Novedades sobre la inversión en crédito

Vaya un paso por delante gracias a nuestro newsletter sobre lo último en inversión en crédito.

Headlines around US import tariffs have kept market volatility elevated. One thing is clear, however: tariffs for trade with the US will be higher than they were before 2 April.

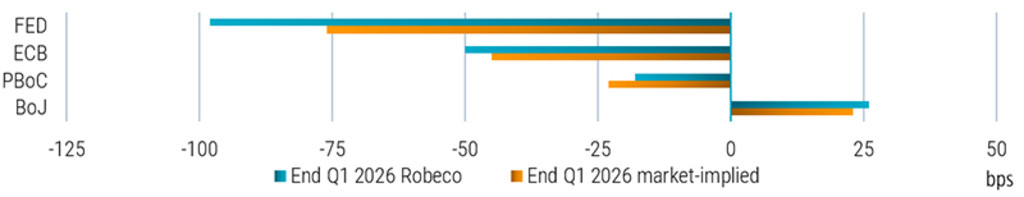

Business conditions have become more uncertain, regardless of the outcome of current trade negotiations. This puts the Fed in a situation where they will be forced to choose between higher tariff-induced inflation and weaker growth.

The ECB faces a different dilemma. For now, with policy rates not yet expansionary, there is a clear case for continuing to cut rates. Inflation has come down and growth is very likely to be hurt by trade tariff uncertainty. Looking beyond the next one to two quarters, things may be different. As we approach the end of this year, the announced large German fiscal stimulus and defense spending might play a more prominent role in supporting growth. At that point, the ECB may face a trade-off between implementing further monetary stimulus or allowing fiscal stimulus to run.

The PBoC remains in a very different monetary policy cycle. It has been easing policy for most of the past seven years and a new stimulus package was announced recently. There is probably more to come, though not in the immediate term.

The Bank of Japan is still in the process of hiking rates, given the resurgence of inflation, but it now also faces an economic environment where growth will be hurt by trade uncertainty. While this clouded outlook has slowed the pace of hikes, we don’t think it has derailed it. In our view, more rate hikes are still likely to come.

Source: Bloomberg, Robeco, based on money market futures and forwards, 12 May 2025

Vaya un paso por delante gracias a nuestro newsletter sobre lo último en inversión en crédito.