion company, and now has a market cap greater than the GDP of Germany.

These risks are also present for global investors. The US currently represents more than 70% of the MSCI World Index, while the Magnificent Seven make up a staggering 25% of the index. Much depends on whether the rally does last much longer.

“With large parts of the market looking fully valued, there isn’t a lot of opportunity in prices to absorb any bad news,” Jones says. “After more than two years of stellar performance in US equities, new cracks are beginning to show in the foundation that’s supported such a rally.”

“The job market in the US has been underwhelming, to say the least, with many companies reluctant to hire, and workers equally hesitant to seek new roles. Inflation, meanwhile, continues to hover around 3%, somewhat higher that the Fed’s stated 2% target.”

“And the housing market – with 30-year mortgage rates north of 6% – is suffering from a dearth of inventory. When taken as a whole, the overall environment in the US has begun to take on signs of the 1970s era of stagflation, the undaunted AI-fueled stock market rally notwithstanding.”

Investors would be wise to ask themselves now whether their portfolios are positioned to endure increased volatility in the markets

Uncertainty outside the US

Outside the US, broad economic conditions are equally uncertain. The European Central Bank cut rates four times in 2025 before pausing in October amid a slight uptick in inflation and steady growth. The central bankers indicated that current policy was appropriate, but that resuming an easing stance could prove necessary should conditions deteriorate.

“Investors would be wise to ask themselves now whether their portfolios are positioned to endure increased volatility in the markets,” Jones says.

Just because certain sectors – or even the market as a whole – appear overvalued, this doesn’t necessarily mean investors need to head for the sidelines, Jones says. The practice of shorting stocks can actually help investors make money when asset prices decline.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

How shorting works

Traditionally, shorting a stock involves borrowing it from a party that already owns it and then selling it on the open market, based on the belief that it can be repurchased later (and returned to its original owner) for less money. The difference between the sale price and the repurchase price represents a profit.

While the basic concept remains the same, in today’s market, there are other ways to achieve the same effect. Purchasing a ‘contract for difference’ (CFD) derivative allows an investor to gain the same exposure that a short sale would allow, without having to go through the actual process of borrowing and then selling a security.

Long/short strategies come in many different styles, but as a rule they can generate a positive return in any of three ways

Three ways to generate returns

When long and short positions are combined in a single portfolio, it creates a number of avenues for generating returns. “Long/short strategies come in many different styles, but as a rule they can generate a positive return in any of three ways,” Jones says.

“The long positions can appreciate; long positions can outperform short positions; and the proceeds from the short sales can be reinvested and earn a positive return themselves, such as by buying high-quality short-term Treasuries.”

How long/short investing works in practice depends on the particulars of the strategy. A market-neutral strategy, for example, tends to hold a 50/50 balance of long and short positions. Other strategies pursue what’s called a long-biased approach, meaning they tend to hold more long positions than short ones.

Different portfolio strategies

As far as how investors work a long/short strategy into their portfolio, there are any number of options. A multi-asset portfolio that typically might be split 60/40, with 60% in equities and 40% bonds, could allocate 10% to a long/short strategy, making the new portfolio either a 60/30/10 or 50/40/10 blend, depending on whether the reallocation comes from stocks or from bonds.

The approach ultimately depends on the investor appetite and perception about the market’s likely direction. But in the end, there’s no ‘wrong’ time to consider adding a long/short strategy to a diversified portfolio, Jones says.

“In just about any environment – even a strong bull market – there are usually opportunities to identify securities that appear overvalued and due for a price correction,” he says. “This is one key way that shorting stocks can add value over time.”

“With a myriad of varieties of long/short strategies available to investors, and multiple ways to implement long/short into a diversified portfolio, we believe investors concerned about the downside risk in equities should be asking how, not whether, to work long/short strategies into their long-term allocations.”

Footnote

1Past performance is no guarantee of future results. The value of your investments may fluctuate. For illustrative purposes only.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会