サステナビリティに関する最新のインサイトを把握

ロベコのニュースレター(英文)に登録し、サステナブル投資の最新動向を探求しましょう。

Investors are expanding their focus to solutions that can adapt to climate change rather than just trying to mitigate it, the Robeco Global Climate Investing Survey 2025 shows.

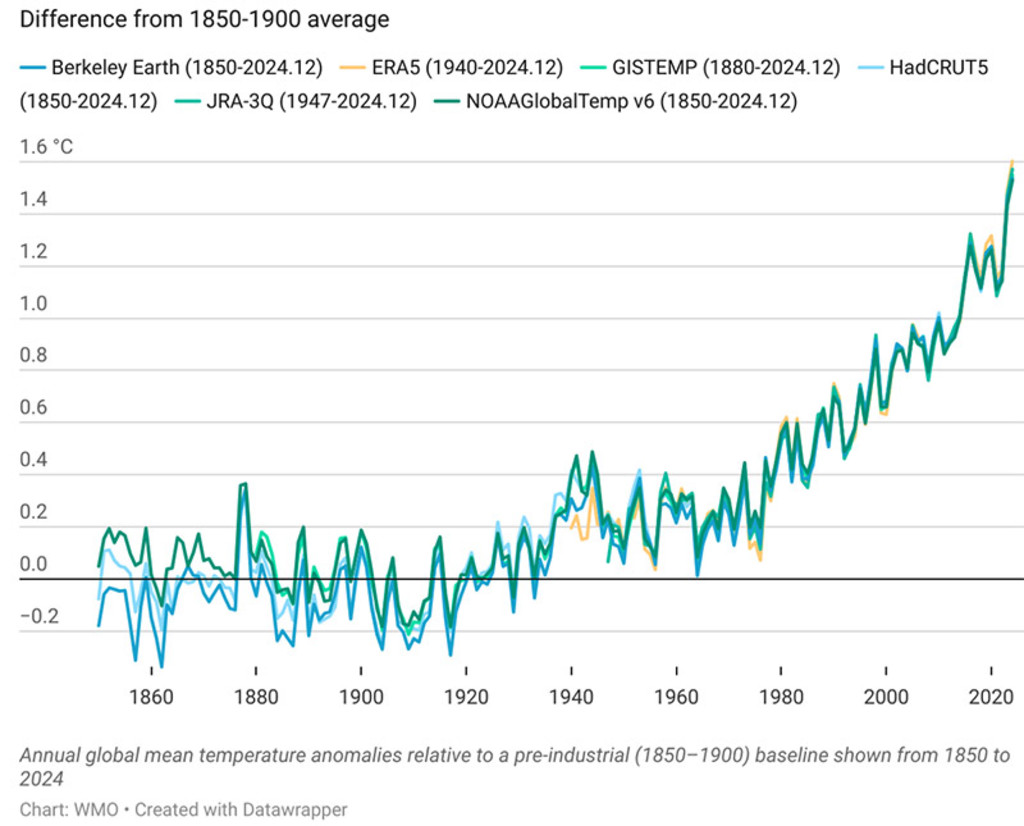

It signals that investors are now preparing to adapt to the consequences of global warming that may be irreversible, alongside trying to stop it getting any worse. A new temperature record of 1.55 °C ± 0.13 °C above 1850’s levels was set in 2024, according to the World Meteorological Organization. Underlying global warming, which is measured over decades, is thought to be about 1.3 °C. 1

Source: WMO

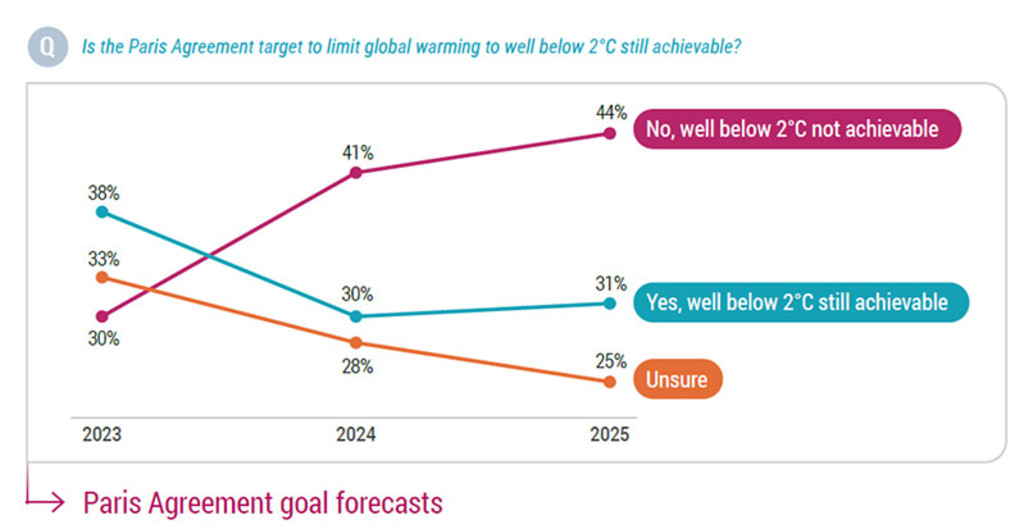

As emissions continue to rise, and as disillusionment grows with governments’ commitment to net- zero initiatives, the fifth annual Robeco Global Climate Investing survey showed a growing proportion of investors think the Paris Agreement is no longer achievable. The Paris Agreement signed in 2015 seeks to limit global warming to 2 °C above pre-industrial levels by 2100, and ideally to contain it to 1.5 °C.

The number of investors who believe that 2 °C is not achievable rose to 44%, up from 41% last year and from 30% in 2023, while those thinking it can still be done rose slightly to 31% from 30%. A quarter of all investors remain unsure.

Source: Robeco Global Climate Investing Survey 2025

ロベコのニュースレター(英文)に登録し、サステナブル投資の最新動向を探求しましょう。

Meanwhile, only 16% of investors think an orderly transition toward net zero is the most likely outcome in the next decade, while almost half (49%) expect it to be ‘too little, too late’. Some 11% now expect to see a ‘hot house world’ outcome, with very little action taken to meet climate goals and avert physical risks, slightly up from 8% last year.

Is it therefore time to recognize that it would be beneficial to invest in measures that can deal with the consequences of climate change, alongside the existing solutions for mitigating it? Almost half of all investors believe that it is.

Some 49% said climate adaptation will become an increasingly attractive growth theme for equity investments over the next three to five years, rising to 62% for European investors. One-third said they are actively seeking to increase exposure to companies providing these kinds of solutions.

Climate adaptation methods range from rebuilding sea defenses and making air purification equipment and refrigerants, to new drugs that combat the spread of known and emerging diseases that warming temperatures and extreme weather events may exacerbate.2 Climate mitigation investment is mainly focused on decarbonization solutions, led by renewable energy and electrification.

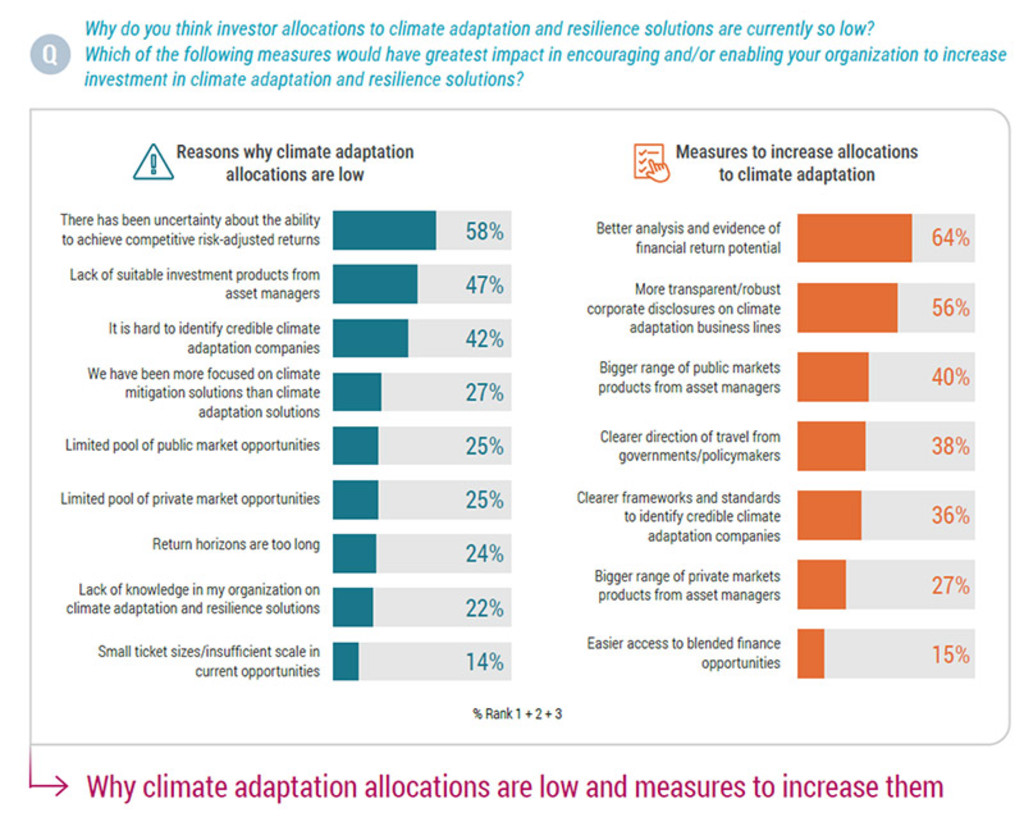

But there remain headwinds, as 58% said there was uncertainty about whether adaptation solutions would generate competitive returns, while almost half blamed a lack of suitable investment products from asset managers (47%), or that it was hard to identify credible climate adaptation companies (42%).

Source: Robeco Global Climate Investing Survey 2025

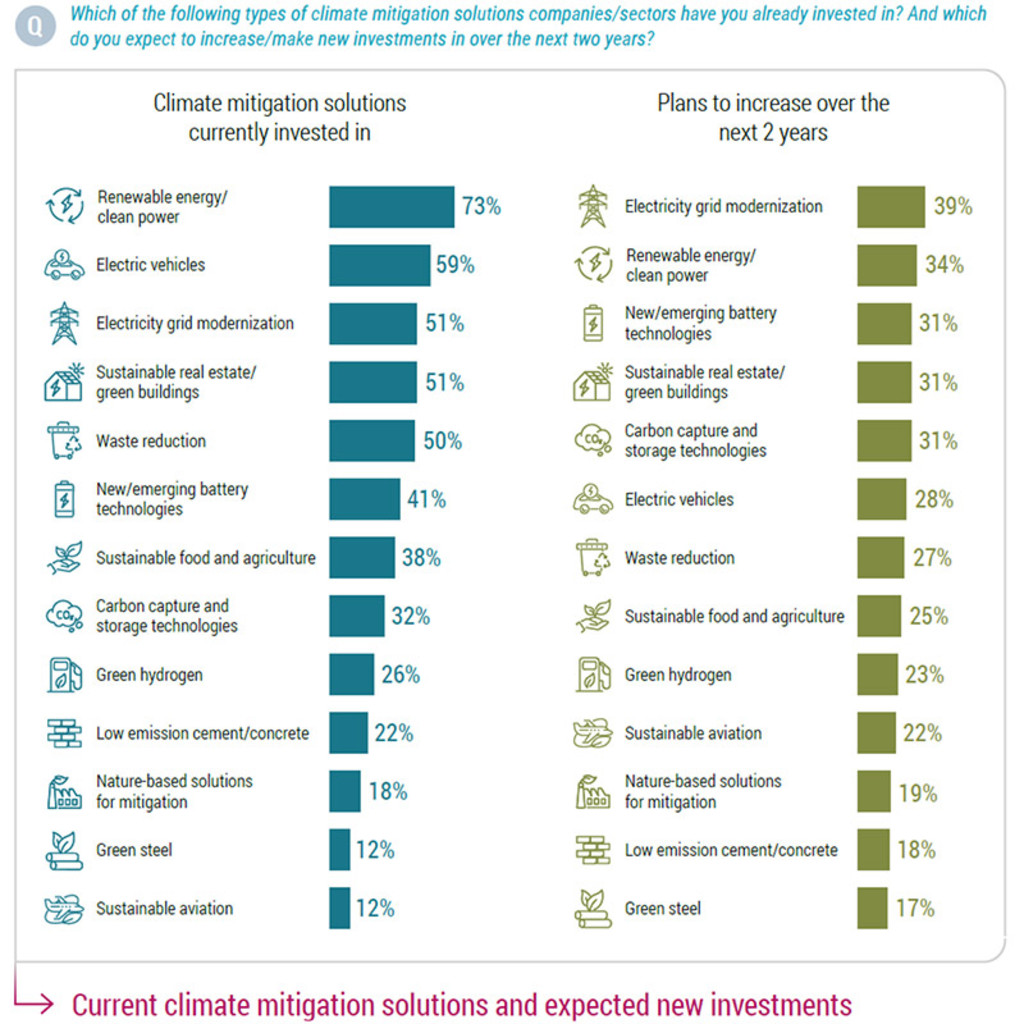

In contrast, climate mitigation solutions are already well established, with proven returns from electric vehicles and renewable energy infrastructure such as wind turbines, solar panels and hydro-electric dams. Nascent technologies such as battery power and carbon capture and storage are rapidly showing they can provide revenue streams as well.

The pursuit of such returns in climate mitigation is a strong motivator for 77% of global investors, and this is even higher among North American investors (86%). Other motivating factors include achieving a real-world impact in tackling climate change (43%) and mitigating climate risk in portfolios (42%). Subsequently, over a quarter (27%) said they have been more focused on climate mitigation solutions than on adaptation.

Almost one-third (31%) expect to increase tech investments in new/emerging batteries, carbon capture and storage in the next two years, among other types of climate mitigation solutions such as waste reduction (27%), low-emission cement (18%) and green steel (17%). The latter two involve increasing use of electric-arc furnaces rather than coal-powered blast furnaces.

Priorities over the next two years show that electricity grid modernation is the most favored investment (39%), followed by renewable energy (34%), with lower interest in battery technology (31%) and electic vehicles (28%). Interest in currently nascent technologies like low-emission concrete (18%) and green steel (17%) remain fairly low over the two-year horizon.

“Investors are already active in established areas such as renewable energy and clean power, electric vehicles and electricity grid modernization,” says Lucian Peppelenbos, Climate and Biodiversity strategist at Robeco. “The next stage of the transition is about scaling investments in climate adaptation and the next-generation mitigation solutions such as hydrogen and low-carbon steel and cement.”

“Investors are on the lookout for these opportunities, but are cautious given the policy uncertainties. These type of investments require clear and consistent long-term policy frameworks. Rolling back the Green Deal or the US Inflation Reduction Act (IRA) does not help in that respect.”

In terms of how to invest in climate mitigation solutions, 44% of global investors said they used public market funds, 30% preferred private market funds, and 20% were making direct investments in nascent climate technology.

Robeco manages a range of investment strategies focused mainly on climate mitigation, smart energy solutions, and the pathways to net zero. All of our capabilities can be seen here:

Striving to keep the global temperature rise well below 2°C

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会

重要なお知らせ 当社や当社役職員を装ったSNSアカウントやウェブサイト等を使った投資勧誘にご注意ください さらに表示