Factors are an all-season phenomenon

Multi-factor strategies currently present an appealing opportunity for equity investors, even against a challenging macroeconomic backdrop. In summarizing key insights from the last two years, we outline how the value, momentum, quality and low-risk factors have historically delivered robust long-term returns, and how they are currently cheaply valued relative to their historical levels. Moreover, we highlight how equity factor premiums typically display resilience when inflation is elevated or interest rates are rising.

Resumen

- Equity factor premiums are an ‘eternal’ feature of financial markets

- Equity factor valuations are currently enticing

- Equity factors are typically resilient across different inflation regimes

The ‘quant equity winter’ chill of 2018-2020 has made way for a sunnier outcome in the past two years as equity factors have strongly rebounded. While this has been welcomed by many asset owners, some are perhaps questioning whether the outlook will remain constructive.

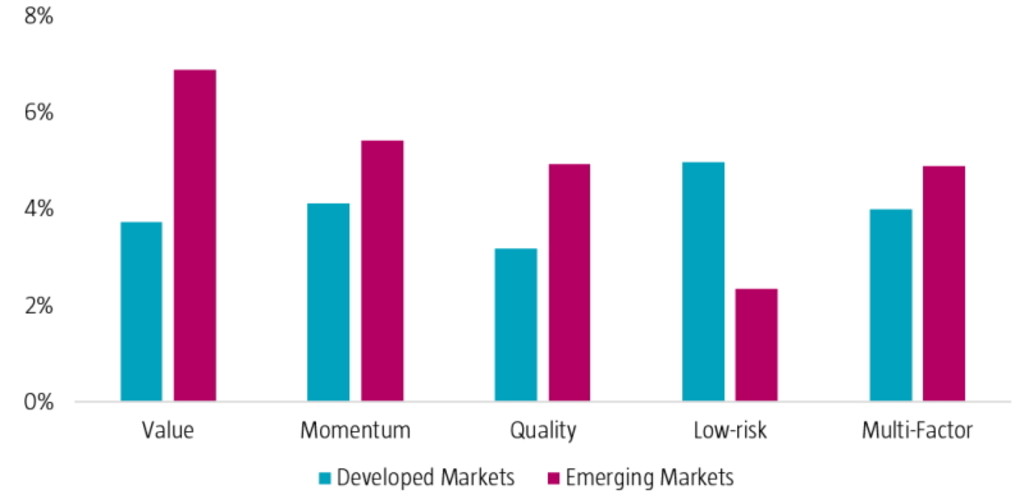

There are several reasons why we are confident that factor investing will continue to reward long-term investors as it has in the past. As Mark Twain is reputed to have said: “History doesn’t repeat itself but if often rhymes.” To this end, Figure 1 illustrates how equity factors have endured in both developed and emerging market over multiple decades.

Figure 1 | Factors have generated healthy long-term premiums

Source: Robeco. CAPM alpha of individual factor premiums and multi-factor combination of factors relative to the MSCI World Index (DM) and MSCI Emerging Markets Index (EM). The sample period is January 1986 or 1996 to December 2021.

But even beyond recent history, factors have been proven to be persistent phenomena, as shown in a groundbreaking research paper by Guido Baltussen and colleagues that used an out-of-sample dataset.1 In this study, the researchers constructed a novel US stock database for the period 1866 to 1926 (pre-CSRP) and uncovered economically substantial and statistically significant premiums as well as CAPM alphas for the value, momentum and low-risk factors.

Also, the 1927-2019 period represents the common sample used by hundreds of ‘Fama-French-style’ academic studies that have also found statistically significant premiums for the same set of factors. This underlines that factor premiums are an ‘eternal’ feature of financial markets and makes a compelling case for long-term allocations to equity factors.

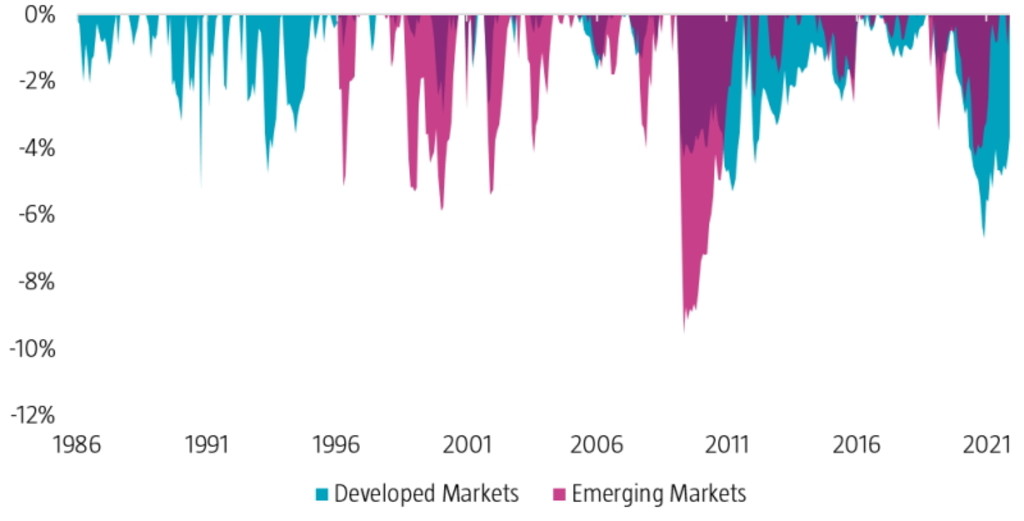

But like any investment style, factor investing is not without risks. While factors offer investors a premium in the long run, they do go through bull and bear phases in the short run as outlined in the Robeco quant cycle research.2 These downturns are typically associated with value crashes or growth rallies and can result in multi-factor strategies suffering drawdowns potentially lasting several years, as depicted in Figure 2.

Figure 2 | Multi-factor strategies can encounter short-term risks

Source: Robeco. Shown are market-relative drawdowns for multi-factor strategies in developed markets (DM) and emerging markets (EM). The sample period is January 1986 or 1996 to December 2021.

The quant equity winter of 2018-20203 is an example that highlights this risk and is still fresh in our memories. When we reflect back on this tough period, we can recall how poor sentiment was towards equity factors, especially low risk and value. But such challenging episodes emphasize how ‘strong hands’4 are required to endure periods of underperformance in order to reap the long-term benefits of factor investing.

As the saying goes, hindsight is 20/20 and equity factors have embarked on a recovery in the last two years, consigning the quant equity malaise to the past. That is why we often say quant investing is more a test of character than a test of intelligence. And based on our quant cycle research, it appears as if we are now back in the ‘normal’ stage in which equity factors tend to do well.

Factors are cheap based on historical levels

From a fundamental perspective, attractive equity factor valuations further underpin our sanguine outlook. Based on our experience, the various behavioral pitfalls that cause investors to be at times overly optimistic or pessimistic – sometimes called ‘animal spirits’ – can result in equity factor valuations either being expensive or cheap relative to long-term averages. That said, these valuations tend to mean-revert in the long run, and changes in them are drivers of short-term factor returns.

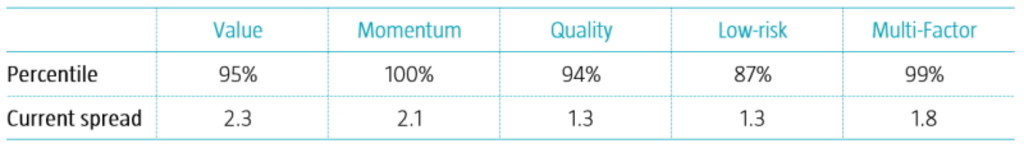

Against this backdrop, the value, momentum, quality and low-risk factors as well as a multi-factor combination all currently trade at attractive levels, as illustrated in Table 1. Consequently, we believe the medium- to long-term outlook is favorable for equity factors as low valuations have historically been associated with higher future returns.

Table 1 | Factors are attractively priced relative to historical valuations

Source: Robeco, Refinitiv, Bloomberg. The table shows the current spread and percentiles of the current versus historical composite valuation spreads for the Value, Momentum, Quality, and Low-Risk factors. The investment universe consists of constituents of the MSCI Developed and Emerging Markets indices12. The sample period is January 1986 to June 2022.

However, a challenging macroeconomic picture characterized by declining growth, rising inflation and interest rates does complicate the picture.

Factor premiums are robust in various inflation regimes

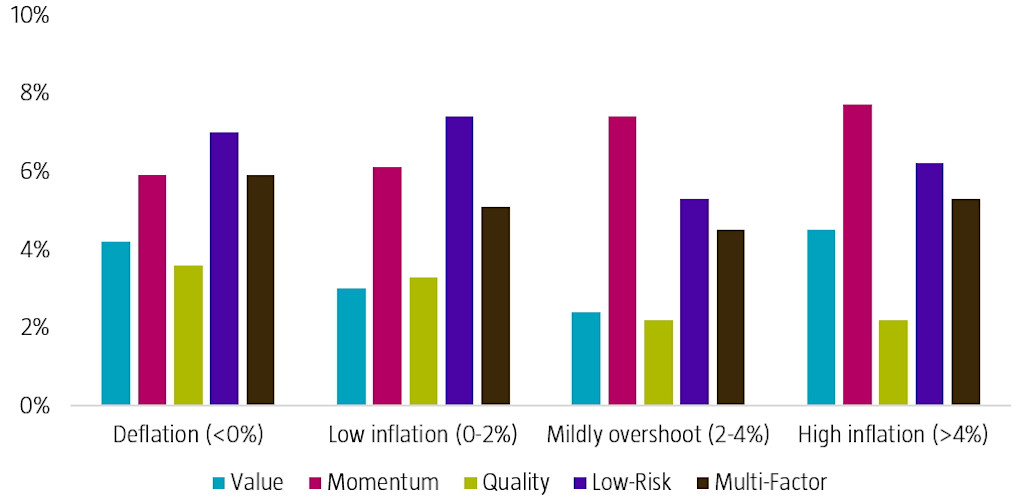

So, given the backdrop of uncharacteristically high inflation (at least compared to what we have seen in the past 30 years), we investigated the historical efficacy of proven equity factors in different inflation regimes in a recent paper.5 As periods of high inflation and deflation are relatively uncommon in recent history, we used a deep sample extending from 1875 to 2021.

Interestingly, we observed that equity factor premiums were generally consistent across varying inflation regimes, in contrast to the equity asset class premium. For example, Figure 3 shows that the long-short multi-factor equity portfolio produces fairly stable performance across all scenarios. At the individual long-short factor level, the variation in returns across inflation buckets was somewhat higher, but never strayed too far from long-term averages.

Figure 3 | Equity factor premiums are resilient across different inflation regimes

Source: Robeco. Shown are market-relative drawdowns for multi-factor strategies in developed markets (DM) and emerging markets (EM). The sample period is January 1986 or 1996 to December 2021.

While we acknowledge that long-only factors are not immune to high inflation, our findings imply that they should, on average, be less affected compared to the traditional equity asset class.

Factors are not overly sensitive to interest rate changes

Furthermore, we also examined the relationship between factor returns and interest rate movements in two Robeco studies in 2021 and 2022.6 We observed that the value factor tended to perform better in the months in which yields rose over the last 10 years. However, this relationship is highly dynamic as the value factor was not significantly related to changes in bond yields before 2015, and only became considerably linked in the last few years.

Low-risk had a somewhat negative link, albeit limited. However, this was not uniform over the sample period as the connection was largely absent around the 2000s. Momentum was negatively related to yield changes over the full sample period. But similar to value, this effect seemed to be mostly concentrated in the last years of the sample. Finally, quality returns were generally unrelated to yield changes over the entire interval.

Consequently, we believe having exposure to multiple factors in a portfolio not only diversifies individual factor and stock risks but also factor sensitivities to yield movements, as these vary widely across factors and time.

Conclusion

All in all, we believe multi-factor strategies present an appealing opportunity for equity investors. From a fundamental perspective, equity factors are attractively priced and portend high expected long-term returns. Moreover, factor premiums have historically held their own in times of high inflation and rising interest rates. Therefore, we believe that together these elements make a strong case for exposure to multiple factors.

Footnotes

1 Baltussen, G., Van Vliet, B., and Van Vliet, P., November 2021, “The cross-section of stock returns before 1926 (and beyond)”, SSRN working paper.

2 Blitz, D., January 2022, “The quant cycle”, Journal of Portfolio Management.

3 Blitz, D., May 2021, “The quant crisis of 2018:2020: cornered by big growth”, Journal of Portfolio Management.

4Van Vliet, P., November 2017, “Strong hands – bridging the behavioral gap”, Robeco article.

5 Baltussen, G., Swinkels, L., Van Vliet, B., and Van Vliet, P., June 2022, “Investing in deflation, inflation, and stagflation regimes”, SSRN working paper.

6 Baltussen, G., Hanauer, M. X., Schneider, S., and Swinkels, L., September 2021, “What valuations and interest rates tell us about equity factors”, Robeco article; and Hanauer, M. X., Baltussen, G., Blitz, D., and Schneider, S., November 2022, “Short-sightedness, rates moves and a potential boost for Value”, Robeco article.