Robeco is committed to promoting DE&I among its employees, clients and other stakeholders, as we consider this a core and crucial value of our business strategy, our operations, our recruitment process and corporate culture.

This video isn't available to you because you have not accepted our advertising cookies yet. If you accept them, then you'll be able to view all content:

Why this topic matters to us

Our employees are our most valuable assets. Having Diversity, Equity and Inclusion (DE&I) embedded as core values in our organization is critical to our strength as an asset manager and our ability to deliver quality returns for our clients. Being a diverse, equitable and inclusive workplace is in line with our commitment to the Sustainable Development Goals and to building a more sustainable future for our employees, clients and society.

As a global organization, we serve a diverse client base across multiple regions. To better understand our clients, we strive to have an organization that is just as diverse as our clients are. Our continued SI leadership is dependent on our ability to further promote these core values within Robeco. Our DE&I values are consistent with our philosophy of carefully considering all perspectives in our research, fully using our valuable resources to meet challenges, and remaining flexible, creative and innovative.

At every level of our organization

We believe DE&I policies need to be led from the top down. Therefore, these core values are determined by our leaders, affirmed by our managers, enhanced by our employees, and guided by our DE&I Board. Managers at all levels are held accountable for fostering a culture of diversity, equity and inclusiveness, and for accelerating the pace of change.

Robeco’s DE&I Board is responsible for developing and evolving our overall strategy and policy for DE&I, working with colleagues worldwide to establish and balance appropriate priorities, and to facilitate the various DE&I initiatives around Robeco. This includes our four Employee Resource Groups. Furthermore, this Board operates on the principle of acknowledging and tackling DE&I issues head-on. It aims to drive employee programs to empower inclusive talent and promote a sense of belonging and work-life balance.

In action: Our journey

While Robeco works hard to achieve its ambitions, we acknowledge that there is still work to be done to build a more diverse, equitable and inclusive organization. We know that the work goes beyond ticking boxes on a corporate checklist. This is a journey: one which requires ongoing learning, unlearning, evaluation and accountability. We are confident that each policy, process and program we implement in this regard brings us closer to our goals.

We strive for broad diversity in multiple ways, but we only set specific global diversity targets if we have the necessary data. Currently we have diversity data available based on gender, age and primary nationality. For gender we have established targets; targets based on other diversity characteristics may follow at a later point in time.

Where do we stand?

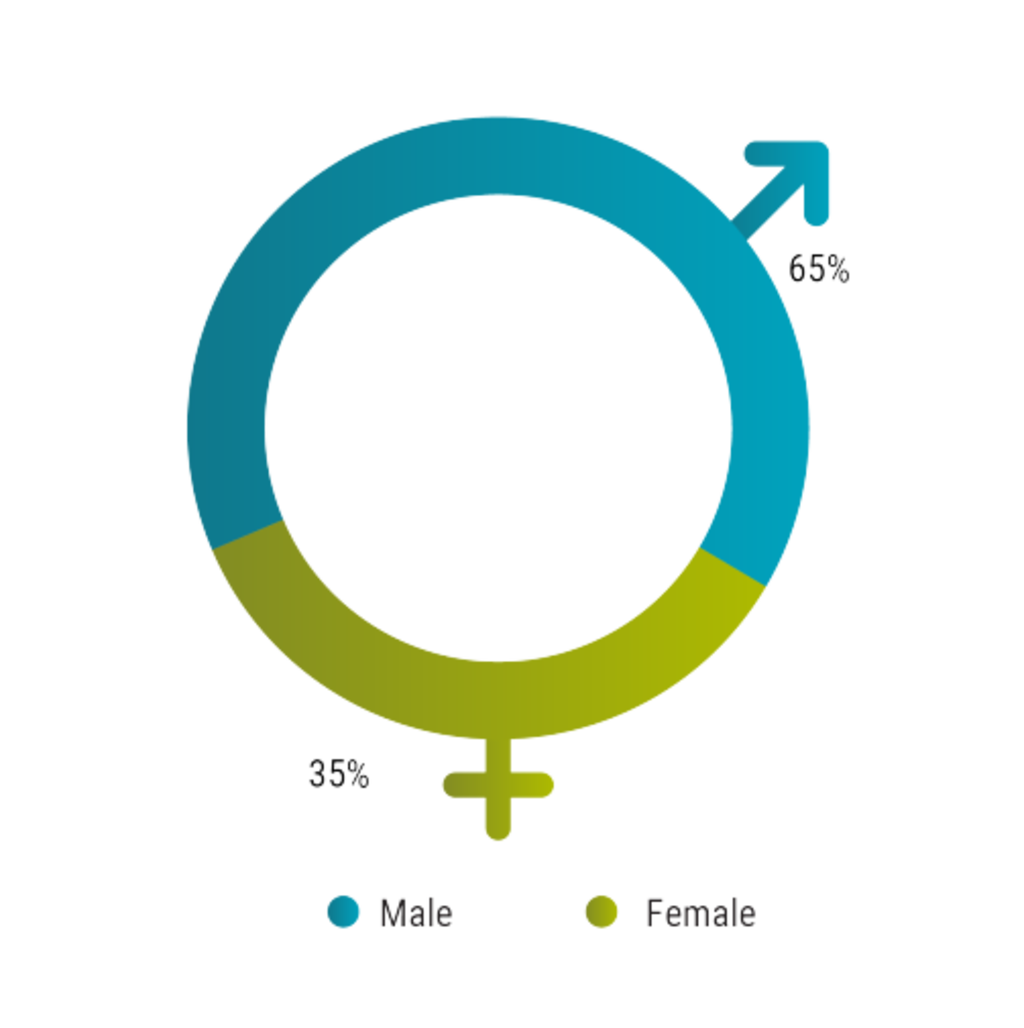

Global workforce composition

Source: Robeco, 2024

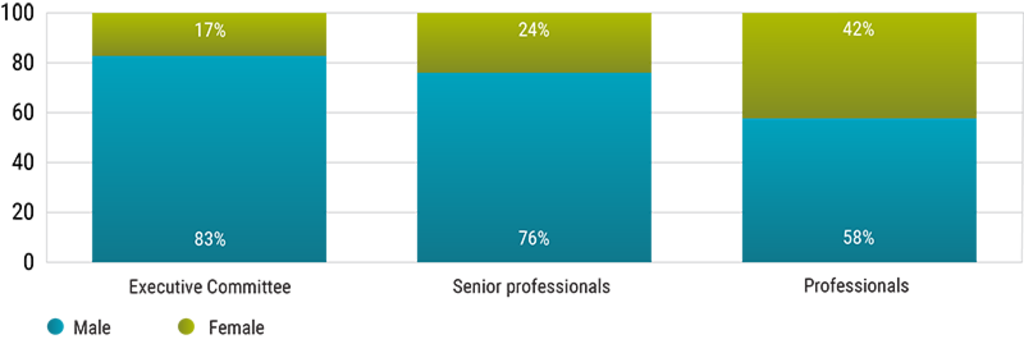

Ratio male/female per level in the organization

Source: Robeco, 2024

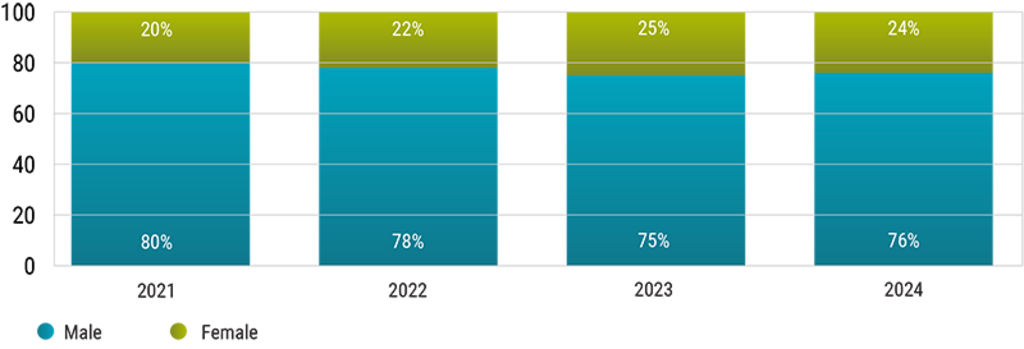

Development ratio male/female senior professionals

Source: Robeco, 2024

Overall ambition

Our long-term ambition is to have a 50% gender balance in Robeco to reflect the diversity of the world in which we work. We strive for gender pay equity at all levels in the organization and monitor our progress.

We know that our gender balance decreases toward the top. Improving this is currently one of our main priorities, alongside the increase in representation and advancement of underrepresented minorities.

Another focus point is increasing inclusion throughout the company and providing a secure base for all colleagues.

Targets

We realize that we need to set clear, ambitious targets supported by actions to ensure we move in the right direction and achieve our long-term ambition. Global targets are the beacons that guide us to our overall ambition. We therefore set the following gender diversity targets:

Executive Committee: 30% gender diversity

Senior professional and managerial level: 30% gender diversity

Professional level: 50% gender diversity

A core part of our investment strategies

A range of credits and equities strategies target the UN Sustainable Development Goals, two of which strive to reduce inequality. These are SDG 5 (Gender equality) and SDG 10 (Reducing inequalities), in addition to the more general SDG 4 (Quality education) and SDG 8 (Decent work and economic growth) which aim to educate, train and empower women and girls.

More generally, sustainable investing means integrating environmental, social and governance (ESG) principles into the investment process. Diversity forms part of the social element, particularly where it pertains to human labor and governance regarding female empowerment at investee companies.

Active ownership

Robeco has used voting and engagement to seek ESG improvements in companies since 2005. New engagement themes are launched every year, each one with a specific focus. Robeco believes that a large impact can be made on advancing diversity by actively engaging investee companies on this topic, and by using our voting power.

Robeco regularly encourages investee companies to improve their practices related to ESG issues. In the Stewardship Approach and Guidelines, more information can be found on what we expect from investee companies, and how we perform proxy voting and engagement to drive progress on diversity.

Ultimately, we believe that companies whose employees are happy and healthy achieve stronger operational and financial performance in the long term. Throughout our engagement efforts focused on social topics, we encourage companies to develop a human capital management policy which should cover how they attract and retain talent, provide training and courses, and establish workforce diversity.