China: navigating the push towards technology leadership

After more than three decades of accelerated catchup with more advanced economies, China is now engaged in a race for global technology leadership. Having turned into ‘the world’s factory’, China now aspires to become the planet’s innovation barycenter too.

概要

- China is engaged in a race for global technology leadership

- The country has already secured a leading position in many areas

- We identify three major investment themes

Research and development (R&D) statistics illustrate this ambition. Supported by higher economic growth, China is actually expected to take global R&D leadership this year, and outspend the US for the very first time.1 China now leads the pack in many areas, such as artificial intelligence (AI), 5G telecommunication networks, ultra-high voltage electricity networks or high-speed rail.

While China’s technology push is hardly news, rising tensions with the West, in particular with the US, have put it under the spotlight. Over the past few years, Chinese officials have increased their emphasis on the need to become less dependent on foreign technology. Some have even theorized a so-called ‘technology decoupling’, advocating self-sufficiency in a number of critical industries.

While China’s technology push is hardly news, rising tensions with the West, in particular with the US, have put it under the spotlight

However, one key consideration to bear in mind is that China’s technology push amid rising tensions with the US does not necessarily herald a full economic decoupling, nor an era of deglobalization, as some have argued.2For now, US restrictions on exports to China issued in 2020 remain essentially focused on a few select technologies, where non-US alternatives are difficult to find.

Meanwhile, China's main policy goal remains to improve the country’s manufacturing capability to produce higher value-added goods and services, and keep the economic growth engine roaring. Policy makers acknowledge that this will be impossible without importing advanced technologies from the US, Europe, Japan, or South Korea.

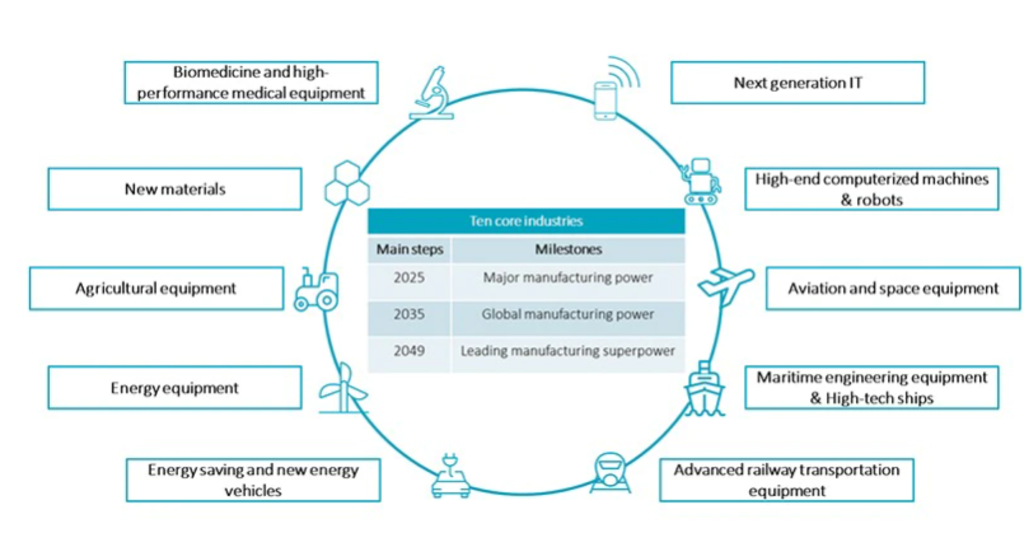

Figure 1: MIC 2025’s ten strategic industries

Source: China State Council, MERICS, Robeco, September 2021.

China’s technology ambitions were formally articulated in 2015 with the ‘Made in China 2025’ (MIC 2025) initiative, a ten-year comprehensive blueprint aiming to modernize further the country’s industrial base. MIC 2025 identifies ten strategic sectors, including aerospace equipment, medical devices, or high-tech ships, in which China intends to excel and secure a leading position.

Even under the MIC 2025 umbrella, the designated ten core industries are clearly not all being pursued with the same intensity. In recent years, China has been prioritizing efforts in a small number of emerging technologies, including AI, semiconductors, robotics, and new energy vehicles (NEVs),3 with colossal efforts being deployed from a human and a financial perspective.

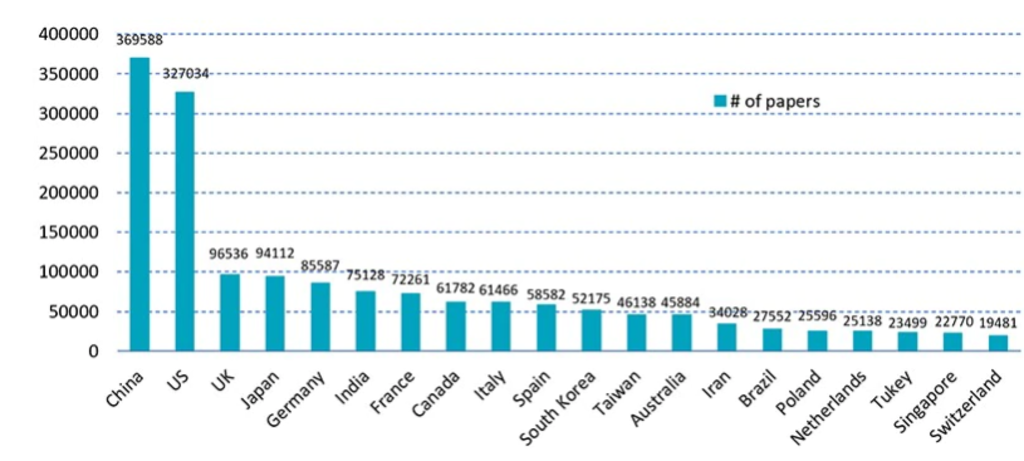

Figure 2: Top 20 countries in AI paper output 1997-2017

Source: China Institute for Science and Technology Policy, July 2018, “China AI Development Report 2018”, Tsinghua University.

AI is perhaps the area in which China has achieved the most spectacular results and secured a clear leading position at global level

AI, for instance, is perhaps the area in which China has achieved the most spectacular results and secured a clear leading position at global level.4 The Chinese AI-related ecosystem benefits from various supporting factors, including the country’s gigantic market size which provided a unique opportunity to assemble large datasets, and a long-standing friendly policy environment.

China seems therefore poised to become a leader in AI-empowered businesses, like speech and image recognition applications. At global level, the main AI services providers remain large US technology giants, but Chinese firms are catching up fast. China already employs the world’s largest cohort, by far, of AI professionals, with over 12,000 AI jobs in 2019, versus roughly 7,500 for the US.5

Another area where strong progress has been made NEVs. China has the world’s largest fleet of NEVs in circulation, far ahead of Europe and the US, as well as the world’s largest battery-charging network. And although the country’s NEV car registrations were overtaken by European ones last year, it remains one of the most dynamic markets, largely dominated by local manufacturers.

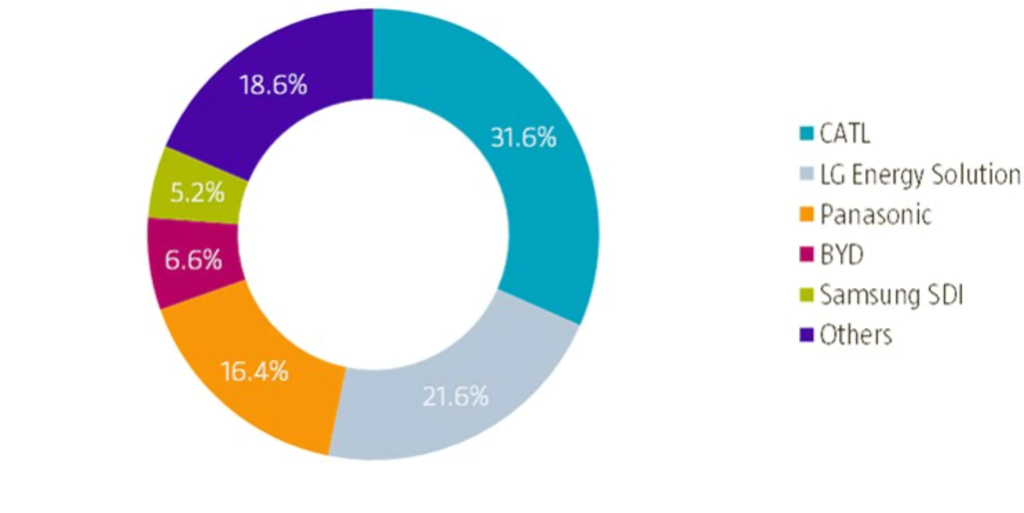

Figure 3: Market share of top five battery makers

Source: SNE Research, March 2021.

了解最新的可持續性市場觀點

訂閱我們的電子報,探索塑造可持續投資的趨勢。

China has also managed to secure a leading position in various areas of the NEV supply chain. This is especially the case for electric battery production, where the largest Chinese manufacturers have emerged as global leaders along with their South Korean and Japanese competitors. Altogether, China accounts for over 70% of global battery cell production capacity.6

Three investment themes

China’s technology push is offering opportunities in many industries, but finding these is not always straightforward. Not all initiatives have lived up to expectations, so far, and political will does not warrant success. Yet that does not mean opportunities in areas where results have been mixed are entirely absent, nor that policy success will necessarily lead to attractive returns for investors.

From this perspective, we have identified three major investment themes worth considering: the relentless rise of NEVs, the advent of ‘industry 4.0’ in China, and an increased focus on the localization of supply chains. Given the bright prospects these three trends offer, we believe this is where some of the most interesting opportunities are to be found.

Footnotes

1Source: R&D World, April 2021.

2 Hale, T., 27 July 2021, “US and China face bumpy ride as talk of decoupling intensifies”, Financial Times news article.

3NEVs are vehicles which are not fueled by common energy sources, such as unleaded petrol or diesel fuel, for example. These include in particular, plug-in electric vehicles, either plug-in hybrid electric ones or an all-electric plug-in battery electric ones.

4Li, D., Tong, T. W., and Xiao, Y., 18 February 2021, “Is China Emerging as the Global Leader in AI?”, Harvard Business Review article.

5United Nations Conference on Trade and Development (UNCTAD), February 2021 “Technology and innovation report 2021 – Catching technology waves: Innovation with equity”, UN Report.

6International Energy Agency , April 2020, “Global EV Outlook 2021”, report.

下載刊物

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.