How M&A, IPOs and a bit of GENIUS are driving fintech fever

A series of successful IPOs and M&As combined with the passage of the groundbreaking US GENIUS Act are rapidly expanding fintech solutions in financial markets and creating significant opportunities for Robeco’s FinTech strategy.

まとめ

- Capital market activity is roaring back to life

- Landmark legislation is laying foundations for tokenization of assets

- Fintech strategy well positioned as structural momentum accelerates

In our 2025 Outlook at the start of the year, we anticipated a resurgence in private and public fintech funding which began to materialize in late spring with a wave of IPOs. Online brokerage platforms WeBull and eToro went public in April and May, respectively, while neobank Chime followed in June, closing the month 28% above its listing price and reaching a market value of USD 13 billion.

Though stellar in their own right, the star performer in this season of launches is stablecoin issuer Circle. It made an exceptional debut, with its share price increasing almost ninefold at its peak before closing in June with a market capitalization of USD 40 billion. And there’s more capital action still to come. Klarna, a buy-now-pay-later provider has already initiated its IPO process, and digital wealth manager Wealthfront confidentially filed for an IPO last month.1

Private fintech funding also continued with Ramp, a spend-management fintech, which raised another USD 200 million in its latest funding round, lifting its valuation to USD 16 billion. Additionally, payment processor Stripe acquired crypto wallet provider Privy for an undisclosed amount, while accounting software provider Xero acquired bill payments platform Melio for USD 2.5 billion. Robust capital market activity signals growing confidence in a diverse and broadening fintech market, creating significant growth opportunities for the FinTech strategy over the short-, mid- and long-term.

Robust capital market activity signals growing confidence in a diverse and broadening fintech market

Genius in motion means more tokens

Stablecoins, once a crypto novelty, are set to become mainstream with the passage of the GENIUS Act (Guiding and Establishing the National Innovation for US Stablecoins Act of 2025) in the US Senate. This landmark legislation will most likely allow banks and regulated issuers to release tokenized US dollars by the end of this summer. That’s the first step in legitimizing stablecoins in cross-border and domestic payments, but also for corporate treasury operations and financial services infrastructure.

The swiftness of response from retail commerce leaders is significant. Both Amazon and Walmart are exploring their own stablecoin issuance which could save them substantial amounts in fees.2 Meanwhile, in partnership with Shopify, Coinbase introduced its stablecoin payment stack built on its base layer-2 blockchain.3 The technology, which went live in June, seamlessly integrates US dollar coin (USDC) payments into Shopify’s processing systems for vendors. These modular stacks leverage programmable payment flows that replicate traditional e-commerce logic4 and will enable tokenized payments to be easily adopted and scaled by online vendors.

Additionally, Fiserv’s forthcoming launch of FIUSD (a US dollar-backed stablecoin) on the Solana blockchain, supported by Paxos and Circle, demonstrates how core banking infrastructure is integrating with blockchain, offering 24/7 settlement and embedded compliance tools. These announcements indicate that stablecoins’ programmable logic and real-time interoperability serve as a foundation for future financial services.

Both Amazon and Walmart are exploring their own stablecoin issuance which could save them substantial amounts in fees

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

Simply stellar stablecoins

Stablecoin issuers primarily earn revenue through interest on fiat currency by depositing it in banks or purchasing US Treasury bills. By the end of June, stablecoins on public blockchains totaled USD 254 billion, with USDT 159 billion (Tether) and USDC 61 billion (Circle). For comparison, the US Federal Reserve’s M2 money supply (a measure of how much fiat currency is circulating in the US economy) was USD 22 trillion at the end of May. In an X post, US Treasury Secretary Scott Bessent projected stablecoins could reach a market size of USD 3.7 trillion by 2030, indicating potential adoption beyond digital assets.5

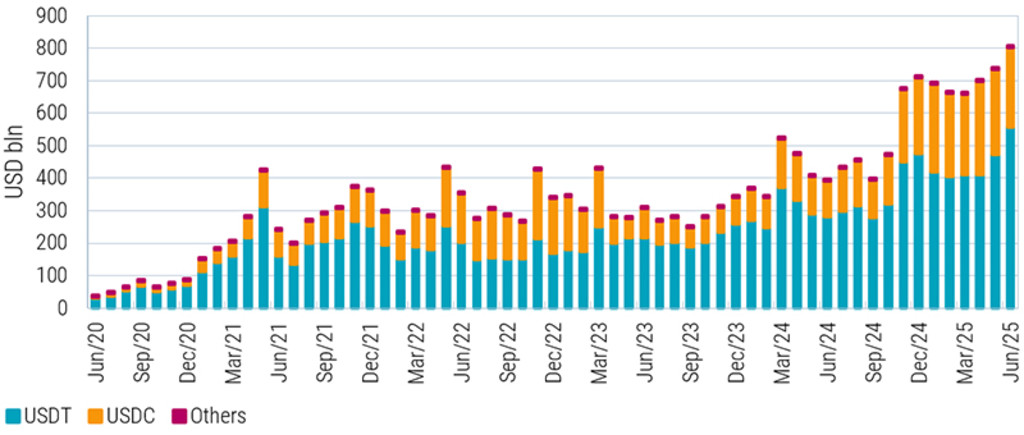

This adoption should be tracked by transaction volume growth (albeit with distortions from bots and high-frequency trading). Figure 1 shows adjusted transaction volumes growing 104% year-on-year to over USD 800 billion in June. JP Morgan CEO Jamie Dimon says his firm moves about USD 10 trillion daily – taken as a proxy for stablecoin volumes, it is clear there is significant room for growth.

Figure 1 – Stablecoin adjusted transaction volumes are growing rapidly

USDT = US dollar tether stablecoin backed by digital currency provider, Tether. USDC = US dollar backed stablecoin offered by Circle, a leading digital infrastructure provider. Source: Allium, Visa, Robeco

The implications of tokenization

Both Visa and Mastercard, giants in traditional commercial payment-settlement systems, have invested heavily to incorporate stablecoin use into their networks. Visa’s CEO, Ryan McInerney, has expressed optimism about stablecoin’s future, but stresses the need for trust, ease-of-use, and scale.

Although stablecoin adoption beyond the digital asset ecosystem is still in its early stages, it appears to be more of a threat to the business models of card issuers than to payment network companies. Visa and Mastercard’s tokenization and merchant network capabilities remain a powerful moat to connect the traditional system with the crypto world, although it does put a question mark around terminal growth. Share prices of both Visa and Mastercard reached all-time highs in June but contracted 5.5% by the end of the month.

Also in June, Robinhood’s ‘To Catch A Token’ event focused on their development of a layer-2 blockchain optimized for real-world assets. This blockchain infrastructure enables the seamless transfer of assets at any time. Robinhood announced stock tokens on listed US equity, such as Nvidia, Microsoft, and Apple, while also offering tokenized shares of OpenAI and SpaceX to users in Europe. Ironically, the regulatory challenges are greater in the US than in Europe, although Robinhood and Coinbase are reportedly in discussions with the SEC to smooth issuance without added legal complexity.

We are confident that the buildout of robust technological infrastructure that is governed by regulatory oversight are strong signals of structural tailwinds that will spur legitimacy, acceptance and growth of tokenization in the wealth management industry. Clearly, Robinhood and Coinbase are on the forefront of these efforts. Robinhood’s stock increased 13% on the day of the event and added 151% year-to-date, despite volatility in April.

Footnotes

1‘Robo-advisor Wealthfront files confidentially for an IPO.’ Bloomberg, June 2025.

2Walmart and Amazon Are Exploring Issuing Their Own Stablecoins, The Wall Street Journal, 13 June 2025.

3Layer-2 networks are built atop the original blockchain base layer and provide additional functionality and flexibility to blockchain architecture. Layer-2 stacks are making blockchain transactions cheaper, faster and more flexible, which will promote scale and adoption for real-world financial transactions.

4Essentially mirroring fiat workflows – from customer checkout, payment authorizations, digital wallet connections, on-chain ledgering, escrow-based captures and refunds.

517 June 2025, X post from the account of US Treasury Secretary, Scott Bessent

Important note:

The companies referenced are for illustrative purposes only in order to demonstrate the investment strategy on the date stated. The companies are not necessarily held by the strategy. This is not a buy, sell or hold recommendation, nor should any inference be made on the future development of the company.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会