Regulatory change is sparking fresh growth for financials and fintechs

After more than 15 years of tightening, the financial sector is entering a new era of rules and reforms. Regulators are easing capital requirements and other constraints on banks, insurers and fintechs, creating unprecedented growth opportunities across old world and next-gen financial systems.

Resumen

- US reforms are accelerating

- Europe is catching up through market integration

- Easing enforcement is boosting next-generation finance

This shift toward a more balanced and pro-growth regulatory environment is a potential game changer for banks – helping to unlock capital, boost activity, and enhance shareholder returns. The rules of the game are changing most quickly in the US where the appointment of Fed governor Michelle Bowman as Vice Chair for Supervision in June signals a more pragmatic, pro-business approach to banking oversight.

The shift toward a more balanced and pro-growth regulatory environment is a potential game changer for banks

The US’s increasingly permissive stance on competition and scale is reflected in a pair of significant regulatory decisions: 1) the removal of the USD 1.95 trillion asset cap imposed on Wells Fargo and 2) the approval of the Capital One–Discover merger.

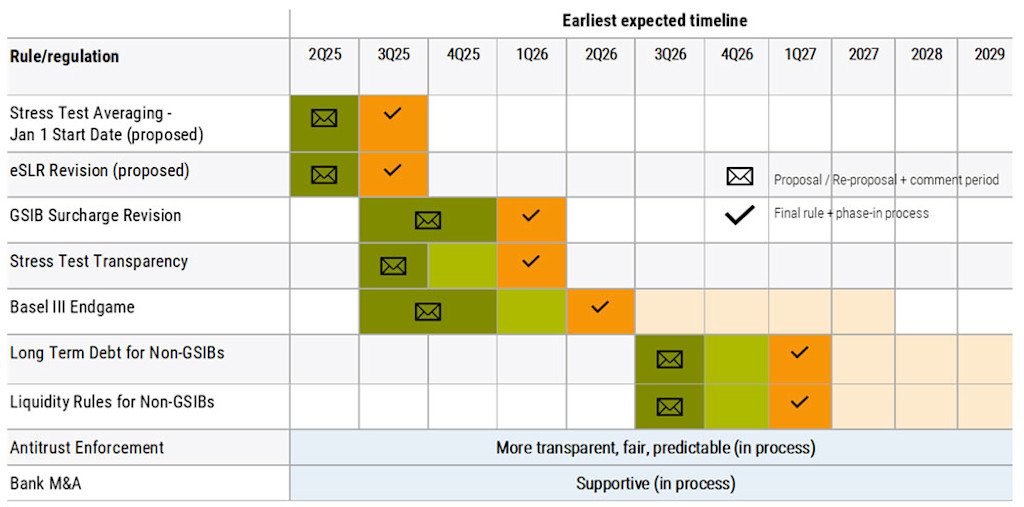

And we are still in the early innings, with many reforms yet to come. Those include the Enhanced Supplementary Leverage ratio (eSLR) revisions, improving stress test transparency, finalizing the Basel III Endgame standards as well as the recalibration of capital buffer surcharge for Global Systemically Importants Banks (GSIBs).

Table 1 – Timing for proposals and final rules in the US

Source: Morgan Stanley, Robeco 2025

These changes are designed to standardize and harmonize risk measurement and capital reserve calculations across global banking. Reforms should not only provide long-term stability to the financial system, but also lower capital reserves and free up cash, with the greatest benefit accruing to large US banks.

Reforms should not only provide long-term stability to the financial system, but also lower capital reserves and free up cash

Increased capital flexibility enables banks to pursue growth strategies, increase dividends and share buybacks, and improve profits. While the exact impact on profitability varies by institution, HOLT analysis suggests that a 1% improvement in Cash Flow Return on Equity (CFROE) – a proxy for economic performance – could translate into an 8% increase in warranted valuation for US banks.

Europe is catching up through market integration

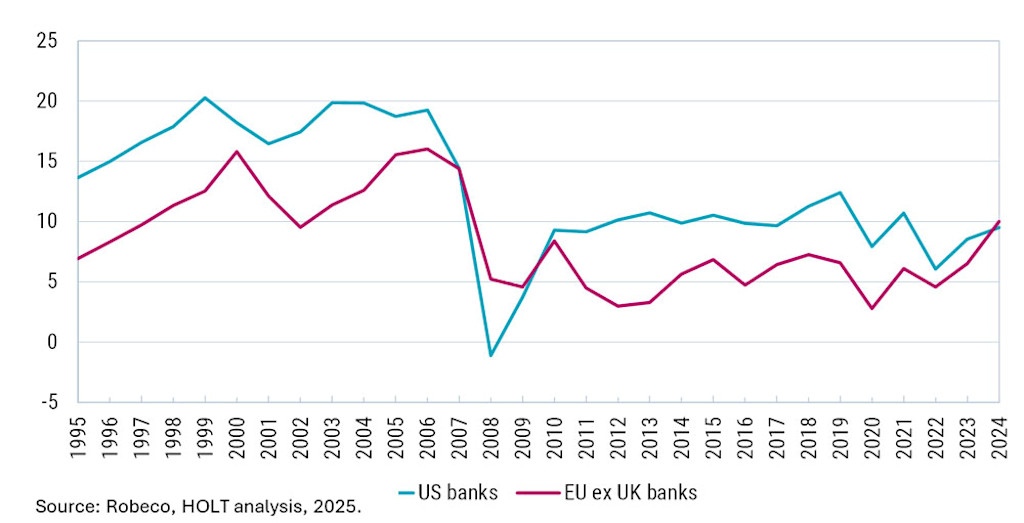

European banks have historically lagged their US counterparts in profitability due to fragmented markets and heavy regulation (see Figure 1). However, external forces – from Trump pressures in the West to geopolitical vulnerabilities from Russia/Ukraine in the East – and internal pressure (the Draghi Report below) are pushing the EU to address its structurally weak and anti-competitive capital markets system.

According to the 2024 Draghi Report, the EU needs to invest EUR 750 billion to strengthen its competitiveness – the lion’s share coming from private, not public sources. Europe’s over-reliance on bank-based financing has limited capital availability, risk-sharing and financial sector innovation and growth.

In future, expanding the role of capital market mechanisms is necessary to channel assets into more productive investments and increase competitiveness. Therefore, the creation of one unified capital market is a clear political priority and legislation is already underway. Key initiatives under the new EU Savings and Investments Union (SIU) strategy include:

Implementing the Listing Act to simplify companies’ access to public markets

Reviewing the securitization framework

Facilitating equity investment by institutional investors

Channeling depositor savings into capital markets via pension schemes

Reforms are expected to boost growth and narrow the competitive gap between US and European banks. According to HOLT analysis, a 1% reduction in the discount rate applied to European banks – reflecting lower perceived risk – could lead to a 17% increase in warranted valuation.

Figure 1 – CFROE of US and European banks

Furthermore, reforms to Solvency II – the EU’s regulatory framework for insurers – will make it easier for insurance companies to provide long-term financing to the European economy. The European Commission is proposing changes that will ease capital requirements, improve solvency ratios and risk margins and enable insurers to more easily invest in the securitization market.

If enacted, insurers could make ‘long-term equity’ investments leading to lower capital charges (22% instead of 39%). Insurers could also access less liquid alternative equity investments if they qualify as long-term equity investments (held-to-maturity/long horizon and matching liabilities). More reforms, including cost-reducing, capital-enhancing and regulatory-efficient measures, are still to come from European lawmakers!

FinTech D USD

- performance ytd (31-1)

- -5,77%

- Performance 3y (31-1)

- 11,09%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Pago de dividendos (31-1)

- No

Easing enforcement will boost next-generation finance

The sweeping policy agenda of the second Trump administration is set to benefit both traditional banking and next-generation finance. Under the executive order titled “Unleashing prosperity through deregulation,” for every new regulation proposed, agencies must repeal at least ten existing regulations. As a result, federal agencies such as the CFPB1 and FDIC2 are scaling back enforcement, especially in the fintech strongholds of Banking as a Service (BaaS), Buy Now Pay Later (BNPL), and digital wallets.

For example, the CFPB withdrew proposed regulations that capped credit card late-fees, which indirectly helps smaller fintechs and neobanks compete more effectively with deep-pocketed banks that issue cards. The CFPB also significantly reduced a civil penalty lodged against Wise, a fintech specializing in digital payment transfers, from over USD 2 million to just USD 45,000.

The sweeping policy agenda of the second Trump administration is set to benefit both traditional banking and next-generation finance

Conclusion

The ongoing regulatory changes represent a major paradigm shift for financial services and create significant opportunities for Robeco’s New World Financial and FinTech Strategies. Our investments in the US are set to benefit from deregulation, including banks such as Citi and Bank of America which are expected to deliver improving profitability and attractive capital returns. We also hold Capital One which is poised to benefit from the approved merger with Discover Financial Services. Moreover, Europe is increasingly attractive given the initiatives under the Savings and Investment Union, fiscal reforms in Germany and persisting valuation differentials.

The decreasing regulatory burdens of fintech players allows them to innovate more freely in areas such as lending, payments, and crypto. Digital wallets providers, including PayPal, Apple Pay, Venmo, CashApp, and Shop Pay, continue to grow their transaction volumes. And BNPL providers such as Afterpay, Affirm and Klarna are also gaining traction. Taken together, looser oversight coupled with less stringent capital requirements should facilitate industry consolidation and partnerships between fintechs, banks and other financial players.

Important note: The companies referenced are for illustrative purposes only in order to demonstrate the investment strategy on the date stated. The companies are not necessarily held by the strategy(ies) nor is future inclusion guaranteed. This is not a buy, sell or hold recommendation, nor should any inference be made on the future development of these companies.

Footnotes

1CFPB, the Consumer Financial Protection Bureau

2FDIC, the Federal Deposit Insurance Corporation

Acceda a las perspectivas más recientes

Suscríbase a nuestro newsletter para recibir información actualizada sobre inversiones y análisis de expertos.