ECB set to end negative policy rates soon

In line with other major central banks, the ECB is pivoting its policy stance sharply towards tightening. A rate hike in July seems a certainty.

まとめ

- An ECB rate hike in July looks to be a certainty

- Unlike the Fed, the ECB is not yet pursuing quantitative tightening

- We note the risk of the hiking cycle being paused or aborted by early 2023

Broadening and intensifying inflation pressures have prompted the ECB Governing Council to end net bond purchases under its asset purchase program (APP) as of 1 July. This paves the way for a 25 bps interest rate hike later next month, which will in all likelihood be followed by a further adjustment at the September meeting. Depending on the inflation outlook at the time, the size of the September move could well be 50 bps.

The ECB signaled that it foresees a “gradual but sustained” path of further rate hikes thereafter. As for the reinvestment of its quantitative easing (QE) holdings, the ECB decided to continue reinvesting the principal payments from maturing securities “until at least the end of 2024” (in the case of securities under the Pandemic Emergency Purchase Program (PEPP)) or “for an extended period of time past the date when it starts raising policy rates” (for securities under the APP). Importantly, this shows that, for now, the ECB is reluctant to follow central banks such as the US Fed on the path of quantitative tightening (QT).

President Christine Lagarde addressed concerns about a possible fragmentation in bond markets across the Eurozone at the ECB media conference. She once again gave the assurance that the ECB would deploy existing or “new” tools, if necessary, should there be a sharp and broad-based widening of government bond spreads over German Bunds. Her comments underline that some ECB governors are deeply worried about a possible revival of such fragmentation during the policy rate normalization process that lies ahead.

By hinting at a series of rate hikes, which could include increments of more than 25 bps, the ECB gave a hawkish signal, which in turn drove bond yields higher. The 2-5-year segment of the curves led this move. Meanwhile, country spreads over Germany, especially that of Italy, widened, most likely because the ECB language on new tools to address bond market fragmentation disappointed in that it lacked substance on the development of such a tool.

最新のインサイトを受け取る

投資に関する最新情報や専門家の分析を盛り込んだニュースレター(英文)を定期的にお届けします。

Policy outlook

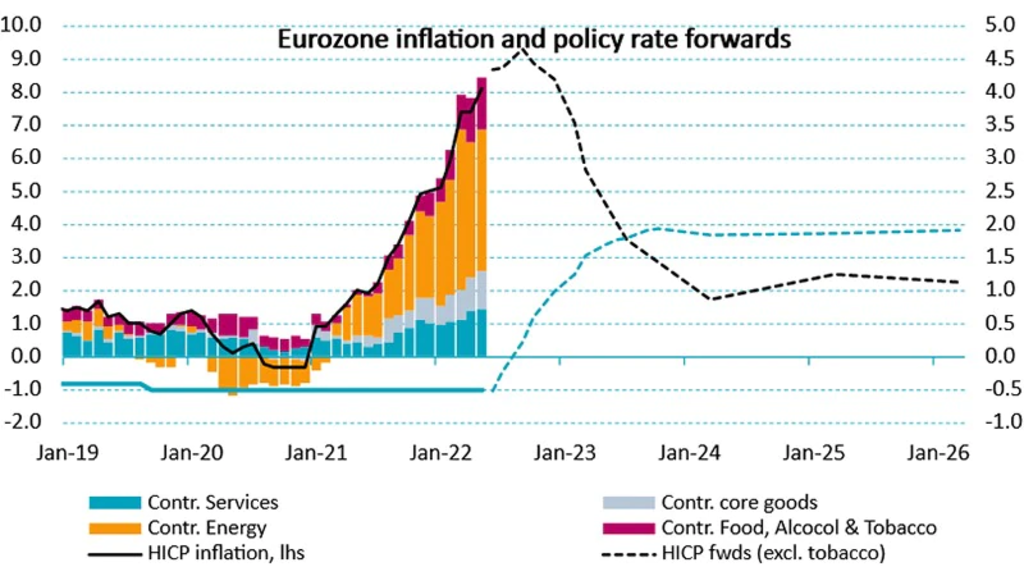

An ECB rate hike in July – the first in over ten years – now looks to be a certainty. An end to negative policy rates by September also seems to be a sure thing. Given the prospect that European inflation could rise to further above 8% over the coming months, we understand why financial markets are pricing in almost 150 bps of rate hikes over the four remaining ECB policy meetings this year. Notably, this encompasses two moves of 50 bps each, and two hikes of 25 bps each.

Looking beyond the next six months, though, we struggle to believe the ECB will be able to hike the depo rate by an additional 100 bps to around 2% and maintain that level, as is implied by forward rates (see chart). In fact, we doubt whether all Eurozone economies could structurally handle such a degree of tightening in financing conditions, especially given weakening cyclical growth. Nevertheless, we expect that a strong pricing out of rate hikes by the market will only occur when there are clear signs of an inflation retreat. Our view is that this could happen towards the end of this year or in early in 2023.

Source: Bloomberg, Robeco

As for the possibility of the ECB launching a new tool for addressing market fragmentation, there is in our view a decent chance that such a new policy instrument will be announced – and that conditions attached to it will be less strict than under the Outright Monetary Transactions (OMT) program. While we doubt it would prevent episodes of spread widening in European government bonds, the fact that it is available could cap any further widening of country spreads.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会