Finding the downside risks in credit with ESG

Using financially material ESG information leads to better-informed investment decisions and benefits society. This is how we approach the analysis.

まとめ

- ESG is one of five factors in our structural issuer analysis

- This assessment is critical in managing downside credit risk

- In 24% of cases, ESG risks have material impact on our fundamental views

ESG considerations have been integral to our investment process since 2010, and are an essential part of our sustainable investing methodology in fundamental credits. Consistently integrating ESG information in our bottom-up credit analysis, and thus avoiding defaults or distressed situations, has helped us reduce downside risks in our credit portfolios. We strongly believe that using financially material ESG information leads to better-informed investment decisions and benefits society.

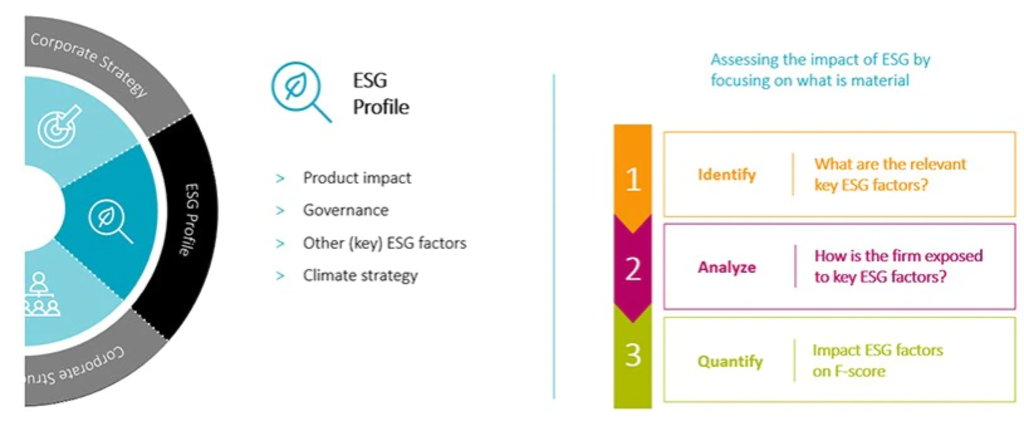

The key focus of our credit analysis is the cash-generating capacity of the issuer, the quality of cash flows, and the ability to repay debt. We assess five factors to reach a conclusion on this. This conclusion is expressed in the form of a fundamental score, referred to as an F score. The issuer’s ESG profile is one of these five factors.

For this factor, we analyze each issuer to determine how it is positioned in terms of the key ESG factors defined by our team for each industry, including climate change considerations, and how this could affect fundamental credit quality.

A four-fold evaluation of ESG risks

Our assessment of ESG factors and their implications for an issuer’s fundamental credit quality considers four elements. These are the impact of the product or service produced, to the company’s governance system, how the company is positioned in terms of the key ESG criteria that our analysts have identified for each sector and sub-sector, and its decarbonization strategy. (As a case study, see: European utilities on the cusp of a decade-long investment opportunity”).

Figure 1 | The role of ESG integration in fundamental credit analysis

Source: Robeco

Product impact: our view is that companies offering unsustainable products and services (e.g., oil, tobacco, refinery services, oil field services, manufacturers of internal combustion engine cars, coal miners) face additional risks. Demand for these products may shrink, while stricter environmental regulations may further constrain a firm’s business model and result in higher capex and R&D expenses. The issuer’s SDG score, determined by our proprietary SDG framework which draws from the UN Sustainable Development Goals, helps to inform our assessment of the product impact.

Governance: we rely on a variety of inputs to assess the quality of the governance framework. These are the S&P Corporate Sustainability Assessment scores, Glass Lewis and the Sustainalytics risk scores.

Key ESG factors: this step is aimed at determining how a firm is positioned in terms of our list of key ESG factors for each sector and sub-sector. The process starts with an analyst assessment that incorporates a range of inputs, including our research and meetings with management, the company profile reports created by our SI research team, the S&P Corporate Sustainability Assessment, Sustainalytics risk scores, and the company’s track record in conduct.

Depending on the company, other factors may be relevant, too. If a firm has been involved in a bribery scandal, for example, it would be important to examine this issue – even if bribery is not considered a key risk factor for the industry in which the issuer operates.

Climate strategy: climate change has a prominent role in our credit research process. Our analysts follow a formal process which takes into consideration the philosophy of the Taskforce for Climate-related Financial Disclosures (TCFD) on climate risks and opportunities. The below section provides further detail on how this criterion is analyzed.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

Assessing whether an issuer is climate-proof

The central question for this last criterion is to assess the extent to which a firm’s decarbonization strategy – or failure to have an appropriate one in place – may have an impact on its fundamental credit quality. This assessment comprises three steps.

Step 1: Identify: determine the exposure to climate risk and opportunities. The average Scope 3 CO2 intensity per sector is used as a starting point to assess a firm’s climate-risk exposure. A high CO2 intensity, as is the case in the automotive, metals & mining and building materials industries, would indicate that the sector is vulnerable to climate risk. Among other reasons, this could be due to the high capex commitments needed for companies to improve their emissions profile. For lower-emission sectors, such as supermarkets, for example, the climate risk is significantly lower. Our overall approach is to evaluate the exposure to climate-related transition and physical risks, as well as the opportunities.

Step 2: Analyze: what is the company’s response? We consider aspects such as a firm’s climate strategy, GHG reduction targets, capex, R&D, and how all of this is embedded in its governance framework. Important inputs can also be derived from company rankings in the various Paris-aligned pathway assessments. These assessments include those from the Science Based Target Initiatives (SBTI) and the Transition Pathway Initiative (TPI).

Step 3: Quantify: draw a conclusion about the impact on the company fundamentals, including capex, margins, asset valuations, and cash flow. Critical questions are whether the issuer’s plans are sufficient and whether it can afford the transition and related investment plans.

A similar three-step approach is used for the other ESG factors.

ESG risks have a material impact on our fundamental views in 24% of cases

In analyzing and investing in corporate bonds, the focus is tilted towards detecting downside credit risk. This makes sense as risk is asymmetrical for credit investors. A good risk management system at a bank, for instance, does not lead to a strong improvement in credit quality; a weak one, though, could lead to its total collapse. In a limited number of cases, we do find companies where ESG factors contribute positively to the fundamental view. This is often owing to the product impact criterion, such as in cases where the product is a solution for a better environment.

We scan all the company profiles created by our credit analysts and keep track of the extent to which ESG factors have a financially material impact on these profiles. Our latest data shows that ESG information has a financially material impact in about 24% of company profiles. In most of these cases, the impact is negative, in the sense that it weighs negatively on our fundamental assessment of the company.

Conclusion

ESG screening has been a fundamental aspect of our credit analysis for more than a decade, and is fully integrated in our bottom-up security analysis. We apply it to each company in which we invest – and across all our fundamental strategies, regardless of whether they have a specific sustainability focus.

Our proven methodology considers four distinct elements – product impact, governance, key ESG factors and climate – and helps shape our overall fundamental assessment of an issuer. In fact, our data shows that ESG information has a financially material impact in about a quarter of our company profiles.

The integration of ESG considerations in our fundamental analysis is critical in our management of downside risk in credit portfolios, and is important in enabling us to identify those issuers that will be part of a more sustainable future.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会