The new new normal

On 11 March 2020, the World Health Organization declared Covid-19 a global pandemic and we all went into lockdown in one form or another. In the three years since, economies around the world have largely reopened, but little has gone back exactly as the way it was. We revisit the pandemic’s impact on how we work, live, and play.

まとめ

- Three years after the start of the Covid pandemic, little has returned entirely back to normal

- Office life has been the most disrupted, and digital upgrades remain a work in progress

- Many Covid-accelerated habits, such as e-commerce in particular, continue above trend

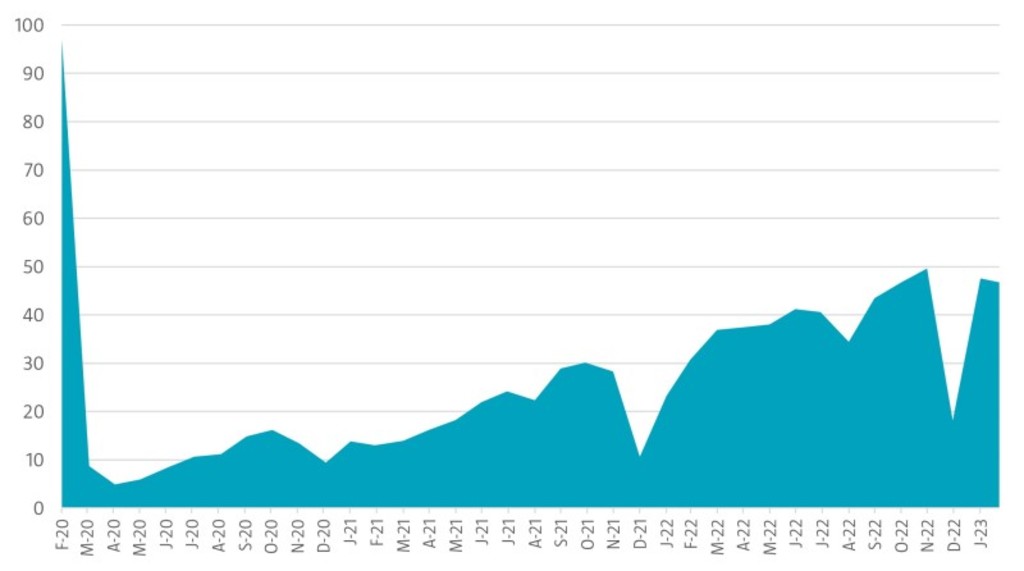

Three years after Covid-related restrictions sent all but essential workers home, restaurants, stores, and schools have largely reopened as before, while offices remain half empty. Data from office security systems provider Kastle Systems shows US office occupancy reached 50.1% in February 2022. Data varies by metro area, with office occupancy at 41% in San Jose, 47% in New York, and 66% in Austin.

In Europe, real estate services provider Savills’ data showed a similar trend with office occupancy in mid-2022 reaching just 32% in London and 54% in Paris. In Asia, Jones Lang Lasalle data shows office occupancy has returned to 75% in cities like Seoul and Tokyo.

Figure 1. Office occupancy percentage, NY Metro area

Source: Kastle Systems, March 2023

Before the pandemic, just 8.2% of employees in the US worked from home every day, according to the Federal Reserve Bank of Dallas. In 2022, 49% of employees maintain a hybrid work schedule, 35% have returned to the office full time, and 17% were fully remote, according to collaboration software Slack’s global survey of office workers. These varied working arrangements impact not only office culture, but also create a schedule and staffing challenges for related services from cafes to public transit.

However, creating and maintaining corporate culture can be difficult without meeting in person. To facilitate the new flexible and hybrid work reality, firms are not only re-thinking how much office space they require, but also systems. Despite working through three years of remote and hybrid work, many firms are still playing catch up. Industry analysts at IDC forecast that enterprise spend on ‘Future of Work’ systems will increase 18.8% year on year to USD 1 billion in 2023.

While many firms are urging workers to return to their desks, others like Airbnb, Coinbase, and Shopify have doubled down on remote work and closed the majority of their offices. As a result, a small but growing cadre of young professionals seek to work from anywhere. The Subreddit group r/digitalnomad, which provides a forum to exchange information on working from afar, doubled in 2021 to one million members. As the trend has proved to last longer than the Covid era, membership in the group doubled again during 2022 to two million.

Digital readiness also requires systems and approaches that go well beyond Zoom video rooms and Teams chat. In April 2020, Microsoft CEO Satya Nadella said on a company earnings call, “We have seen two years’ worth of digital transformation in two months.” Indeed, as the world went into lockdown, stores, many of which previously lacked a web presence, raced to facilitate online orders, and Michelin-starred chefs joined fast-food restaurants on food delivery apps.

As a result, software revenue growth accelerated, but that surge has more recently ebbed. According to IDC, after expanding at a compound annual growth rate of 27% over the last five years, Software as a Service (SaaS) revenue growth is expected to decelerate to 20% over the next four years. That said, while the SaaS deceleration has been jarring to valuations, the sector is still growing more than twice as fast as the broader software industry, and nearly three times faster than the technology industry as a whole.

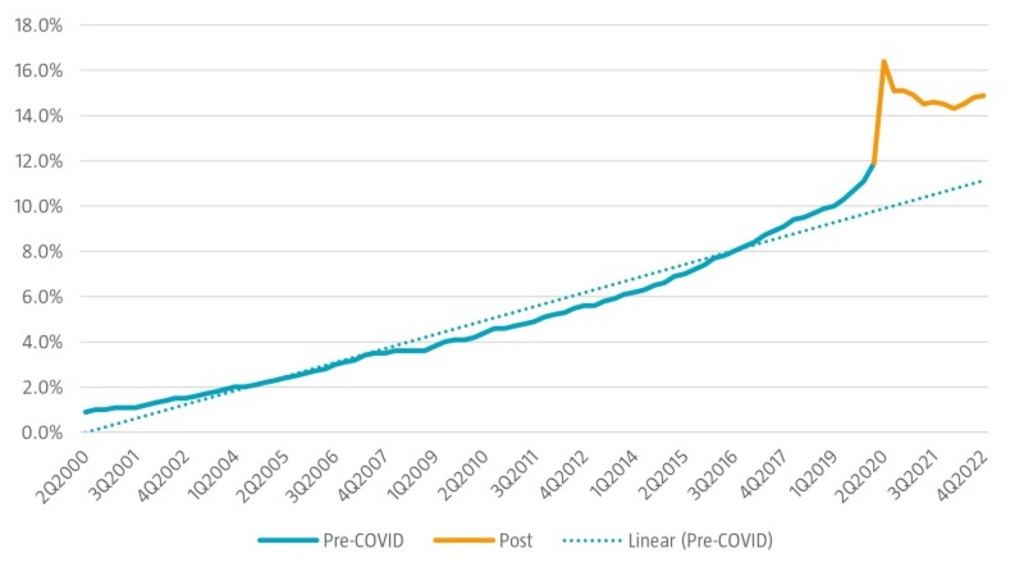

How we live

As pandemic restrictions forced most retail stores to close their doors, e-commerce’s share of retail sales in the US accelerated from 11.1% in 4Q19 to a peak of 16.4% in 2Q20. Unsurprisingly, as restrictions eased and high-street shops reopened, e-commerce sales growth decelerated, and its share fell to 14.3% by 2Q22. Nevertheless, in recent quarters, e-commerce growth re-accelerated, reaching 14.9% share during 4Q22; a level that remains well above the pre-pandemic trendline.

Figure 2. US e-commerce sales as a percent of total retail

Source: US Department of Commerce

With gyms closed and even outdoor exercise often restricted, online fitness services soared during the pandemic. Post-pandemic, fitness has also not entirely returned to normal. A 2022 market research survey from Upswell found that while 50% of gym members returned within nine months of restrictions being lifted, nearly 28% still have not returned and 31% are working out less in gyms.

At the same time, many online services continue to expand. Last year fitness-tracking service Strava reported that indoor cycling and running activities recorded on services like Peloton and Strava grew at a faster pace than outdoor activities. Positively, whether at home, at the gym, or outdoors, the fitness trend continues. A UK poll by YouGov reports that 68% of Brits worked out at least once per week last month versus 60% in February 2020.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

How we play

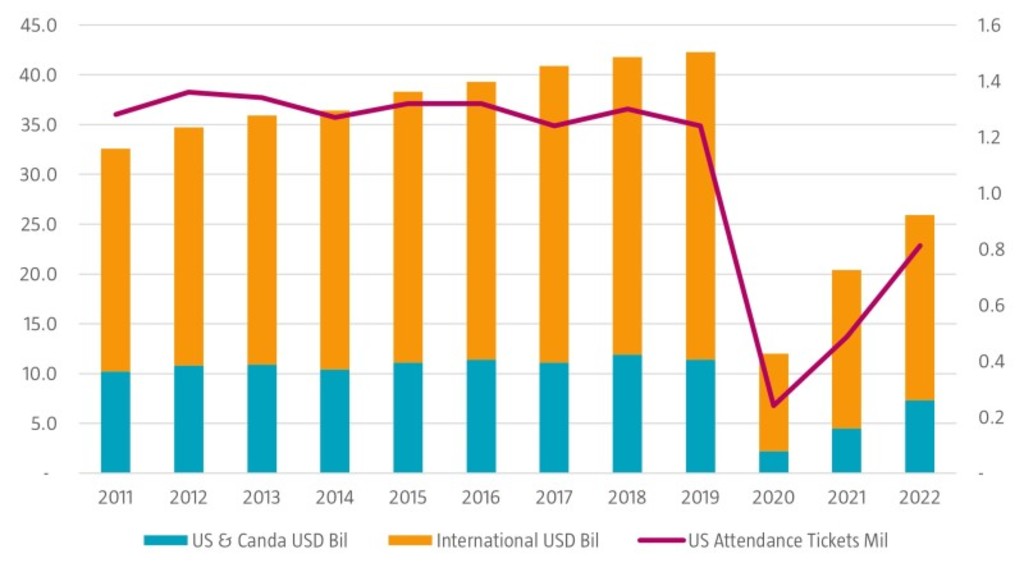

Wakanda may be forever, but the future of movie theaters is less certain. With theaters shuttered in 2020, box office revenues naturally plummeted and have not fully recovered since. In 2021, global theatrical revenues jumped 70%. Super heroes like Spiderman drew audiences back to the big screen. In 2022 the recovery continued, rising 27% year on year as studios released further installments of big franchises like Avatar, Top Gun, and Jurassic World.

Nevertheless, the global box office in 2022 was still 39% beneath the market in 2019. In the US total attendance in 2022, as measured by the number of tickets sold, was 34% lower than in 2019. The decline in movie theater attendance began well before the pandemic as flat-screen technology improved, streaming services gained ground, and as content producers shifted focus from tentpole releases toward similarly produced television series like Game of Thrones and Stranger Things.

Those developments also drove continued declines in cable television, with US subscribers falling from 100 million in 2012 to 70 million in 2022.

Figure 3. Box office revenues and attendance

Sources: MPAA, Gower Street Analytics, 2023

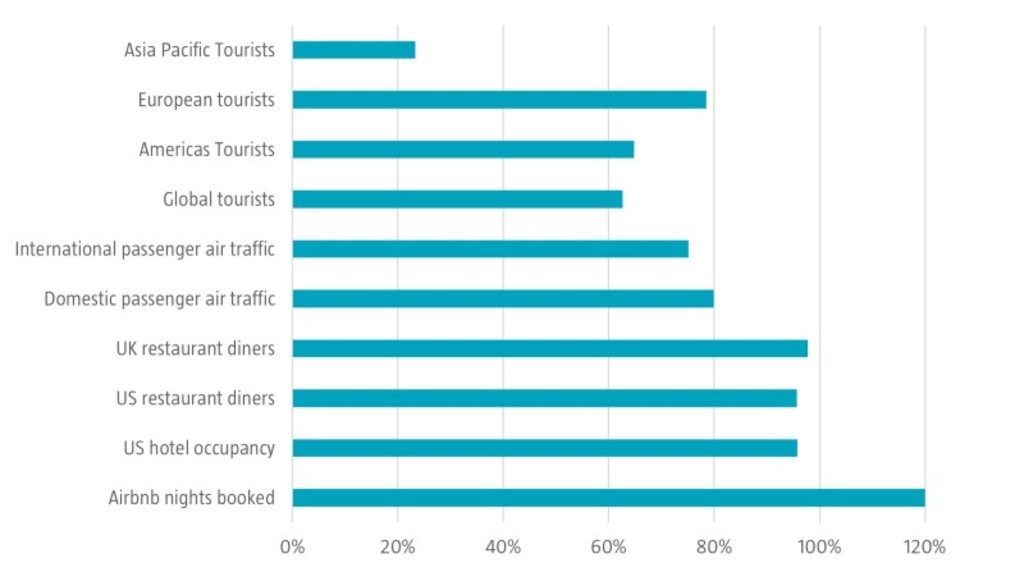

The travel and hospitality sector is another sector that bounced back as restrictions eased, but still remains below pre-pandemic trend. According to the United Nations, in 2022, global tourism reached 63% of the levels recorded in 2019 with Europe achieving 79% recovery and the Americas 65%. With China’s prolonged border closure tourist traffic in the Asia-Pacific region in 2022 reached just 23% of 2019 levels.

According to the IATA, in 2022 passenger air traffic as measured by revenue passenger kilometer (RPK) reached 80% of 2019 levels on domestic flights and 75% on international flights. Restaurants and hotels have seen the largest recovery. OpenTable’s index of seated diners at restaurants that reopened reached 96% of 2019 levels in 2022 in the US, and 98% in the UK. Bloomberg reports that during 3Q22, hotel occupancy in the US was down just 4.2% versus 3Q19.

Notably, consumers appear most interested in experiences off the beaten track, with alternative accommodation marketplace Airbnb recording room nights booked in 2022 at 120% of 2019 levels.

Figure 4. Travel & leisure metrics 2022 versus 2019

Sources: United Nations, IATA, OpenTable, Bloomberg, Company reports, March 2023

Conclusion

As we reflect on the three-year mark since the start of the pandemic, it’s clear that our lives have been permanently altered: the way we work, live, and play has transformed with the shift towards remote work, accelerated adoption of e-commerce, and the rise of online fitness services, for example. While some industries have shown signs of recovery, others have been reshaped, and the resilience and adaptability of individuals and businesses alike have been tested and will continue to shape the new new normal in years to come.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会