El extraño caso del doctor Equity y Mr. HY-de

Según Mathieu van Roon, inversor multiactivo, la divergencia inusual entre la rentabilidad esperada de la renta variable (RV) y la de bonos high yield (HY) podría favorecer a la renta variable de cara a 2026.

Resumen

- La renta variable y los bonos HY suelen afrontar un nivel similar de riesgo

- Se espera un sólido crecimiento de los beneficios en un contexto macroeconómico positivo

- Los bonos HY se enfrentan a un aumento de la tensión crediticia, un desequilibrio de la demanda y spreads muy reducidos

Van Roon considera que las diferentes facetas que presenta lo que suele ser la misma operación de disposición o aversión al riesgo encierra un paralelismo con la novela gótica de terror titulada El extraño caso del doctor Jekyll y Mr. Hyde. En esta historia decimonónica, el apacible doctor Jekyll se convierte en el monstruoso Mr. Hyde tras beber una poción. Ambos son el mismo hombre, pero con facetas muy diferentes.

«Ahora que nos acercamos al final del año y empezamos a poner la vista en 2026, observamos una clara bifurcación en los riesgos a la baja y al alza entre la renta variable y las clases de activos similares a esta», afirma Van Roon, Portfolio Manager de Robeco Investment Solutions.

«Mientras que normalmente esperamos que los bonos high yield y la renta variable conlleven la misma disposición o aversión al riesgo, y que ofrezcan rentabilidad en las mismas circunstancias, para 2026 tememos que el high yield pueda mostrar su faceta más terrible. Podríamos llamarlo El extraño caso del doctor Equities y Mr. HY-de. Por eso, hemos adoptado una posición a largo en renta variable y a corto en bonos high yield».

Van Roon afirma que la bifurcación radica en los factores macroeconómicos a los que se enfrenta cada clase de activos, que resultarán ser positivos para el doctor Equities y negativos para el pobre Mr. HY-de. «Por un lado, los mercados de renta variable de EE.UU. y Europa y las grandes compañías investment grade rebosan optimismo debido a los sólidos beneficios, recompras agresivas y las mejoras de productividad que promete la IA», afirma.

«Por otra parte, la economía real (especialmente en EE.UU.) y los emisores de bonos high yield apalancados están lastrados por el deterioro de los fundamentales y el aumento de los riesgos macroeconómicos».

«Esta dicotomía de perspectivas sobre las clases de activos es sorprendente, ya que los precios de los bonos high yield y de la renta variable suelen estar estrechamente correlacionados, pues ambos dependen de las expectativas positivas de crecimiento económico y empresarial».

«No obstante, en 2026, el entorno macroeconómico y técnico de los bonos high yield podría empeorar, mientras que la renta variable tiene más posibilidades de seguir subida a la ola de solidez de los beneficios y optimismo tecnológico, una situación que se asemeja a los últimos coletazos de la burbuja tecnológica de finales de la década de los 90».

Acceda a las perspectivas más recientes

Suscríbase a nuestro newsletter para recibir información actualizada sobre inversiones y análisis de expertos.

Crecimiento derivado del gasto y la IA

Se espera que las enormes economías de EE.UU. y Europa crezcan el año que viene, aunque por motivos diferentes. El crecimiento de Europa está relacionado con el gasto fiscal, incluido el destinado a defensa e infraestructuras, y con el ahorro de la demanda contenida. Las expectativas de crecimiento en EE.UU. se basan en el gasto de capital relacionado con la IA, así como de las posibles mejoras de productividad derivadas de esta, y en el consumo de las rentas altas. A ello contribuyen también las ayudas fiscales de la One Big Beautiful Bill Act y las grandes devoluciones de impuestos.

«No obstante, este crecimiento no está exento de tensiones», advierte Van Roon. «Se espera que los aranceles de Trump afecten al crecimiento de EE.UU. y/o a los beneficios de las compañías, y que la inflación persista. La Fed se encuentra en una posición difícil para seguir siendo demasiado restrictiva en un mercado laboral ya de por sí frágil o para iniciar un ciclo de flexibilización demasiado pronto, con lo que las expectativas de inflación podrían desanclarse».

«A esto hay que sumar la incertidumbre política respecto a las elecciones de mitad de mandato que se celebrarán en noviembre de 2026, y un posible cambio en la cúpula de la Fed cuando el mandato del presidente Jerome Powell llegue a su fin en mayo. También se espera que el mencionado auge de la IA siga reconfigurando el mercado laboral, ya que se necesitan menos personas para producir lo mismo».

«Estos acontecimientos pueden repercutir negativamente en el gasto de los consumidores. Por otra parte, el aumento de la eficacia incrementará el tiempo de ocio. Henry Ford aprovechó la eficiencia que conllevaban de las cadenas de montaje de automóviles para que los trabajadores disfrutaran del concepto de "fin de semana", pues creía que esto fomentaría la compra y el uso de automóviles».

Doctor Equities

En este contexto, Van Roon afirma que se prevé que la renta variable estadounidense disfrute de un sólido crecimiento de los beneficios de en torno al 14% en el caso del S&P 500, la mitad de los cuales procederán de sectores ajenos al tecnológico. Las compañías de la UE también saldrán ganando gracias al estímulo fiscal y a la extensión del crecimiento más allá de EE.UU. Se espera que el aumento de la productividad derivado de la IA se extienda a otros sectores, como el de la salud y el comercio minorista, lo cual respaldará el repunte.

«Las valoraciones actuales son altas, pero gracias a los sólidos fundamentales de las compañías (márgenes, flujos de caja y bajos niveles de apalancamiento), no se sitúan en los extremos», afirma Van Roon. «Por último, pero no menos importante, los flujos hacia la renta variable siguen siendo sólidos y estando diversificados, pues los inversores minoristas, pasivos e institucionales de todo el espectro siguen comprando valores».

Mr. HY-de

Esto contrasta claramente con el mercado de bonos high yield. «Mientras que las perspectivas de renta variable son bastante optimistas, las perspectivas de high yield son mucho más prudentes», afirma Van Roon. «En comparación con las grandes compañías investment grade, las de menor calificación, las más pequeñas y las más apalancadas se están enfrentando a condiciones de financiación más estrictas y al aumento de los tipos de interés de la refinanciación».

«Se espera que el panorama macroeconómico, con más incertidumbre política, arancelaria e inflacionaria y pérdidas de empleo relacionadas con la IA, debilite la demanda de los consumidores, de la que dependen este tipo de compañías».

«Por otra parte, se prevé un incremento de la oferta neta impulsado por las inversiones en bienes de capital relacionadas con la IA, las fusiones y adquisiciones, y la refinanciación, mientras que se considera poco probable que las inversiones sigan el ritmo de esta oferta. Las recientes preocupaciones sobre el aumento de la tensión en el ámbito del crédito privado podrían extenderse a los mercados públicos de high yield, especialmente si se dan perturbaciones sectoriales (como la revolución de la IA en el ámbito del software) que desencadenen un bucle de retroalimentación negativa, en el que los bonos con calificaciones más bajas, como B o CCC, son más vulnerables».

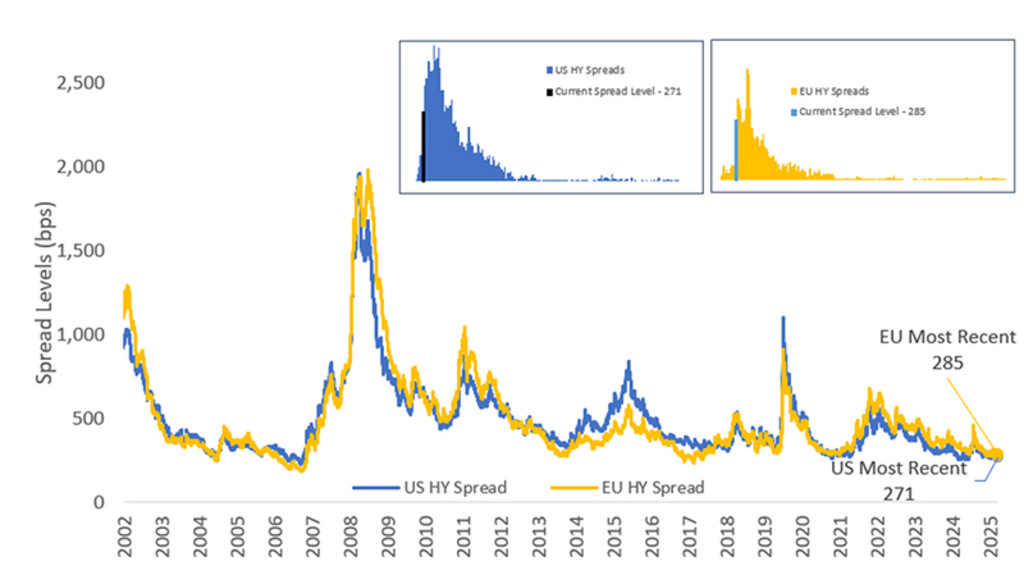

«Al igual que ocurre con la renta variable, las valoraciones actuales de los bonos high yield son elevadas, ya que los spreads rozan mínimos históricos». El siguiente gráfico ilustra este fenómeno.

Figura 1: Evolución histórica de los spreads de high yield

Fuente: Bloomberg, Robeco

Mejores perspectivas para la renta variable

«Los inversores no piden una gran compensación adicional por invertir en bonos high yield. La posibilidad de que los spreads se estrechen existe, pero es relativamente limitada. Por lo tanto, el atractivo de esta clase de activos reside principalmente en la gran rentabilidad vía carry que conlleva la tenencia de estos bonos».

En definitiva, Van Roon afirma que el equilibrio entre riesgo y rentabilidad es mucho más constructivo en el caso de la renta variable que de los bonos high yield. «La reducción de los spreads, el aumento de la oferta y el difícil entorno macroeconómico nos hacen ser más prudentes con respecto al high yield, pero esta clase de activos aún puede ofrecer atractivas rentabilidades vía carry en el futuro, especialmente en relación con otros sectores de renta fija», afirma.

«La renta variable se beneficiará del apoyo fiscal, del aumento de los beneficios derivado de la IA y de unos flujos sólidos, y tiene más potencial alcista. Por tanto, nos ponemos de parte del "doctor Equities"».