Eight reasons to invest in critical minerals

Magnets, minerals, and metals are the silent enablers of the modern world. A global race to secure supplies and counter China’s dominance is disrupting the entire value chain, from mining to manufacturing. Here we outline eight reasons why minerals are set for multi-decade growth.

Summary

- From common to rare, minerals power electrification and the clean-energy transition

- They’re also essential to data centers, defense systems, and high-tech healthcare

- China’s dominance brings risk — but also long-term opportunity in mineral supply chains

Copper and aluminum may seem too ordinary to be ‘strategic’, but their light weight and extraordinary conductivity make them essential for electricity transmission. These metals are used in countless cables, wires, inverters and switches used to transport electricity safely across not only today’s energy grids but also the rapidly expanding clean energy grids of the future.

In addition to transmission, copper and a host of other critical minerals – including graphite, zinc, lithium, chromium and nickel – are also components of wind turbines and solar cells at the heart of renewable power generation. In fact, clean energy infrastructure is far more mineral intensive than legacy fossil-fuel powered systems.1

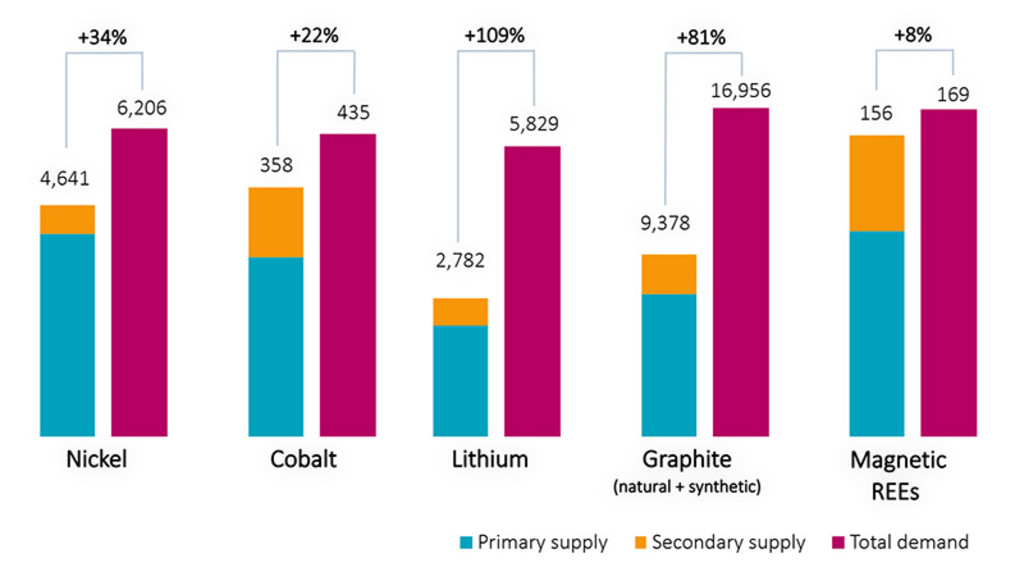

Figure 1 – Demand for many critical minerals is expected to exceed supply by 2035

Note: Supply / demand in Kilotonnes per annum. REE = rare-earth elements

Source: Ellen MacArthur Foundation, IEA – Minerals Data Explorer, 2024.

2. Minerals enable the electrification of diverse sectors in the wider economy

Electrification doesn’t just mean more wires; it means billions of motors and drives turning electrons into motion. From the large turbines of hydropower plants and traction motors in EVs, to the micro-motors of drone fleets and/or simple household electronics, copper coils are needed for efficient flows of electric current.

Rare-earth magnets using neodymium, praseodymium, dysprosium, and terbium provide high-torque density and precision control in EVs, drones, and advanced robots to name a few. In fact, independent research predicts robotics will be the single largest driver of demand for Neodymium-Iron-Boron (Nd-Fe-B) magnets by 2040, further extending minerals’ influence on industrial manufacturing.2 Motors, magnets and minerals are also essential for enabling the electrification of a diverse group of end-markets, creating a steady source of robust demand across the global economy.

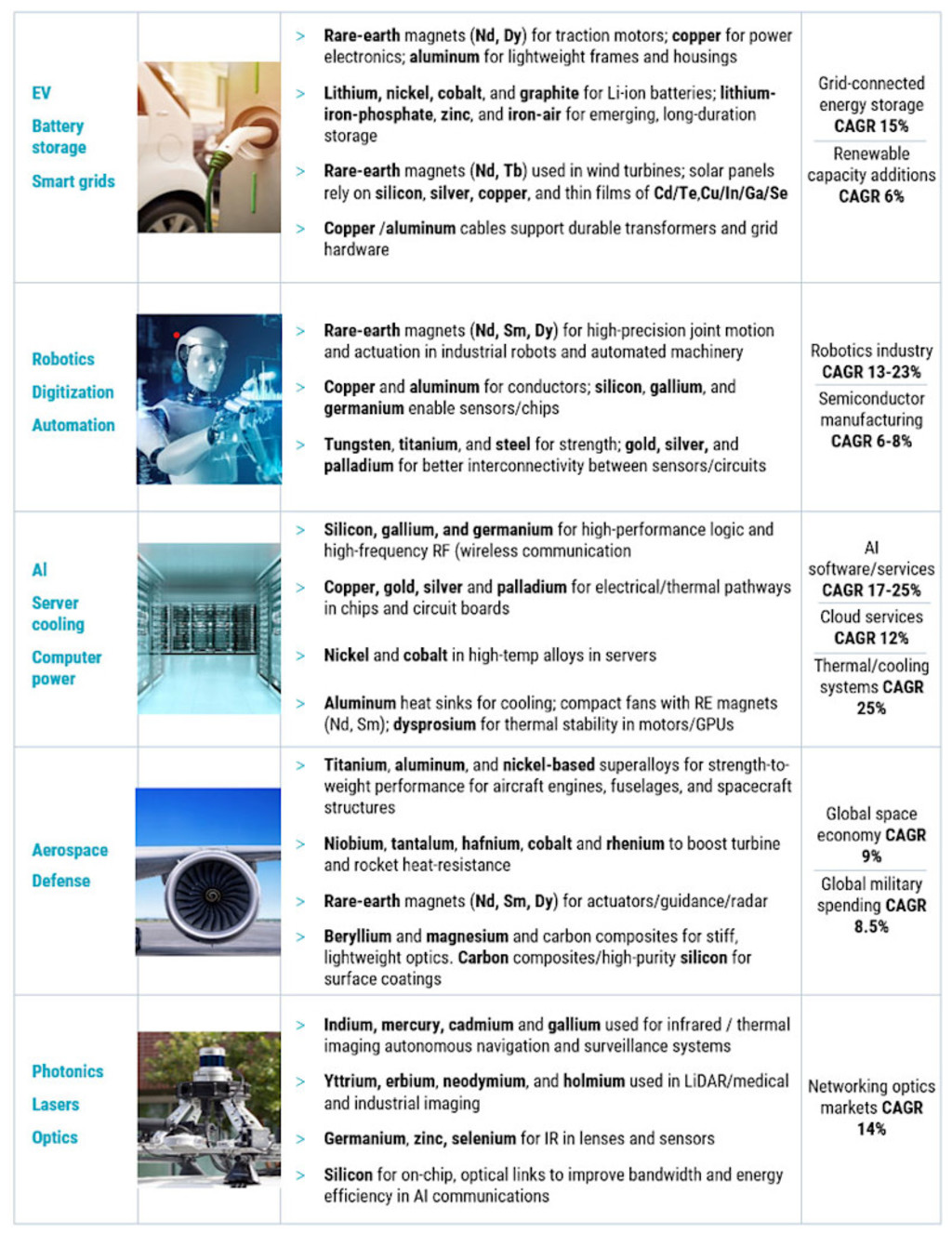

Figure 2 – Strategic minerals are essential for next-gen economic growth

Source: Robeco, 2025. CAGR estimates from BNEF, 2025; IEA, 2024; McKinsey 2024-2025; Stockholm International Peace Research Institute, 2025.

3. Metals are crucial in AI, data centers and smart infrastructure

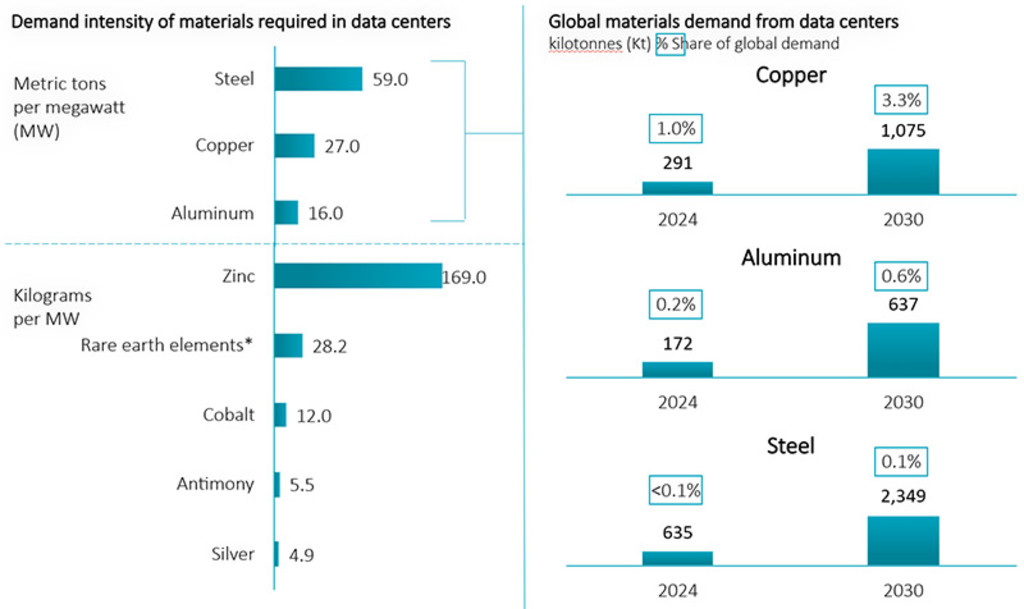

As with energy grids, strategic metals are also underpinning the world’s shift to a digital/automated economy. Copper and aluminum distribute massive electrical loads across hyperscale data centers, busbars, switchgear, and kilometers of cabling, while other specialty metals join silicon as semiconductors inside chips to create denser and more powerful computer processing capacity (see Figure 2).

Moreover, analysts estimate AI datacenters alone could require around 400,000 tons of copper per year within a decade, or 3% of total global demand.3 Add fast-growing electrification projects — from energy grid reinforcements to e-mobility charging stations — and the consumption curve steepens further.

Figure 3 – Data centers and the digital economy demand a host of strategic metals

Source: McKinsey, October 2025.

Note: Charts are non-exhaustive. *Includes dysprosium, neodymium, praseodymium and terbium.

4. Supply squeeze meets China’s chokehold

The latest IEA Materials Outlook compares projected copper demand from announced infrastructure projects (e.g., energy grids, EVs, wind/solar farms, industrial spend) with projected supply outputs. The analysis shows a 30% mined-copper shortfall by 2035. That’s roughly equivalent to Chile’s entire annual output.4

And while supplies for rare-earth elements (REE) look adequate on spreadsheets, these fail to consider the chokehold China has on processing them into something usable by industries. China refines about 90% of the world’s rare-earth oxides and finished magnets, creating an acute single-point vulnerability. 5 That means even modest demand surprises — or policy shocks — can translate into tight supplies and outsized price moves across both copper and rare-earth value chains, especially if China implements export controls.

Smart Materials D EUR

- performance ytd (31-1)

- 10.26%

- Performance 3y (31-1)

- 6.21%

- morningstar (31-1)

- SFDR (31-1)

- Article 9

- Dividend Paying (31-1)

- No

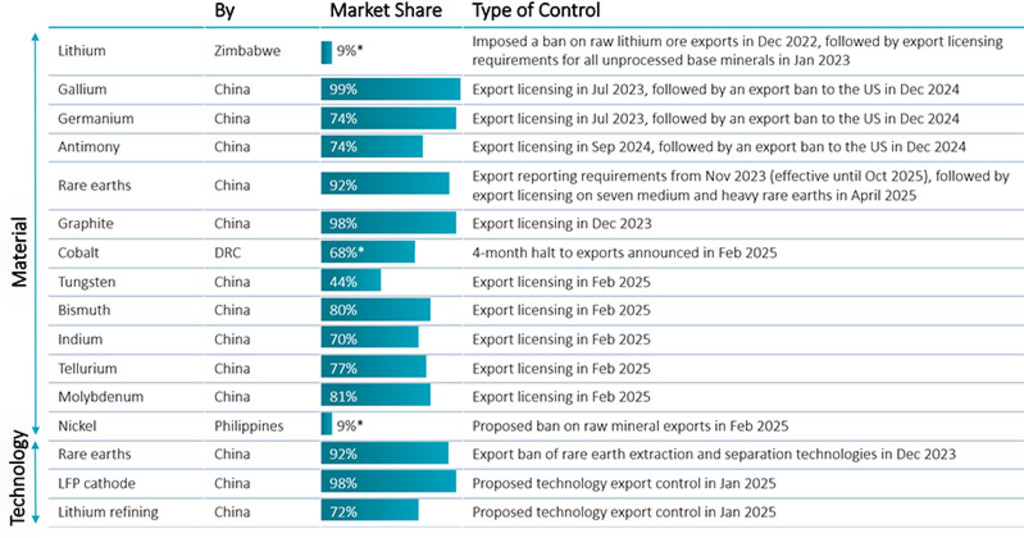

5. Minerals are central for national security and geopolitical leverage

China has frequently weaponized its monopoly on minerals, leveraging its dominance when geopolitical tensions flare. The latest salvo came in October when it imposed controls on REE shipments on top of restrictions executed over the summer, which resulted in a 31% drop in REE exports.6

Washington’s answer was immediate, with the Pentagon instructing the Defense Logistics Agency to build a USD 1 billion strategic stockpile of critical minerals ranging from heavy rare-earth oxides to cobalt and antimony.7 Similar moves are under discussion in the EU and Australia.8,9

Figure 4 – China continues to weaponize and disrupt mineral supply chains

*Mined output. Notes: LFP = lithium iron phosphate. Market shares are based on refined output in 2024.

Sources: IEA analysis based on USGS (2025), Mineral Commodity Summaries 2025, and EC Raw Materials Information System (accessed April 2025).

Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

6. A cautionary tale: the Magnequench sell-off

History shows how quickly a competitive advantage can vanish. When General Motors sold its Indianapolis-based Magnequench unit to a Chinese-backed consortium in the late 1990s, it was the world’s top producer of Nd-Fe-B powder – a rare earth mix also used for high-performance magnets used in defense-guidance systems.10 In 2003, the plant permanently closed, and the equipment was shipped to China, erasing the US’s lone domestic source of military-grade magnets and handing Beijing roughly 85% of global production almost overnight.11

The episode still haunts policymakers — and explains not only the current stockpiling but also the sharp shift in industrial policies and the rise in engagement and partnerships among US, EU, and allied countries. Billions in investments are being channeled toward re-shoring manufacturing capacity and friend-shoring to strengthen mineral supply chain networks.

7. Policy as economic stimulus

Governments now treat mineral access like energy security. The EU Critical Raw Materials Act sets 2030 targets to mine 10%, process 40% and recycle 25% of the EU’s needs, while capping reliance on any single foreign supplier at 65%. Across the Atlantic, the US Department of Energy (DOE) has earmarked nearly USD 1 billion in grants and loans to kick-start domestic mining, refining and recycling for copper, rare-earths and allied metals. Such programs are more than climate policy; they anchor high-wage industrial jobs, regional growth and self-reliance in countries which are presently mineral-importing.

8. REE-cycling momentum is ramping up

Projections of primary mineral mining from ore show supply is not expected to fill future demand, prompting governments to search for supplementary sources including waste. US DOE-backed pilot projects now recover rare-earth elements (REE) from coal ash, mine tailings and end-of-life magnets, delivering up to 95%-pure outputs.12 Commercial ‘REE’- cycling efforts are also ramping up. Apple and MP Materials recently announced a USD 500 million partnership to build magnets from industrial scrap and magnets at the end of life.13

Across the pond, the race is on to perfect and scale rare-earth recycling and production. Companies across the UK, Norway, Germany and Sweden are rushing to extract rare earths from magnets.14 UK-based LCM is building a plant in France to refine REE from recycled magnets.15 Belgian-French firm, Solvay, is expanding its rare-earth plant in La Rochelle, aligning with France’s ambition to be a Euro-hub for REE. To earn that title, it will have to compete with other EU members such as Estonia, where Neo Performance Materials recently opened the EU’s largest rare-earth magnets factory.

Conclusion

Accelerating electrification, AI computing, data-center build-outs, and defense spending are converging with constrained supply chains and policy tailwinds to create a decades-long investment cycle for the critical minerals value chain. Demand-supply gaps as well as price-spiking policy tensions will likely remain fixtures of markets and politics for years to come, making the critical minerals space an attractive opportunity for investors.

Important note: The companies referenced are for illustrative purposes only. The companies are not necessarily held by the Robeco Smart Materials strategy. This is not a buy, sell or hold recommendation, nor should any inference be made on the future development of these companies.

Footnotes

1‘Harnessing the potential of critical minerals for sustainable development.’ UN Dept of Economic & Social Affairs, IEA data, January 2025.

2Adamas Intelligence, an independent research and consultant specializing in rare earth and critical minerals markets. Nd-Fe-magnets are used for high-performance actuators in robotic joints.

3BNEF estimates, ‘AI data centers to worsen copper shortage’. Mining.com. August 2025.

4Global Critical Minerals Outlook, IEA, 2025.

5‘Developing rare-earth processing hubs: An analytical approach.’ Center for Strategic and International Studies, June 2025.

6‘China’s rare earth exports fall sharply in September.’ Reuters, October 2025.

7‘Pentagon looking to buy USD 1 billion in critical minerals.’ FT, Bloomberg, October 2025.

8Brussels to stockpile critical minerals because of war risk. Financial Times. July 2025.

9Australia consults on critical minerals stockpile ahead of Albanese-Trump meeting. Reuters. October 2025.

10‘Six military uses of rare earth elements in defense technologies.’ Rare Earth Exchanges, October 2025.

11‘Developing rare-earth processing hubs: An analytical approach.’ Center for Strategic and International Studies, June 2025.

12‘Recovery of rare-earth elements and critical materials from coal and coal byproducts.’ US Dept of Energy. May 2022.

13‘Apple expands US supply chain with USD 500 million commitment to American rare-earth magnets.’ Apple Newsroom. July 2025. In July, the US government invested USD 400 million in a 15% equity stake in MP Materials .

14‘Belfast magnet recycling start-up offers rare earth promise.’ March 2025.

15‘UK rare earths company to build plant in France.’ Reuters. May 2025.