Chi siamo

Piacere di conoscerti

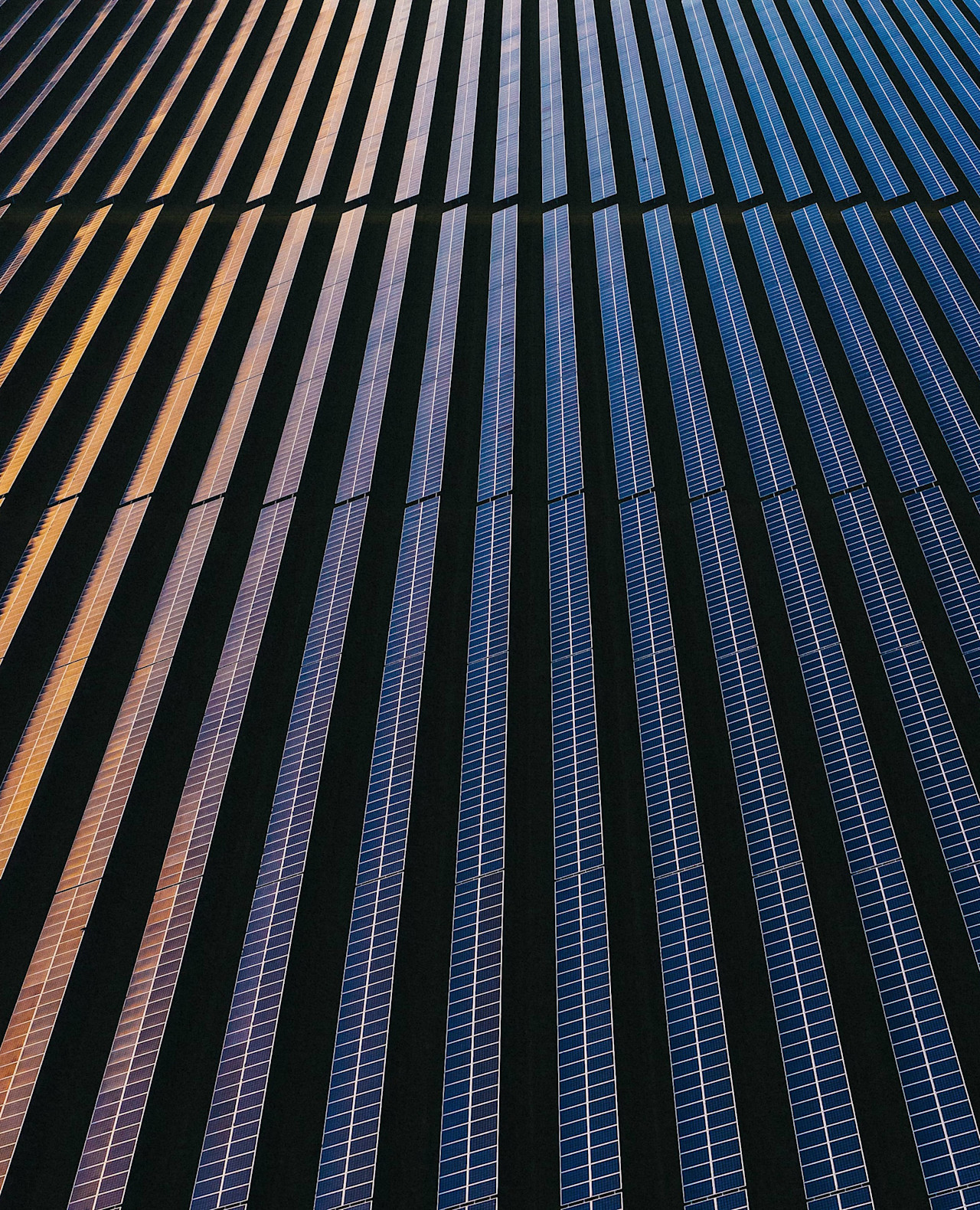

In qualità di asset manager globale, incentriamo le nostre soluzioni sulle esigenze dei nostri clienti. Siamo animati da una curiosità sconfinata, da una ricerca rigorosa e da una passione comprovata per la sostenibilità, e ti guideremo verso strategie d’investimento attive all’avanguardia.

Sei interessato a investire per le esigenze di oggi e di domani? Il nostro obiettivo comune è contribuire alla salute del pianeta e della società attraverso i nostri investimenti. Parliamone: condividi le tue considerazioni con uno dei nostri colleghi.

Prospettiva annuale

Prospettiva annuale Gli ETF attivi di Robeco

Gli ETF attivi di RobecoI nostri ETF attivi per gli investitori di oggi

Opportunità

Siamo lieti di evidenziare alcune opportunità selezionate dai nostri esperti.

Ultimi approfondimenti

Un assaggio dei nostri prodotti

QI Global Developed 3D Enhanced Index Equities

Approccio fattoriale sistematico e sostenibile come alternativa all’investimento passivo

Emerging Stars Equities

Investimenti concentrati e senza vincoli nelle migliori società asiatiche

Credit Income

Ricerca di un livello costante di rendimento attraverso società che contribuiscono agli SDG

Climate Euro Government Bond UCITS ETF

Una nuova soluzione d'investimento che allinea il portafoglio del debito sovrano all'azione per il clima