8 out of 9: Conservative Equities scores

In a decade dominated by the relentless rise of US Big Tech, defensive equities have faced tough headwinds. Yet Robeco’s Conservative Equities strategies have continued to prove their worth since inception. Our review shows that they have met performance expectations in eight out of nine major drawdowns – a strong track record of reducing risk while still delivering equity-like returns.

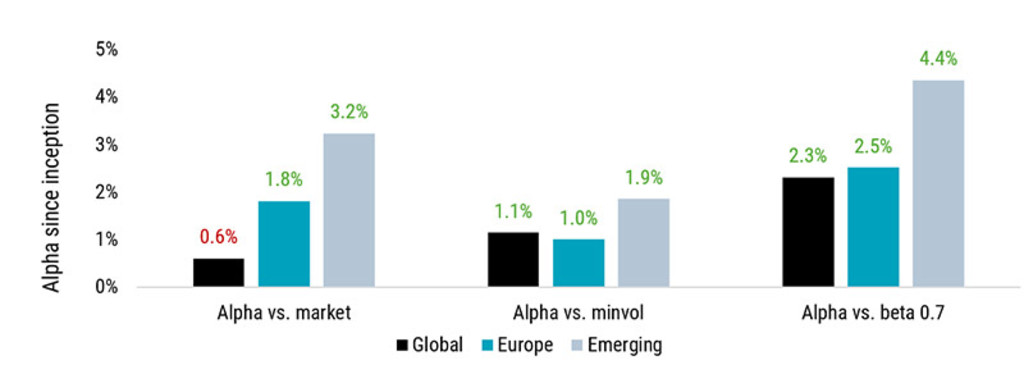

To evaluate Robeco’s Conservative Equities strategies, we review performance since inception across three major regions: global developed markets, Europe, and emerging markets. Each strategy was assessed using three metrics:

Alpha vs. the market index

Alpha vs. the minimum volatility index (minvol)

Alpha vs. the market index, adjusted for a target beta of 0.7

That makes nine scores in total. Eight of them were positive. The only exception was the developed markets strategy relative to the MSCI World Index, where 20 basis points of outperformance over 18 years is not economically significant.

Figure 1 I Global, Europe and Emerging Conservative Equities strategies’ alphas since inception

Past performance is no guarantee of future results. The value of your investments may fluctuate. Source: Robeco Performance Measurement. Index: MSCI World, MSCI Europe, MSCI Emerging Markets, and corresponding MSCI Minimum Volatility indices. Portfolio, share class and inception date: Robeco QI Institutional Developed Conservative Equities (“Global”), September 2006; Robeco QI European Conservative Equities B EUR (“Europe”) , August 2007; Robeco QI Emerging Conservative Equities I EUR (“Emerging”), February 2011. All figures in EUR. Data as of 30 April 2025. Returns gross of fees, based on gross asset value. If the currency in which the past performance is displayed differs from the currency of the country in which you reside, then you should be aware that due to exchange rate fluctuations the performance shown may increase or decrease if converted into your local currency. Performance since inception is as of the first full month. Periods shorter than one year are not annualized. Values and returns indicated here are before cost; the performance data does not take account of the commissions and costs incurred on the issue and redemption of units. These have a negative effect on the returns shown.

Reducing drawdowns, enhancing compounding

The hallmark of the Conservative Equities strategies is ‘winning by losing less.’ By focusing on downside protection, the strategies aim to smooth the investment journey. When markets dropped more than 10%, Robeco’s Global Conservative strategy reduced losses by an average of 31%, compared to the MSCI World Index. The European and Emerging strategies showed similar results.

This matters more than it might seem: for example, a -22% loss requires an asymmetrical +28% gain to break even. Reducing drawdowns enhances long-term compounding – the core of robust portfolio growth.

Over a full cycle, defensive equities should deliver equity-like returns with lower risk. Robeco targets at least 2.0% outperformance versus the market on a beta-adjusted basis. That bar was cleared in all three strategies. In fact, in emerging markets, the strategy exceeded expectations by a wide margin, thanks to stronger alpha signals and a favorable environment for low-risk stocks.

Two decades, two stories

From inception through 2014, the Conservative Equities strategies thrived in a low-return world. Our Global, European, and Emerging strategies all posted wide-margin outperformance versus both market and minvol indices. The prudent integration of valuation factors helped mitigate the risk of defensive stocks becoming too expensive as their popularity rose among investors.

But from 2015 to 2024, markets shifted dramatically. Fueled especially by the rise of Big Tech, developed markets surged. The MSCI World’s +11.7% annualized return created a tough benchmark for defensive strategies. While Robeco’s Global Conservative strategy returned a strong +9.4% annually, it fell short of the index.

Even so, the strategy still outperformed the Minvol index and maintained its downside protection. Europe and Emerging held up even better, with Emerging outperforming both the market and Minvol indices during this high-return period.

Why the lag in developed markets?

The dominance of a handful of large US tech stocks – the so-called “Magnificent Seven” – explains much of the developed market shortfall. These stocks tend to have high volatility and are often excluded or underweighted in low-risk portfolios. While some, like Apple and Microsoft, are more stable and often included in Robeco’s portfolio, others like Tesla or NVIDIA typically do not score well on low-risk or valuation metrics.

This skew in index composition created an unusually difficult environment for low-risk strategies. But that tide may now be turning.

Outlook: Favoring a defensive approach

We believe that the current outlook for low-risk stocks is quite favorable, based on three observations. The first is that the duration of current market leadership for cyclicals (including Big Tech) over defensive stocks has been unusually long: history suggests a reversal is likely – and when that comes, low-risk strategies typically shine.

The second observation is that, with US markets trading at historically high valuation multiples, the potential for a market correction has increased. Robeco’s research shows that in scenarios of multiple contraction, defensive equities strategies are likely to outperform.

Our third observation is that we see our Conservative Equities strategies trade at a discount compared to their respective market index – expectations for low-risk stocks are rather low, while fundamentals seem solid. We expect this valuation gap, or margin of safety, to be a tailwind for long-term investors in Conservative Equities, and see a similar discount for Emerging Conservative Equities, and a lower discount for our European strategy.

Positioning for resilience

While investor sentiment for defensive equities has waned in the era of US Big Tech dominance, elevated US equity valuations, rising concentration risks, and increasing volatility suggest the tide may turn. Market leadership is cyclical and Robeco’s Conservative Equities strategies has historically thrived in environments of moderate equity returns and heightened volatility.

With a disciplined focus on risk reduction, stable fundamentals, and valuation awareness, the strategy remains well-positioned for those seeking resilience and a time-tested solution: winning by losing less.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会