The ‘Great Rebalance’ – themes poised for growth as markets broaden

Markets remain surprisingly sanguine despite Trump’s aggressive tactics and geopolitical volatility. A broadening market and the decentralization of geopolitical power beyond the US are emerging signals that should be supportive of our globally diversified thematic strategies heading into 2026.

Resumen

- Markets remain calm despite multiple geopolitical shocks

- Trump’s tactics are helping deconcentrate markets and decentralize power

- Broader leadership opens door for more sustainable approach to growth

2025 delivered headline after headline which in the past would have unsettled markets, or at the very least pushed oil prices and equity risk premiums meaningfully higher. Those include the US bombing of an Iranian nuclear facility, the continuation of the Russia-Ukrainian war, and the build-up of military presence off the coast of Venezuela.

Pair these physical conflicts with the weaponization of trade and industrial policies by the world’s super-economies and 2025 should have witnessed sustained seismic movements in volatility. Yet, Trump’s Liberation Day tariffs on 2 April were the only real sign of fear and panic in the markets, resulting in the S&P 500 falling nearly 5% and the Nasdaq nearly 6% in one-day trading. But even this dip was short-lived.

As we enter 2026, volatility remains near historic lows, judging by traditional market indicators. However, anyone glancing at volatility charts alone would hardly infer that global power structures are being contested, that economic outcomes – particularly in the US – have become distinctly K shaped, or that labor market imbalances pose long term challenges. Consumer sentiment, from the US to China , has hit multi-year lows reflecting job market, inflation and economic insecurities among middle- and lower-income segments. Such a stark contrast between surface signals and teeming tensions seething beneath the surface provides a landscape that will be challenging but at the same time rewarding topography for thematic investing as we charge into 2026.

A new world order taking shape

Trump remains ever true to character – bold, brazen, unpredictable and unapologetic. However, like in markets, the impact of these shock and awe tactics is increasingly being met with muted reactions from world leaders, who by now are catching on to the ‘TACO tango’. But that’s not to say these theatrics are not taking a diplomatic toll. The structural implications for the US are concerning. Its credibility, reliability and position as a force of stability in the economic and political scene are deteriorating. US bullying is pushing its traditional partners to embrace other alternatives. The UK is re-engaging with China on trade. Meanwhile, the EU and India have just concluded a landmark trade agreement, and an equally noteworthy EU-Mercosur deal would open up good flows between EU states and South America’s major economies.

Stronger trade alliances are a sign of broadening and diversification of economic growth globally rather than being concentrated in the US. Antagonizing politics of the US are amplifying de-globalization trends as countries realize they can no longer rely on the US and set out to protect their own national and economic interests. In the process, a new world order is emerging, leaving room for Europe and China to establish renewed leadership on climate tech and the energy transition, where they along with Robeco’s thematic strategies already have a head start.

Markets – broadening leadership

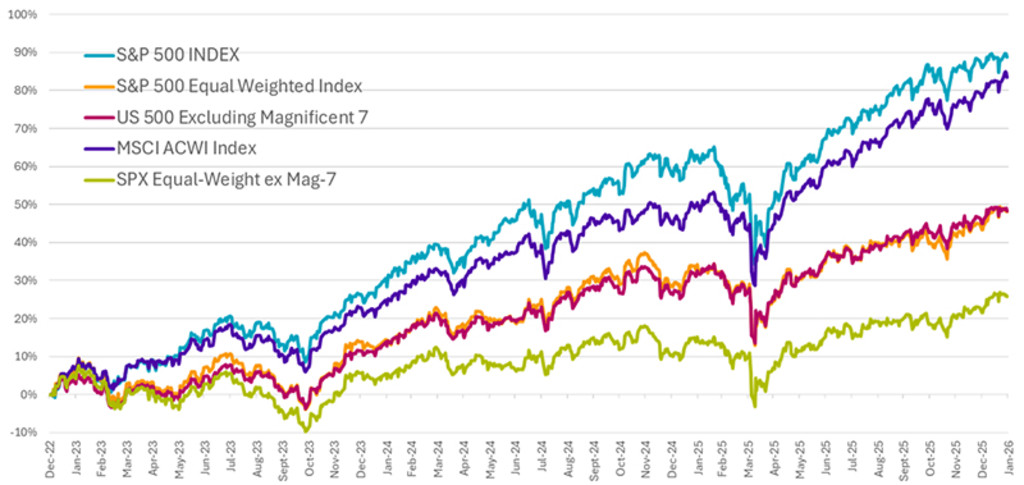

The past three years have been marked by an increasingly synchronized market rhythm, largely dictated by a narrow cohort of mega cap US tech (the Magnificent Seven) companies. Over this period, the equal weighted S&P 500 and the S&P 493 (the index minus the mega caps) returned roughly 44%1. That’s only half of what the market-cap-weighted and heavily skewed S&P 500 achieved!

Meanwhile, the more globally diversified MSCI All Country World Index generated an impressive 79%2. The market synchronization argument appears to be dissipating as global benchmarks continue to deliver strong returns beyond the US. We are already seeing meaningful rotations: leadership is separating. AI-linked semiconductors have surged while software has lagged, and the ‘safe haven’ trade has favored gold over bitcoin. Moreover, utilities and telcos, traditional defensive hedges, are also seeing gains.

Regional and style breadth has improved as well – Europe, mid-caps and emerging markets have already moved ahead of the S&P 500 earlier in the year. In this environment, market broadening is likely to be a defining feature of 2026, reinforcing the opportunity set for active management – and for thematic strategies in particular – as returns become less concentrated and more dispersed across sectors, regions and business models.

Figure 1 – Market leadership is moving beyond the ‘Mag Seven’ and US dominance

Past performance is no guarantee of future results. The value of the investments may fluctuate. The MSCI All Country World Index (ACWI), which includes both emerging and developed markets, provides a reasonable gauge of global equity market health. It has surpassed returns of the Mag7 and an equally weighted basket of US equities and is now catching up with US equity returns that are market-cap weighted.

Source: Robeco, Bloomberg, 2026.

Looking back at 2025 – some themes survived and thrived alongside AI

Despite the narrow market leadership, several thematic strategies have held their ground remarkably well. Themes such as AI enablers, digital innovation, energy infrastructure, financials and fintech, and selective consumer trends were able to match global equity markets over the last three years. For Robeco, five out of twelve thematic strategies performed at least in line with global equities — a hit rate that compares favorably with the roughly 20% of global equity funds that managed to outperform.

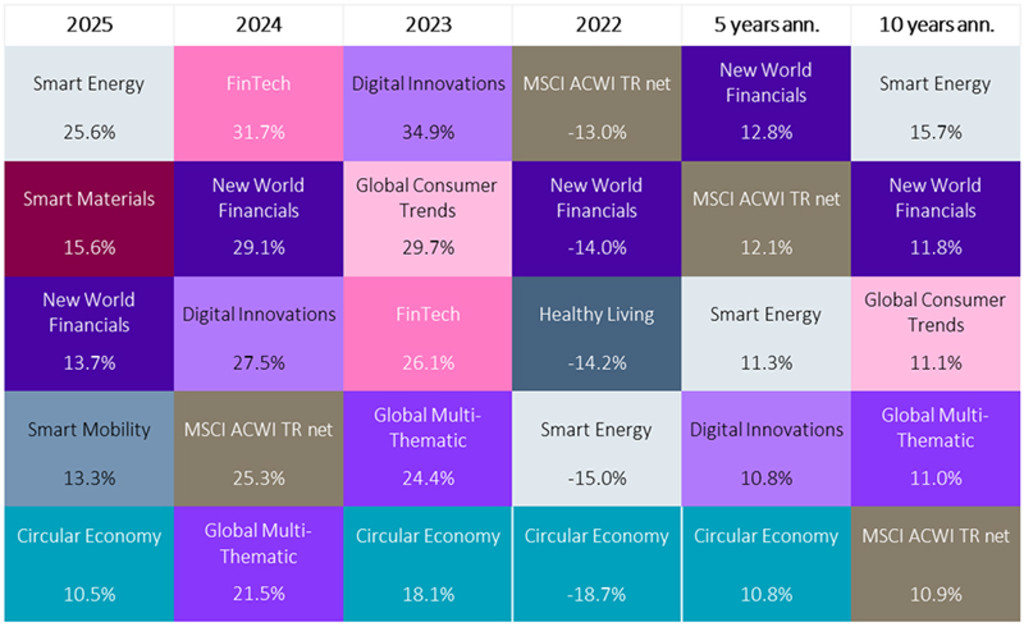

We never expect all themes to do well at all times. That’s inherent in their design. Robeco has a broad range of themes each characterized and composed of a broad mix of companies diversified by growth stage, sector, supply chain position and world region. They are hence impacted by diverse headwinds and tailwinds (regulations, macro factors, consumer sentiment, etc). This creates extreme variations in performance. Figure 2 clearly illustrates how themes shift performance leadership along with prevailing market dynamics over the short, mid- and long-term.

Figure 2 – Thematic returns leadership rotate based on investment cycles

Past performance is no guarantee of future results. The value of your investments may fluctuate.

Source: Robeco, MSCI. Index: MSCI All Country World Index. Performance based on absolute returns in EUR for all portfolios and mandates within each of the listed strategies as of 31 December 2025. Returns are gross of fees, based on gross asset value. If the currency in which the past performance is displayed differs from the currency of the country in which you reside, then you should be aware that due to exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency. Performance since inception is as of the first full month. Periods shorter than one year are not annualized. Values and returns indicated here are before cost; the performance data does not take account of the commissions and costs incurred on the issue and redemption of units. These have a negative effect on the returns shown. Upon request information on other share classes can be provided.

The implication is clear: selecting the right theme to complement the current portfolio’s exposure is as essential for fund allocators as stock selection for active managers. A passive, one size fits all approach is insufficient in a world where technological, demographic, environmental, and geopolitical vectors accelerate and collide.

The broad underperformance of many themes in 2024 - 2025 has normalized valuations back to historically reasonable levels. This shift appears driven more by market sentiment than by structural weaknesses in the underlying companies. As valuations reset and dispersion gradually returns, alpha potential increases. Furthermore, with long duration growth assets traditionally found within thematic strategies, the expected easing cycle in interest rates should act as a tailwind.

Acceda a las perspectivas más recientes

Suscríbase a nuestro newsletter para recibir información actualizada sobre inversiones y análisis de expertos.

Looking ahead – themes that excite us

Looking ahead, the opportunity set is broad – from accelerating the energy transition and electrifying mobility, to robotizing manufacturing; from dematerializing applications of a circular economy, to democratizing finance through neobanks and fintech. These are robust structural trends that should continue to compound – not only from a ‘values’ perspective but also from plain-vanilla profitability logic. They strengthen long-term security, improve productivity, and support more resilient economic growth.

Smart energy – the growing power-capacity crunch

Electricity demand is in the midst of a powerful structural upswing, led by the explosive growth of AI and data center infrastructure. Broader electrification trends across the economy add further upward pressure. EVs and AVs mean more electricity demand in transportation; meanwhile, industrial reshoring means robotics and automation are increasing electricity intensity across manufacturing.

Such outsized demand is exposing severe constraints in grids, generation, and transmission capacity –pushing power system modernization to the top of policy agendas in the US and Europe. Moreover, momentum is increasingly underpinned by economics – particularly AI driven demand growth – rather federal than subsidies. Global commitments are expected to triple renewable capacity and double energy efficiency by 2030 which further reinforces capital flows toward storage, smart grid technologies, power management equipment, and data center efficiency solutions.

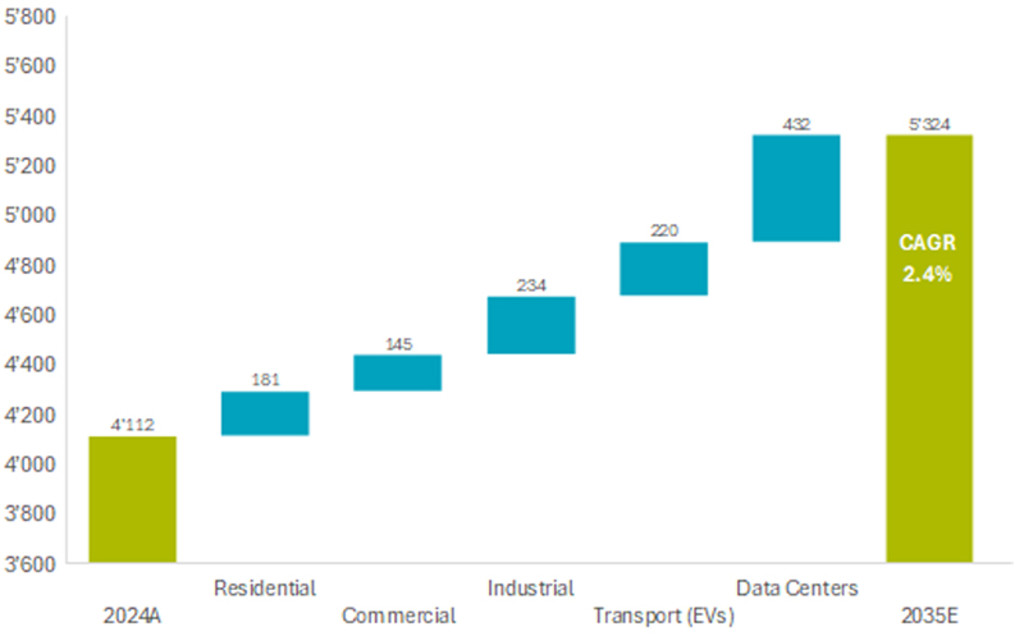

Figure 3 – Main drivers of increased US power demand (TWh)

After more than two decades of flat demand, total US energy demand is expected to rise to 5,324 TWh by 2035 (up 2.4% CAGR from the actual demand of 4,112 TWh in 2024). Data centers are expected to account for 432 TWh or 36% of new demand, followed by the electrification of industry (19%), transport (18%), residential (15%), and commercial buildings (12%).

Smart materials – mineral scarcity meets economic security

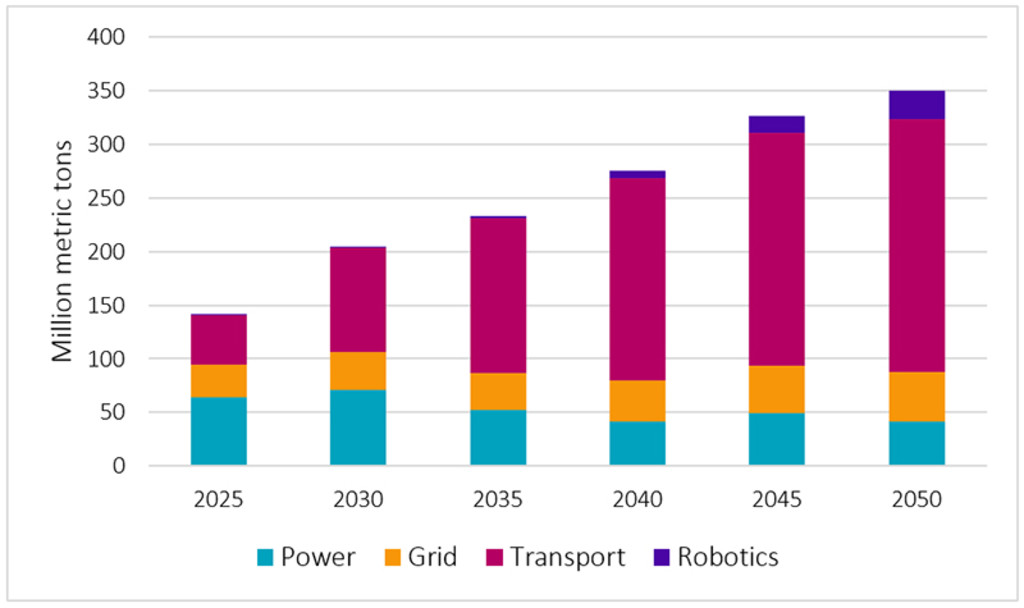

Smart Materials focuses on the critical minerals and advanced materials needed to electrify transport, digitize industry, and decarbonize manufacturing.

Entering 2026, tailwinds are strengthening. Easing rates and a firmer manufacturing cycle support select cyclical areas, while structural capex in grids, renewables, battery storage and mineral refining remains robust. AI driven data center expansion is now the most powerful demand engine, lifting needs for ultra pure chemicals, photonics, precision analytics and advanced packaging – all part of the materials value chain. At the same time, critical mineral security, accelerating factory automation and early humanoid robotics adoption intensify pressure on lithium, copper, rare earths and automation suppliers. With scarcity dynamics intact and valuations still reasonable, companies enabling mineral supply, circular materials and intelligent production remain well positioned for the next leg of growth.

Figure 4 – Global transition metal demand by major end markets

Source: Robeco, BloombergNEF, 2025.

Smart mobility – electrification and AI are powering sustained growth

Smart mobility is shifting from early adoption to scaled, intelligent systems. In 2025, EVs accounted for roughly a quarter of global light vehicle sales, with China exceeding 50% NEV penetration and several European markets also surpassing key adoption thresholds. This electrification trend continues to raise semiconductor content per vehicle, providing structural demand support against broader macro cycles.

A second catalyst is the convergence of physical AI and mobility, marked in 2025 by accelerating robotaxi deployment and regulatory progress on advanced assisted driving. The battery value chain is benefiting from strong EV momentum and growing energy storage demand tied to AI data centers and new Chinese policies. Firming lithium prices indicate sustained demand may push the market toward tighter supply conditions.

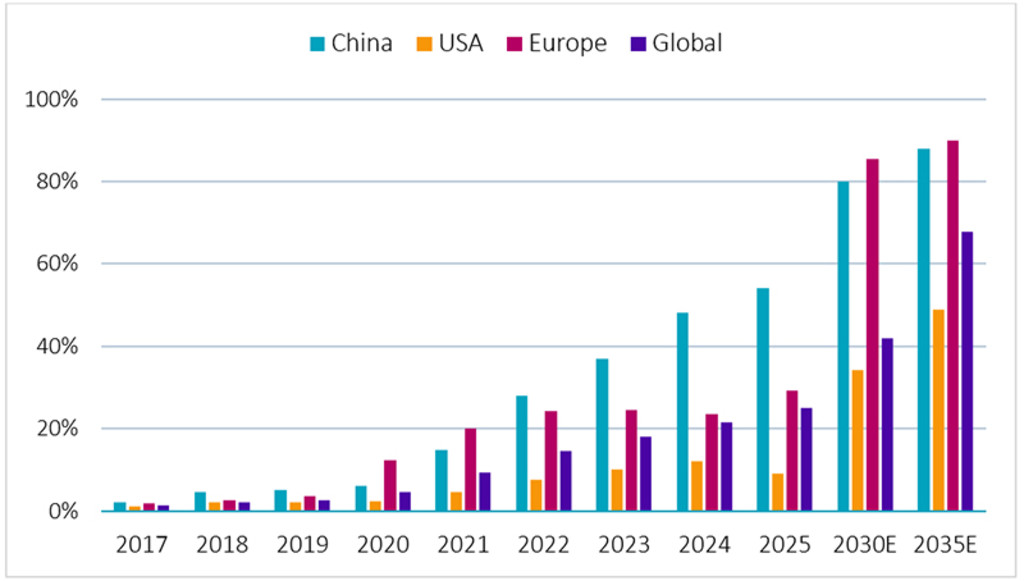

Figure 5 – EV penetration > 80% in major markets in less than four years

Global EV penetration rates across regions.

Source: Robeco, BloombergNEF, 2025.

The recovery in valuations, the gradual return of dispersion, and a more balanced opportunity set beyond AI dominance form a favorable backdrop for the coming year. Policy shocks and geopolitical friction, especially from the US, are acting as catalysts, pushing capital and nations toward greater resilience, efficiency and independence. Countries and companies are already re-thinking and re-aligning toward calm, cool, consistent and, above all, patient leadership, the kind needed for durable, sustainable outcomes.

Footnotes

1Past performance is no guarantee of future results. The value of the investments may fluctuate.

2Ibid.