Crisis rhymes but no repeat: equity markets left finely balanced

As volatility increases after the inflation fight destabilizes the banking sector, we continue to recommend exposure to a diversified portfolio of quality stocks and an increased allocation to emerging markets.

まとめ

- Echoes of 2008 but the policymaker and regulator response is faster and more decisive

- Quality remains the focus, enabling us to stay invested and capture upside when it comes

- Emerging markets to outperform as dollar weakens and China recovery gathers pace

The 22 March 2023 decision by the Federal Reserve to raise its policy rate only 25 bps sets the scene for a much-anticipated rate hike pause later in the year. After three weeks of US banking sector stumbles the Fed’s room to hike is now limited and Fed chairman Powell’s relatively dovish post-meeting comments reflect that. We don’t believe this is a repeat of the crisis of 2008, with policymakers acting much faster to address stability issues, but volatility is here to stay as the global economy continues to adjust to a higher inflation, higher interest rate environment.

Within this environment we believe there are excellent opportunities for long-term equity investors but that doesn’t include just buying and holding the index. The strange juxtaposition of headlines about US authorities considering how to insure all US bank deposits1, with ‘Biggest Fear for Trillion-Dollar Funds Is Missing Next Rally’2 shows that this is an uncertain and potentially treacherous time where active strategies will prevail over passive.

Recent data points from around the world show inflation still isn’t dampening down enough to allow policymakers to turn decisively dovish. Inflation data has surprised on the upside recently, notably in the UK, Switzerland and Singapore, while in Europe the ECB remains hawkish3 with eurozone CPI inflation sticky around 8.5%. The trend in the US is more helpful with producer prices falling 0.1% month on month in February, helping firm projections that a peak policy rate level is in sight. In addition, in conjunction with other central banks the Fed has eased dollar liquidity considerably4 to take pressure off the banking sector, partially reversing its quantitative tightening program. These indications and actions are now supporting equity markets.

Increasing dollar liquidity will only work if it more than offsets the tightening of financial conditions caused by bouts of deposit flight, and reduced inter-bank trust. Stress in the commercial real estate market5 is also likely to complicate efforts to move beyond the current scrutiny of US banks. As a result, based on the experience of 2008, the Fed is likely to remain generous in its liquidity provision until sentiment is normalized. In addition, if the problem at mid-size banks is due to concentrated long treasuries exposure as at SVB, then declining yields will help solve that. Either way, a more accomodative monetary environment is likely to manifest itself through the year to try and stop credit being squeezed which will offer some support for equities, even if the economy slows.

Developed market economic data belie recession fears

Macro indicators are still proving resilient in developed markets despite the difficult environment and ongoing pessimism from some analysts. That Europe survived the winter without energy-related disruption has helped, and kept Germany in positive growth, while eurozone PMI surprised on the upside in March coming in at 54.1. In the US retail sales weakened in February after strong data in December and January, and weekly unemployment claims are still showing the labor market is relatively tight. Japan is also set up for growth in 2023 with recent inflation data encouraging the belief that the BoJ will finally exit its zero interest rate policy.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

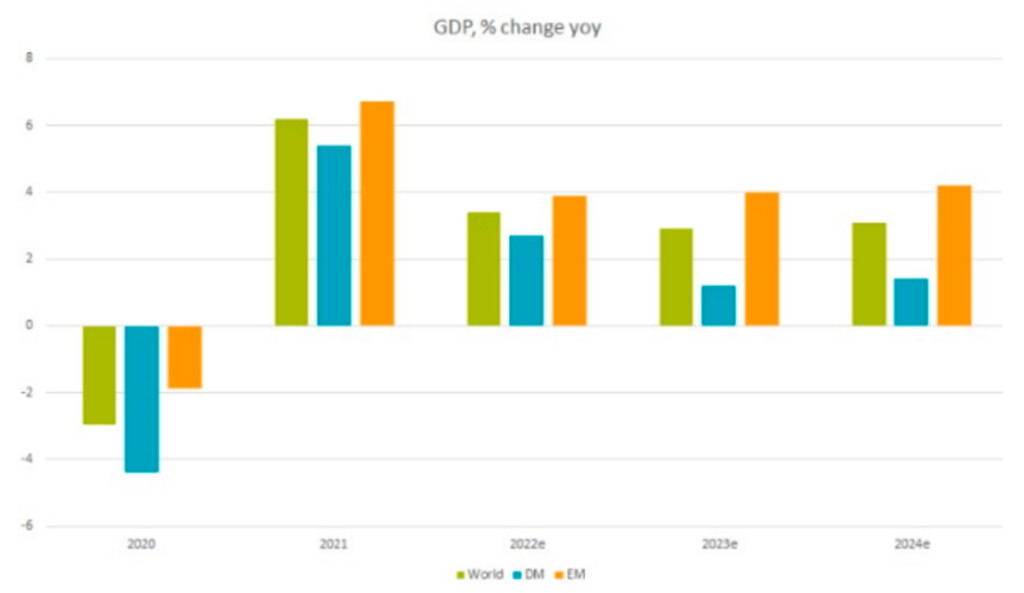

Nevertheless, emerging markets remain much better placed than developed markets

Despite a rather tepid market reaction to China’s conservative GDP growth forecast of 5%, data is moving in the right direction with consumption and fixed asset investment both looking good in January and February. Add a weakening US dollar and the ingredients for EM outperformance are in place. The banking crisis manifesting in the US and Switzerland has seen Chinese equities, led by the financial sector, rally, supporting this thesis. The more general macroeconomic positive for EM is that inflation just hasn’t embedded itself in the same way as in the developed world. Some of the largest emerging economies like Brazil and India are at a different stage in the credit cycle, and are benefiting from some one-off deflationary anchors, including cheap Russian oil in India’s case. All this will add up to faster growth for EM compared to DM.

Figure 1 – GDP expectations in EM are much more positive

Source: IMF, January 2023

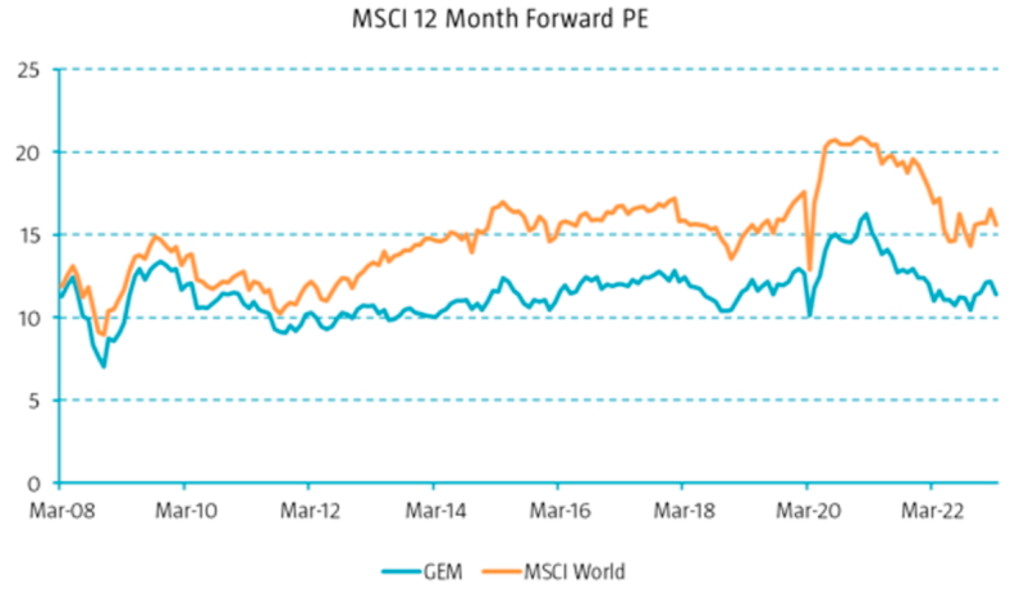

In addition, valuation metrics hit extremes in 2022 with EM trading at a 30% discount to DM. This gap has narrowed slightly but remains unjustified in our view.

Figure 2: Valuation gap DM vs EM

Source: IBES, Robeco, March 2023

Quality focus will capture upside when it comes

Economic data is resilient and monetary policy will turn supportive, but there is still a coalesence of different risks to equities, including still high inflation, ongoing recession fears, banking troubles, and signs of stress in the commercial real estate market. Quality names have outperformed in early 2023 after lagging in 2022, and we believe focusing on quality in an equity portfolio is the best way to navigate this turbulence.

By quality, Robeco means a high return on invested capital (ROIC) with clear reinvestment opportunities, high free cash flow generation and a discount to intrinsic value. Screening for companies that offer a macro shield in downturns, but will also capture upside when it comes, enables us to stay invested.

Footnotes

Download the publication / レポートのダウンロード

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会