最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

As investors chase returns in the tech titans, the infrastructure that underpins the technology mega trends is under-owned and offers a valuable blend of growth potential and defensive characteristics, says Matthew Norris, lead portfolio manager of the Robeco Gravis Digital Infrastructure Income strategy.

The Robeco Gravis Digital Infrastructure Income strategy offers pure exposure to the most valuable physical assets that sustain the world of AI, ecommerce, gaming and social media, including data centers, communications towers and logistics hubs through a portfolio of listed securities. It is managed by a London-based team at Gravis, a boutique asset manager that specializes in real estate, infrastructure and clean energy. The new strategy shines a light on an under-invested real estate segment that is underpinned by the same mega trends driving investment in technology platforms, says Norris.

“The world has changed: the way we work, the way we shop, the way we play. And now everything is stored in the cloud. Humankind back in 2010 had created only one zettabyte of data. But then, explosive growth in social media and streaming came along and by 2020 we were at 60 zettabytes,” he says.

Source: Gravis, Statista. 1 Zettabyte = 1,000,000,000,000,000,000,000 [1021] bytes

This has created demand for more and more data center capacity. “Tech platforms need this capacity in proximity to big populations, so they either build it themselves or rent it. But it’s becoming much harder to build due to the constraints on power supply and access to the hyper fast fiber optic networks, so the existing companies in this space are very well placed”, says Norris.

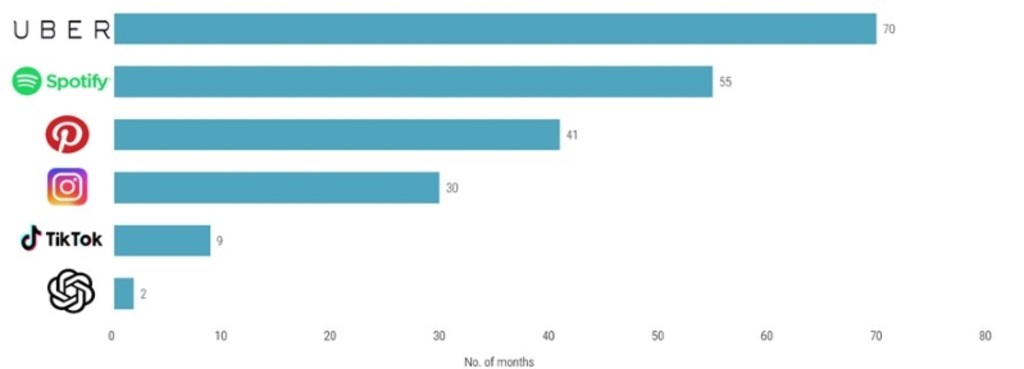

The same dynamic is driving the slow but steady rollout of 5G infrastructure worldwide, says Norris. “The acceleration in demand for data is staggering“ he says, pointing to the adoption cycle of novel platforms with ChatGPT reaching 100 million users in only two months1.

Source: Gravis, UBS, February 2023.

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

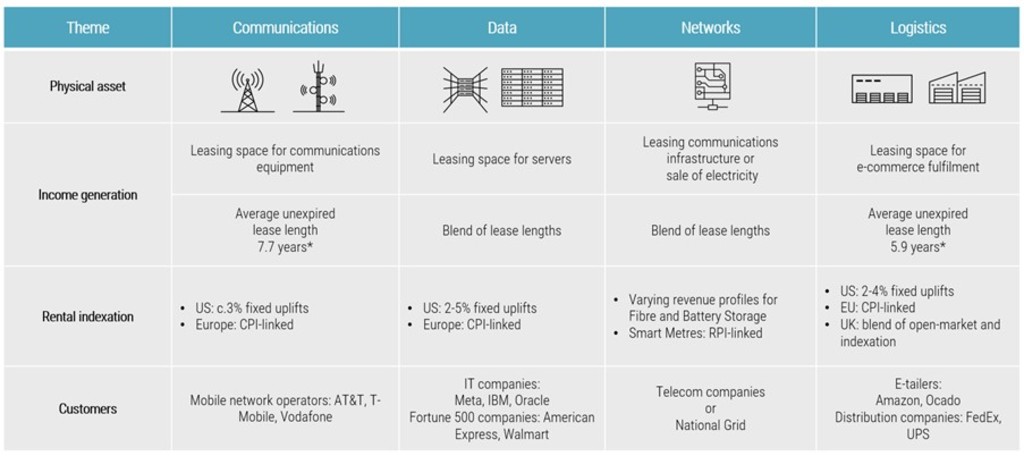

This places owners of telecommunications infrastructure in a sweet spot, says Norris. “With the towers, we invest in concrete and steel owners. When you get a tenant on it and the tenant is a mobile network operator, you have a profitable tower. And when they want to upgrade to 5G that just adds more dishes, which adds more rent,” he says.

This “picks and shovels” approach avoids many of the pitfalls of conventional commercial property investment. “There are no legacy buildings and there’s little exposure to the tech cycle. We own the space, not the servers or the dishes on towers, or the robotics in a logistics center. Even the electricity is almost always a pass-through cost.”

He says large tech platforms also invest in their own infrastructure but, because of the need for proximity to customers and limitations on new developments, they also rent space from the existing owners of data center sites and logistics facilities, where the requisite power access and fiber networks are already in place. “Some of the cloud providers are competitors to the companies we (the Robeco Gravis Digital Infrastructure strategy) own, but they are almost always customers too, renting prime space on long leases.”

Norris says the positive outlook for digital infrastructure is validated by the private equity activity in recent years, attracted by the same balance of reliable income and potential growth. “The difference with our strategy is that it’s a diverse set of best in class investments across the whole space, whereas investing via a private equity route you are probably exposed to more concentration in terms of specific assets, and thus more risk.” The strategy only invests in developed markets and uses a bottom-up fundamental approach to stock selection. In February 2024, it is composed of 28 different investments from a potential universe of more 80 listed entities that fit the investment criteria and sustainability requirements.

“We have a quality bias and very low churn rate, below 10%, and this helps us find that balance of regular income and capital appreciation,” he says. The strategy pays a quarterly dividend. “The businesses we focus on are regular dividend payers with next generation assets and that defensive nature is valuable in this environment” he says.

Source: Gravis, Robeco. * Average unexpired lease lengths based on data made publicly available.

Norris underscores sustainability is part of the portfolio construction process. More than half of the portfolio must consist of sustainable investments making a positive contribution to the UN SDGs under the Robeco SDG Framework2. Moreover, the strategy is classified as Article 8 under SFDR. “In February 2024 that measure is at 65%. Best in class data center operators, like the companies we invest in, are trying to source more power from renewables while also improving their power usage efficiency.”

The strategy will vote in line with Robeco’s Engagement Policy and Proxy Voting Policy included in Robeco’s Stewardship Policy, and follow the Robeco exclusion policy.

1Time Magazine, January 2023.

2Sustainable Development Goals, Robeco, February 2024.

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会

重要なお知らせ 当社や当社役職員を装ったSNSアカウントやウェブサイト等を使った投資勧誘にご注意ください さらに表示