Finding alpha in emerging markets’ sustainable transition

Emerging markets lie at the forefront of the low-carbon transition – and it could bring some amazing opportunities if you know where to look.

まとめ

- Asia requires almost half the USD 125 trillion needed for net-zero transition

- Emerging markets lag behind developed world for clean energy investments

- New mindset along with the right tooling is needed to find potential opportunities

Tackling global warming requires some serious investment, with Asia alone requiring almost half of the USD 125 trillion needed to meet the Paris Agreement temperature goals and achieve net zero by 2050.

Yet, the funding of decarbonization has tended to focus on developed market economies, rather than in the emerging markets where it is most needed. A change in mindset is essential if investors are to not only play their role in net zero, but also find the best opportunities in the transition, Robeco’s latest research has found.

“This decade is make or break for climate change. The battleground is in emerging markets and developing economies,” says Thu Ha Chow, Head of Fixed Income in Asia and co-author of a special report on the issue, ‘Finding alpha in emerging markets’ sustainable transition.’

“In the past ten years, these emerging economies have accounted for 93% of the rise in carbon emissions. In the next ten years, they will account for 98% of global population growth. This makes them a key part of the global transition story, where the greatest impact is needed, and can be made, if we are going to reach our global net-zero targets.”

Even though emerging markets have largely been ignored – or even excluded – by mainstream investors when it comes to pursuing net zero, the financial odds remain in their favor. “Cutting emissions in these economies is estimated to cost half as much as in advanced economies due to the relative ease of purchasing clean technologies,” Chow says.

“In a study of ten developing economies, Standard Chartered reported that every dollar spent on adaptation in these countries in this decade would result in USD 12 of economic benefit. This supports a greater allocation of resources in emerging markets, where decarbonizing investments will ‘get more bang for the buck’.” 1

Insufficient data and terminology

One problem has been a lack of reliable data; research by Mobilising Institutional Capital Through Listed Product Structures (Mobilist) shows that mainstream ESG screening has actually diverted funds away from emerging economies because vital information is lacking.2

“Another key issue has been the lack of a clear definition for ‘transition’ which goes beyond strict adherence to ‘green’ activities against a backdrop of greenwashing fears,” says Chow. “Although emerging economies (excluding China) account for over two-thirds of the global population, they currently represent only one-third of global energy investment and a mere 20% of clean energy investment. Further, only about 3.6% of global pension funds are invested in these economies.”

This lack of definitions is being addressed by regional regulators such as the Monetary Authority of Singapore, which has launched the Singapore-Asia Taxonomy. This is the first in the world to include a ‘transition’ category that accounts for the needs of Asia as it seeks to position itself as a transitional financing hub for the region, alongside Hong Kong and Japan.

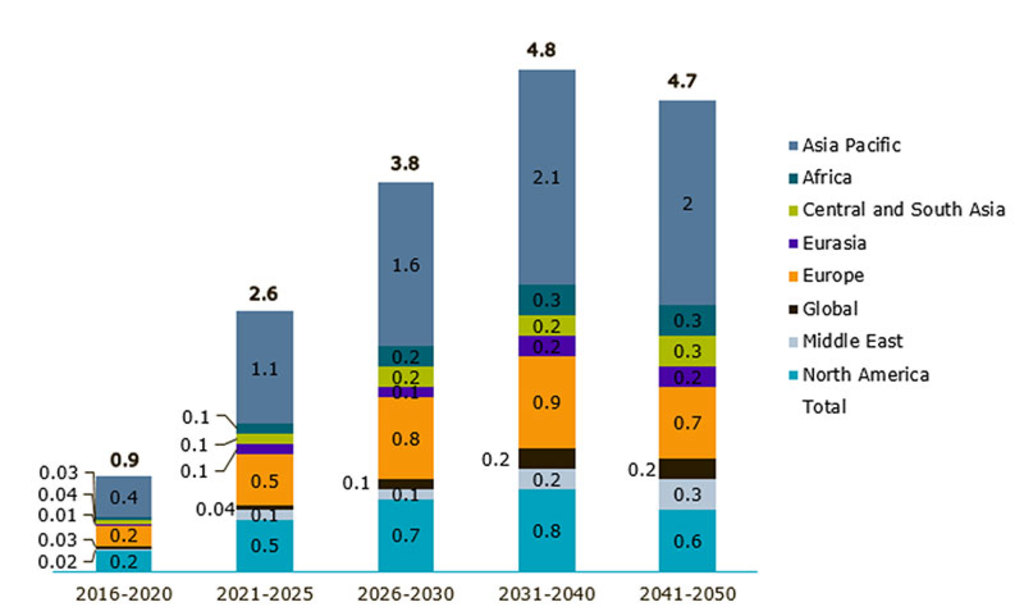

Annual average investment (USD trillions) required for decarbonization across regions, 2021-2050. Source: GFANZ. 3

Two ways to find potential opportunities

So, how can investors address the problem? It lies in two areas: using this imperfect data to actually play markets at their own game rather than shying away from them, and having the right tools to identify the best corporate opportunities, Chow says.

“Imperfect information and market bias can offer attractive alpha opportunities for investors who find ways to bridge what the market lacks,” she says. “These research-driven investors aim to understand what is beyond the numbers, moving beyond the known facts to seek what the market may have missed. This applies just as much to sustainability and transition assessments as it does to financial analysis.”

“In the high-emitting sectors, the ability to transition is fundamental to an investment case, and the conclusion should not be to avoid the sectors, but to invest in the winners and the solution providers. It means creating frameworks that will allow us to establish credible transition candidates.”

Using the right frameworks

You therefore need the right frameworks. Robeco has developed tools that allow a 360-degree view of the potential emerging market investment landscape through the lens of the Sustainable Development Goals, using our proprietary SDG Framework for both companies and countries. This can view industries more reliant on fossil fuels as a solution waiting to happen, rather than as a current problem.

“For example, in emerging markets, vital activities like power generation are often tied to carbon-intensive assets,” Chow says. “Here we should be looking at the companies that have credible transition plans, as they will be main beneficiaries of decarbonization. This requires tooling such as our geographical Sector Decarbonization Pathways (SDPs) and our Traffic Light credibility assessment.”

“Meanwhile, Robeco’s wider stewardship and active engagement strategy ensures that we can keep a close eye on material sustainability issues that go beyond simple decarbonization. This can improve the transparency that is sometimes lacking in emerging markets, overcome inaction caused by greenwashing fears, and better channel investments to where impact can be maximized.”

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会