The future of food will be healthier and more sustainable

The increased focus on health and well-being is impacting all aspects of consumer spending. This includes food production and dietary patterns. Current changes are forcing dominant food producers to rethink their offerings. But they also offer attractive investment opportunities in niche segments, such as plant-based food and beverages, meal kits, and food ingredients.

Summary

- Food demand is shifting toward healthier and sustainable products

- Several attractive niches set to benefit from this

- Large incumbent players are at risk of falling behind

Food production and dietary patterns have changed profoundly over the past 50 years. Rising crop yields and efficient production have helped to improve life expectancy as well as to reduce hunger, infant and child mortality rates, and global poverty. However, these benefits have been partially offset by a number of detrimental side effects.

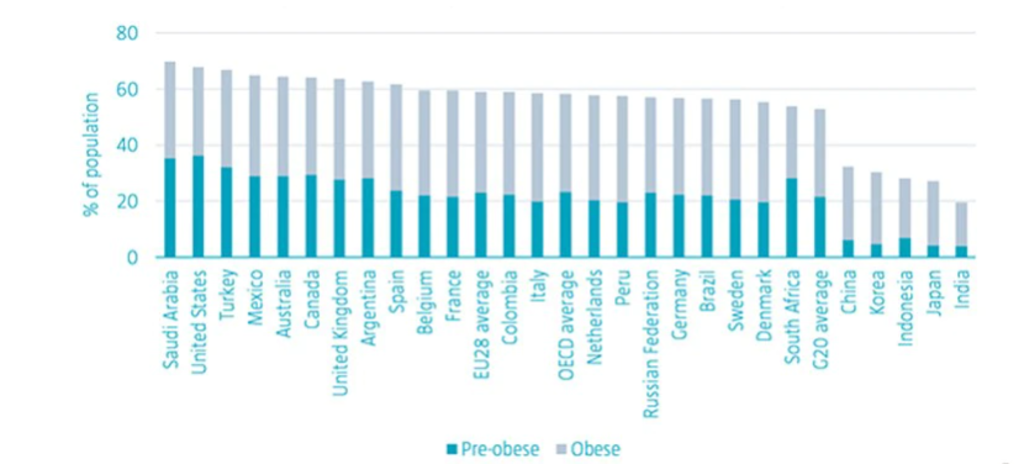

These include massive environmental degradation due to unsustainable farming practices, as well as rapidly expanding health problems, ranging from widespread obesity to heart disease, as diets have tilted toward higher-calorie and heavily-processed foods. Faced with these challenges, consumers are now gradually changing their behavior by opting for healthier and more sustainable products.

Figure 1: Large parts of the population are overweight

Source: WHO Global Health Observatory. Date: 2018

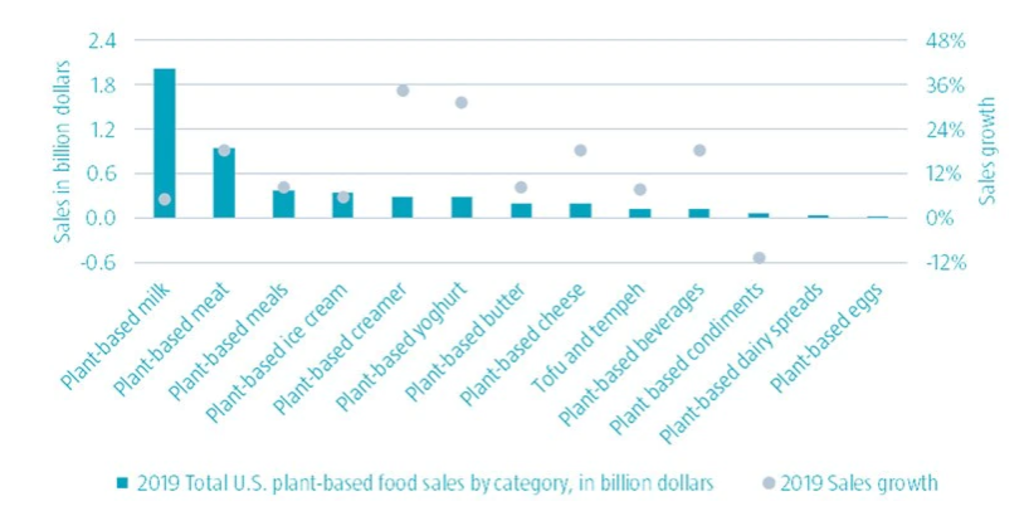

In the US, for instance, sugar and dairy consumption have been decreasing. Although the declines in demand have been slow, the impact on food producers has been profound. The country’s milk industry has been under pressure as consumption has been falling by 40% since 1975. The drop in cow’s milk consumption has been partly replaced by plant-based dairy products.

In this context, large incumbent players of the consumer-packaged goods market are facing increasingly stronger headwinds, as they still derive most of their sales from relatively unhealthy food products. These large groups have been investing in healthier and more sustainable foods, because these segments are growing faster than their core categories.

Food giants have an opportunity to improve the healthiness of their products, and in fact, they are. Those with the right strategy of becoming more sustainable and selling healthier food could in fact benefit from shifting consumer preferences, if they use their large capital resources and distribution networks.

Smaller packaged-food companies, with superior health and sustainability credentials, appear to be better positioned for now. While impact investors could argue that food giants are not best-in-class yet, they do impact the diets of more people than smaller-sized companies as they undergo positive change.

Food giants have an opportunity to improve the healthiness of their products, and in fact, they are

Focusing on attractive niches

Meanwhile, shifts in consumer preferences also offer attractive investment opportunities in segments such as plant-based food and beverages, meal kits, and food ingredients. Pure-play food companies in these segments are becoming more relevant to consumers, they operate in a very large market, and have relatively low product penetration. This provides growth opportunities.

Sales of plant-based food, for example, are growing at steady 10% to 15% annual growth rates in the US, EU, and UK.1 Moreover, they still represent only a fraction of total food sales, leaving ample room for future growth. In the EU and UK, just 2.5% of dairy sales and 0.7% of meat sales are plant-based.2 This compares to 0.6% of all US retail food sales being plant-based.3

Figure 2: Dairy is the largest category in US plant-based food

Source: The Good Food Institute, SPINS and IRI. Date: 2020.

Meal kit companies also feature attractive prospects. They deliver boxes with mostly fresh, specific ingredients on a weekly basis to customers’ homes. As such, they enjoy a vast addressable market, with high growth potential. Some of these businesses have been growing at high double-digit rates over the past few years, with significant acceleration during the Covid-19 pandemic.

Another example of an attractive niche in the food production sector is related to ingredient companies. These have been experiencing structurally higher volume growth relative to general food businesses. Over the past decade, ingredient companies’ volume growth has averaged 3.5%, compared to 0.5% for their general food counterparts.4

Ingredient makers benefit from supplying a high value-add product that influences the user experience at a relatively low cost. At the same time, competitive pressures are lower relative to other food businesses, as ingredient companies often compete in an oligopolistic market. Barriers to entry such as scale, increasing product complexity and regulations further lower competitive pressures.

Meanwhile, increasing fish consumption in China presents an opportunity for listed Atlantic salmon companies. Fish is one of the most efficient meat products, in terms of environmental impact.5 Every 100 kg of feed yields 56 kg of edible fish meat, compared to only 7 kg of beef meat. In addition, only 7.9 kg of CO2 are produced for every kg of edible fish meat, compared to 39 kg for a kg of beef meat.

Consumers reducing their environmental footprint are therefore likely to switch from pork and beef to fish and poultry. China’s per capita consumption of salmon is currently only 60 grams per year, while Europe’s is about 2 kg, which means that the market for salmon in China is far from saturation and still has great development potential.

Digitalization is coming to all sectors and restaurants are no exception

A ‘pick-and-shovel’ approach for the kitchen

Indirectly related to the food production sector, companies supplying professional kitchen equipment also represent an attractive segment for investors, because they benefit from growing demand for restaurant food, whether it is eaten in an actual restaurant or delivered to the consumer’s home.

Major opportunities for these suppliers stem from growth in eating-out expenditure, the replacement of traditional equipment, and emergence of ghost kitchens6 servicing food delivery. In recent years, expenditure on eating out has risen 4% to 5% annually.7 Although recently interrupted by the pandemic, we believe consumers will continue to increase spending on eating out in the future.

Finally, digitalization is coming to all sectors and restaurants are no exception. Digital enablers for the restaurant industry tend to feature attractive subscription and transaction-fee-based business models. Therefore, we expect the number of restaurants subscribing to these types of services to continue to grow at a rapid pace over the coming years.

Keep up with the latest sustainable insights

Join our newsletter to explore the trends shaping SI.

Footnotes

1ING, Good Food Institute, SPINS and IRI. Date: 2020.

2Euromonitor. Date: 2019.

3United States Census, The Good Food Institute, SPINS and IRI. Date: 2019.

4Jefferies. Date: 2020.

5Barclays Research and MOWI. Date: 2020.

6Ghost kitchens are a professional food preparation and cooking facility set up for the preparation of delivery-only meals. However, a ghost kitchen differs from a virtual restaurant in that a ghost kitchen is not necessarily a restaurant brand in itself and may contain kitchen space and facilities for more than one restaurant brand.

7McKinsey. Date: 2020.