Embracing fundamental and quant investing in emerging markets

New research explores the dynamic interplay of fundamental and quant investing styles in emerging markets, revealing potential for enhanced portfolio performance.

Summary

- A new era in emerging markets is likely dawning, ripe with investment opportunities

- New Robeco research shows both fundamental and quant strategies can generate alpha in emerging markets

- Merging these strategies skillfully can enhance portfolio stability through style diversification

Emerging markets are well placed to lead the next global equity upcycle, both from a macroeconomic and valuation perspective. This positive outlook is also reflected in our five-year expected return forecast of 8.25% for emerging markets, a 1.5% premium over developed markets.

Furthermore, we see growing interest in this asset class from clients. A new white paper by our quant researchers Vera Roersma, Harald Lohre, and Matthias Hanauer delves into whether a fundamental or quant approach is better suited to capitalize on these opportunities. More specifically, they examine fundamental and quantitative emerging market equity strategies’ risk and return profiles, as well as their style exposures. Alternatively, investors who refrain from choosing and instead adopt both strategies may benefit from the best of both worlds.

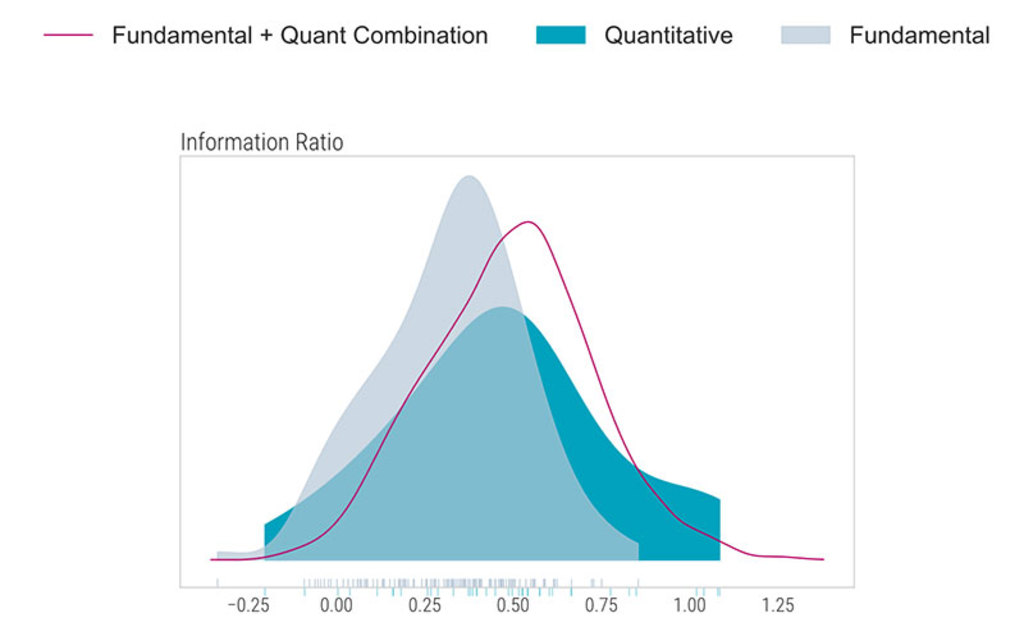

Our research reveals distinct investment styles and risk profiles between fundamental and quant strategies. Despite achieving similar average outperformance of around 2%, fundamental managers typically take higher active risks, resulting in relatively higher information ratios (IRs) for quant strategies (0.47 vs. 0.32). This suggests that quantitative strategies tend to deliver more stable performance with lower relative risk. However, higher active risks (or tracking errors, TEs) are most often a prerequisite for high outperformance. Interestingly, the high TEs of the top-performing strategies often derive from below-average absolute volatility, highlighting the effectiveness of low volatility strategies in emerging markets.

Figure 1 – Distribution of information ratios for fundamental and quantitative strategies and 50/50 combinations

Source: Robeco, eVestment. The figure shows density plots for the annualized information ratio. The densities for the quantitative strategies are shown in blue, for fundamental ones in grey, and for the 50 fundamental/50 quant combinations in pink. We include strategies that were active from April 2011 to September 2023. This results in 123 fundamental strategies, 39 quant ones, and 39*123 = 4,797 50/50 combinations.

What EM opportunities are out there?

Receive our newsletter to dive deep into EM investment opportunities.

Investment style analysis shows that quantitative strategies usually have exposure to the four style factors considered in the study, in contrast to most fundamental strategies that exhibit a growth-like exposure as reflected in their anti-value tilt. This distinction offers a strategic opportunity for portfolio diversification. Indeed, merging quant and fundamental styles in a 50/50 split raises the average IR to 0.49, indicating a 25% improvement over the individual subgroup averages, as illustrated in Figure 1.

More thoughtful combinations of quant and fundamental approaches can bolster portfolio performance and risk management even more, and the study thus presents a benchmark-relative core investment, a sustainable core investment, and a conservative completion portfolio.

Conclusion

Our comprehensive study highlights the potential effectiveness of both quantitative and fundamental strategies in emerging market equities. While their returns are similar, their risk-taking approaches differ, with quantitative funds typically exhibiting lower active risks. Thoughtfully combining these styles not only enhances the IR but also creates a more balanced risk profile, demonstrating the strategic advantage of a diversified approach in emerging markets investment.

Download the publication