Finland and Norway claim top honors in latest Country Sustainability Rankings

A trio of Nordic nations made another clean sweep of the final country sustainability rankings of 2022. Scores for Finland, last year’s top finisher, slipped only slightly, but enough to share top honors with Norway. Just a razor’s edge behind sits Sweden. The equally familiar trio of Denmark, Switzerland and Iceland rounded out the elite six with the world’s best sustainability performance. The dazzling display of decades-long consistency at the top attests to the long-duration value of sustainable policies and practices.

Resumen

- Long-term consistency at the top demonstrates sustainability’s enduring value

- Political instability looms large across regions

- Environmental and social indicators strengthened in CSR revamp

The top twenty showed similar consistency, once more dominated by EU member countries alongside New Zealand, Australia, Canada, and Japan from the rest of world. Among high- and middle-income countries (based on nominal GDP), China, the Philippines, India, Nigeria and Pakistan rounded out the bottom five. However, they are replaced by Libya, Sudan, Iran, Iraq, and Yemen – all economically, socially, and politically fragile states in the Middle East and Africa when considering the full 150-member strong country universe.

Governance factors have long dominated ESG country analysis, and rightly so. Healthy institutions, systematic process, government accountability, as well as empowered citizens provide a protective platform for nurturing and sustaining social and environmental goals. Though governance is still the most heavily weighted overall, the CSR methodology was modified this year to reflect the increasing risks of climate change, biodiversity loss and human rights abuses for country sustainability performance.

Manténgase al día de las novedades en inversión sostenible

Suscríbase a nuestro newsletter para descubrir las tendencias de IS.

Controversial names capture short-term gains

This year, Saudi Arabia moved the most thanks to improvements in human and labor rights in addition to governance factors such as globalization and innovation. The Kingdom is slowly gaining ground across all three ESG dimensions as a result of its “Vision 2030” strategy which, in addition to social reforms that give more rights to women and migrant workers, also aims to curb greenhouse gas emissions, boost renewable energy and become net-zero by 2060. Still, gains are easy when working from such a low base; and while human rights in general advanced, gender equality has barely nudged.

Controversy-courting Türkiye1 and Brazil have also seen modest gains this year in part from solid or improving environmental measures; however, overall, they still underperform relative to emerging market peers. The defiant authoritarian and nationalist policies of Türkiye’s long-serving president, Recep Tayyip Erdogan, have damaged economic and political stability and undermined institutional frameworks, personal freedoms and human rights. Brazil has suffered similar governance setbacks under Jair Bolsonaro’s populist-driven regime.

Controversy-courting Türkiye and Brazil have also seen modest gains this year in part from solid or improving environmental measures

The recent win of a more conciliatory and inclusive Luiz Inácio Lula da Silva (popularly known as “Lula”) in Brazil and a strengthening opposition in Türkiye signal changing political tides that could favorably benefit sustainability performance.

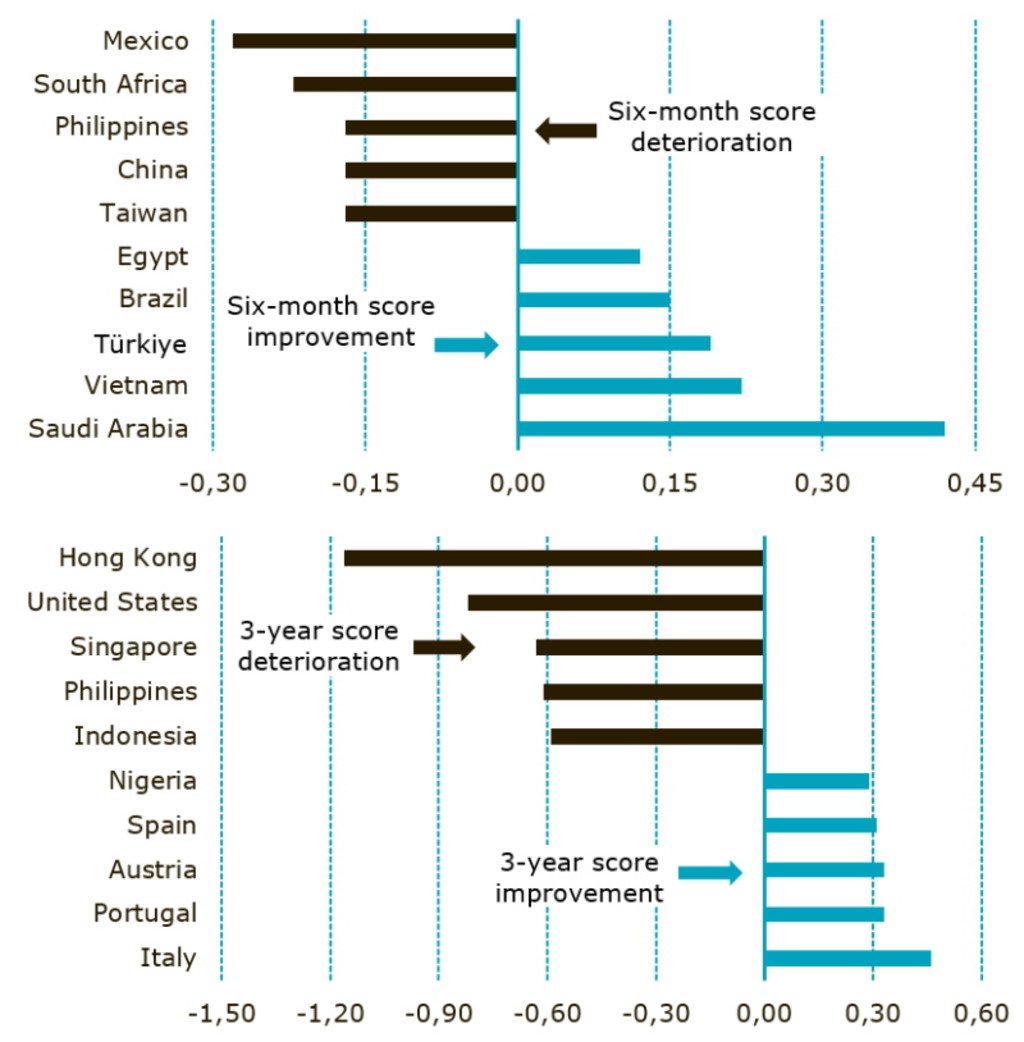

Figure 1 | Largest gains and losses in ESG scores over six months and three years

Data source: Robeco; data assessed as of October 2022

Data note: The chart displays countries with the largest score losses (left) and gains (right) over the past six months and three years ending October 2022. Only countries within the universe comprising the top-50 developed and emerging economies in terms of nominal GDP are shown.

Mexico, South Africa, the Philippines, China and Taiwan were the countries with the largest losses over the six months. Mexico’s scores were beat down by anti-democratic and anti-climate tendencies of its sitting president, Andres Manuel Lopez Obrador, or simply AMLO. Meanwhile, South Africa’s scores were mired down by poor health systems, lacking energy infrastructure, chronic corruption and persistent poverty and inequality. China, already a bottom-five performer among higher income nations, slid further still due to deteriorating social indicators. Growth in elderly populations is outpacing that of younger workers, threatening to hamper future growth and productivity and to deepen future public debt.

Southern Europe advances most over three years

Italy, Nigeria, Austria, Portugal and Spain saw the most improvements over a three-year horizon, driven by a mix of social and environmental factors including stronger labor force participation as well as better climate and energy performance.

Though Italy showed the largest score gains, the jury is still out on whether Giorgia Meloni, the new Italian PM, can continue the advance. Renewable energy investments, low carbon emissions and high recycling / waste control measures relative to the EU average, have lifted Italy’s environmental performance in recent years. The same applies to Italy's record on human rights. Yet, recurrent political turmoil has beleaguered other reforms and led to a slippage in key governance criteria over the past two decades. Strong governance is desperately needed to combat Italy’s structural challenges from low productivity and feeble economic growth to unfavorable demographics and high unemployment.

Political instability cast three-year shadow

Political risk and instability loomed large in three-year losses. Hong Kong led declines due to China’s long-standing interference with institutional and individual freedoms. The US too lost ground, owing to residual damage inflicted in the Trump era. Ground-breaking legislation from the Biden administration along with promising mid-term election results provide positive precursors for a recovery in US sustainability scores.

Rising political opposition, harsh economic conditions, and the Covid crisis, all stirred turbulence across Singapore in recent years, reflected in heightened political risks scores. Meanwhile, separatist movements and Islamic extremism have stoked political instability and strangled ESG performance in Indonesia. And while recent elections were favorable for Brazil’s sustainable future, they seemed less so for the Philippines where the offspring of two controversial former presidents have won the right to rule. Skeptics doubt a return to political normalcy and fear a further concentration of power and influence among a political elite.

Financial markets increasingly accept the critical link between country ESG data, economic prosperity and fiscal solvency

A sovereign tool

Financial markets increasingly accept the critical link between country ESG data, economic prosperity and fiscal solvency. Robust sustainability performance demonstrates political, economic, environmental and social stability – factors that promote economic growth, a solid fiscal position and positive long-term sovereign credit profiles. The opposite is also true; poor performance on ESG factors can signal foreboding risks that should give investors caution. Consistently strong correlations between Robeco’s Country Sustainability Ranking and key measures of sovereign bond risk bear this out and underscore its usefulness as a tool for making holistically informed investment decisions.

Footnote

1 As of June 2022, Türkiye (pronounced (tur-key-YAY) is now the official name of the country formerly known worldwide under the anglicized name of Turkey.