Value investing: "The reports of my death have been greatly exaggerated"

As 2024 kicks off, we explore the resurgence of the Value factor since the Covid-19 vaccine announcement roughly three years ago, with insights from ten key graphs and analyses.

概要

- The value factor experienced a resurgence since November 2020

- We explore long-term performance and valuation spreads and provide expected returns for different scenarios

- Learn about the interplay between value investing and interest rates, growth expectations, and the 'Magnificent 7'

In November 2020, the announcement of a successful Pfizer-BioNTech Covid-19 vaccine candidate results triggered the long-awaited comeback of the value factor. Since then, value has been mainly on the rise. Here, in ten graphs, we review the developments since the announcement as well as some general insights on value investing.

The first chart illustrates the cumulative performance of the enhanced value strategy for a global sample of large and mid-cap stocks since 1986. We use the 'enhanced value' definition throughout this post as given in our paper inline: asset-hyperlink, sys.id: 5GnGZawHP0sT7xOAXmC258. However, we focus on the pooled sample of developed and emerging markets for better readability.

Figure 1: Cumulative return for the enhanced Value factor

Source: Robeco, Refinitiv. The graph shows the cumulative return of an enhanced value strategy as in Blitz and Hanauer, 2021, 'Resurrecting the value 'premium', Journal of Portfolio Management. The enhanced value strategy is based on a composite of book-to-market (R&D adjusted), EBITDA/EV, CF/P, and NPY metrics. Stocks are sorted into quintile portfolios based on the value composite and the quintile portfolios are equal-weighted. We apply region and sector neutrality for developed markets by independently ranking stocks within each region/GICS level 1 industry (11 sectors) bucket. Developed market regions are North America, Europe, and Asia-Pacific. For emerging markets, we apply country neutrality. The investment universe consists of all nonfinancial constituents of the MSCI Developed and Emerging Markets indices. Before 2001, we used the FTSE World Developed Index for developed markets (going back to December 1985), and for emerging markets, the largest 800 constituents of the S&P Emerging BMI at the semi-annual index rebalance (going back to December 1995). The sample period is January 1986 to December 2023.

Despite its solid long-term track record, the strategy also suffered during the 'quant winter' from 2018 to 2020, after which many called value investing dead. However, the announcement of successful Pfizer-BioNTech Covid-19 vaccine candidate results on 9 November 2020 triggered a new spring for the value factor. This resulted in the long-awaited value comeback, which maintained traction in 2021 and 2022 and continued through 2023 (see comments regarding 2023 in our ninth graph). Overall, the enhanced value factor has delivered attractive long-term returns despite the challenging period between 2018 and 2020. Please note that the grey-shaded area presents the out-of-sample data after posting the abovementioned paper on SSRN.

2. Valuation of Value portfolios

So, what led value strategies to perform poorly between 2018 and 2020? The poor performance stemmed mainly from an extreme widening of valuation multiples between growth and value stocks, with the former becoming relatively more expensive. Before diving into the value spread, i.e., the value of value, we first want to show the forward price-to-earnings (P/E) ratio of the cheapest and most expensive value portfolios over time.

Figure 2: Forward P/E ratio for Value quintiles (AC)

Source: Robeco, Refinitiv, I/B/E/S. The graph shows the median forward (NTM) P/E ratio for the top and bottom quintile portfolios of the enhanced value strategy. The investment universe consists of all nonfinancial constituents of the MSCI Developed and Emerging Markets indices. Before 2001, we use the FTSE World Developed Index for developed markets (going back to December 1985), and for emerging markets, the largest 800 constituents of the S&P Emerging BMI at the semi-annual index rebalance (going back to December 1995). The sample period is January 1986 to December 2023.

The chart shows the FWD P/E ratio for the top (value) and bottom (expensive) quintile portfolios of the enhanced value strategy. The investment universe consists of constituents of the MSCI Developed and Emerging Markets indices.

While the median forward P/E of value stocks is around 11 and fluctuates between 8 and 14 most of the time, the median forward P/E of the most expensive stocks is around 20; however, it also reached levels of 30 during the dot-com bubble and even higher in 2020 and 2021. Furthermore, one clearly sees that the spread in valuation between value and growth stocks substantially widened between 2018 and 2021 but has not fully normalized since then. This demonstrates that a substantial part of the outperformance of growth stocks during this period was not driven by increasing earnings but by multiple expansions.

3. The Value spread

When we take the ratio of valuation of the value and growth, we can quantify the valuation spread in one number per month. By deducing the time series median and taking the average over several valuation measures, we get a robust estimate of the abnormal valuation spread between value and growth. Consequently, a valuation spread above 1 indicates cheapness, while a reading below one implies that the factor is relatively expensive. The chart below shows the value spread over time.

Figure 3: Valuation spread for Value (AC)

Source: Robeco, Refinitiv. The graph shows the composite valuation spread between the top and bottom quintile portfolios of the enhanced value strategy. The investment universe consists of all nonfinancial constituents of the MSCI Developed and Emerging Markets indices. Before 2001, we use the FTSE World Developed Index for developed markets (going back to December 1985), and for emerging markets, the largest 800 constituents of the S&P Emerging BMI at the semi-annual index rebalance (going back to December 1995). The value spread is the average spread of the book-to-market (R&D adjusted), EBITDA/EV, and CF/P. The sample period is January 1986 to December 2023.

Interestingly, the spread has only shrunk slightly over the last two years. More specifically, it is still wider at the end of December 2023 than at the beginning of the value year-end in 2018. To put things in perspective, the current spread is about as wide as it was at the peak of the dot-com bubble in 2000.

4. Value returns vs. Value spreads

Why is value still trading at a considerable discount compared to its 2018 levels despite the recent recovery? While changes in the value spread account for a significant part of the returns, they don't explain the entire picture. Other factors – such as carry (+), portfolio migration (+), and change in fundamentals (+ or - ) – also contribute to what we call the ‘structural alpha’: a more stable component of returns. In contrast, the revaluation alpha stems from changes in the value spread. The next graph illustrates the relationship between continuously compounded annual value returns and annual changes in the log value spread.

Figure 4: Value returns vs Value spreads

Source: Robeco, Refinitiv. The figure shows the relationship between value returns and changes in value spreads. Value returns are the continuously compounded annual return on the enhanced value factor. The change in value spread is the log of ending minus the log of starting value spread. The investment universe consists of all nonfinancial constituents of the MSCI Developed and Emerging Markets indices. Before 2001, we use the FTSE World Developed Index for developed markets (going back to December 1985), and for emerging markets, the largest 800 constituents of the S&P Emerging BMI at the semi-annual index rebalance (going back to December 1995). The sample period is January 1986 to December 2023.

We observe a robust negative relationship between value returns and changes in the value spread, with the latter accounting for roughly 50% of the variation in the former. Crucially, we also document a high intercept of almost 10%. This can be interpreted as a cleaner estimate of the value premium for a hypothetical long-minus-short value factor, given that it is purged of the time-varying effects of multiple expansions and compressions.

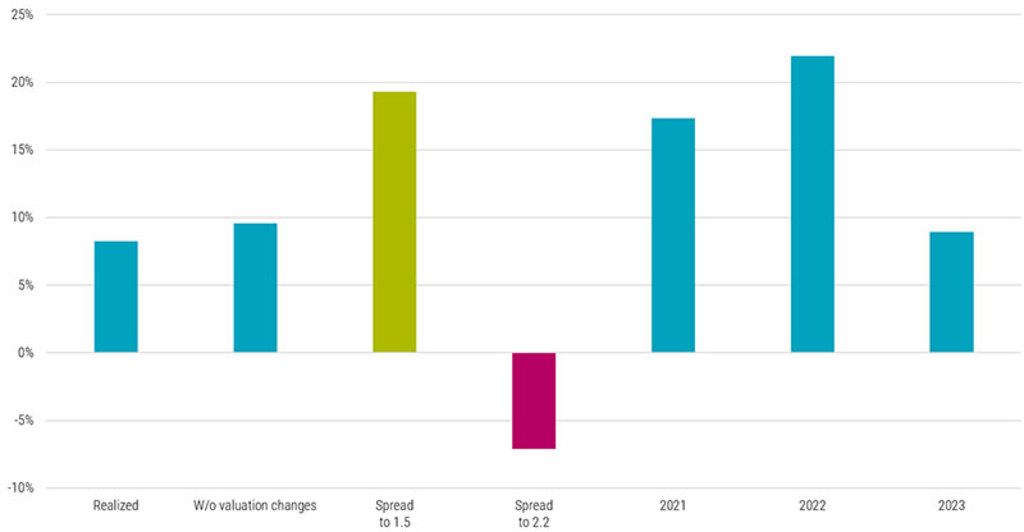

5. Return scenarios for Value investing

The analysis above also allows us to form medium-term return expectations for the value factor based on changes in the value spread, for example, if it reverts toward its long-term average. Given the relationship estimated above and the current value spread of 1.73 at the end of December 2023, we can conduct a scenario analysis for the expected top-minus-bottom value portfolio (continuously compounded) return over the next 12 months. For instance, the value spread reverts to 1.5 as of January 2020 (pre-Covid level) or widens back to 2.2 as of June 2021.

Figure 5: Return scenarios for Value investing

Source: Robeco, Refinitiv. The figure shows the continuously compounded annual value return over the full sample, the expected value return assuming no changes in the value spread and assuming that the value spread will go to 1.5 and 2.2 within the next 12 months. Furthermore, we show the continuously compounded annual value return for 2021, 2022 and 2023. The expected value returns are estimated based on the regression from the previous slide. The investment universe consists of all nonfinancial constituents of the MSCI Developed and Emerging Markets indices. Before 2001, we use the FTSE World Developed Index for developed markets (going back to December 1985), and for emerging markets, the largest 800 constituents of the S&P Emerging BMI at the semi-annual index rebalance (going back to December 1995). The sample period is January 1986 to December 2023.

Furthermore, we show the average realized over the full sample period, the expected value return without valuation changes, and, for better reference, the long-short value returns of 2021, 2022, and 2023. For more background on this approach, we refer to the 2022 article on short-sightedness, rates moves and a potential boost for value.

6. Value and interest rates

A popular narrative is that the rise in interest rates caused the value comeback over the last three years. While we have already been skeptical in our 2021 article on the relationship between factors and interest rates, this narrative can also be viewed in a less technical way.

Figure 6: US Value returns vs 10-year Treasury yield changes

Source: Robeco, Refinitiv, FRED. The figure shows the returns of the US enhanced value strategy vs. contemporaneous changes in the 10-year Treasury yield. The investment universe consists of all nonfinancial US constituents of the MSCI Developed Index. Before 2001, we use the FTSE World Developed Index for developed markets (going back to December 1985). The sample period is January 1986 to December 2023.

The chart above illustrates the relationship between US value returns and contemporaneous US 10-year Treasury yield changes. The chart shows little to no relationship between the value factor and interest rate changes between 1986 and 2017. Yes, there is some correlation between 2018 and 2020, but we find very little correlation again afterward. The value-rates narrative therefore seems more like a short story than an ongoing saga.

7. Expected vs. realized growth

The key argument for the value-rates narrative is that growth stocks exhibit longer duration than their value counterparts. Therefore, they should benefit from a lower discount rate being applied to their cashflows and suffer from rising yields. We acknowledge this reasoning line but believe this is only a second-order effect. The real question is whether expensive (i.e. growth) stocks do indeed have higher future growth. To answer this question, we refer again to the analysis in the article on short-sightedness, rates moves and a potential boost for value.

Figure 7: Expected vs. realized growth

Source: Robeco, Refinitiv, I/B/E/S. The chart shows the previous five-year realized growth in earnings and the long-term (five-year) EPS growth expectations of analysts for the top (value) and bottom (expensive) quintile portfolios of the enhanced value strategy at portfolio formation (t=0) and up to ten years (t=120) after portfolio formation. For each measure and month, we compute the median for both the cheapest and most expensive quintile and deduct the universe median. The investment universe consists of all nonfinancial constituents of the MSCI Developed and Emerging Markets indices. Before 2001, we use the FTSE World Developed Index for developed markets (going back to December 1985), and for emerging markets, the largest 800 constituents of the S&P Emerging BMI at the semi-annual index rebalance (going back to December 1995). The sample period is January 1986 to December 2023.

The chart above depicts the previous five-year realized growth in earnings and analysts’ long-term (five-year) earnings per share (EPS) growth expectations at portfolio formation (t=0), and up to ten years (t=120) after this for the cheap (‘value’) and expensive (‘growth’) quintile portfolios versus the universe. The chart shows that the spread for both historical growth and growth expectations between value and expensive firms is indeed highest at portfolio formation. However, these differences are not persistent.

As shown in the chart, the spread in both growth expectations and realized growth rapidly converges in the years after portfolio formation, with value stocks experiencing improvements in growth realizations and expectations. In contrast, their expensive peers encounter deteriorating growth realizations and expectations. Therefore, investors appear to be overpaying for the expected growth differences at portfolio formation, as analysts and other market participants extrapolate historical growth too far into the future. In other words, realized growth does not live up to expectations.

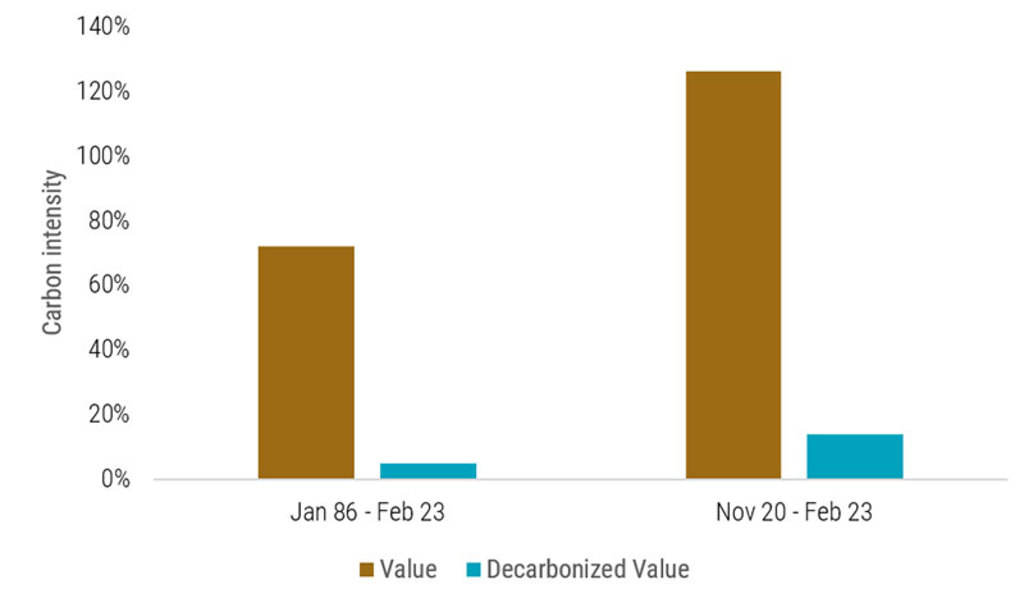

8. Decarbonizing the Value factor

Conventional value strategies tend to have high environmental footprints, including greenhouse gas (GHG) emissions. Could value stocks just look cheap using common valuation metrics, but this is mainly because their environmental footprints are not well reflected in accounting numbers? Therefore, we wondered whether we could decarbonize the value factor without significantly impacting value exposure. The short answer is ‘Yes’.

Figure 8: Decarbonizing the Value factor

Source: Robeco, Refinitiv, Trucost. The graph shows the average and current carbon intensity of the highest value quintile portfolio minus the lowest value quintile portfolio as a percentage of the footprint of the equally-weighted universe for the conventional and decarbonized value composite. A positive number means value stocks have a larger footprint than non-value stocks. Carbon intensity is the total GHG emissions in tons of CO2 equivalent (tCO2eq) per one million USD revenues. The investment universe consists of all nonfinancial constituents of the MSCI Developed and Emerging Markets indices. The sample period is January 1986 to March 2023 (left) and November 2020 to March 2023 (right).

In our article How Value investors can avoid the climate traps we demonstrate how value strategies can be ‘decarbonized’ effectively. For example, we demonstrate that our decarbonization methodology reduces the carbon footprint without impacting exposure to the value factor. Note that we do not impose region-sector or countries neutralities in this analysis in contrast to the other points. Imposing these neutralities would have resulted in similar but less pronounced results.

9. The Magnificent Seven against the rest of the world

While we show positive returns for the long-short value factor in 2023, most of you will probably say that 2023 wasn’t a good year for pure value strategies. Our analysis shows a positive number because we present the return difference between the average value and the average growth stock across global developed and emerging markets, giving each stock the same weight. However, the Magnificent Seven that dominated global developed stock markets in 2023 were typically not included or at least underweighted in long-only value portfolios. Therefore, the underperformance of such value portfolios is actually caused by a size effect in disguise. The chart below illustrates that the Magnificent Seven were outperforming the average stock by far in 2023.

Figure 9: The Magnificent Seven against the world

Source: Robeco, Bloomberg. The graph shows the cumulative return of the MSCI World Equal Weighted Index and the Bloomberg Magnificent Seven Index. The sample period is December 30, 2022 to December 29, 2023.

Furthermore, value portfolios in emerging markets typically outperformed their cap-weighted benchmarks in 2023.

10. Emerging vs. developed markets

Finally, investors can also find value not only within one market but also across markets. Systematic country or market selection based on valuation multiples should be applied with caution as it represents a rather low breadth game, i.e., just a few countries or markets to select versus thousands of stocks. However, decomposing relative returns with changes in relative valuation can still give valuable insights, as we did in our recent article Double delight: Seizing the dual discount in emerging markets.

Figure 10: MSCI Emerging Markets vs MSCI World

Source: Robeco, MSCI. The figure shows the relative performance and valuation spread of the MSCI Emerging Market Index vs. the MSCI World Index. Performance is measured via the total return index, and the valuation spread is based on four bottom-up-calculated multiples (price-to-book, price-to-earnings, price-to-cash EPS, and price-to-dividend). For each multiple, the valuation ratio of the MSCI Emerging Markets Index is divided by the same valuation ratio for the MSCI World Index. The sample period is September 1995 to December 2023.

Applying the same methodology as in this paper, we see that emerging market equities currently offer a substantial discount over developed markets. Moreover, the underperformance of emerging markets over the past decade has been more of a function of changes in relative valuation rather than deteriorating fundamentals.

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

Active Quant: finding alpha with confidence

Blending data-driven insights, risk control and quant expertise to pursue reliable returns.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.