Stewardship Report 2024: Staying the course on sustainability

Sustainability has always held different meanings for different people. As a global asset manager, Robeco is increasingly seeing significant variations in regional approaches to sustainability – particularly in climate investing – reflecting the diverse markets that we serve.

まとめ

- Robeco remains committed to sustainable impact and generating alpha

- Engagement and voting activities outlined in 2024 Stewardship Report

- Human rights, labor practices and biodiversity core to active ownership

In this evolving landscape, we have witnessed several large asset managers exit from the Climate Action 100+ Initiative, an exodus of North American banks and asset owners from net-zero alliances, and a potentially changing emphasis on sustainability in the new UK Stewardship Code.

However, in the interest of our clients, Robeco is staying the course when it comes to sustainability and stewardship, focusing on our key SI topics of climate change, biodiversity, social issues, corporate governance and the Sustainable Development Goals (SDGs). We strive to balance our clients’ goals of return, risk, and sustainability by attentively listening to their objectives and customizing our solutions accordingly. That is the main message of the annual Stewardship Report detailing all Active Ownership activities in 2024.

“We continue to actively engage with investee companies around key sustainability risks, impacts and opportunities, and as such we support them in building future-proof business models,” says Mark van der Kroft, Chief Investment Officer, in the introduction to the report.

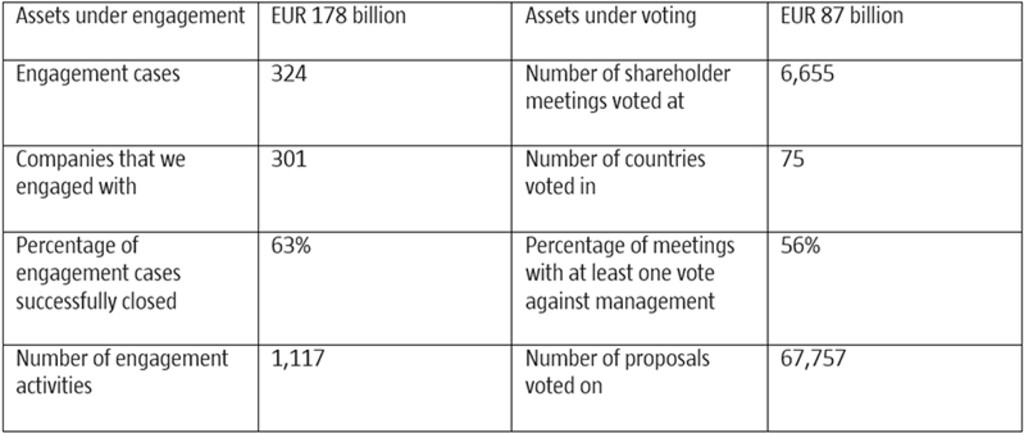

2024 key statistics

Source: Robeco, figures as at 31 December 2024

“We believe that more sustainable corporate behavior results in an improved risk-return profile of our investments. We use our engagement and voting rights to strengthen corporates’ awareness and approaches toward responsible business conduct; one constructive dialogue at a time.”

“In 2024, we further strengthened our climate engagement program and climate voting policy, managing both risks and opportunities, to the benefit of our clients and long-term value creation. During the year, we concluded several of our climate engagements successfully, with most investee companies meeting the climate expectations.”

Collaborative engagements

Robeco also took part in collaborative engagements at over 20 of the Climate Action 100+ Initiative’s focus companies, either as a lead or a contributing investor. And in line with our ‘no deforestation’ commitment, we actively engage with companies in sectors that have a considerable negative impact on biodiversity.

Biodiversity-related considerations are also included in our voting guidelines. In 2024, we engaged explicitly on the topic of biodiversity loss with more than 30 companies as part of different engagement programs, either collaboratively or directly with the investee company.

Human rights and diversity

Protecting human rights is also an important topic which is incorporated into our three-year engagements and voting activities. In 2024, we successfully closed 57% of engagement cases in the ‘Labor practices in a post Covid-19 world’, focused on improving labor standards for workers in the gig economy, hospitality, and retail sectors.

In 2025, ‘Diversity and inclusion’ will be expanded into a broader human capital management theme that addresses a wider range of workforce topics relevant to investee companies.

Driving positive change

“As we move forward, Robeco remains committed to driving positive change and fostering sustainable practices,” Van der Kroft says. “Amid growing regional differences in the adoption of sustainability, our dedication to sustainable investing, combined with our strategic engagement and voting activities, ensures that we can continue to support our clients in achieving their long-term investment goals.”

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会