Innovation remains the engine of growth

Despite global uncertainty, innovation is thriving. AI, nuclear fusion, and quantum computing are advancing rapidly, driving significant investments and automation, reshaping industries, and generating revenues.

まとめ

- Innovation remains the key driver of economic growth

- Artificial intelligence advancements continue despite market turmoil

- Geopolitical tensions renew focus on automation and cybersecurity

Although the evolving trade war has fueled uncertainty over the world economic order and roiled markets, humanity’s knack for overcoming hurdles through innovation persists. From the agrarian age’s gristmill to the information age’s integrated circuit, humankind is continuously reshaping the world around us. As the late economist Robert Solow observed, “Innovation is the driving force behind sustained economic growth. Without new ideas, economies stagnate.” While macroeconomic factors may, at times, accelerate technological investment and at other times forestall plans, the direction of travel is inexorably forward.

Recent developments in artificial intelligence (AI), nuclear fusion, and quantum computing demonstrate the pace of innovation is accelerating. In particular, investments and progress in AI have remained undeterred by market turmoil as corporations and nations alike race to gain an edge. Advancements in automation and robotic technologies will also play a key role in renewed efforts to reshore manufacturing. At the same time, rising geopolitical tensions place increased focus on cybersecurity systems as risks to critical infrastructure expand.

AI is revolutionizing industries and reshaping the future of technology. Even as stocks have faltered so far in 2025, global competition has spurred continued investments into new AI models, digital infrastructure, and new applications. Notably, speaking at the World Economic Forum in January, Demis Hassabis, CEO of Google DeepMind said the company was on track to submit AI-designed drug candidates into clinical trials in 2025. More mundanely, but no less impactfully, AI agents are poised to shift from merely answering questions to taking action, as the technology seeks to fulfill its productivity-enhancing promise.

Building the foundation

While investors were concerned that the pace of investment into AI infrastructure might slow following the release of DeepSeek’s model in China in November 2024, increased usage of AI applications has spurred capital spending plans higher. Morgan Stanley estimates that global cloud computing capital spending will reach USD 353 billion in 2025, a figure that is nearly USD 38 billion greater than their previous estimate. AI has also driven an acceleration in venture activity, as funding to the sector jumped 79% in 2024 to more than USD 100 billion, according to CB Insights.

Putting AI agents to work

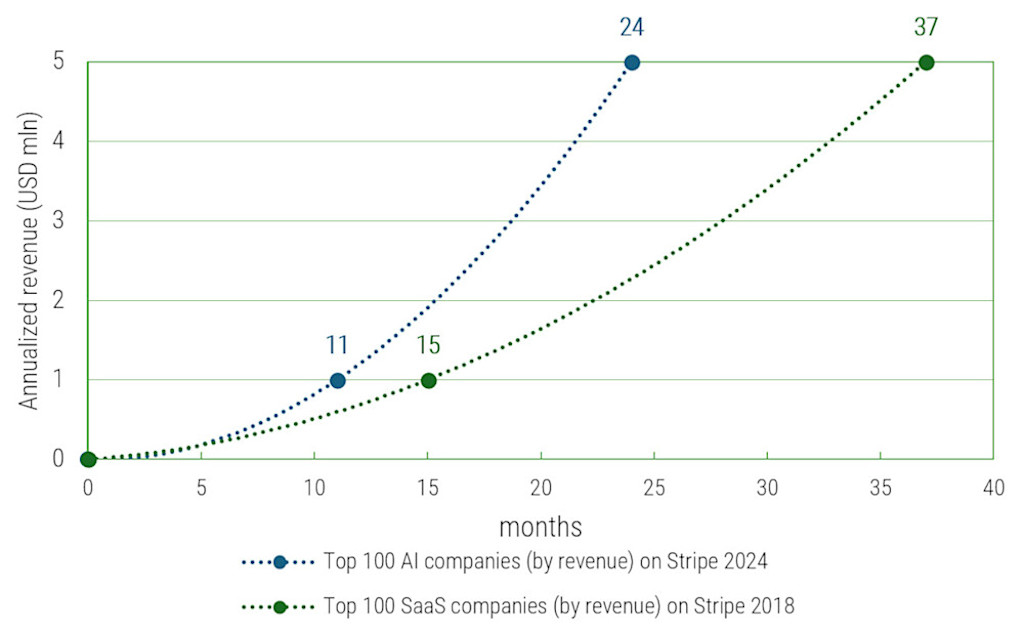

While AI is still early in the adoption phase, the technology is already generating meaningful revenues. For instance, Microsoft reported in January this year that annualized AI revenues had grown 175% year-on-year to USD 13 billion. Notably, in just two years since the launch of ChatGPT, OpenAI reported revenues of USD 3.7 billion in 2024, placing the young firm within the top 20 software companies. AI is also accelerating the growth of smaller firms too. According to the payments processor Stripe, in 2024, the median time for AI startups to reach annualized revenues of USD 5 million was 24 months, compared to 37 months for Software as a Service (SaaS) startups in 2018.

Figure 1: SaaS and AI startups’ median time to annualized revenue milestone

Source: Stripe, February 2025

AI agents and tech applications that can take action rather than merely answer questions should continue the trend. These AI agents are working their way into existing software to automate tasks that often involve data entry or the manual process of integrating information from multiple applications. McKinsey estimates that AI could enable the automation of up to 70% of business activities.

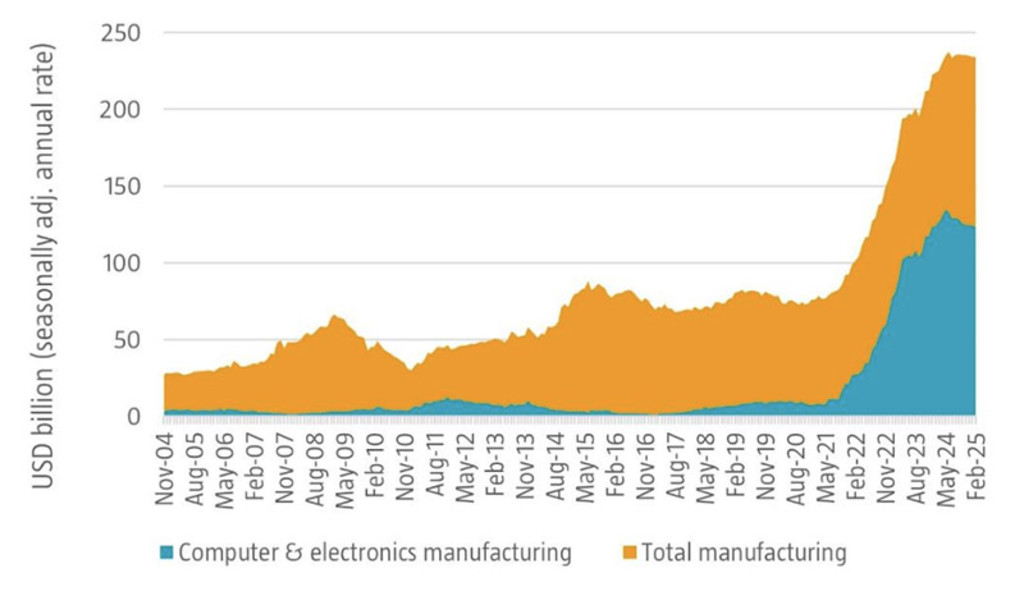

US investment in technology manufacturing facilities rose 15-fold over four years

Build it here

Production bottlenecks, labor shortages, and security considerations have renewed interest in automation and reshoring manufacturing closer to home long before US President Trump introduced his unprecedented import tariffs. While the desire to reinvigorate domestic manufacturing is not new, follow-through with significant investment spending has been less robust until recently. In the US, investment in manufacturing facilities expanded by more than threefold over the last four years reaching nearly USD 235 billion in 2024. According to the Peterson Institute for International Economics, the US invested more on technology manufacturing facilities in 2024 than it did in the prior 20 years combined. Importantly, those figures include only the structures and facilities, not the capital equipment used in production. Given the typical lag between construction and the outfitting of new sites with machinery and labor, the runway is now set for an acceleration in robotics, automation and capital equipment spending. Although the Trump administration has shifted focus to tariffs rather than fiscal policy to spur manufacturing, many key investments are already well underway.

Figure 2: Private construction spending on manufacturing facilities in the US

Source: US Census Bureau, April 2025

Rise of smarter robots

These investments seek to not only bring on new capacity, but to also modernize the manufacturing process. In addition to providing margin improvements through increased efficiency, industrial automation systems address a critical issue – a shortfall of talent as the workforce ages. According to Deloitte and The Manufacturing Institute, 1.9 million manufacturing jobs could go unfilled over the next ten years if talent challenges are not addressed.1 As a result, robotics have continued their steady advancement across the factory floor. Over the last five years, the globally installed base of industrial robots has expanded at a steady 11.3% CAGR.

Robots are not only getting more plentiful; driven by AI they are getting smarter too. During a presentation in January 2025, Nvidia CEO Jensen Huang declared robotics a ‘multi-trillion-dollar opportunity’ as the company announced its Cosmos foundation model platform for what the company dubs ‘physical AI.’ AI coupled with advancements in mechanical engineering have also renewed hopes for developing humanoid robots which could be trained to work in numerous environments rather than fixed locations. CB Insights notes that the venture investment into industrial humanoid robotics tripled in 2024 to USD 1.2 billion.

Nvidia CEO Jensen Huang declared robotics a ‘multi-trillion-dollar’ opportunity

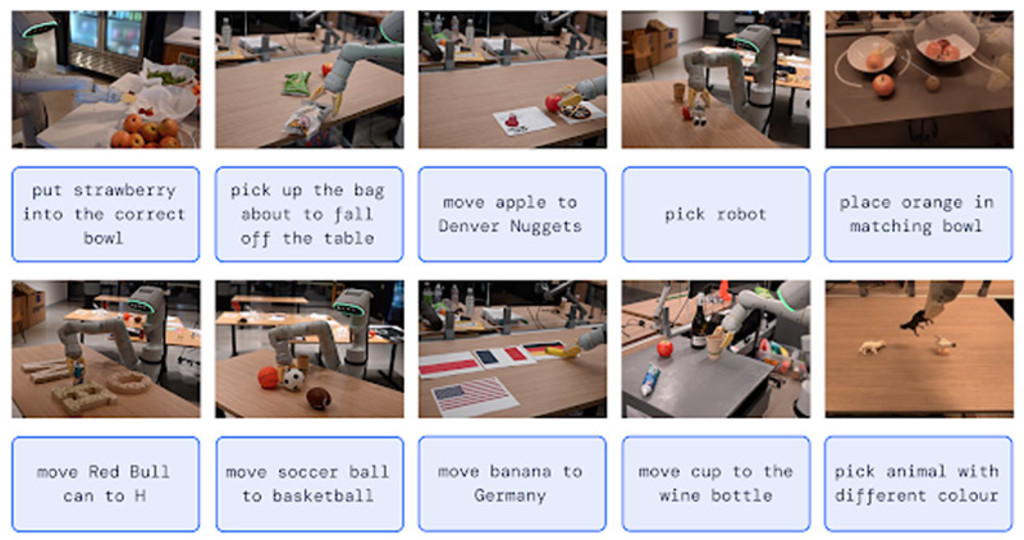

Currently robots are either human controlled or follow pre-defined programming to operate. More recently, autonomous and semi-autonomous robotics enable dynamic actions that factor circumstance and real-time conditions. By learning from human controls and taking input from sensors and cameras, robotic production is poised to become more efficient and more flexible. For instance, Google DeepMind’s RT-2 model was trained on both robotic-specific data, as well as from the web. This system enables machine vision equipped robots to perform tasks that were not preprogrammed.

Figure 3: Google DeepMind robotic arm performs tasks not contained in pre-defined instructions

Source: Google DeepMind, 2024

Secure everything

Increased digitalization, fragmented systems, and rising geopolitical tensions have more than doubled cyberattacks over the last four years according to the International Monetary Fund. Alarmingly, cyberattacks have increasingly targeted government networks and critical infrastructure. Although digital transformation offers the potential for increased efficiency, connected systems are subject to an increasingly hostile cyber threat environment. While AI is also enabling more adaptive and efficient security systems, bad actors have also proven adept at incorporating the technology. Similarly, recent breakthroughs in quantum computing have sparked concern the technology could break existing cryptography algorithms. With cybersecurity concerns remaining a top priority, the IDC forecasts global spending on the sector will accelerate modestly from 13% growth in 2024 to 14% in 2025, reaching USD 274 billion.

The cost of cybersecurity complacency is rising

The cost of complacency is also rising as cyberattacks inflict measurable damage. According to an analysis by Allianz, in cyber insurance claims exceeding EUR 1 million, cases of stolen data rose from 40% in 2019 to more than 77% in 2023. The World Economic Forum estimates the total cost of cybercrime will rise from USD 6 trillion in 2021 to USD 10.5 trillion in 2025.

Infrastructure, a matter of national security

Cyber threats have also escalated on the national security agenda as state-sponsored actors appear to have been behind a myriad of recent attacks. For instance, according to the US Cybersecurity & Infrastructure Security Agency in December 2024, state-sponsored Chinese hackers breached the US Treasury Department’s network, stole documents, and even accessed the computer of Treasury Secretary Janet Yellen. Governments around the world including Canada, Germany, Japan, and the UK have reported similar state-sponsored cyber breach incidents over the last year, according to the Center for Strategic International Studies.

Concerningly, critical infrastructure has also come under attack. Unlike cybercrime motivated by profit, or espionage extracting state secrets, attacks on infrastructure portend debilitating disruption. At a time of increased geopolitical tension, experts warn cyber attacks on infrastructure could not only disrupt daily life, but also the ability to respond in the event of military conflict. Along those lines, in January 2024, the US Federal Bureau of Investigations announced the agency had extracted malware that the US says was planted within the networks of communications, transportation, and energy hubs.

Footnote

1 Taking charge: Manufacturers support growth with active workforce strategies, Deloitte, April 2024

トレンド投資とは?

ニュースレター(英文)に登録して、テーマ型投資の最新動向を入手しましょう。

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会