Streaming is the future of media

Digitalization of consumption is one of the trends our Global Consumer Trends strategy focuses on. And it is still profoundly transforming the media and entertainment industry. Among the structural winners of this trend are streaming platforms. These have enjoyed strong success over the past few years, and their prospects remain bright despite the dire economic consequences of the Covid-19 crisis. But there is a caveat: commercial success often comes at a hefty price when producing the necessary exclusive content.

概要

- Streaming market boom expected to continue

- Increased SVOD services will likely boost adoption

- Covid-19 a catalyst for SVOD, less so for music or games

After years of stellar growth, the streaming boom is expected to continue in the coming years – mainly due to a surge in global demand for video streaming. According to Digital TV Research, global online TV episode and movie revenues could double between 2019 and 2025, from USD 83 to 167 billion1. Around USD 16 billion will be added this year.

The total online TV market consists of various segments – the main one being subscription-based video on demand (SVOD), offered by players such as Netflix, Disney+, or Amazon Prime Video. Digital TV Research expects global SVOD revenues to double over the next few years, and climb by USD 50 billion between 2019 and 2025, to a total of USD 98 billion.

The streaming market, also called the OTT (over-the-top) market, refers to all types of media services and content offered to customers directly online, bypassing traditional cable, broadcast, and satellite television networks and platforms. It therefore includes not only increasingly popular SVOD services, but also music streaming and video games services.

One of the main growth drivers behind OTT service demand is convenience. Customers can easily subscribe and cancel online, and content is available all the time. Subscribers can watch what they want, where they want and when they want, using the device they want. This has become increasingly important to customers, particularly for younger generations.

Another important factor driving demand, particularly for SVOD, is cost. OTT providers charge their clients relatively low monthly fees, compared to cable networks and more traditional distribution channels, such as DVDs or movie theater tickets. This is important, especially given the relatively high content quality, typically offered by these platforms nowadays.

In order to standout from competition, platforms have had to move into the production business.

Over the years, the main SVOD platforms have made considerable efforts to offer a very wide, and often exclusive, selection of trending films, series and documentaries. In order to standout from competition, these platforms have had to move into the production business. Netflix was the first platform to pursue this strategy when it launched “House of Cards” back in 2013.

Since then, SVOD platforms have been following the same strategy: producing exclusive content for their subscribers. Premium content that used to first be distributed through movie theatres or via traditional TV channels, is now increasingly being made directly available on these platforms. Lockdown measures against Covid-19 ensured most consumers stayed home, further accelerating this shift.

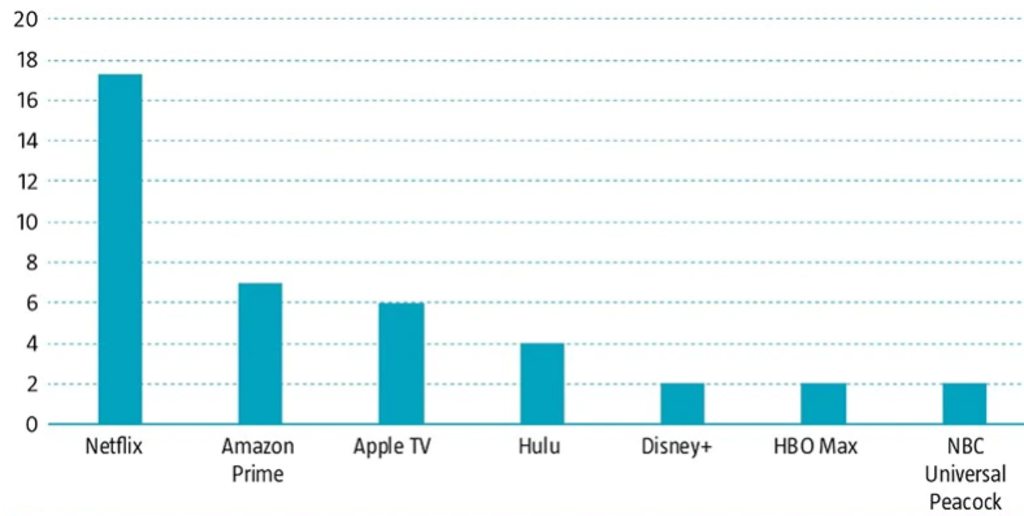

Figure 1: The sinews of streaming wars: estimated content spend for 2020

Source: Robeco, BMO Capital Markets via Tubefilter, January 2020

For recorded music, the advent of streaming has revived a once rapidly collapsing music market. Music consumption, which used to revolve around the sale of records, CD and DVDs, started declining quickly with the arrival of the internet. This was mainly because revenues from downloads could not compensate for the nosedive physical recordings had taken.

But after years of contraction, the music market started growing again in 2015, due to the success of platforms such as Spotify or Apple Music. It is now close to the levels of 2002-2003. In 2019, streaming accounted for 56% – USD 11.1 out of 20.8 billion total – of the total recorded music market worldwide.

In addition to video and music, the concept of streaming is increasingly catching up in other areas as well. Subscription-based online gaming, where players signup to access a selection of video games from their computer, smartphone or tablet, is a case in point. However, this segment is still in its infancy and remains dependent on technological improvements, as it requires a very fast internet connection.

Cord-cutting has increased, indicating that these customers are unlikely to return to their traditional viewing habits anytime soon.

Covid-19 as a catalyst

So far, the Covid-19 crisis has been a catalyst for online video adoption, as captive viewers accelerated their move towards these platforms. Cord-cutting has increased, indicating that these customers are unlikely to return to their traditional viewing habits anytime soon. The positive flywheel effect from a larger user base, leading to higher monthly subscription income and enabling platforms to add more exclusive content, is also very much intact.

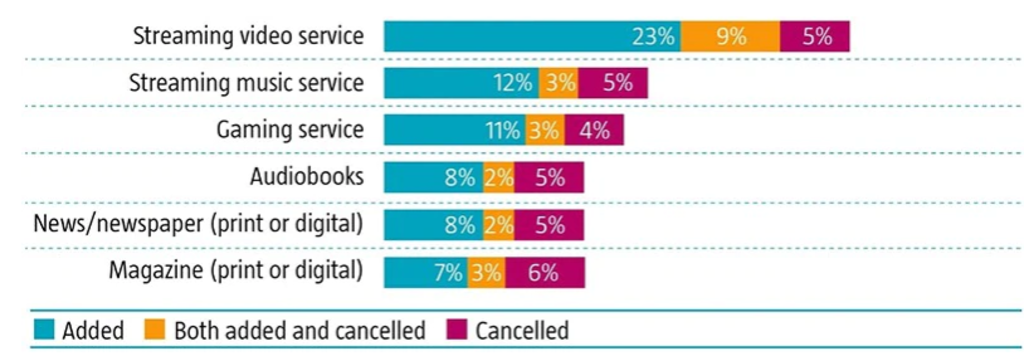

Figure 2: Changes made to paid subscriptions since the Covid-19 pandemic began

Source: Deloitte Insights, June 2020.

A similar development is happening in the music industry. Streaming has not only stemmed the decline in music consumption, but consumers are paying for music again, as the ease of use and vast libraries are providing value in excess of the usually low monthly fees charged. Streaming platforms are expanding their offering beyond music adding all kinds of other audio content, including podcasts and audiobooks, to lure an even wider audience.

For video game streaming, the outcome is less clear-cut, for now. We remain in the early stages of cloud-based gaming and latency issues still tend to affect user experience for multi-player games, for instance. Yet broadband speed is expected to continue to improve in the coming years. It is therefore likely just a matter of time before video game streaming can really take off.

Overall, the long-term prospects remain bright for the streaming industry, despite the dire economic consequences of the Covid-19 crisis. The future of media is certainly streaming.

The Big Book of Sustainable Investing

Footnote

1Source: Digital TV Research, Global OTT TV and Video Forecasts, May 2020.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.