Denmark extends Country ESG winning streak

Denmark has captured its third straight title as the country with the best ESG credentials globally.

Resumen

- Latest update shows general declines in scores at the top

- Country spotlights focus on a polarized Poland and a burgeoning Bulgaria

- Physical climate risks metrics reveal the most vulnerable and least prepared

While it comfortably beat second and third place, Sweden and Finland, its overall score was slightly lower compared to spring results as well as last year. In fact, the scores of four of the top five dropped, albeit for different reasons. Denmark etched small losses in governance and social criteria, while Sweden and Finland’s losses were attributed to stalled progress on GHG emissions. Europe continued to dominate the group of top-tiered countries with superior scores of 8.0 and above; but this group also saw a general decline in overall scores.

Please visit Robeco’s SI Open Access portal for more details on scores and rankings.

Figure 1 - Country ESG-score leaders

Source: Robeco, October 2025. Score changes are compared to April 2025.

Scores were mixed among the world’s largest sovereign debt issuers. Though its rank remained unchanged, Japan (place 22), saw a slight decline in its overall score, based on disappointing results on GHG emissions. In contrast, China’s overall rank and score increased based on positive GHG emissions developments. The US had a modest increase in performance and rank, as expected drops on governance indicators were offset by increases in social areas. However, changes were less about demonstrated progress than changes to weighting mechanics that emphasize human rights over labor policies.

This autumn’s country rankings also welcomed a new indicator within the Governance pillar. The ITU Global Cybersecurity Index measures a country’s commitment to enforcing cybersecurity based on their performance on legal, technical, organizational, international cooperation criteria. High performers include a diverse mix of developed and emerging market countries including the US, Finland, Egypt, Türkiye, Bangladesh and Saudi Arabia. In addition, Saudi Arabia also made gains in other Governance indicators including Political Stability as well as Globalization and Innovation, boosting its score by (+0.13) and its rank by nine places.

The largest recent moves came from countries in the emerging markets group including Liberia, Trinidad and Tobago which saw scores increase on the back of improved GHG emissions and biodiversity measures. In contrast, Suriname, Venezuela, Zimbabwe, and Belarus dropped significantly. Yemen (2.42), Libya (2.52), and Sudan (2.66) continue to rank at the bottom, reflecting persistent ESG challenges.

Figure 2 - Top ten countries with largest gains (compared to April 2025)

Source: Robeco, October 2025. Score changes are compared to April 2025.

Manténgase al día de las novedades en inversión sostenible

Suscríbase a nuestro newsletter para descubrir las tendencias de IS.

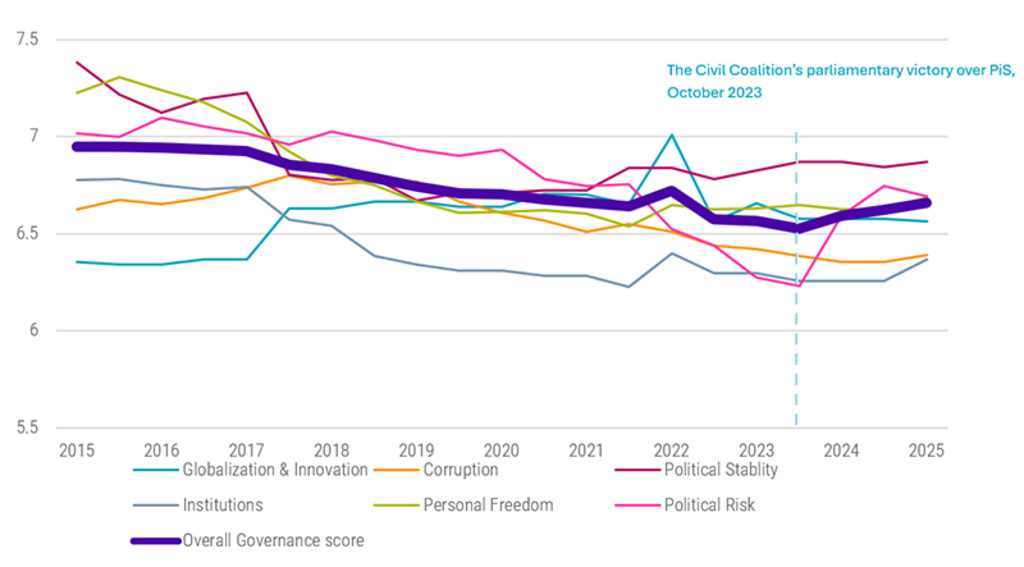

Poland – polarized progress

Poland’s governance is still in a state of recovery after a period of significant weakening under the Law and Justice Party (PiS) which ruled from 2015 to 2023. Shortly after assuming power, the PiS implemented policies that undermined the judiciary, sparking widespread criticism as well as EU intervention. The PiS also attacked the free press by tightening government control over broadcasting and marginalizing independent outlets. It also weaponized the media, using it to attack and discredit opposition leaders.

Unsurprisingly, Poland’s rating in democracy and governance dropped while the PiS was in power and has only recently rebounded after the Civil Coalition and its allies wrested control and enacted course-reversing reforms after its 2023 parliamentary win. Those gains however are now threatened by the recent presidential win of Eurosceptic and PiS member, Karol Nawrocki, who narrowly beat centrist candidate Rafał Trzaskowski in a highly polarized election in October.

Nawrocki is expected to use his presidential veto power to obstruct Prime Minister Donald Tusk’s reform agenda, particularly on efforts aimed at restoring judicial independence, strengthening media freedom, and aligning Poland more closely with the EU. Poland’s future democratic progress is now uncertain and its Governance pillar scores face renewed downward pressure.

Figure 3 - Governance scores, Poland (2015 - 2025)

Source: Robeco, October 2025.

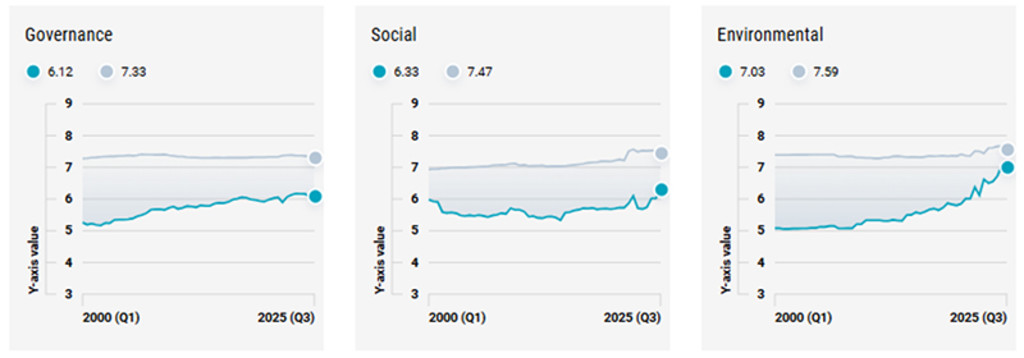

Bulgaria – with great progress come great expectations

Bulgaria has undergone a remarkable transformation since joining the EU in 2007, reflected in several key milestones: it achieved high-income status in 20241 and will also soon adopt the euro in January 2026. These achievements should considerably facilitate investments as they virtually eliminate currency risk, enhance policy credibility, and should lower borrowing costs through improved market confidence and access to ECB support.

They will also bring more scrutiny with EU benchmarks and peers, including ESG performance. Still, it’s off to a good start, outranking many of its EU counterparts, particularly when it comes to reducing GHG emissions and protecting biodiversity. Moreover, the government is committed to achieving the EU’s Green Deal targets.

While it has made commendable progress in economic development and environmental adaptation, deep-rooted social and governance challenges continue to constrain its long-term potential, especially compared to EU peers. To fully realize the benefits of Eurozone membership, Bulgaria will need to address institutional weaknesses, reverse demographic decline, and ensure inclusive growth.

Figure 4 - Development of Bulgaria’s ESG scores vs. European peers (2000-2025)

Source: Robeco, October 2025. Bulgaria (blue) vs. European peers (grey)

Thematic spotlight – physical climate risks

Extreme weather isn’t just life threatening, it’s economically costly and can severely hamper economic growth and development for the most vulnerable. According to the UN World Meteorological Organization, on average, African countries are losing 2-5% of GDP each year on climate-related impacts. Furthermore, governments are diverting up to 9% of their budgets in response to extreme climate events which they can hardly afford amid high debt levels and constrained public finances.

It can also dampen country credit ratings, making it more costly to borrow and reducing resources spent on real productive projects and programs. The Robeco Country Framework uses data from the University of Notre Dame Gain Index (ND-GAIN), which examines countries’ vulnerability to climate physical risks as well as their readiness to manage these issues. The data is then aggregated into a final score, which can be used to examine a country’s resilience to physical climate risk.

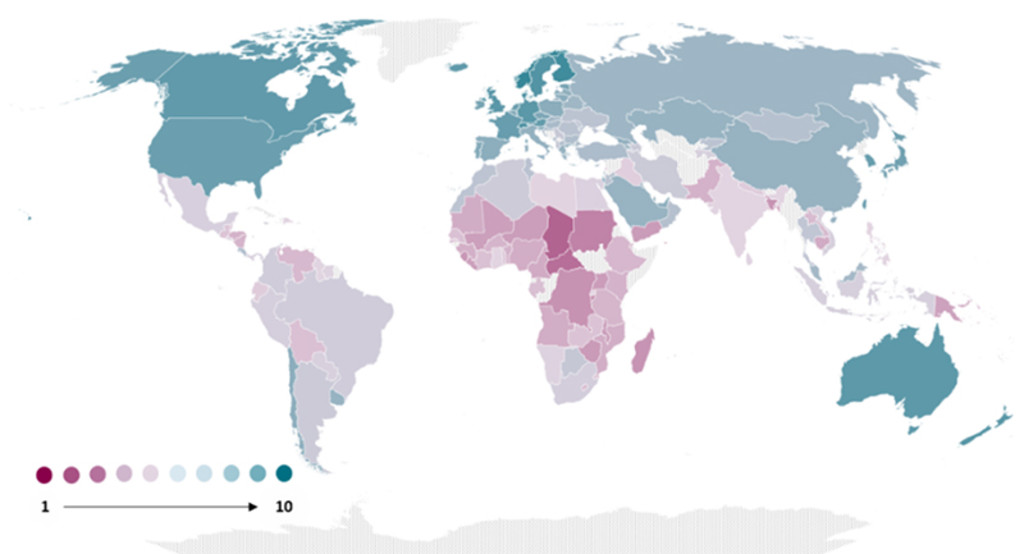

Figure 5 - Measuring country preparedness for physical climate risks

Lower scores indicate that countries are more vulnerable and less prepared for physical climate risks.

Source: University of Notre Dame Global Adaption Index (ND-GAIN), 2025.

Footnote

1 Officially defined by the World Bank as a country with gross national income (GNI) over USD 13,935 (as of 2025). Countries with high-income distinction are characterized by strong economies, developed infrastructure and have high per capita standards of living.