Quant chart: how NLP can anticipate GICS changes

The recent changes to the global industry classification standards (GICS) illustrate their rigid and sluggish nature. This article argues that natural language processing (NLP) techniques can offer additional insights in today’s fast-changing market environment.

The GICS is the classic framework to classify similar firms into sectors, industry groups, industries and sub-industries. But the GICS methodology is rigid. Revisions are infrequent and take years to implement, as they involve extensive consultations with market participants. As a result, alternative methods of classification have been suggested based on customer-supplier data, textual similarities in companies’ 10-K business descriptions, comparable technologies based on patent data or shared analyst coverage.

One of the major changes in the recent GICS revision is the creation of the new sub-industry transaction and payment processing services under the financials sector. This new sub-industry will include companies such as Visa, Mastercard and Paypal, which were previously included in the data processing & outsourced services sub-industry, under the software & services industry group and the information technology sector.

The change reflects both the increasing role these companies play in facilitating payments across various platforms and markets, and the fact that these activities are closely aligned with the business activities covered under the financial services industry group. However, this change only took effect on 17 March 2023, two years after the first consultation on the subject started.1

Text-based stock clustering (TBSC) is an interesting alternative to GICS. It uses NLP techniques to analyze textual data from various sources, such as 10-K reports. TBSC has several advantages over GICS:

TBSC can be more adaptive and flexible because it can update its classifications more frequently based on new information.

TBSC can be more granular and accurate because it can capture the similarities and differences among companies within or across sectors based on their specific products or services.

TBSC can be more informative and insightful because it provides explanations for its classifications based on textual evidence.

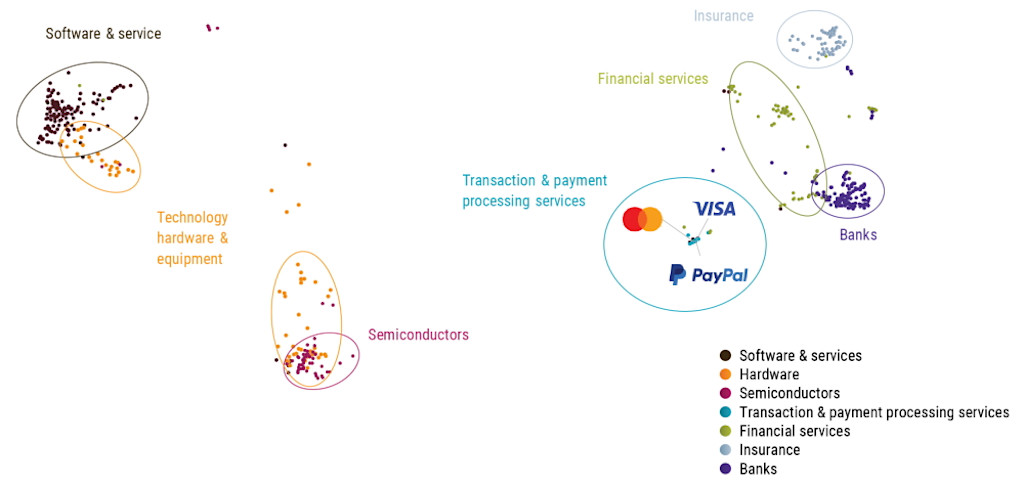

To illustrate these advantages, Figure 1 shows a 2D projection of company-specific vector embeddings derived from 10-K filings using the bidirectional encoder representations from transformers (BERT) model. We use 10-K reports for the fiscal year 2021 as input for the model to test whether the NLP technique could already anticipate the current GICS revisions.

The results show that the transaction and payment processing services companies – such as Visa, Mastercard and Paypal (light blue) – are indeed closer to their new industry group financial services (green) than their previous industry group software and services (brown). This finding suggests that TBSC can anticipate changes in GICS before they are officially implemented. However, we also find that the financial services industry group is rather heterogeneous compared to other industry groups such as banks, insurance, or semiconductors & semiconductor equipment.

Figure 1 | 2D projection of word embeddings based on 10-K filings for the fiscal year 2021.

Source: SEC, Refinitiv, Robeco. The figure shows a 2D projection of numerical embeddings derived from BERT based on firms’ 10-K filings for the fiscal year 2021. The analysis is restricted to MSCI USA Index constituents augmented with large and liquid constituents of the FTSE World Developed and S&P Broad Market Index. The different colors indicate different GICS industry groups within the Information Technology (Software & Services, Technology Hardware & Equipment, and Semiconductors & Semiconductor Equipment) and Financials (Banks, Financial Services, and Insurance) sectors. Furthermore, the stocks from the newly created Transaction and Payment Processing Services sub-industry under the Financial Services industry group are highlighted. Previously, these stocks were included in the Software & Services industry group.

In conclusion, TBSC might be a better and more timely alternative to standard sector or industry classifications, such as GICS. By using NLP techniques to analyze textual data from various sources, TBSC can provide more adaptive, granular, accurate, informative and insightful classifications for stock analysis.

Footnote

1 For example, the consultation of potential changes already started in 2021, were announced in March 2022, but only become effective in March 2023.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.