Who needs the Mag 7: A long tail of opportunity

Over the past five years, equity markets have become increasingly concentrated, with overall returns driven by a small group of mega-cap stocks. While investors cannot easily reduce the impact these companies have on market beta, they can prevent this concentration from dominating alpha.

まとめ

- The Magnificent Seven may shape the benchmark, but not necessarily outperformance

- Systematic, benchmark-aware investing keeps single stocks in check

- Our Global Developed Active Equities strategy uncovers alpha across the entire market

Our new article explains how Robeco’s benchmark-aware Active Equities approach is designed to keep alpha generation broad, ensuring performance is not overly influenced by just a handful of names.

As of 30 October 2025, the so-called Magnificent Seven stocks have ballooned to more than a quarter of the entire MSCI World index.1 The rise in concentration has been steady, but the narrative surrounding it has not, starting with the name.

Over the past decade, this small, evolving cohort of dominant companies has been rebranded repeatedly – from FANG, to FAANG, FAANG+, MAMAA, Magnificent Seven, and even BATMMAAN – each acronym attempting to capture the prevailing market story of the moment.2 And those stories have shifted just as often, from the platform-economy boom to the impact of quantitative easing, and from the Covid-driven digital acceleration to most recently the surge in AI enthusiasm. Yet despite the changing names and narratives, one constant has remained: the sheer scale of these firms and the outsized influence they continue to exert on global equity markets.

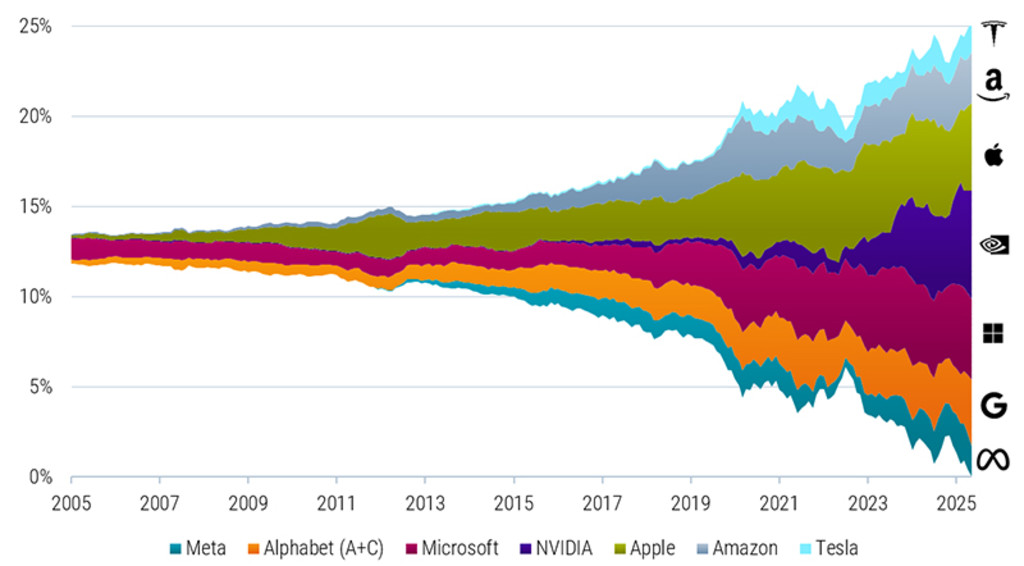

Such an acceleration is rarely seen outside of periods of high euphoria. In practical terms, fewer stocks now drive a greater share of total market absolute performance, with the effective N 3 decreasing from more than 300 in 2005 to just 84 in October 2025. Expressed differently: the market may contain thousands of listed companies, but the experience of owning the index has increasingly resembled owning just a few. The composition of major developed market indices, such as the MSCI World Index, is a stark reflection of the prevailing narrative, as depicted in Figure 1.

Figure 1 – Weight of Magnificent Seven stocks in the MSCI World Index

Source: Robeco, LSEG. The figure shows the cumulative weight of the Magnificent Seven stocks in global developed markets. The Magnificent Seven comprise Alphabet (A & C shares), Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla. Global developed markets are represented by the MSCI World Index. The sample period covers October 2005 to October 2025. For illustrative purposes only.

The challenge

It cannot be denied that these companies have reached a size where they are key drivers of market beta and will remain so, at least for the foreseeable future. The real question is whether your alpha must also be dictated by this same small group. When such a small group of stocks contributes so meaningfully to index returns, large relative positions in aggregate – either overweight or underweight – can become the primary drivers of whether a strategy outperforms or underperforms. For many active strategies it has concentrated both opportunity and risk in a way that challenges the foundations of diversification, with significant implications.

For investors positioning against current leaders in anticipation of mean reversion, the risk is that the momentum extends and persists longer than valuation models might suggest, leading to a persistent relative performance drag. Yet leaning heavily into the winners is equally problematic. Concentrated overweight positions can amplify portfolio risk and create uncomfortable exposure to a narrative that could shift quickly, especially if earnings momentum slows, policy environments change, or business models are disrupted. History shows that reversals often occur not gradually, but abruptly – and after prolonged periods where it was claimed, “This time is different”.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

A benchmark-aware quant solution

Robeco offers a third path: a systematic, benchmark-aware approach that spreads risk across the full equity universe. Rather than making big calls on the Magnificent Seven – or missing out on them entirely – the strategy takes many small under- and overweight positions, guided by diversified return signals and disciplined risk controls at the stock, sector, and country levels. This keeps any single exposure from overpowering the portfolio.

The result is a portfolio of hundreds of positions, each contributing modestly to active risk and return. Alpha is built through breadth, not concentrated bets; aiming to capture opportunities across the entire market rather than relying on the dominant index constituents of the moment.

Footnotes

1The Magnificent Seven refers to Alphabet (A and C shares), Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla.

2FANG initially comprised Facebook (now Meta), Amazon, Netflix, and Google (A and C shares, now Alphabet). FAANG added Apple, while FAANG+ referred to FAANG plus additional large-cap technology stocks such as Microsoft or Tesla (with definitions varying across sources). MAMAA consists of Meta, Apple, Microsoft, Amazon, and Alphabet. BATMMAAN extends the Magnificent Seven by adding Broadcom to this cohort.

3Effective N is calculated as the inverse of the Herfindahl-Hirschman Index (HHI) for portfolio weights, where HHI is the sum of the squared stock weights. For instance, in a portfolio of 100 stocks with equal weights, the effective N would be 100. In contrast, if a single stock dominated 99.9% of a 100-stock portfolio, the effective N would be closer to 1.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会