Regulatory change is sparking fresh growth for financials and fintechs

After more than 15 years of tightening, the financial sector is entering a new era of rules and reforms. Regulators are easing capital requirements and other constraints on banks, insurers and fintechs, creating unprecedented growth opportunities across old world and next-gen financial systems.

まとめ

- US reforms are accelerating

- Europe is catching up through market integration

- Easing enforcement is boosting next-generation finance

This shift toward a more balanced and pro-growth regulatory environment is a potential game changer for banks – helping to unlock capital, boost activity, and enhance shareholder returns. The rules of the game are changing most quickly in the US where the appointment of Fed governor Michelle Bowman as Vice Chair for Supervision in June signals a more pragmatic, pro-business approach to banking oversight.

The shift toward a more balanced and pro-growth regulatory environment is a potential game changer for banks

The US’s increasingly permissive stance on competition and scale is reflected in a pair of significant regulatory decisions: 1) the removal of the USD 1.95 trillion asset cap imposed on Wells Fargo and 2) the approval of the Capital One–Discover merger.

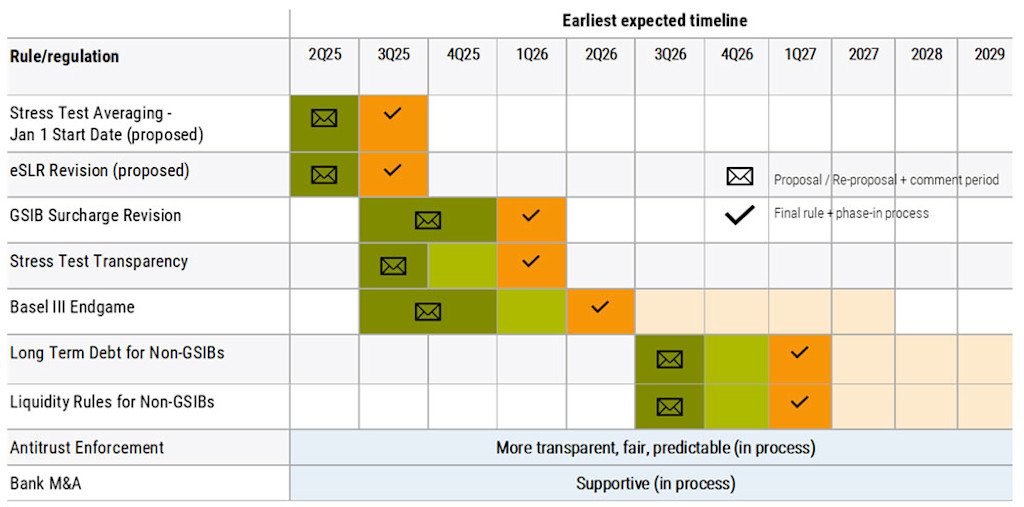

And we are still in the early innings, with many reforms yet to come. Those include the Enhanced Supplementary Leverage ratio (eSLR) revisions, improving stress test transparency, finalizing the Basel III Endgame standards as well as the recalibration of capital buffer surcharge for Global Systemically Importants Banks (GSIBs).

Table 1 – Timing for proposals and final rules in the US

Source: Morgan Stanley, Robeco 2025

These changes are designed to standardize and harmonize risk measurement and capital reserve calculations across global banking. Reforms should not only provide long-term stability to the financial system, but also lower capital reserves and free up cash, with the greatest benefit accruing to large US banks.

Reforms should not only provide long-term stability to the financial system, but also lower capital reserves and free up cash

Increased capital flexibility enables banks to pursue growth strategies, increase dividends and share buybacks, and improve profits. While the exact impact on profitability varies by institution, HOLT analysis suggests that a 1% improvement in Cash Flow Return on Equity (CFROE) – a proxy for economic performance – could translate into an 8% increase in warranted valuation for US banks.

Europe is catching up through market integration

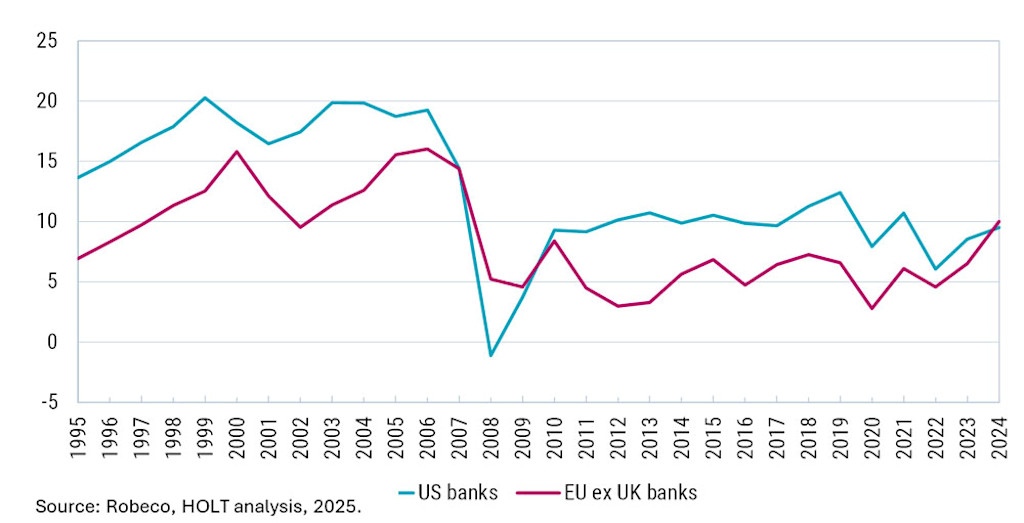

European banks have historically lagged their US counterparts in profitability due to fragmented markets and heavy regulation (see Figure 1). However, external forces – from Trump pressures in the West to geopolitical vulnerabilities from Russia/Ukraine in the East – and internal pressure (the Draghi Report below) are pushing the EU to address its structurally weak and anti-competitive capital markets system.

According to the 2024 Draghi Report, the EU needs to invest EUR 750 billion to strengthen its competitiveness – the lion’s share coming from private, not public sources. Europe’s over-reliance on bank-based financing has limited capital availability, risk-sharing and financial sector innovation and growth.

In future, expanding the role of capital market mechanisms is necessary to channel assets into more productive investments and increase competitiveness. Therefore, the creation of one unified capital market is a clear political priority and legislation is already underway. Key initiatives under the new EU Savings and Investments Union (SIU) strategy include:

Implementing the Listing Act to simplify companies’ access to public markets

Reviewing the securitization framework

Facilitating equity investment by institutional investors

Channeling depositor savings into capital markets via pension schemes

Reforms are expected to boost growth and narrow the competitive gap between US and European banks. According to HOLT analysis, a 1% reduction in the discount rate applied to European banks – reflecting lower perceived risk – could lead to a 17% increase in warranted valuation.

Figure 1 – CFROE of US and European banks

Furthermore, reforms to Solvency II – the EU’s regulatory framework for insurers – will make it easier for insurance companies to provide long-term financing to the European economy. The European Commission is proposing changes that will ease capital requirements, improve solvency ratios and risk margins and enable insurers to more easily invest in the securitization market.

If enacted, insurers could make ‘long-term equity’ investments leading to lower capital charges (22% instead of 39%). Insurers could also access less liquid alternative equity investments if they qualify as long-term equity investments (held-to-maturity/long horizon and matching liabilities). More reforms, including cost-reducing, capital-enhancing and regulatory-efficient measures, are still to come from European lawmakers!

Easing enforcement will boost next-generation finance

The sweeping policy agenda of the second Trump administration is set to benefit both traditional banking and next-generation finance. Under the executive order titled “Unleashing prosperity through deregulation,” for every new regulation proposed, agencies must repeal at least ten existing regulations. As a result, federal agencies such as the CFPB1 and FDIC2 are scaling back enforcement, especially in the fintech strongholds of Banking as a Service (BaaS), Buy Now Pay Later (BNPL), and digital wallets.

For example, the CFPB withdrew proposed regulations that capped credit card late-fees, which indirectly helps smaller fintechs and neobanks compete more effectively with deep-pocketed banks that issue cards. The CFPB also significantly reduced a civil penalty lodged against Wise, a fintech specializing in digital payment transfers, from over USD 2 million to just USD 45,000.

The sweeping policy agenda of the second Trump administration is set to benefit both traditional banking and next-generation finance

Conclusion

The ongoing regulatory changes represent a major paradigm shift for financial services and create significant opportunities for Robeco’s New World Financial and FinTech Strategies. Our investments in the US are set to benefit from deregulation, including banks such as Citi and Bank of America which are expected to deliver improving profitability and attractive capital returns. We also hold Capital One which is poised to benefit from the approved merger with Discover Financial Services. Moreover, Europe is increasingly attractive given the initiatives under the Savings and Investment Union, fiscal reforms in Germany and persisting valuation differentials.

The decreasing regulatory burdens of fintech players allows them to innovate more freely in areas such as lending, payments, and crypto. Digital wallets providers, including PayPal, Apple Pay, Venmo, CashApp, and Shop Pay, continue to grow their transaction volumes. And BNPL providers such as Afterpay, Affirm and Klarna are also gaining traction. Taken together, looser oversight coupled with less stringent capital requirements should facilitate industry consolidation and partnerships between fintechs, banks and other financial players.

Important note: The companies referenced are for illustrative purposes only in order to demonstrate the investment strategy on the date stated. The companies are not necessarily held by the strategy(ies) nor is future inclusion guaranteed. This is not a buy, sell or hold recommendation, nor should any inference be made on the future development of these companies.

Footnotes

1CFPB, the Consumer Financial Protection Bureau

2FDIC, the Federal Deposit Insurance Corporation

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会