Goldilocks is awaiting a haircut

Investors looking for a ‘Goldilocks’ soft landing for the global economy may be disappointed, says strategist Peter van der Welle.

概要

- US economic data has surprised to the upside, with inflation falling

- Three reasons though why ‘peak Goldilocks’ optimism may fall flat

- Central banks may rein in excess demand, implying a drag on markets

He forecasts a potentially scarier ending for the market fairy tale in which the economic porridge is not too hot, or too cold, but just right. While inflation is indeed falling and economic data is improving, the history of recessionary signals may prove too strong to prevent one, he says.

This means Goldilocks is likely to be in for a haircut, prompting the Robeco multi-asset team to take a more cautious position in its portfolios. They remain neutral on global equities and favor more attractively valued high yield bonds as a hedge against extension of the benign market sentiment.

“As global equities are up almost 5% in the year to date in euros, markets in recent months have shrugged off the imminent recession narrative and instead have rooted for a soft landing – or even a no landing – scenario for the global economy,” says Van der Welle, strategist with Robeco Sustainable Multi-Asset Solutions.

“Not only investors, but also seasoned government officials like US Treasury Secretary Janet Yellen have lately been joining the soft landing chorus. A Bloomberg survey showed that searches for ‘soft landing’ have skyrocketed.”

“This pivot in recent months towards the Goldilocks scenario is understandable; the evidence at hand seems to have changed for the better. Clearly the hard data about the US economy such as non-farm payrolls and retail sales have been surprising to the upside and have contrasted with prior, more downbeat soft data.”

A more resilient Western consumer, favorable weather and a successful reopening of the Chinese economy after abandoning its zero-Covid policy have also boosted sentiment. “The pace of Western disinflation has been stronger than expected, and as a result, markets have been enjoying a wave of unexpectedly higher economic growth and lower inflation,” Van der Welle says.

“Yet, we might just have seen peak Goldilocks, as markets may have been cheering for the most benign scenario based on the recent evidence at hand, and no bears are coming home yet. However, in doing so they have overlooked what has happened the most often in history in similar economic circumstances.”

“American psychologist Daniel Kahneman has especially highlighted the risks of base rate neglect in decision making. In our view, a haircut awaits for the Goldilocks scenario probabilities reflected in current market pricing.”

Three reasons for a haircut

Van der Welle says there are three reasons why a haircut awaits for our golden-locked heroine: traditional recession indicators, a mismatch between inflation and unemployment, and disinflation occurring in conjunction with positive macro surprises.

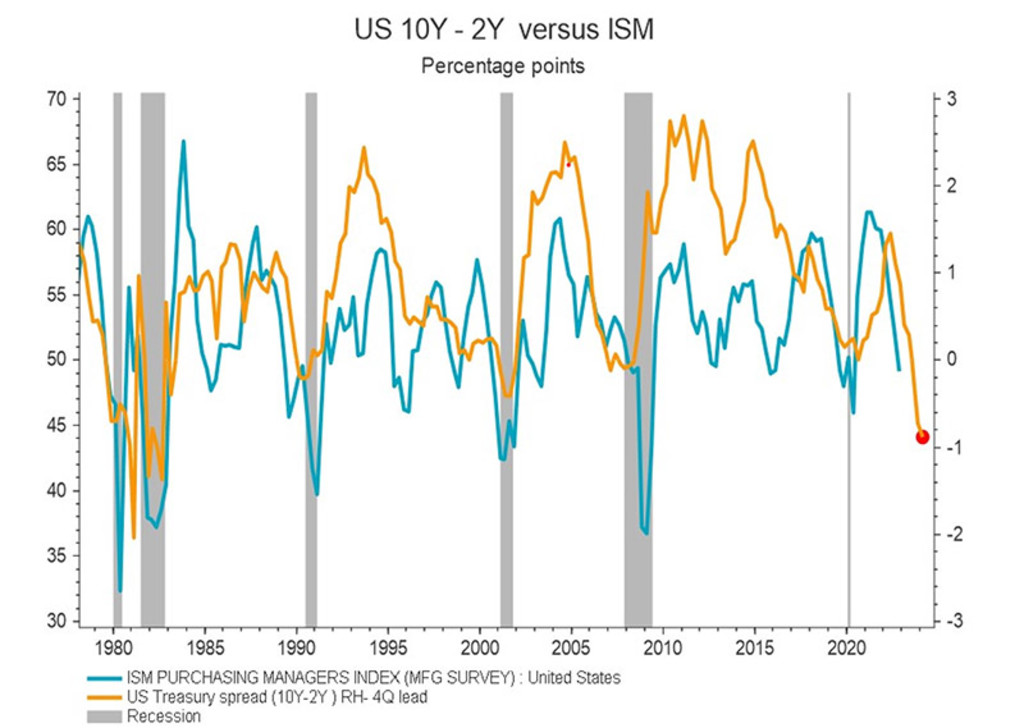

“First, reliable recession indicators are strongly contradicting Goldilocks’ endurance on a 12-month horizon,” he says. “In fact, the warning signal from the yield curve has grown even stronger in the year to date, as the inversion of the 2-year/10-year curve has deepened on the back of the recent upward repricing of the Fed’s hiking path to a terminal policy rate of 5.4%.”

“US yield curve inversion has rarely raised a false flag when it comes to calling a recession over the past four decades, with a notable exception in 1998. The bond market tells us that a Fed that is determined to bring inflation back to target by raising real policy rates well into positive territory will ultimately create headwinds against aggregate demand.”

Inversion of the yield curve is a traditional indicator of an impending recession. Source: Refinitiv Datastream, Robeco

“Timing is of the essence here, as the lags between the yield curve inversion signal and the subsequent economic fallout are highly variable, with the potential to wrongfoot both macro bulls and bears post-inversion. For instance, when the yield curve inverted in August 2005, it took still 29 months before the onset of an NBER recession in 2008, even though the average lag is 16 months.”

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

Inflation versus unemployment

Secondly, there is the mismatch between rising inflation and falling unemployment. “While there is much to cheer about the resilience of the consumer on the back of continuing tight labor markets, a cyclical low in unemployment rates as we observe today, with US unemployment at 3.4%, is a contrarian signal for future economic activity,” Van der Welle says.

“Whenever the US unemployment rate drops below 5% and inflation edges above 4%, a recession ensues in the subsequent two years 100% of the time. Such a strong base rate leaves little room for complacency about the risks facing the US medium-term growth outlook.”

“This view can be further substantiated by looking at the steep drop in housing market sentiment, which serves as a leading indicator for US unemployment. As the decision to buy a house is strongly determined by perceived future job security, the deterioration in buyer sentiment signals that a significant turn in the labor market might be ahead.”

Highly unstable equilibrium

The third reason for a peak Goldilocks scenario is the recent episode of stronger-than-expected disinflation in conjunction with positive macro surprises. “This represents a highly unstable equilibrium,” Van der Welle says.

“While the disinflation process itself might not be at risk, the pace of disinflation could slow – inflation surprise indices edged higher already last month – and take some shine off the Goldilocks appeal.”

“Economic momentum has improved in advanced economies, with the global PMI above 50 again (signaling economic expansion) for the first time in six months. While commodity prices have declined by 3.3% in the year to date, a continued recovery in manufacturing activity led by Asia could slow the pace of headline disinflation.”

Inflation is still up

Meanwhile, the much-feared core PCE inflation has increased in recent months, and the data shows that almost half of its rise is still related to the supply side of the economy.

“Although supply chain problems have notably eased, another strong positive supply side shock through investments would be needed to remove sticky inflation elements from several economic sectors,” Van der Welle says.

“All in all, inflation might prove to be stickier until a recession enters the scene, as this phase of the business cycle typically triggers strong disinflation. In the meantime, central banks could feel they have to do more to bring down aggregate demand, which implies a larger drag on the economy and financial markets further down the road.”

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.