Hey Big Spender: Powering the climate transition with capex investments

Investor finance needs to be directed at companies that are spending heavily on the infrastructure needed to combat climate change, say Robeco’s transition specialists.

Resumen

- Capital expenditures are a crucial barometer for a company’s transition ability

- Global Climate Transition Equities strategy targets leaders for capex

- Renewable energy leads the way, but large funding gap remains until 2050

Eye-watering amounts of capital expenditure (capex) are needed in areas such a renewable energy, decarbonizing utilities and building new electricity grids in order to decarbonize the global economy.

While it is a financial challenge running into the trillions, it also offers huge opportunities for investors, say Farahnaz Pashaei Kamali, Robeco’s Sector Lead for Energy, Utilities and Sustainable Alpha Research. and Chris Berkouwer, Portfolio Manager for Robeco’s Global Equity team.

It means focusing on companies where climate transition factors are the most material to long-term value creation, they say. This can be done through strategies such as Robeco Global Climate Transition strategy, which invests in companies at the forefront of capex targeted at this kind of infrastructure.

“Capital expenditures are a crucial barometer for transition investing, providing a tangible measure of a company’s commitment to sustainability,” says Pashaei Kamali. “High capex in climate-aligned sectors like renewable energy and electrification signals a company's strategic positioning for future growth, while low or misaligned capex can pose significant risks, including stranded assets.”

“Furthermore, insufficient capex can mean missed opportunities for innovation, and excessive spending on non-aligned areas may dilute long-term returns and heighten climate-related vulnerabilities. Thus, a thorough analysis of capex is an essential part of any robust investment strategy.”

Achieving a pathway that can limit global warming to well below 2 °C – when we are already at 1.3 °C of confirmed warming1– requires unprecedented levels of capital deployment. The International Energy Agency estimates that an average USD 3.3 trillion a year of investment is needed up until 2030, reaching a cumulative USD 55 trillion by 2050.2 An infrastructure spending program of this scale has not occurred since rebuilding Europe at the end of World War Two.

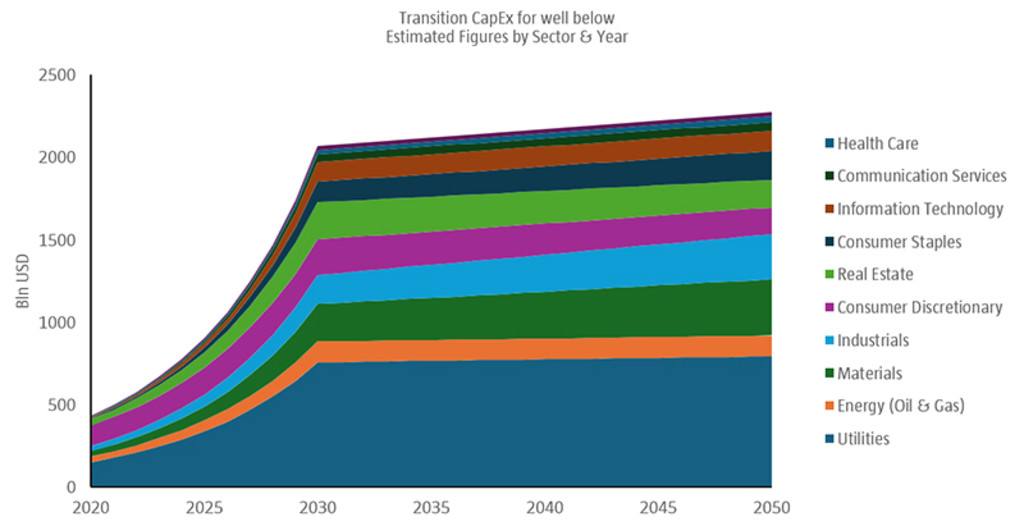

“Much of it will be spent on renewable energy projects, electrification, industrial decarbonization and climate-resilient infrastructure,” says Berkouwer. “Utilities dependent on fossil fuels need the largest share of the investment, followed by materials and consumer discretionary.”

“This underscores where both the most significant risks and opportunities for investors are likely to emerge, particularly in identifying the leaders and laggards in companies according to their readiness for transition.”

Identify the transition leaders

The Global Climate Transition Equities strategy seeks out the leaders while avoiding the laggards, in order to align the portfolio with a ‘well-below 2 °C’ trajectory. To do this, it specifically looks at their capex commitments, along with standard ESG metrics and Robeco’s proprietary Climate Traffic Light system. And increasingly, artificial intelligence is being used to bring the deepest possible scope.

Figure 1: The capex needed by sector for a ‘well-below 2 °C’ trajectory

Source: Robeco.

“An AI-powered system extracts data directly from corporate disclosures, capturing investments such as direct capital spending, green bond issuance, and expenditures aligned with the taxonomies covering climate,” Pashaei Kamali says.

“Where companies report renewable capacity in megawatts rather than monetary terms, figures are converted into US dollars using regional cost projections. This provides investors with a comprehensive view of the scale and credibility of transition commitments across the portfolio.”

Making real capex commitments

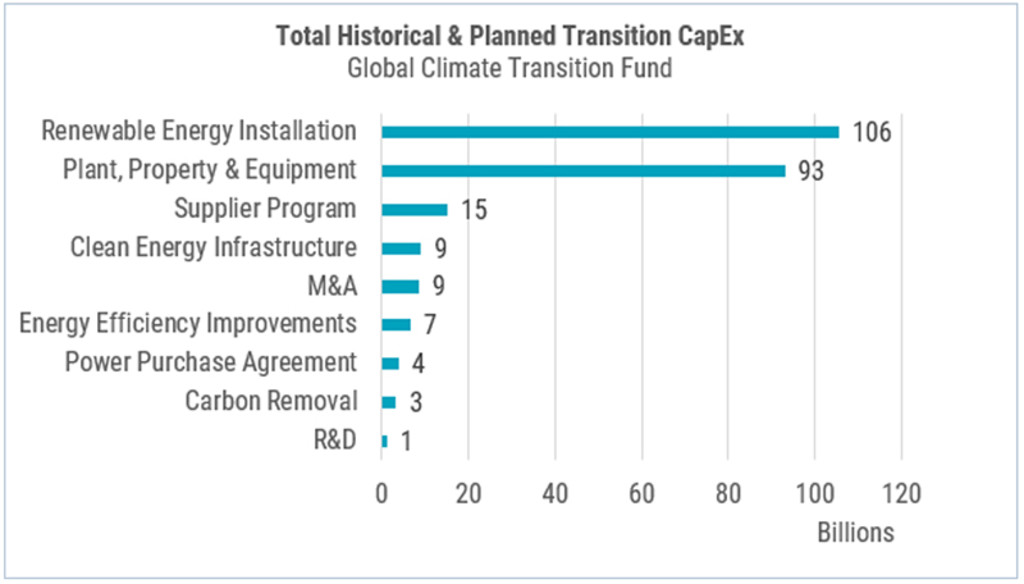

So far within the portfolio, 48 companies have announced 176 identifiable transition capex commitments worth more than USD 81 billion. Around 93% of this capital is targeted toward climate change mitigation. The financial sector was excluded from analysis because its role in financing the transition is an indirect form of capex that requires separate evaluation.

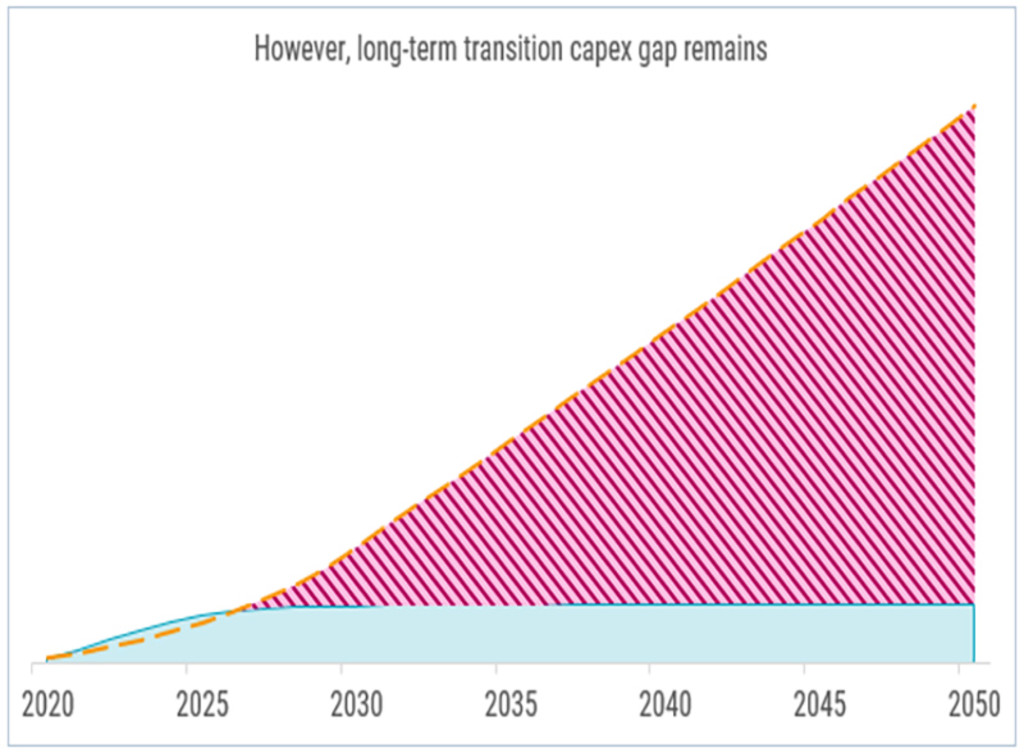

“Encouragingly, the portfolio is currently ahead of the benchmark trajectory for a ‘well below 2 °C’ scenario through 2030, reflecting strong near-term momentum,” Berkouwer says. “Beyond 2030, however, commitments decline significantly.”

“To remain on track toward 2050 targets, an estimated 12% year-on-year increase in transition capex will be required.” The funding gap can be seen in the chart below.

Figure 2: The gap between capex now and what is needed by 2050

Source: Robeco.

Sector trends in portfolio holdings

The analysis also reveals notable differences in investment drivers between sectors among the companies held in the portfolio:

Healthcare companies are investing heavily in renewable procurement, energy efficiency upgrades, and resilient facility design, responding to both operational and regulatory pressures.

Information technology firms are directing significant capital toward meeting surging energy demand from data centres and AI computing, often through large-scale power purchase agreements for renewable energy.

Communication services companies face similar energy challenges and are upgrading networks to operate more efficiently.

Utilities, having already invested substantially in green infrastructure, now act as enablers for other sectors’ decarbonization.

Acceda a las perspectivas más recientes

Suscríbase a nuestro newsletter para recibir información actualizada sobre inversiones y análisis de expertos.

Renewable energy focus

The largest single category of committed transition capex is in renewable energy installation, with wind energy leading due to its scalability and cost competitiveness. Additional investments include battery storage, grid upgrades, and the construction of EV and battery manufacturing facilities. The chart below shows how this is reflected in the investments in the Global Climate Transition strategy.

Figure 3: Capex commitments by category

Source: Robeco Global Climate Transition Equities strategy, October 2025.

Implications for investors

All this leads to a focus on identifying the climate leaders, in the belief that it will not only benefit the planet but also achieve the investment strategy’s core objective of seeking alpha – returns that are higher than the benchmark or peer group.

“This kind of climate leadership can reduce downside risk, enhance operational resilience, and open pathways to growth in sectors benefiting from the energy transition,” Berkouwer says. “It also indicates that the portfolio is strategically aligned with both climate objectives and long-term value creation.”

“Notably, ‘low-impact’ sectors like healthcare, information technology and communication services are leading the way,” adds Pashaei Kamali. “Their proactive investments, driven by internal operational needs and robust financial positions, serve as a testament to the strategic value of decarbonization beyond a sector's carbon intensity.”

“Targeted investments suggest a potential for reduced downside risk and more stable cash flows for investors over the long term, reinforcing the importance of corporate investment behavior in achieving global climate objectives.”

Ahmet Kaplan contributed to the AI agentic modeling applied in this research.

Footnotes

1https://wmo.int/publication-series/state-of-global-climate-2024

2https://www.iea.org/news/global-energy-investment-set-to-rise-to-33-trillion-in-2025-amid-economic-uncertainty-and-energy-security-concerns