Real-life experience: Using ML and distance-to-default to predict distress risk

Tail risk is extremely relevant for investors. While small wins and losses are inherent to stock market investing, significant price crashes can be highly detrimental. Identifying stocks that are likely to experience severe price crashes is crucial.

まとめ

- ML risk and distance-to-default signals are strong tail risk predictors

- Since strategy inception, these signals have beaten standard risk factors

- Our year-by-year analysis includes real-life stock examples

Traditional risk indicators like stock beta and return volatility are useful but limited as they rely on historical data. To better estimate tail risk, Robeco has incorporated advanced measures such as distance-to-default (DtD) since 2011, and more recently in 2021, a machine learning (ML) risk signal that identifies complex market patterns. This note reviews their performance, particularly focusing on out-of-sample results. It demonstrates that DtD and ML signals have outperformed traditional measures in real-life investment strategies, supported by practical examples and analysis.

The distance-to-default (DtD) signal, inspired by the Merton model1 , captures how close a firm is to defaulting on its debt. It’s a key concept in credit risk modelling, used by analysts and bond investors to assess a company's financial stability and the likelihood of credit default. In this model, stock equity is seen as a call option on the company's total value, including liabilities. This value is influenced by the volatility of the company's asset market value. The forward-looking nature of DtD offers additional insights compared to traditional metrics. Since 2011, an enhanced version of this proprietary distress risk measure is a negative screening tool for all our Quantitative Equity strategies, and has been integral to our stock selection model for Conservative Equities.2

The machine learning risk signal, introduced to our Quantitative Equity models in 2021, is trained to identify firms likely to suffer severe stock price crashes. ML techniques have several advantages, such as adapting to data patterns and capturing complex relationships like nonlinearities and interaction effects.3 For example, the empirical relationship between a firm’s financial leverage and its risk level is not linear. While firms with low or average leverage tend to have an average distress risk, those with high leverage are much more likely to experience significant price crashes. ML techniques excel at identifying such nonlinear relationships. 4

Data and analysis

Our evaluation focuses on comparing the out-of-sample performance of three distress indicators since their incorporation into real-life investment strategies:

50/50 combination of beta and volatility

DtD signal

ML distress signal

For this we include a year-by-year analysis, examples of individual stock price crashes, power curves and portfolio sorts.

Year-by-year analysis: Since integrating DtD into Robeco's strategies in 2011, the annual performance of the riskiest stocks has been tracked. In strong market years like 2013 and 2019, these stocks sometimes outperformed the market. However, during downturns (e.g., 2018 and 2022), as expected the high DtD stocks suffered more significant losses.Notably, during negative market years, emerging markets experienced more substantial drawdowns than developed markets. On average, DtD outperformed traditional beta/volatility measures by about 2 to 3% annually in both developed as well as emerging markets.

Individual stock examples: In 2022, many companies experienced substantial drops in market value, with the top ten losers declining by an average of 69.8%. Noteworthy cases include Silicon Valley Bank and Snap, which had poor DtD and ML risk signal scores at the beginning of the year. This highlights how DtD and ML can effectively predict individual stock crashes complementing traditional risk factors.

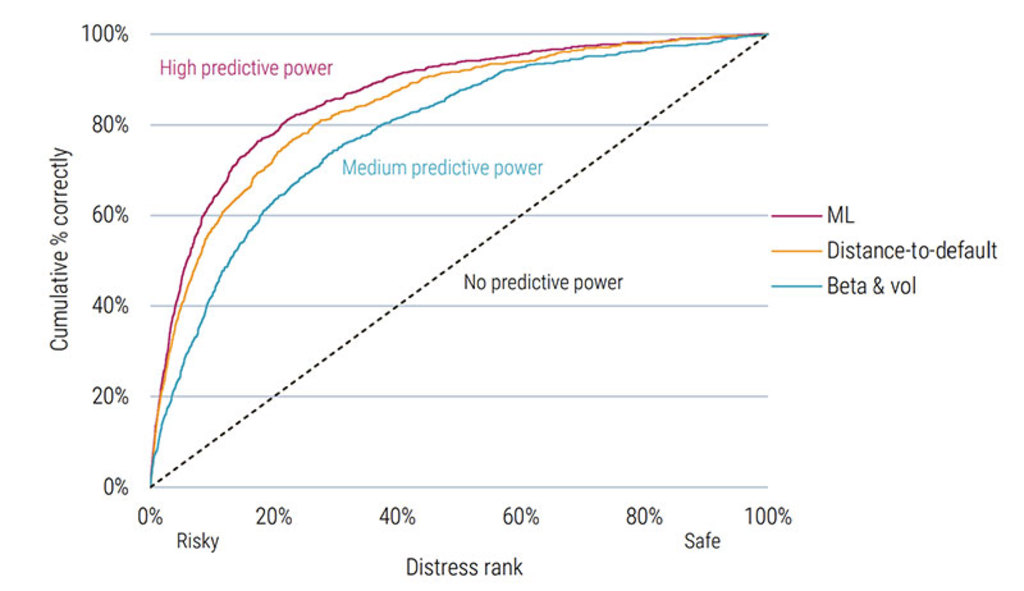

Power curves: A statistical tool commonly used to assess prediction accuracy is the power curve. In this analysis, all three indicators (beta & volatility, DtD, and ML) outperformed the no-predictability benchmark. The power curves for DtD and ML were further from the 45-degree line than the beta & volatility curve, indicating their superior predictive power. The ML signal had the highest area under the curve (AUC) score, followed by DtD and then the beta-volatility combination.

Figure 1 | Power curves for various predictors of distress

Global Developed Markets 2002-2023. Source: Robeco, MSCI, DataStream, Compustat and Worldscope, 2023.

Portfolio sorts: The analysis examined the 10% of stocks with the highest risk scores (beta & volatility, DtD, and ML). Stocks in these high-risk portfolios typically underperformed the market. The underperformance was more pronounced for DtD and ML compared to the beta-volatility basket. This indicates that advanced measures like DtD and ML are more effective in detecting risky stocks, and avoiding or shorting these stocks has historically led to higher returns.

Conclusion

This article presents detailed evaluations of proprietary tail risk predictors used in all of our Quantitative Equity strategies in general and Conservative Equities in particular, focusing on the comparison between traditional and advanced measures. Our analysis, which includes a year-by-year review, individual stock examinations, power curves and portfolio sorts, indicates that DtD and ML risk signals have added a distinct dimension to risk prediction since their inclusion in 2011 and 2021 respectively. These findings suggest a potential for improved identification of distressed stocks, which is a key consideration in strategy development and risk management.

Footnotes

1 Merton, R. C. (1974). On the pricing of corporate debt: The risk structure of interest rates. The Journal of finance, 29(2), 449-470.

2 How distress risk improves low volatility strategies: lessons learned since 2006, Joop Huij, Pim van Vliet, Weili Zhou and Wilma de Groot, Robeco Research Paper, February 2012

3 For an overview of the use of Machine Learning for asset management we refer to: Blitz, D., Hoogteijling, T., Lohre, H., & Messow, P. (2023). How can machine learning advance quantitative asset management? The Journal of Portfolio Management, 49(9), 78-95.

4 A more extensive description of the Machine Learning approach was published in 2021, at the time of introduction in our Quantitative Models, and can be found at: Forecasting stock crash risk with machine learning.

クオンツ運用の価値を探求

最先端クオンツ戦略の情報やインサイトを定期的にお届けします。

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会