Are humanoids the future of industrial automation?

Factory automation has been evolving for decades, but many tasks require human-level dexterity that current industrial robots lack. Humanoids are designed to fill the gap, helping address chronic labor shortages and improving productivity. Here we explain the challenges and opportunities for smart materials and manufacturing.

まとめ

- More factory automation leads to higher productivity

- Humanoid adoption hinges on dexterity

- Component suppliers as interesting as humanoid producers

The first industrial robot, Unimate, was used by General Motors on one of its assembly lines in 1961. In the early 1980s, over a fifth of US jobs were in manufacturing, but by 2024, that number had dropped to around 8%.1 Labor productivity in the manufacturing sector more than doubled over this period, supporting the thesis that automation doesn’t eliminate jobs, it eliminates repetitive tasks enabling humans to focus on higher value-added activities in trade, services and education.2

Automation doesn’t eliminate jobs, it eliminates repetitive tasks enabling humans to focus on higher value-added activities

Structural support

Beyond the constant push for greater productivity, labor shortages in manufacturing are also a structural trend expected to push the robotics industry. Manufacturing-heavy countries such as China face the challenge of a rapidly aging population. According to WHO estimates, the proportion of people aged 60 and over is projected to increase by around 60% by 2040 to just under 30% of the total Chinese population.3 In the US alone, 1.9 million jobs in manufacturing could be unfilled by 20334, while in Europe there are expected to be 50 million fewer people of working age by 2035 compared to 2010.5

Current technology not enough

Many labor-intensive tasks in manufacturing remain difficult to automate with today’s industrial robots. Wire harness installation, apparel production, and electronics assembly are all examples where human dexterity and flexibility are still essential. Foxconn for instance, is the world’s largest electronics manufacturer, producing high volumes of devices such as the iPhone – still employs over a million people, the majority of whom are in manufacturing.

Human-shaped robots, or humanoids, offer a way to integrate automation into factory settings originally built for humans. Today, more than 160 companies worldwide are developing humanoids.6 Among them are Tesla’s Optimus, Unitree’s G1, Boston Dynamics’s Atlas and Xpeng's Iron, which are all models in or near testing phases in manufacturing facilities worldwide.

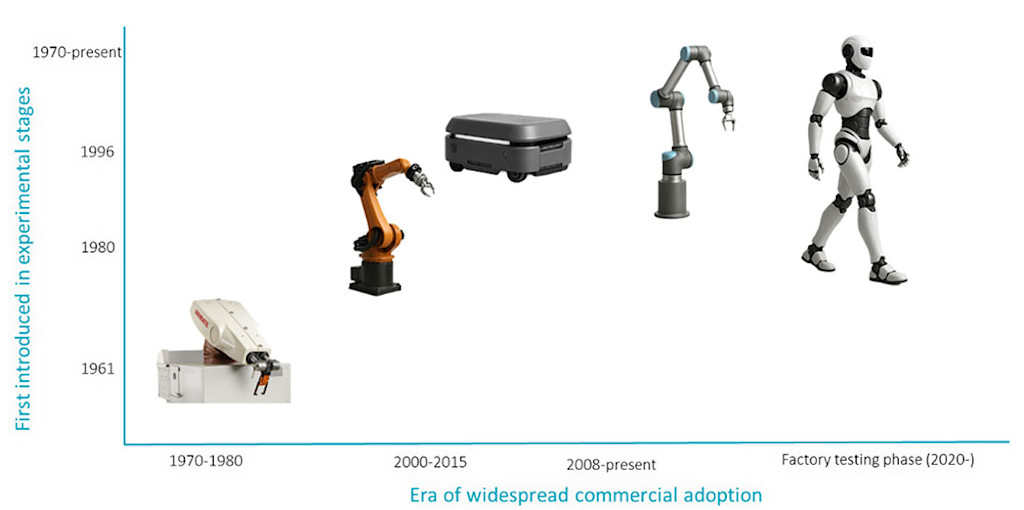

Figure 1 – Robotic range: from industrial arms to human forms

From left to right. 1) The Unimate robot model was first introduced on a GM assembly line in 1961. 2) A traditional robotic arm used for tasks such as welding. 2) An autonomous mobile robot (AMR) used for transporting warehouse goods. 3) A cobot – a robotic arm with advanced flexibility and safety for working alongside humans. 4) A humanoid robot, capable of human-like movement, precision and dexterity.

Source: International Federation of Robots, Waseda University Japan, Robotsguide.com, Universal Robots Automotive companies like Mercedes-Benz, BMW, Tesla, and some Chinese EV makers are testing humanoids in various tasks – from inspection of door locks and seat belts to dexterity-heavy tasks such as placing sheet metal components into designated fixtures during vehicle chassis assembly.

Automotive companies like Mercedes-Benz, BMW, Tesla, and some Chinese EV makers are testing humanoids in various tasks – from inspection of door locks and seat belts to dexterity-heavy tasks such as placing sheet metal components into designated fixtures during vehicle chassis assembly.

Humanoids and the dexterity challenge

Actuators are responsible for generating movement and with around 20-30+ actuators per robot, they are generally the most expensive of all humanoid parts.

Figure 2 – Dexterity is expensive

Actuators needed for human-like movement account for nearly half of component costs.

Source: Morgan Stanley, Robeco 2025.

With today’s technology, some of the most advanced humanoids have demonstrated an ability to perform relatively well at tasks that require some level of precision. However, a key challenge to mass adoption is developing generalized dexterity, enabling robots to perform more than just a single pre-programmed task in a tightly controlled environment.

However, a key challenge to mass adoption is developing generalized dexterity.

While human hands can balance both dexterity and payload, robots with high-force applications require high-torque actuators. The latter is difficult to package within the constrained form of a robotic hand. Moreover, the mechanical forces involved in gripping heavy objects can interfere or even damage the sensors used for fine motor control.

Researchers such as Rodney Brooks, co-founder and former Chief Technology Officer of iRobot, argue that without better mechanical systems, human-level dexterity would be hard to achieve. Indeed, even in the most advanced human-shaped robots, smoothly handling precise and delicate tasks remains a visible challenge today.

Mechanical component manufacturers will likely play a key role in solving this challenge, working closely with humanoid developers to enhance the robots' movements. The area largely consists of a handful of highly specialized engineering suppliers, among which are Regal Rexnord, Inovance and Harmonic Drive.

Vision and battery life

The robot's vision is another noticeable challenge. High-speed automated systems, such as welding robots, pose safety risks and therefore must operate within tightly fenced environments. Putting a fence around a constantly moving human-shaped robot is obviously impractical. To let such robots operate freely on the factory floor, their vision systems must be close to perfect.

Lidars are likely to be a key enabler here. These laser-based ranging sensors are mostly used in the advanced driving systems of vehicles today, but manufacturers in the space such as Hesai and RoboSense are already focusing R&D resources for robotics.

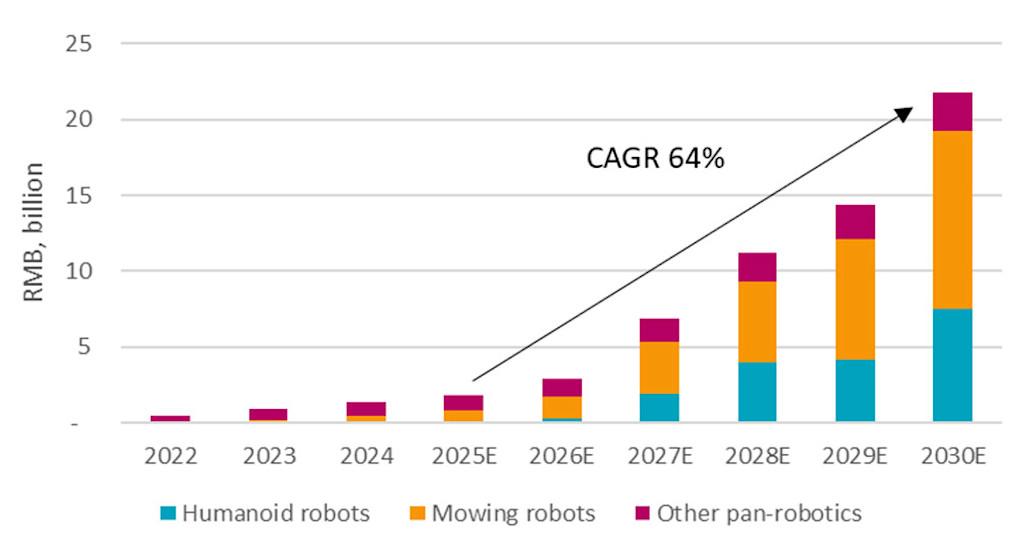

Figure 3: The lidar market is growing rapidly

Lidar market forecast for non-automotive uses. Figures in Renminbi.

Source: Jefferies, Robeco 2025.

The battery life of human-shaped robots is another part that needs improvement. While humans can do eight-hour shifts, humanoids can currently last only around two to three hours before having to be recharged. This is why it is worth following the progress companies such as Contemporary Amperex Technology are making in the battery space.

Outlook

Estimates of the future market size for humanoids vary widely, with ranges from a few to hundreds of billions of dollars in the coming decades to low-trillion-dollar figures in the longer term. While these projections assume broad adoption across sectors beyond manufacturing, the latter is expected to represent a substantial share, as this is the domain where human-like robots are likely to be most critically needed.

Humanoids have the potential to disrupt industrial automation, but the commercialization of the technology will depend on further innovation and upgrades across the supply chain. This includes everything from hardware components and battery systems to vision and perception algorithms. Companies providing these enabling technologies may benefit as much as the humanoid makers themselves.

Important note: The companies referenced are for illustrative purposes only in order to demonstrate the investment strategy on the date stated. The companies are not necessarily held by the strategy. This is not a buy, sell or hold recommendation, nor should any inference be made on the future development of the company.

Smart materials and manufacturing

Making manufacturing leaner and cleaner

Footnotes

1University of Wisconsin-Stevens Point, 2025

2Manufacturing Sector: Labor Productivity (Output per Hour) for All Workers (OPHMFG) | FRED | St. Louis Fed

3https://www.who.int/china/health-topics/ageing

4Skills, applicant gaps threaten US manufacturing growth

5https://www.ft.com/content/49e1e106-0231-11ea-b7bc-f3fa4e77dd47

6Shenzhen New Strategy Media's Industrial Research Institute, 2024

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会