Deep evidence that factor investing works well in bond markets

More than two centuries of data confirms that value, momentum and low risk offer attractive premiums. These are consistent across various market and macroeconomic scenarios.

まとめ

- We test factor premiums in government bond markets over 200+ years

- Value, momentum, low risk offer attractive and persistent premiums

- A multi-factor bonds portfolio adds value, whether yields rise or fall

Several studies show factor premiums are persistent phenomena in markets.1 Many of these studies examine equity factors; however, more recently, several research papers also show individual factors work well in credit markets and across asset classes. Despite these developments, not that much is known about factor premiums in government bond markets, where investors have been slower to adopt factor investing. This while government bonds represent about 30% of total market capitalization across asset classes.

We studied factor premiums in global government bond markets using a deep sample of 221 years of data between 1800 and 2020. Existing bond factor studies cover only the recent 20 to 30 years, which has a big potential pitfall: yields structurally declined over this period. Moreover, 20 to 30 years of data can be short in the light of the ‘p-hacking’2 concerns that plague backtesting and research. In a nutshell, our findings reveal that bond factors (value, momentum, low risk) offer attractive premiums that do not decay across samples, are persistent over time, and are consistent across various market or macroeconomic scenarios.

A multi-factor bonds strategy that combines value, momentum and low risk provides the strongest risk-adjusted returns and has a stable performance over time. This performance is strong regardless of being in ‘good’ or ‘bad’ states as characterized by expansions and recessions, non-crises or crises, positive or negative equity returns, or low or high inflation. Further, the factor premiums diversify to each other, as well as to bond or equity market risks, and consistently add value over traditional bond portfolios. Overall, a multi-factor bonds portfolio is interesting for bond investors, as it robustly adds value over a passive government bond portfolio.

To date, relatively few studies have examined government bond factor premiums. These studies typically research government bond factors over a limited sample, focus on one particular factor, or only consider a long-short perspective. For example, they generally cover the 30-year period 1982-2012. However, this sample has been a rather unique period in history, with few major episodes of bond market crises, economic recessions and inflationary episodes. Since 1980, yield levels in most markets experienced a secular decline. As a result, a key question is how bond factor premiums are influenced by falling or rising yield levels, and other episodes that typically are a concern for investors. In addition, several studies argue that published factor premiums could be influenced by p-hacking, which means that published findings might reflect a type I error in testing (i.e., falsely discovering predictability) and may fail to hold out of sample. This would be a big concern, as our focus is on achieving the best performance going forward, rather than seeking results that may apply in the past only.

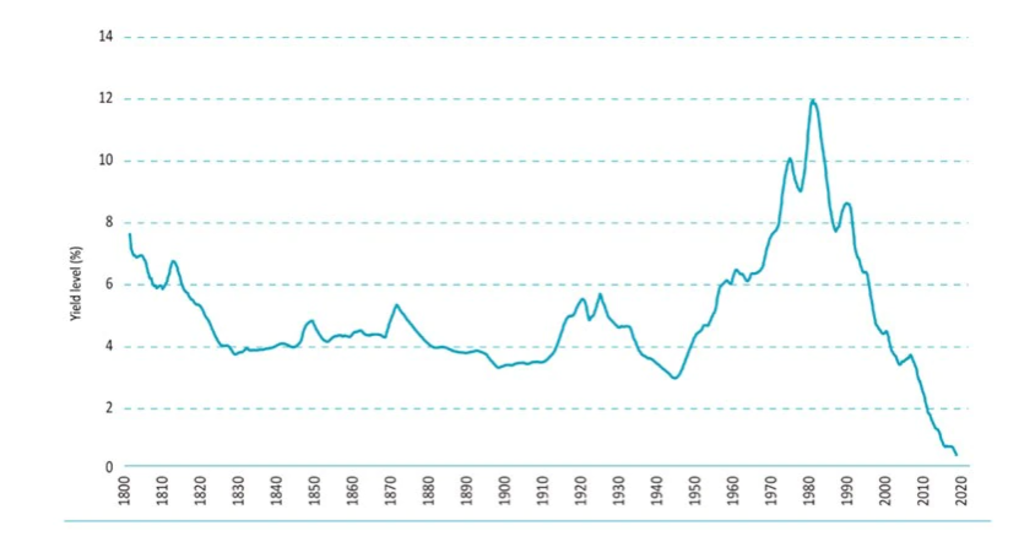

To address these concerns, we use an extensive historical sample that spans all major government bond markets from developed countries, over a 221-year period. In total, our sample has 35,784 monthly return observations, which gives us sizable testing power to examine bond factor premiums. Moreover, over our sample period, global bond yields displayed several secular rates cycles, as illustrated in Figure 1 by the development of the global average 10-year yield based on France, Germany, Japan, the UK and the US. Generally speaking, post-1980 global government bond yields displayed a secular decline across the world. Before that period, though, yields behaved differently, and also experienced times of secular rises. Our study therefore also provides a natural robustness test of the influence of secular yield trends on bond factor premiums.

Figure 1 | Average 10-year yields 1800-2020

Note: 3-year rolling average of the 10-year yields for France, Germany, Japan, the UK and the US, from January 1800 to December 2020

Source: Baltussen, Martens and Penninga, 2021.

クレジットの最新動向は?

クレジット運用の最新情報を先取りするニュースレター(英文)に登録しましょう。

Consistently attractive factor premiums, over long periods

We focus in our study on three key bond factors: value, momentum and low risk. These are applied either across developed market bonds, or within a market on the bond yield curve. The industry typically considers these to be key factors; they have been documented in previous studies, and have sufficient coverage over a substantial part of our sample period and across the markets we study.

We find that value, momentum and low risk offer attractive factor premiums. Moreover, these factor premiums are consistent over time, being positive in 72% (momentum) to 92% (value) of 10-year rolling periods. Combining the factors into a simple multi-factor portfolio gives a highly significant Sharpe ratio of 0.56 from 1800 to 2020. The premium is positive in 89% of the 10-year rolling periods. In other words, factor strategies in government bonds offer attractive returns and diversify each other.

Next, we show a multi-factor bonds portfolio gives robust performance over various macroeconomic states that typically are a concern for investors. As yields have displayed a secular decline over the past 40 years, and investors are concerned that we might be entering a period of a secular rise in yields, this insight is very important.

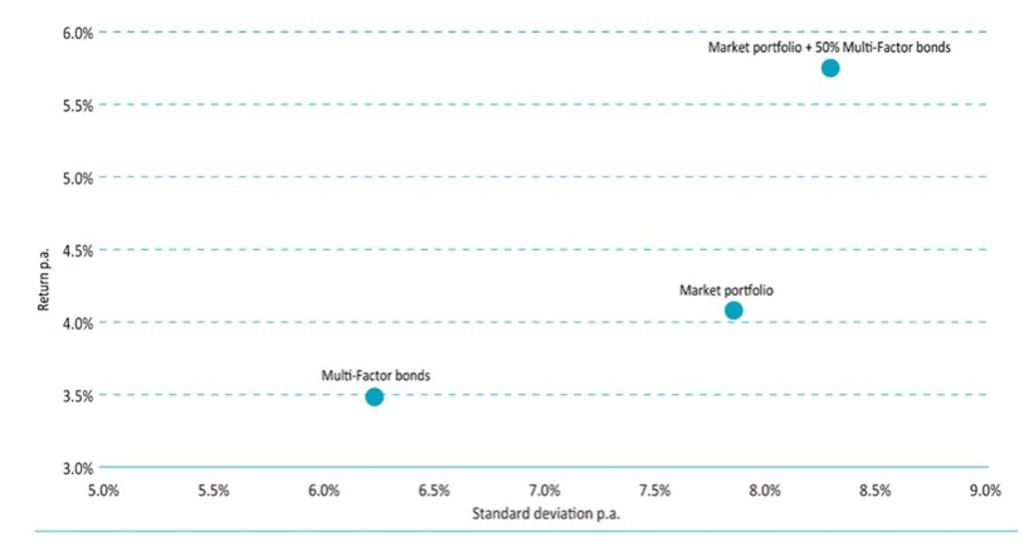

Figure 2 | Return and risk for the bond market portfolio and bond factor premiums

Note: The figure shows the average annualized returns and standard deviations for the global bond market portfolio (‘Market portfolio’), the global Multi-Factor bonds portfolio (‘Multi-Factor bonds’) – which combines the momentum, value and low-risk factors – and a combination of the bond market portfolio and 50% multi-factor bonds. The sample period is 1800-2020.

Source: Baltussen, Martens and Penninga, 2021.

For a long-only bond or multi-asset investor that considers adding bond factor premiums, we find there is strong evidence of value addition in a multi-factor bonds portfolio. Figure 2 summarizes the benefits. A multi-factor bonds portfolio has an average return of 3.48% a year, at a correlation of -0.05 with the bond market; adding a multi-factor bonds strategy to a passive global government bond portfolio increases returns substantially, with little impact on risk.

The findings show that, overall, a multi-factor bonds portfolio presents an interesting opportunity for bond investors, robustly adding value over a passive bond portfolio.

Footnotes

1This article is based on an academic paper entitled “Factor Investing in Bond Markets: Deep Sample Evidence”.

2P-hacking refers to the conscious or unconscious misuse of data analysis to find patterns in data.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会