Indices insights: Does sustainability integration affect factor premiums?

In this ‘Indices insights’ article, we analyze the impact of sustainability integration on factor premiums. We demonstrate that Value, Momentum, Quality and Low-risk factor premiums remain largely unchanged after SDG integration or carbon footprint reduction.

概要

- Value, Momentum, Quality and Low-risk factor premiums are historically significant

- The premiums are largely unaffected by SDG integration or carbon footprint reduction

- Thus, factor investing and sustainable investing can be combined efficiently

Factor investing entails the exploitation of academically proven factor premiums such as value, momentum, quality and low-risk. To harvest the long-term premiums associated with this style of investing, sufficient exposure to these factors is required. As investors are increasingly taking sustainability considerations into account, a key question is whether integrating sustainability aspects interferes with a portfolio’s factor tilts, leading to reduced performance.

In the previous two ‘Indices insights’ articles,1 we first analyzed the impact of sustainability integration on a passive, market-cap-weighted investment approach, as well as how this affects the opportunity set for an active investor. We demonstrated that, even after filtering the investment universe on certain sustainability criteria, a passive investor can still enjoy risk-return characteristics similar to those of the market, and that the distribution of stock characteristics does not change materially for an active investor. In this article, we will look into how such sustainability screens influence expected factor premiums.

In our assessment, we investigated the effects of applying SDG integration or carbon footprint reductions on global value, momentum, quality and low-risk premiums historically. For this purpose, we simulated factor-based portfolios for different investment universes. Specifically, we constructed long-short value, momentum and quality portfolios as well as a long-only low-risk portfolio based on the large and mid-cap segments of the market.

We then built similar factor-based portfolios using an investment universe that either excludes companies that contribute negatively to the SDGs (determined by Robeco’s proprietary SDG framework), or firms that belong to sub-industries with the highest carbon footprints. We then compared the performance of the factor-based portfolios constructed using the unconstrained, full universe with portfolios built using the sustainable universes (which apply either the SDG or carbon screens).

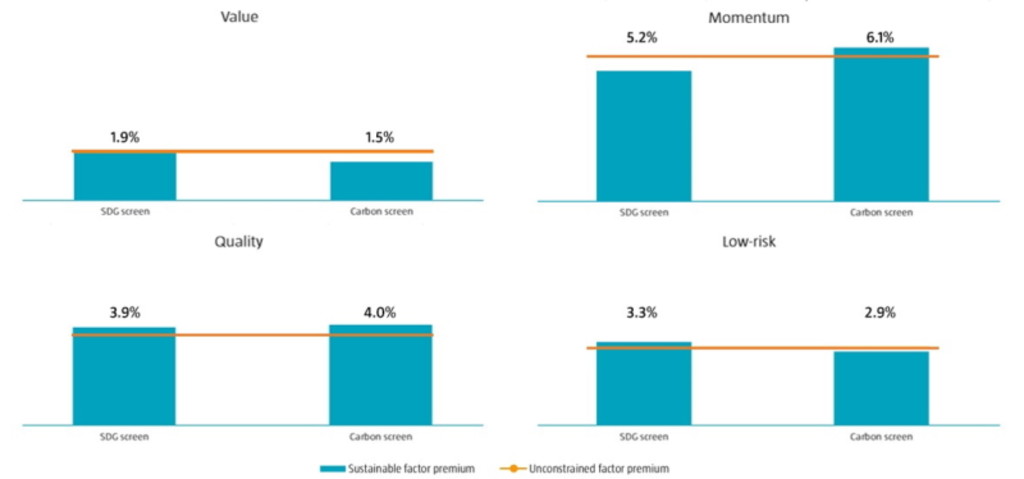

As shown in Figure 1, we found that excluding stocks with negative SDG scores or with high carbon footprints does not have a significant impact on the long-term performance of value, momentum, quality and low-risk portfolios. Across the board, the factor premiums were broadly similar when using the full universe and the sustainable universes.

Figure 1 | Factor premiums are largely the same after SDG or carbon screens are applied

Source: Robeco, FactSet. Global factor premiums over the period 1986 – 2021.

訂閱 – 指數洞察

時刻把握荷寶最新可持續性、因子及市場觀點文章。

For instance, the average value premium for the full universe was 1.9% per annum over the sample period. This was similar to the SDG-aligned universe, which also led to an annualized average value premium of 1.9%. Meanwhile, for the low-carbon universe, the average value premium was somewhat lower at 1.5% on an annual basis. In terms of momentum, the low-carbon universe had a higher average premium compared to the full universe, while it was slightly lower for the SDG-aligned universe. Interestingly, the average quality premium was higher for both sustainable universes versus the full universe. Regarding low risk, the average premium was virtually identical for all three universes.

Data and methodology

For our analysis, we used the monthly US dollar returns of FTSE World Developed Index constituents before January 2001, and of MSCI World Index constituents thereafter. The full sample period of our investigation spanned from January 1986 to December 2021. For each month, we constructed market-cap-weighted portfolios based on the value, momentum, quality and low-risk factors for three different universes: the full universe (unconstrained) and two sustainable universes (using either SDG or carbon screens to filter out stocks).

Robeco’s proprietary SDG framework is used to assign SDG scores to companies. The framework provides a clear, consistent and replicable approach to measuring the contributions that firms make to the 17 SDGs. To create historical proxies for these SDG scores, we allocated SDG scores to companies based on their sub-industries. Therefore, our method resulted in a baseline sub-industry assessment of the goods produced and/or services provided by a company and how these contribute to the SDGs.

Sub-industries that make a positive impact receive SDG scores of +1 to +3 (low positive to high positive), depending on the strength and quality of their contributions. For example, positive contributions can be related to healthcare, medicine and water. Similarly, sub-industries that have a negative impact attain SDG scores of -1 to -3 (low negative to high negative), depending on the severity of their adverse impact.

For instance, negative contributions can be linked to gambling, fast food and shale gas. In our analysis, we assumed the SDG scores are fixed over the full sample period. For the SDG-aligned universe, we excluded all companies with negative SDG scores, which resulted in a reduction of between 20% and 25% in terms of total market cap as well as the number of stocks over the entire sample period.

Similarly, we first ranked all sub-industries on their carbon footprints based on scope 1 and 2 emissions as at the end of our sample period. Thereafter, we excluded the companies that belong to the sub-industries with the highest carbon footprints when we constructed the low-carbon universe. We assumed that present-day high-carbon sub-industries were also high-carbon sub-industries historically. The carbon screen resulted in a reduction of roughly 20% of the total market cap as well as the number of names over time, and a carbon footprint reduction of more than 50% at the end of our sample period.2

Within these three universes, we constructed 5x5 factor portfolios sorted on market cap and book-to-price ratio (value); market cap and past 12-minus-1 month return (momentum); market cap and gross profits-to-assets ratio (quality) and market cap and past 36-month beta (low risk). To control for the size effect, we took the average across the different market-cap-sorted quintiles, resulting in five size-neutral portfolios for each of the four factors.

We constructed a long-short value factor portfolio by taking a long position in high book-to-price stocks and a short position in low book-to-price stocks; a long-short momentum factor portfolio by taking a long position in recent winners and a short position in recent losers; a long-short quality factor portfolio by taking a long position in high profitability stocks and a short position in low profitability stocks. Using these long-short portfolios, we then estimated the historical factor premiums by calculating the average annualized return.

For the low-risk factor premium, we took a slightly different approach and only considered the long leg consisting of low-beta stocks. We then determined the Jensen alpha versus the market-cap-weighted return of all stocks within the unconstrained, full universe.

Conclusion

Given our findings, we conclude that long-term expected factor premiums remain largely the same after sustainability integration (via SDG or carbon screens). As such, we are of the opinion that single-factor or multi-factor strategies that incorporate sustainability considerations (such as SDG integration and/or carbon footprint reduction) are an interesting proposition for investors who want to achieve market-beating returns while following a sustainable approach.

Footnotes

1Sustainable Index Solutions Team, March 2022, “Can passive investors integrate sustainability without sacrificing returns or diversification?”, Robeco article.

2 Measured by TruCost Scope 1 and 2 emissions divided by EVIC.

Background to sustainability metrics

In defining sustainability, investors have a multitude of dimensions and metrics they could consider. For example:

Values-based exclusions

ESG integration

Impact investing

ESG scores typically put more focus on the operations of a business, whereas SDG scores also incorporate the impact that the business’ products and/or services have on society.

We see client sustainability objectives increasingly moving towards avoiding controversial businesses (values-based exclusions) and including those that provide sustainable solutions (impact investing). In the first few articles of our Indices Insights series, we will empirically show how the different sustainability metrics (negative screening/exclusions, ESG, SDG) relate to these increasingly impact-oriented client sustainability objectives.

指數洞察

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.