Credit outlook: Buy the dip

We are far enough into the business cycle and rate cycle that when markets become too bearish, like in October, or when banking events like those of recent weeks drive spreads wider, buying opportunities occur.

概要

- Economic conditions still fair but credit conditions are tightening quickly

- The November peak was a buying opportunity, as was March

- Policy intervention and banking stress present an opportunity

Over the past few quarters we have been highlighting the theme of identifying the Fed’s second-to-last rate hike as a means to develop an end-of-cycle portfolio strategy. Market pricing around the Fed’s end game has shown this is not an easy task – as we knew would be the case.

In October last year we decided to buy the dip to a certain extent since the market was overly cautious. We increased betas to just above one for investment grade and close to neutral for high yield. Whether a bear market rally or not, it turned out to be the right choice. We reduced this position in the first quarter of 2023.

More recently, US and Swiss banking events have also had an impact on market pricing and we believe the financial sector has become a buying opportunity again, due to the Silicon Valley Bank and Credit Suisse debacles.

The basis scenario still is that the Fed was on a hiking path. Inflation and economic data were not yet sufficiently subdued.

“We also know there will be black swan events at the end of a Fed hiking cycle, and certainly after such a prolonged period of free money and in the wake of such a dramatic change in course for the Fed and ECB,” says Victor Verberk, Co-head of Credits at Robeco.

“Meanwhile, it seems the market trades between the certainty of a recession and the hope of a shallow one.”

Fundamentals

What happened at Silicon Valley Bank and Credit Suisse? As a regional bank, Silicon Valley Bank operated under a flaw in the US banking regulation. Smaller banks (balance sheets below USD 250 bn) have a lighter regulatory regime than the bigger banks. They do not have to realize unrealized losses in the ‘assets held for sale’ portfolio, which is meant as a pool of liquidity. For Silicon Valley Bank it started when venture capital deposits, which typically are working capital rather than old-fashioned deposits, were withdrawn. Silicon Valley Bank was forced to sell liquid ‘assets held for sale’ and realize the losses.

Importantly, the big US banks do not suffer from this regulatory flaw. Neither do European banks.

Credit Suisse, in turn, had an operating problem. A sound credit culture had been broken and the bank needed time to repair this. Unfortunately, a bank does not always get that time when confidence has been broken and capital is insufficient.

“We believe the banking sector has deleveraged a lot, capital ratios have increased and balance sheet risks have been made much more conservative. This means that this time around the banking sector is not the systemic risk factor,” says Verberk.

So much for banking risks. Back to economics. The US economy shows many signs of normalization from overheating. There is an expected increase in job cuts, hourly earnings are coming down and the number of hours worked is moderating. The main concern at the moment is that markets have become optimistic again since last October.

We would point to the fact that earnings per share drop on average 23% in a recession, which does not fit current equity market valuations. Only when risk-free yields go down significantly can some optimism return.

The European story is dull. The economy is in stagnation, as has been the case so many times before. It is clear that industrial production is suffering the most. By contrast, consumer behavior is much more stable due to jobs growth, wage increases and, going forward, lower inflation.

Overall, the main theme fundamentally is that corporates will face headwinds. A big headwind is the fact that wages will rise and hence margins will compress from very high levels.

The conclusion is that we will experience a traditional recession late this year. The question is whether markets are priced for that. Sometimes they are, and sometimes not.

Time to build back credits exposure?

Webinar

Valuations

The stress at some US and Swiss banks has caused an aggressive repricing of bank spreads. This has been centered around the AT1 market and has even triggered questions about the functioning of the AT1 market.

Robeco Fixed Income did not hold Credit Suisse’s AT1 bonds – nor those of Silicon Valley Bank or other Californian banks.

The reason we like AT1 now is that these events have increased massively the risk premiums on them. At above 8% yield, let alone at current much wider levels, we normally like these bonds. Equity-like returns are possible in these AT1 bonds. It also shows that equity-like risks are involved in a very adverse, scarce and idiosyncratic situation.

“Looking at our valuation sheets there is a clear difference between financials and corporates,” says Sander Bus, Co-head of Credits at Robeco. “Both in high yield and investment grade, the corporate sectors are a touch cheap but no longer recession-proof as in October.”

We will remain a bit constrained still in buying CCC-rated credit, peripheral (financial) bonds or corporate hybrids. We prefer a quality portfolio with some exposure to financials. We are most cautious on real estate, retail and other rate or recession-sensitive sectors.

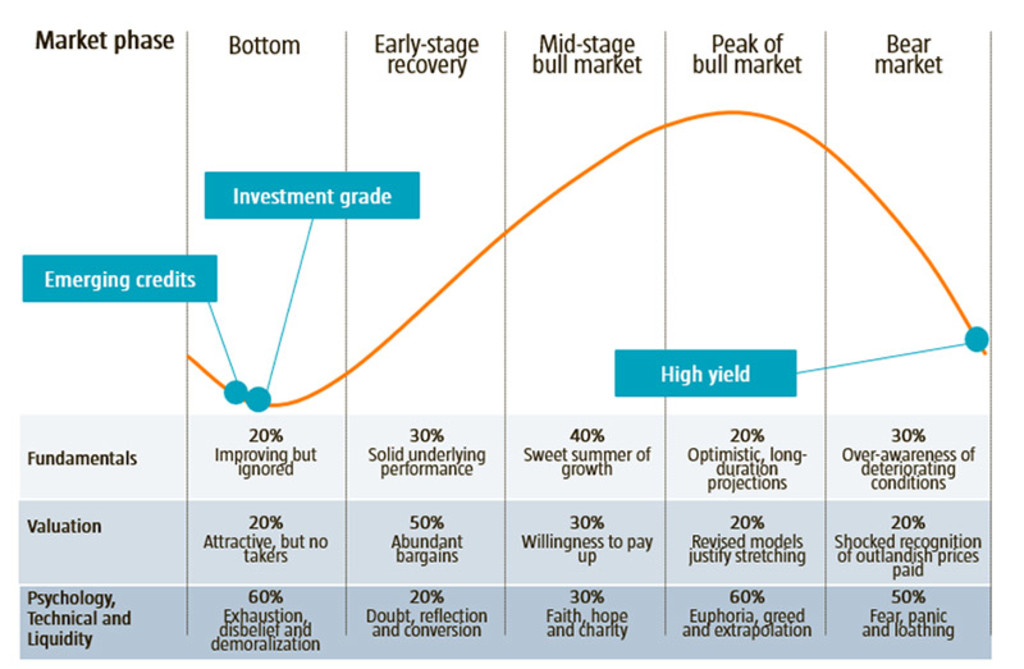

Figure 1: The market cycle

Source: Robeco, March 2023

Technicals

Compared to previous meetings, there was a slight change of tone in the Fed’s latest FOMC press release: it now states that some more rate hikes may be appropriate, depending on data and the assessment of the banking stress and potential contagion.

It means a more balanced rate outlook from the Fed. We are still in the phase of the business cycle where the Fed is not your friend: technicals remain against us.

Bus points out that the active exploring by markets of where we are in the cycle and when the recession will start has caused a very particular market behavior. “Data shows we constantly slip into a risk-on-risk-off kind of environment. It means yields drop and spreads widen, and vice versa. In this beta-on or beta-off environment we try to steer beta contrarian to market moves.”

This period of the cycle is known for all kinds of flash crashes, corrections and convulsions. Last week we noticed a record three-day spread widening followed by one of the strongest ever one-day recoveries. Also it seems the correlation between spreads and rates has become negative again. It means markets are not driven by rate fears anymore.

Conclusion

Central banks have been experimenting with monetary policy for years – and have invented a lot of new monetary instruments and strategies along the way. The result has been low or negative yields for way too long. The economic system created debt in all corners of society.

A fast and aggressive hiking cycle will for sure reveal many problems. Which ones that will be we don’t know, but a few real estate and banking accidents would all make sense.

All time series show the recession could start somewhere toward the end of the year – and we believe central banks will definitely cause one.

“Our strategy in the current phase of the business cycle is to buy on dips. Spread markets reflect recession every now and then, driven by yield peaks, financial stress like that of recent weeks or via an old-fashioned corporate credit crunch,” according to Verberk.

The Fed is not our friend yet, and rate cuts are too optimistic an expectation for now. Be prepared for risk-free rates being very credible alternatives to other asset classes for longer. It is payback time for years of negative yields and manufactured bubbles.

下載刊物

信貸投資的新動態

訂閱我們的電子報,緊跟最新的信貸投資趨勢。

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.