La calidad toma el mando: Perspectivas en Crédito HY para 2026

Nuestros gestores de carteras high yield desgranan las claves de sus perspectivas para 2026: posicionamiento, sectores seleccionados y emisores de calidad.

Resumen

- Los fundamentales de la deuda HY siguen sólidos, respaldados por el crecimiento y una política fiscal favorable

- Surgen oportunidades seleccionadas en los sectores financiero y químico, así como en partes del energético

- La IA no es tan determinante en emisión, pero cada vez influye más en la selección de emisores y en los sectores en los que impacta

A pesar de las persistentes tensiones geopolíticas, el High Yield ofreció rendimientos estables en 2025,1 de la mano de un crecimiento resistente y la estabilidad monetaria. En ese entorno, la estrategia HY de Robeco batió levemente al mercado,2 producto de su posicionamiento en "calidad superior". Ese sesgo nos favoreció, dada la mayor dispersión entre los créditos de mayor y menor calidad, así como tener una asignación sobreponderada en emisores europeos.

De cara a 2026 somos optimistas sobre esta clase de activos y prevemos que surjan nuevas oportunidades en sectores como financiero, químico y valores energéticos seleccionados. La deuda HY ofrece un atractivo potencial de rentabilidad frente a la IG, mientras que la elevada dispersión entre los mejores y peores emisores subraya la importancia de ser selectivo.

En nuestro último Q&A trimestral, los gestores de carteras HY Sander Bus (SB) y Christiaan Lever (CL) reflexionan sobre esta dinámica y analizan su significado para el año que tenemos por delante.

SB: "Los fundamentales empresariales parecen sólidos desde una perspectiva top-down. Las métricas de apalancamiento y flujo de caja no muestran grandes problemas, mientras que la política fiscal se mantiene muy favorable tanto en EE.UU. como en Europa, lo que contribuye a apuntalar el crecimiento económico".

"La otra cara de la moneda es el riesgo geopolítico. El contexto continúa impredecible, algo que no parece importarle demasiado al mercado. El año pasado, los spreads se ampliaron bruscamente en abril, aunque luego se redujesen rápidamente. Desde entonces, el mercado parece dispuesto a ver cada ampliación del spread como una oportunidad de compra".

"Los factores técnicos también han sido muy favorables. Las nuevas emisiones se han absorbido con facilidad el año pasado y las primeras semanas del presente. Las primas de las nuevas emisiones son bajas y, a veces, las operaciones incluso alcanzan los niveles del mercado secundario, haciendo posible que valores de mayor riesgo accedan al mercado. No obstante, esa situación podría cambiar. Los bajos costes de financiación y la elevada confianza pueden dar lugar a una mayor actividad de M&A, que suele financiarse con deuda, lo que aumentaría la oferta tanto en los mercados HY como IG. Además de eso, la inversión a gran escala relativa la a IA y a la construcción de centros de datos podría aumentar mucho la oferta en el mercado IG, con el consiguiente efecto en el high yield".

El diferencial frente al investment grade sigue en torno a los 200 pb en términos de TIR, de ahí que la clase de activo conserve su atractivo

"Así las cosas, nos mantenemos cerca de la beta del índice y seguimos siendo selectivos. En general, todos los años se producen episodios en los que los spreads se amplían al menos 100 pb. Esos momentos pueden suponer una buena oportunidad para aumentar el riesgo, aunque depende de cuál sea su detonante".

CL: “Estoy de acuerdo. Los mercados suelen reaccionar pasajeramente ante titulares o tuits, sobre todo de Trump, aunque pronto se olvidan de ellos. Los breves recortes se consideran inmediatamente como oportunidades de compra. El actual optimismo del mercado podría ser excesivo, aunque es difícil saber qué lo haría tropezar. El sólido aspecto técnico refuerza ese optimismo, ya que aún queda capital por desplegar".

"La dispersión en la deuda high yield aumentó hacia finales el año pasado, siendo superados los créditos de menor calidad, como los CCC, por los BB de mayor calidad. Nuestro sesgo de calidad propició que esa dinámica nos fuera favorable. Los spreads volvieron a comprimirse luego con el reajuste de rentabilidades de principios de enero, al buscar los inversores rendimientos sin mucho criterio entre valores de poca calidad".

SB: "A principios de año se volvieron a estrechar, pero lo normal es que la dispersión reaparezca con el tiempo"

¿Cuáles son sus expectativas de rentabilidad para este año?

CL: "Históricamente, las probabilidades de lograr un excedente de rentabilidad positivo durante el año son menores cuando los spreads del índice lo inician por debajo de 350 pb. El año pasado fue una excepción, y ahora partimos otra vez de niveles similares. El mayor riesgo puede ser que la inflación se reactive e influya en la política monetaria, sobre todo en EE.UU. Al mismo tiempo, la presión política sobre los bancos centrales podría mantener los tipos más bajos de lo que la inflación aconsejaría, con el consiguiente estimulo para determinados mercados finales, como el de vivienda o financiación al consumo."

"La deuda investment grade también se enfrenta a valoraciones ajustadas, con una renta variable cara y unos mercados emergentes con spreads comprimidos. En este contexto, el HY destaca como fuente de valor relativo. De hecho, algunos inversores institucionales han aumentado sus asignaciones estratégicas en HY. Esos sólidos flujos de entrada siguen respaldando esta clase de activos"

La IA fue uno de los temas principales de sus perspectivas de diciembre de 2025. ¿Cómo afecta específicamente la IA al HY?

SB: "La IA tiene menos impacto en la oferta HY que en la IG. En el universo HY sólo hay un puñado de emisores relativos a centros de datos. Sin embargo, la IA es muy relevante desde una perspectiva bottom-up y podría alterar sectores enteros. Para algunas empresas, la IA es una oportunidad de aumentar eficiencia y recortar costes; para otras, sobre todo algunas relacionadas con los servicios o el software, supone una seria amenaza. En nuestra selección de emisores, evaluamos específicamente si la IA supone una oportunidad o un riesgo para cada empresa. En ese sentido, la IA es muy relevante para el HY, aunque no como origen de nuevas emisiones".

High Yield Bonds DH USD

- performance ytd (31-1)

- 0,64%

- Performance 3y (31-1)

- 6,87%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Pago de dividendos (31-1)

- No

Fuera de la IA, ¿en qué sectores o tendencias concretas se fijan?

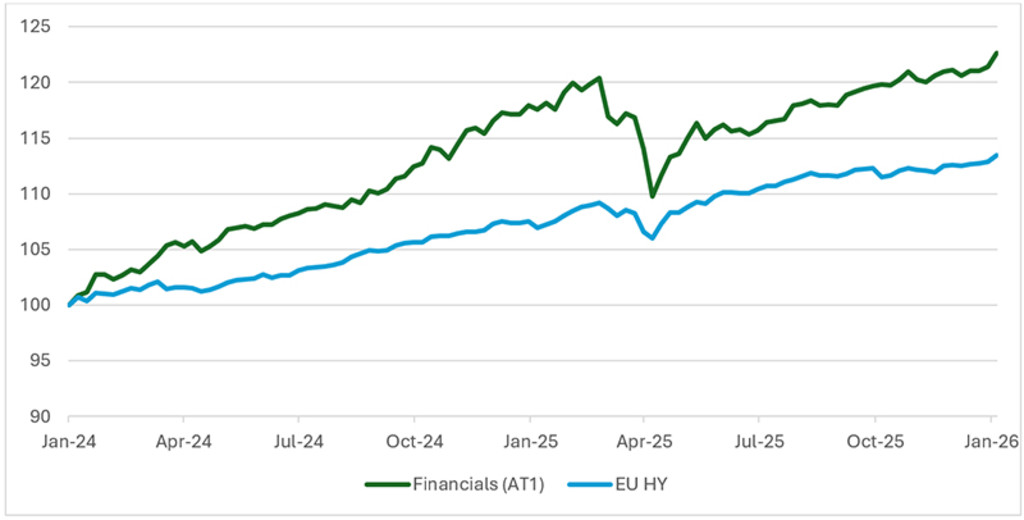

CL: "Seguimos siendo optimistas en el sector financiero, aunque se trate de una posición ajena al índice. Los valores financieros subordinados ofrecen spreads interesantes en relación con su calidad, especialmente en comparación con el high yield de calificación BB. Consideramos la asignación fuera del índice de referencia como una oportunidad a caballo entre el HY y el IG, con un valor relativo apreciable en toda la estructura de capital. Contar con analistas que cubran tanto el investment grade como el high yield nos permite identificar estas oportunidades".

"En el HY europeo, vemos oportunidades seleccionadas en sectores como envases o químico. En general, los emisores europeos están mejor posicionados que sus homólogos internacionales, favorecidos por balances más sólidos y estructuras de capital más conservadoras".

"La presión sobre estos sectores ha obedecido al aumento del coste de las materias primas y, en algunos casos, a la mayor competencia de las importaciones chinas. Esta dinámica ha lastrado los spreads, pero también ha deparado puntos de entrada interesantes. La depresión ha durado más de lo habitual en este ciclo, y también ha agudizado la dispersión dentro de los sectores. En este contexto, nuestro posicionamiento en el sector químico podría beneficiarse de los posibles aranceles de la UE u otras medidas antidumping contempladas a principios de enero3 ".

"Por tanto, la selección de emisores es fundamental. Aunque algunas empresas se encuentran en un momento del ciclo adverso, cuentan con balances sólidos para hacerle frente, mientras que otras afrontan retos estructurales. Nosotros nos centramos en identificar a las primeras y en ser muy selectivos en cada sector".

Gráfico 1: El sector financiero sigue siendo una posición de alta convicción con spreads atractivos

La rentabilidad anterior no es garantía de resultados futuros. El valor de las inversiones puede fluctuar.

Fuente: Bloomberg, Rendimientos totales del índice Bloomberg Europe CoCo Tier 1 Index vs índice Bloomberg Euro High Yield, enero de 2026.

¿Y qué hay de los sectores relacionados con la vivienda?

CL: "En EE.UU., los propios constructores de viviendas han seguido cotizando relativamente ajustados, al calor de las sólidas carteras de suelo que respaldan sus balances. Eso ha limitado la volatilidad y las oportunidades. Sin embargo, los spreads se han ampliado más entre los proveedores del mercado de la vivienda: materiales de construcción, tejados o puertas. Estas empresas suelen tener un mayor apalancamiento y menos respaldo de activos, lo que explica su deterioro. Una posible recuperación de la vivienda beneficiaría a esos segmentos".

SB: "Es un segmento que seguimos muy de cerca, sobre todo en EE.UU., pero haciendo siempre hincapié en la calidad de los emisores y la solidez de los balances".

Acceda a las perspectivas más recientes

Suscríbase a nuestro newsletter para recibir información actualizada sobre inversiones y análisis de expertos.

El atractivo clave del high yield han sido las tires. ¿Qué les parece ahora ese argumento?

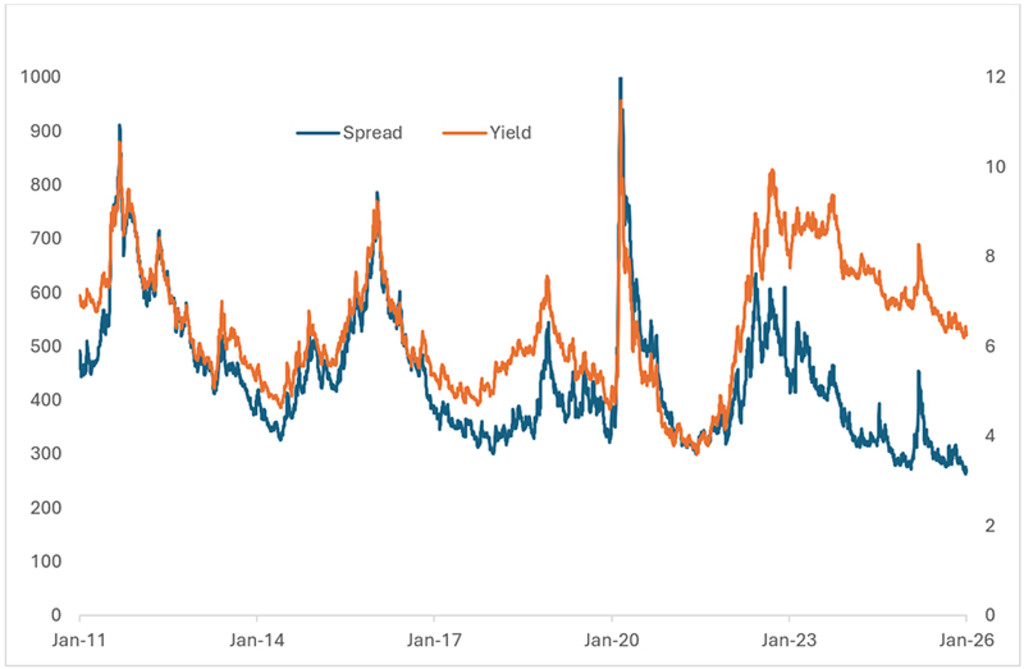

SB: "Las tires se han reducido significativamente respecto a 2022.4 Las tires de la deuda pública se han reducido y los spreads se han estrechado. Teniendo en cuenta sus tires es difícil sostener que el high yield está realmente barato. El HY cuenta ademas con un mecanismo interno de estabilización: cuando las tires suben porque aumenta el crecimiento, los spreads se comprimen; cuando los spreads se amplían debido a la debilidad económica, las tires de la deuda publica se reducen. Esa combinación sirve para homogeneizar el rendimiento a lo largo del tiempo".

CL: "En la actualidad, la HY cotiza en EE.UU. cerca del 7% de rentabilidad al peor, mientras que en Europa ronda el 6%. El margen frente al IG sigue en torno a los 200 pb en términos de TIR, por lo que la clase de activos sigue interesante en términos relativos".

Gráfico 2: Condiciones del mercado mundial HY: spreads y tires

La rentabilidad anterior no es garantía de resultados futuros. El valor de las inversiones puede fluctuar.

Fuente: Índice Bloomberg Global High Yield Corporate Total Return sin cobertura al USD, enero 2026

Por último, el sesgo favorable a la calidad es un elemento central de su estrategia. ¿Cuál es su importancia en el entorno actual?

SB: "Para nosotros, el sesgo favorable a la calidad es una convicción a largo plazo. Históricamente, los bonos de mayor calidad han superado a los de calidad inferior no sólo en términos ajustados al riesgo, sino a menudo también por excedente de rentabilidad. Siempre hay ganadores y perdedores, incluso cuando la economía está estable en su conjunto. Esa dispersión podría ir a más, dada la volatilidad derivada de la geopolítica y la convulsión provocada por la IA. Nuestro proceso de inversión se centra en evitar a los perdedores, por ser esa la mayor fuente de outperformance a largo plazo".

CL: “Un enfoque de HY basado en la calidad suele ser provechoso cuando un año exhibe unos fundamentales sólidos, pero con un ruido y unos riesgos de cola elevados. Ofrece ingresos interesantes y un potencial de recortes limitado, sobre todo en comparación con una renta variable que cotiza en máximos históricos y con los excesos de otros mercados."

Notas al pie

1Las rentabilidades pasadas no son garantía de resultados futuros. El valor de las inversiones puede fluctuar.

2El fondo despuntó en 14 pb (6,08% frente al índice de referencia del 5,94%).

3En enero de 2026, la Unión Europea aplicó importantes medidas antidumping, aranceles y nuevas normativas para proteger su industria química de la competencia desleal, sobre todo de China, Rusia y otros países no pertenecientes a la UE. Véase https://policy.trade.ec.europa.eu/enforcement-and-protection/trade-defence/anti-dumping-measures_en

4Las rentabilidades pasadas no son garantía de resultados futuros. El valor de las inversiones puede fluctuar.