Robeco to launch Biodiversity Equities strategy

A new Robeco investment strategy targets companies that can benefit from the transition to a nature-positive world.

まとめ

- New product focuses on thematic investment opportunities in biodiversity

- Four investment clusters target more sustainable land and sea activities

- Total biodiversity market worth up to USD 10 trillion in opportunities

RobecoSAM Biodiversity Equities is the culmination of over a year of work to create a product that specifically promotes biodiversity in a targeted thematic style, rather than just investing in environmental or climate-related stocks generally.

The strategy will invest in companies that support the more sustainable use of natural resources and ecosystem services, as well as the technologies, products and services that help to reduce biodiversity threats or restore natural habitats. These are the companies that benefit most from the transition to a nature-positive world that protects biodiversity in all its forms.

“Nearly all human activity in a modern society creates losses; our job is to invest in companies that can profit from being competitively positioned to reduce biodiversity loss,” says David Thomas, Portfolio Manager for the new strategy, which will be launched on 31 October 2022.

“To find those future market winners, we will focus early on sustainable activities that can be found in agriculture, forestry, fishing and ocean-based aquaculture, which represent nearly three-quarters of species loss. Using a system of carefully designed, biodiversity-specific key performance indicators, we can isolate those companies that are meaningfully contributing to the promoting biodiversity.”

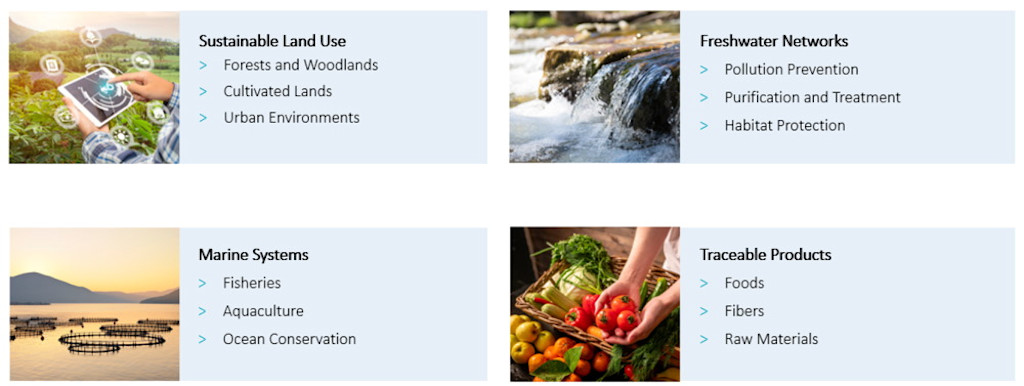

The strategy will target a thematic universe of about 250 companies that will be narrowed down to about 40-80 arranged in four investment clusters: Sustainable Land Use; Freshwater Networks; Marine Systems; and Traceable Products. This is shown in the illustration below.

These will target a broad remit of themes, including environmental remediation, reforestation, waste water treatment, hazardous waste management, aquaculture and sustainable fishing. The traceable products theme will look for opportunities in organic food and beverages, eco-friendly furniture and more environmentally friendly consumer goods such as cosmetics.

The strategy will be managed by Robeco’s Zurich-based thematic team which as over 20 years of investment experience running more than EUR 12 billion in impact investing-related assets. The team aims to have about 25% of the portfolio names under engagement to try to further improve the contributions they can make to biodiversity.

Creating the product follows the publication in January 2022 of a positioning paper entitled ‘Robeco’s approach to biodiversity: Towards the integration of nature-related risks, opportunities and impacts in our investments’. The white paper formed a blueprint for future policy and acted as the bedrock for what became Biodiversity Equities.

“Systematically identifying thematically aligned companies with great performance potential is both a science and an art,” says Aaron Re’em, co-Portfolio Manager of the strategy. “But all analysis is underpinned by the same rigor that we’ve applied over more than two decades of developing thematic investment products that target solutions to sustainability challenges.”

“We use our foresight to recognize the structural trends related to biodiversity, apply our proven thematic process to build an investment universe, and select attractively priced winners that are well positioned to benefit from the rapidly evolving competitive landscape.”

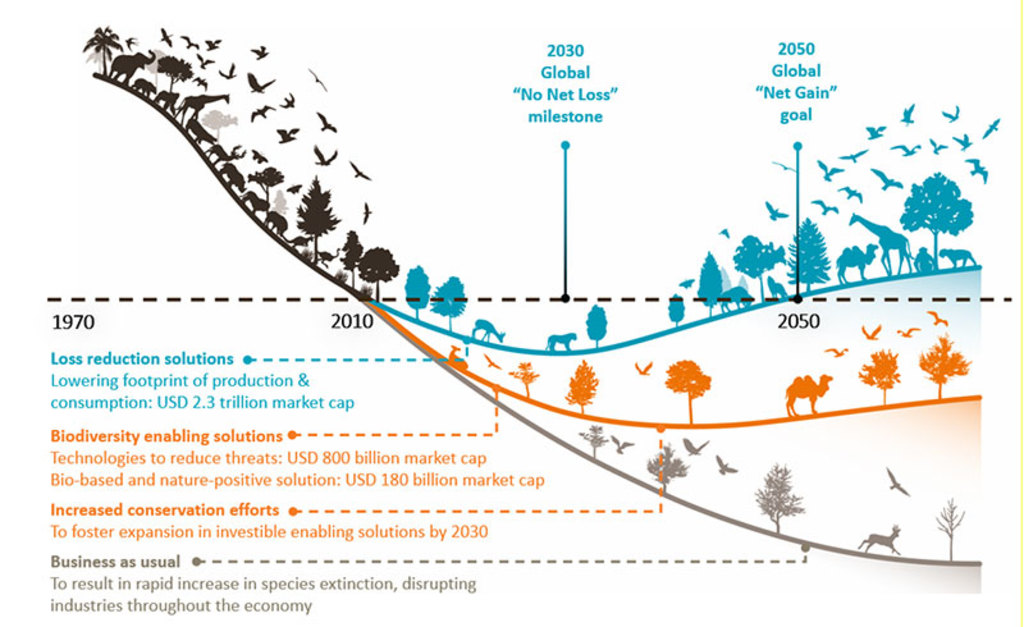

These kinds of solutions can be seen in ‘bending the curve’ to stop the decline of biodiversity loss and start reaping both the natural and economic rewards that come from enhancing biodiversity instead, as seen in the graphic below.

Investible solutions arising from bending the curve

Reversing the biodiversity threat by ‘bending the curve’ of biodiversity loss brings huge investment opportunities. Source: Robeco, Bloomberg. Illustration adapted from Leclère et al, Nature, 2020

However, investors have a big job ahead of them in bending this curve. The daily destruction of forests, plants and the natural habitats of animals due to human activity is seen as a challenge as great as the one the world faces with climate change. Unsustainable human development is putting up to one million species at risk of extinction within a few decades.

Climate change is further exacerbating the problem, as older forests and peatlands absorb carbon dioxide, which means deforestation and loss of plant life makes global warming worse. Many scientists believe that climate change and biodiversity loss are two sides of the same coin.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

Irreversible consequences

“Biodiversity is an acute threat with irreversible consequences playing out in the here and now,” Thomas says. “Irresponsible development is clearing natural forests, wiping out animal habitats, burning plant species, pumping fish with antibiotics, and dumping chemical fertilizers into waterways on a daily basis. These activities are destructive in real time, not strung out over decades.”

“There is some hope though. Countries have set new national biodiversity targets for 2030, much sooner than the net zero targets of 2050. The EU is leading the way extending mandates on organic farming, increasing quality standards for waterways and soils and legislating measures that support sustainable fishing and aquaculture management. It is also developing a Taxonomy to define what types of investments actually address biodiversity loss.”

SDG alignment

The strategy will invest in companies that can make a contribution to the UN’s Sustainable Development Goals, specifically SDG 3 (good health and well-being); SDG 9 (industry, innovation and infrastructure); SDG 12 (responsible consumption and production); SDG 14 (life below water); and SDG 15 (life on land).

Within the four clusters, some sectors will naturally produce more portfolio candidates than others, with Consumer Staples generating about one-third of companies, and Industrials one-quarter. Regionally, Europe and the Americas will provide about 40% each.

A vast problem and opportunity

As with climate change, the sums of money involved in avoiding disaster are vast. The World Economic Forum (WEF) estimates that more than half of the world’s economic output of USD 44 trillion is moderately or highly dependent on nature in some form, meaning that if natural systems collapse, so will our economic and financial systems.

The WEF places biodiversity loss as third on its lists of global risks by the perception of their severity, behind climate change and extreme weather. This placed it higher than infectious diseases – despite the recent memory of the ravages of Covid-19 – and the kind of geo-economic confrontation seen when Russia invaded Ukraine.

But it is also a massive opportunity: the potential market for biodiversity-friendly investments is more than USD 10 trillion, according to the World Economic Forum. This is primarily by transforming the three economic systems that are responsible for almost 80% of nature loss, namely food, infrastructure and energy.

“It means ecosystems can be viewed as important assets that can continue to be monetized, if this is done in a more sustainable way,” Re’em says. “This is the essence of the strategy. Protecting biodiversity is not just a means of saving nature – it’s also one of the biggest investment opportunities of our times.”

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会