Taking on the challenge of measuring investment impact

We’ve further innovated the process of quantifying companies’ impact on the world. Our new impact measurement framework is illustrated by applying it to the SDG Credit strategies.

概要

- The result will enable investors to direct capital towards positive impact

- Using our new framework, we can quantify a portfolio’s contribution to the SDGs

- To illustrate, we apply the framework to one of the SDG Credit strategies

Impact investors want their actions to be measurable. But impact measurement remains complex, partly owing to the absence of standardized data to determine how companies make their mark on society and the planet. Robeco’s development of its proprietary SDG investing framework marked an important milestone in the process of creating a universal investment methodology that takes impact into account. We have now advanced this process by formulating a framework that more precisely quantifies the contribution of portfolio companies to the SDGs. The results enable us and our clients to direct capital towards companies that have a tangible positive impact on people and the planet. To illustrate, we apply this framework to one of the SDG Credit strategies.

Robeco’s proprietary SDG framework, which we have been applying to our impact credit range since 2019, is a robust tool that systematically evaluates companies based on their performance across key SDG targets. Companies are assigned a score for each SDG that is relevant to their business, ranging from -3 to +3; the individual SDG scores are then consolidated into a single overall score. This score indicates whether companies have positive impact on the SDGs, and also which SDGs are promoted or harmed by their activities.

But, while an SDG score positions us well to create investment strategies dedicated to the SDGs, it does not quantify the tangible difference companies make. For instance, a pharmaceutical company could receive an SDG score of +2, indicating it has medium positive impact, thanks to its creation of adequate and safe medicines that help reduce mortality and morbidity. A follow-up challenge is to quantify the number of patients the company has reached with its healthcare products.

A measurement framework that is precise and consistent

To this end, Robeco has created a framework through which we can quantify companies’ positive contributions to relevant SDGs in a concise, consistent and comparable manner. It consists of indicators that are linked to official SDG targets and indicators. For holdings with a positive SDG score, we measure the overall contribution and attribute part of this impact to our investment, based on the value of the holding relative to the company’s enterprise value. In so doing, we only show the impact exposure that is attributable to our investment based on the capital we allocated to the company generating the impact. Next, we aggregate the results. The impact can be attributed to an investment of EUR 100 million, which allows for comparison across strategies of different sizes.

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

Applying the impact measurement framework to SDG Credits

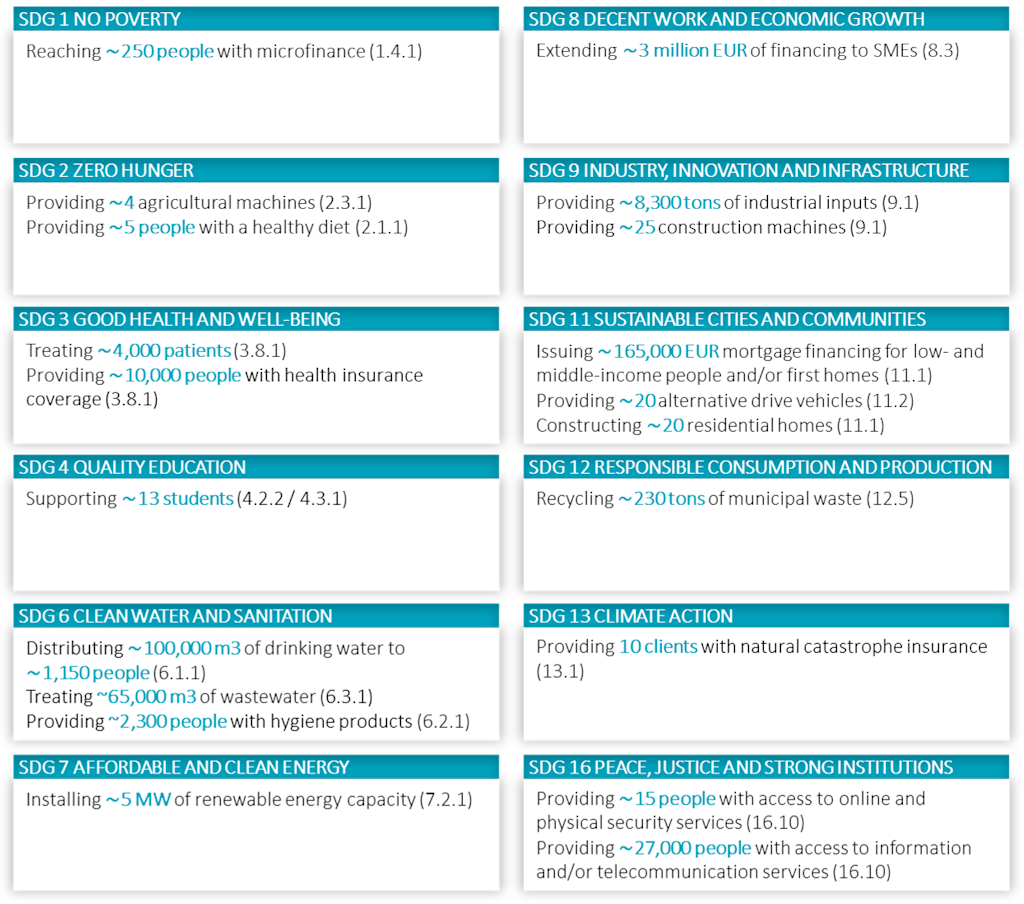

We illustrate the framework by applying it to RobecoSAM Global SDG Credits. The strategy invests in credit issued by companies globally that have a neutral or positive impact on the SDGs (that is, they have an SDG score 0 or above). The impact of each individual issuer is aggregated at the portfolio level and expressed in terms of an investment of EUR 100 million into the strategy. The figures are shown in Figure 1.

For clarity, we highlight that:

We use the term ‘impact measurement’ liberally and inclusively to indicate our efforts in identifying the contributions that companies make to the SDGs. These could be in the form of company outputs or societal outcomes.

While the reported impact metrics relate to the impact of the issuer’s products, they do not reflect the environmental footprint of the production process. We report companies’ environmental footprint separately.

We only measure the impact of companies with a positive SDG score. In the case of RobecoSAM Global SDG Credits, these accounted for 81% of the portfolio market value as of 30 June 2021. Not all companies with a positive SDG score report on their impact, though, while others’ impact reporting is not always fully compatible with our framework. These companies are excluded from the analysis. As a result, the metrics reported cover 77 of the portfolio holdings, representing 55% of its market value as at 30 June 2021.

There are cases where companies provide relevant information on their impact, but where additional calculations are required to turn this data into informative metrics. Therefore, the impact reported contains estimates and margins of error. In addition, as some companies in the portfolio may be working towards the same outcome (e.g. both treated the same patient in the reporting year); as all individual company impacts are aggregated, the metrics reported may include double counting.

The investment in the strategy has no causal relation with the impact metrics. For example, increasing the portfolio exposure to a specific issuer does not imply that the issuer will increase its positive impact.

Figure 1 | Measuring investment impact - In one year, EUR 100 million invested in the Robeco Global SDG Credits strategy is associated with:

Source: Robeco. The opinions and interpretations expressed are solely those of Robeco and are not those of the United Nations. As at 30 June 2021

Reflections on our framework: what should be measured?

Generally, when assessing investee companies’ sustainability practices, investors focus mainly on operational impact, such as the environmental footprint of production, in part because this data tends to be more readily available. This approach allows investors to identify companies that deliver their products and services without disproportionate environmental or social pressures.

Few investors, however, assess the impact of companies’ products and services, even though this is the core of a company’s impact. For such activities, the strategic imperative is to exploit the present business models to scale the positive impact stemming from these activities.1 This is also where companies can have additionality.

Measuring the impact of companies’ products and services is thus a distinguishing feature of Robeco’s approach. It allows us to identify companies that make a meaningful and unique contribution to the SDGs and that are best positioned to scale their positive impact with additional capital.

As we consider the next stage of innovation in measuring impact, our aim is to expand the scope of our framework from measuring the impact of products and services, to also incorporate meaningful metrics for operational impact.

Footnote

1 Analyzing companies' interactions with the Sustainable Development Goals through network analysis: Four corporate sustainability imperatives - Zanten - 2021 - Business Strategy and the Environment - Wiley Online Library

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.