Is an AI bubble forming? Separating hard data from hype

As the artificial intelligence (AI) computing era continues to gain momentum, questions have emerged regarding the scale of investment and the valuations of companies involved. As with any investment cycle, periods of hyper growth can be accompanied by periods of consolidation. The AI era is likely to follow a similar pattern.

Summary

- Valuation multiples have expanded, but remain well beneath prior peaks

- AI has driven material growth for both AI infrastructure and software applications

- Stretched valuations and risks extend beyond technology

Speaking in October at the Italian Tech Week conference, Amazon.com founder Jeff Bezos said that AI was currently in an ‘industrial bubble.’ Explaining the phrase, Bezos noted that whereas financial bubbles are born purely on speculation, industrial bubbles arise as new industries are built, with the resulting inventions accruing to the benefit of the economy and society. However, he also noted that during these periods of excitement, both the good ideas and the bad ideas receive funding. Separating the wheat from the chaff requires a sharp eye on fundamentals.

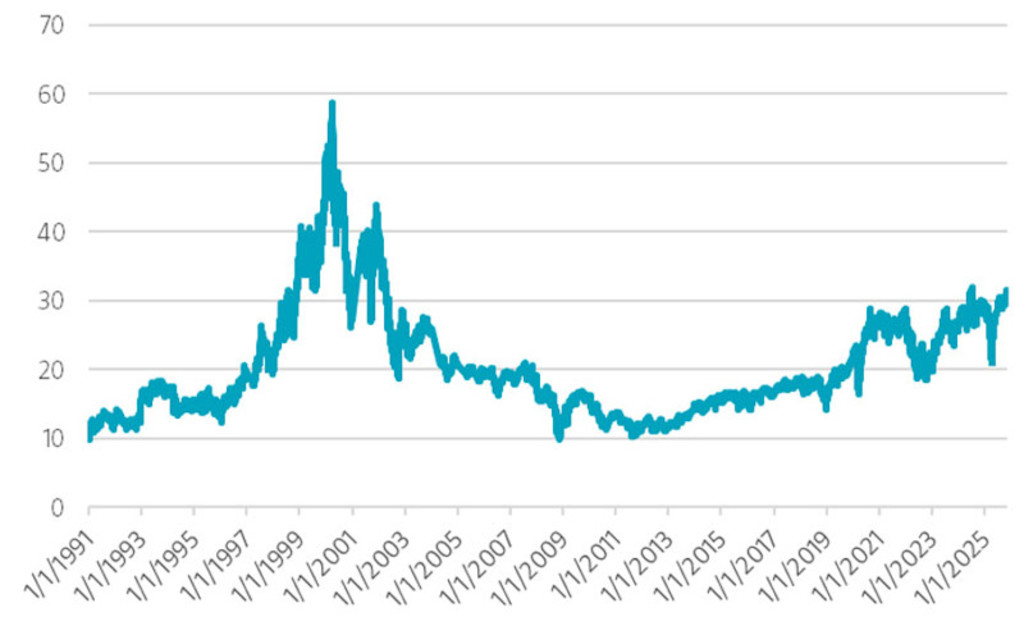

Although valuation multiples have risen, they remain below prior peaks, and earnings forecasts continue to expand. The US technology sector currently trades at 30.4x forward earnings (see Figure 1), compared to a 5-year average of 26x and a 10-year average of 22.4x. For comparison, at the 1972 peak, the Nifty-50 traded at 42x earnings and in March 2000, the US technology sector traded at 58.7x, while the Nasdaq 100 Index traded at 75x.

Figure 1 – S&P Technology Sector Index forward price to earnings (P/E) ratio

Source: Bloomberg, Morgan Stanley, November 2025.

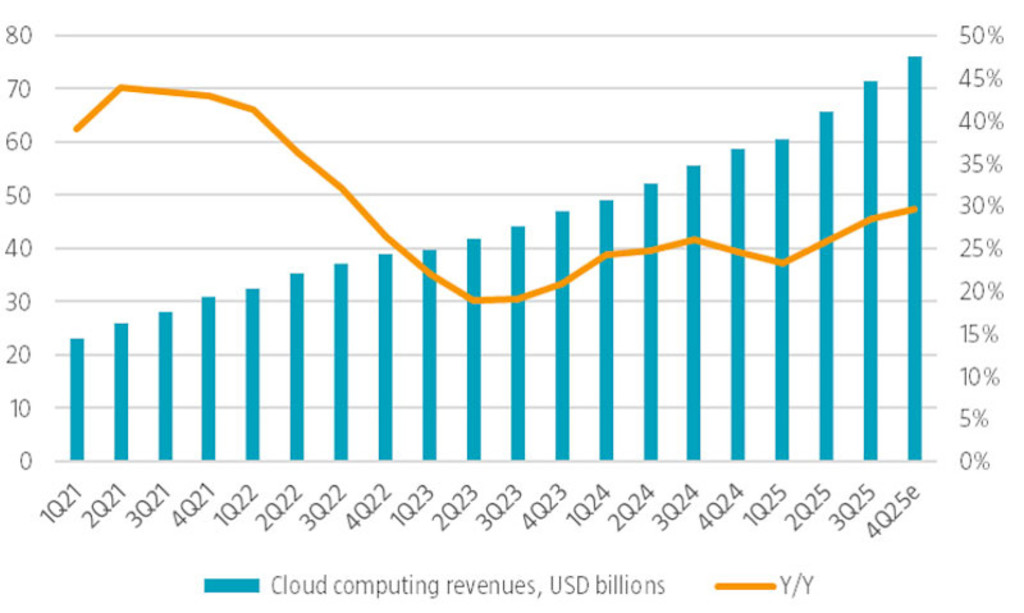

Importantly, rising values have been supported by earnings growth. For instance, in the US, earnings for S&P 500 constituents grew an estimated 13.1% year-on-year in 3Q25, marking the fourth consecutive quarter of double-digit growth. The technology sector is expected to have reported 3Q25 earnings growth of 27.1%, measurably above the 20.9% growth rate that analysts had forecasted at the start of reporting season. In the AI ecosystem, the three largest cloud computing platforms, Amazon, Google, and Microsoft, collectively reported accelerating segment growth of 28.5% year-on-year, 300 basis points greater than in the prior quarter. As a group, these so-called hyper-scalers are, according to consensus estimates, expected to generate USD 273 billion in cloud computing revenues this year – a nearly four-fold increase in the last five years (see Figure 2).

Furthermore, technology incumbents aren’t the only ones benefiting from AI. For instance, in less than three years since the launch of ChatGPT, OpenAI reported generating more than USD 13 billion in annualized recurring revenues; its competitor Anthropic reported USD 7 billion. Those revenues place both companies in the top ten of all publicly listed software providers. AI may not yet be showing up in macroeconomic productivity statistics, but it is measurably impacting income statements economy wide.

Figure 2 – US hyper-scaler cloud-computing revenues

Source: Bloomberg, company reports, November 2025.

Demand-driven capital investment

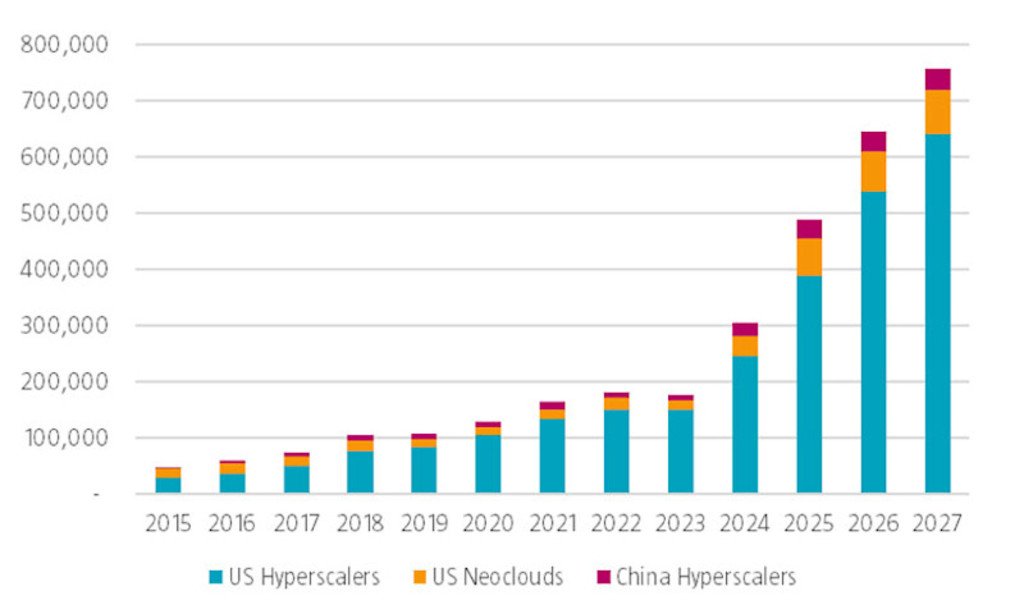

Notably, each of the three leading US cloud computing providers reported on recent earnings calls that customer demand for AI applications continued to exceed capacity. A similar message was delivered by neo-cloud providers like CoreWeave and Oracle in the US, as well as leading cloud providers in China. As a result, despite concerns that investment spending might slow, AI-related capital spending plans rose higher. The combined capital expenditures of US hyper-scalers, neo-clouds, and Chinese hyper-scalers are now expected to rise 60% year-on-year in 2025 to USD 488.5 billion. This revised forecast for 2025 is more than USD 67 billion greater than estimates published by analysts in August. Estimates for 2026 cloud capital spending also ratcheted higher – from USD 145 billion to USD 645 billion (see Figure 3).

Figure 3 – Cloud computing infrastructure capital spending trends, USD millions

Source: Bloomberg, Morgan Stanley, November 2025.

Increased leverage concerns

While there has been growing (and reasonable) concern related to the rising use of leverage, the leading cloud platforms continue to generate substantial profits. As a group, the three largest US cloud providers reported combined 3Q25 segment operating margins that expanded 210 basis points quarter-on-quarter to 35.2%. Despite elevated capital spending, the group’s cash flow remains substantially positive. In 2025, infrastructure investment by these cloud leaders is expected to account for 54% of operating cashflow. Furthermore, the technology sector collectively holds over USD 1 trillion in cash on their balance sheets, providing ample headroom for additional investment.

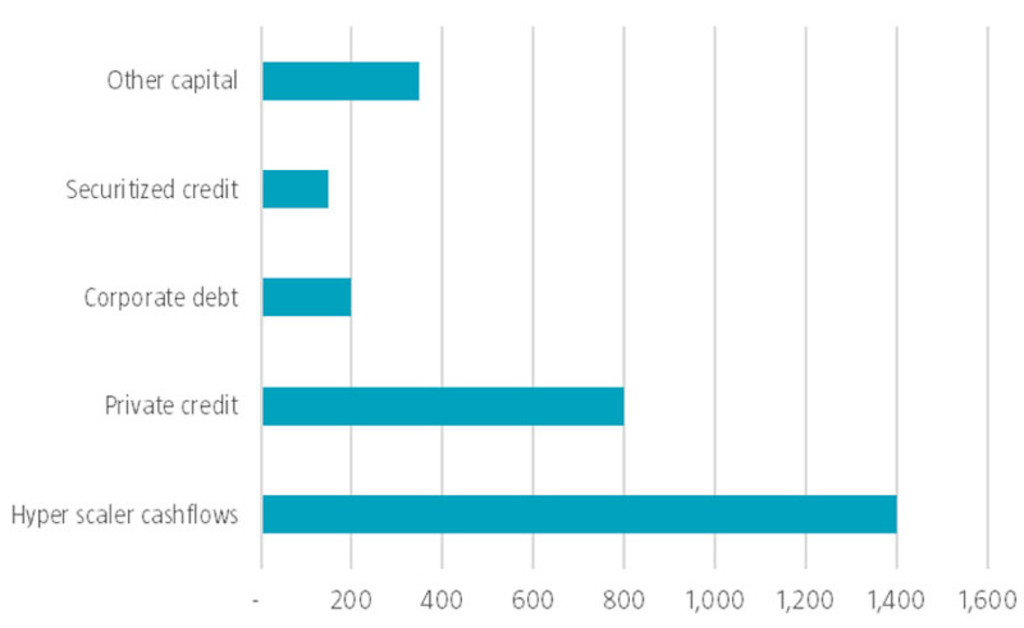

However, the speed at which the AI market has developed, coupled with market entry, and the relative attractiveness of debt financing has driven a wave of credit issuance. According to Bloomberg data, US companies have issued more than USD 200 billion worth of bonds this year, in large part to fund AI infrastructure projects. Morgan Stanley estimates that over half of the USD 2.9 trillion in AI investments expected between 2025 and 2028 will be funded by credit and debt sources (see Figure 4).

While tight spreads suggest credit markets are not yet concerned by technology sector leverage, creative financing structures pose a new area of risk. For instance, private credit arrangements increasingly structured as special purpose vehicles enable issuers to raise capital for new data centers via joint ventures without that debt directly appearing on their balance sheets. While adding complexity may increase flexibility, it also increases risk.

Figure 4 – Global cloud infrastructure capital investment by source, 2025-2028 USD billions

Source: Morgan Stanley, August 2025

Digital Innovations D EUR

- performance ytd (31-1)

- -1.37%

- Performance 3y (31-1)

- 13.02%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Dividend Paying (31-1)

- No

Circular financing

Another area of concern has been the seemingly circular nature of financing arrangements among participants in the AI ecosystem. For instance, Amazon, Google, Microsoft and Nvidia have each made multiple equity investments in AI developers that are also their customers, including Anthropic, Cohere, and OpenAI. Over the last year, the Magnificent Seven completed nearly USD 30 billion in venture investments across more than 250 transactions.

For some, these deals are reminiscent of the dotcom era vendor financing arrangements, where vendors like Cisco, Lucent, and Nortel made loans to unprofitable telco and internet service provider customers. However, given the equity component of the current crop of deals, these investments also present opportunities to generate upside beyond the sale of products and services. Moreover, such cross-industry investments are not without precedence. For instance, ASML received investments from Intel, Samsung, and TSMC to develop their extreme ultraviolet chip fabrication technology. Similarly, Apple, Acorn, and VLSI Technology Inc. were founding investors in the mobile chip designer, ARM. More recently, music streaming service Spotify received equity funding from label partners Sony, Universal, and Warner.

What’s trending?

All the latest thematic investing trends just one newsletter subscription away.

Risks extend beyond AI and technology

While the current bubble discussion has centered on technology, the risk extends to the broader economy and other sectors including industrials, utilities, and commercial real estate. For instance, the surge in data center construction has also driven outsized demand for industrial equipment to power and cool the new facilities. Industrial sector sales to the data-center market are projected to increase 55% this year, with the segment making up over 20% of sales for several key suppliers. Spillover effects from AI and data center demand have also helped drive copper prices up 22% and natural gas prices up 67% this year. Goldman Sachs estimates that in total, AI-driven investments drove 92% of incremental demand in the US economy in the first half of the year.

Further, valuations in several other segments have risen even more sharply than for AI. In particular, valuations of other emerging technologies appear well ahead of current fundamentals. Morgan Stanley’s index for nuclear energy trading stands at 100x forward earnings and quantum computing is at more than 400x projected sales. It is not only technology experiencing heightened expectations, the Morgan Stanley EU defense index trades at 41x earnings, compared to 12x before Russia invaded Ukraine in 2022. Moreover, even after recent pullbacks, gold and bitcoin both trade within the 99th percentile of their historical valuation ranges.

In summary

As we know in hindsight, the bursting of the dotcom bubble in the early 2000s represented the start, rather than the end, of the internet era. For investors seeking to participate in the growth of the AI era, it therefore remains essential to stay selective and focus on underlying fundamentals.