Human instincts drive the Value premium

Companies with exciting growth stories can lure investors, while those that receive little fanfare can deter them. The resulting optimism about glamour stocks and pessimism about their Value counterparts give rise to the Value premium.

概要

- Risk alone cannot explain Value anomaly

- Hardwired human behavior gives rise to Value

- Strong hands are required to harvest Value premium

Value investing is predicated on selecting stocks that appear to be trading at a discount to their intrinsic value and avoiding those that seem to be trading at a premium. The general idea behind this is that markets overreact to good and bad news in the short run, leading to stock price moves that don’t reflect the long-term fundamentals of companies.

But pinpointing what actually drives the value premium is a contentious issue among academics and practitioners. One argument is that it is compensation for some type of risk, such as distress or macroeconomic risk. Another is that the value premium is attributed to rational decisions or behavioral biases that cause ‘irrational’ reactions.

The value premium is attributed to rational decisions or behavioral biases that cause ‘irrational’ reactions

Risk-based explanations of the value premium are largely linked to the efficient market hypothesis (EMH), which states that higher risk should lead to higher returns. In the early 1990s, a number of Fama and French publications1 posited that the value anomaly is not explained by the capital asset pricing model (CAPM) or standard risk measures such as beta and volatility.

Instead, they argued that the return differences between value and growth stocks are driven by common risk factors such as financial distress. The economic rationale behind this notion is that investors are rewarded for taking on the risk of investing in companies that are facing financial difficulty; i.e., those that have typically low market values compared to their book values and are therefore classified as value stocks.

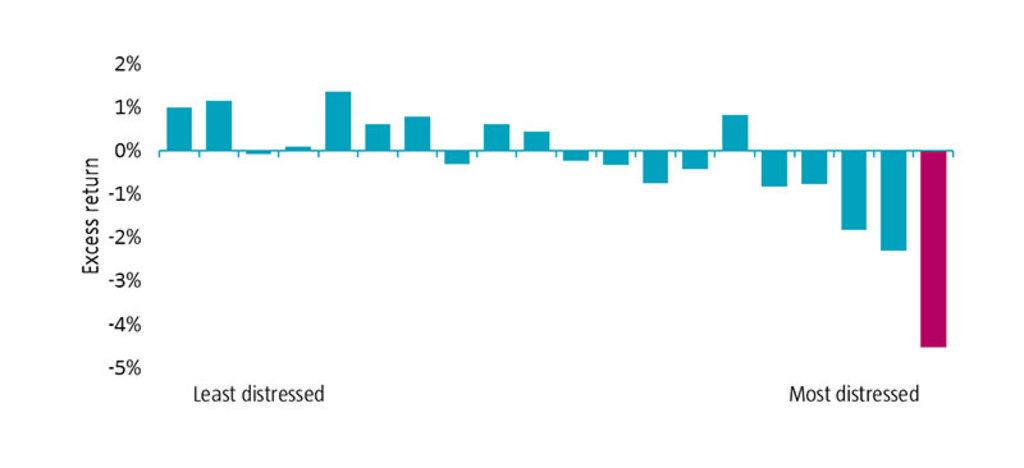

However, there is a lack of consensus in the academic literature on whether this is indeed the case. For example, a Robeco study conducted in 2018 investigated whether the value premium is attributable to financial distress.2 The researchers found no evidence of a causal relationship between value and distress risk and no evidence to support the pricing of this risk. Figure 1 reflects the latter outcome as it shows that a distress risk premium is not concentrated in distressed stocks.

Figure 1 | Relationship between excess return and distress risk

Source: The chart uses monthly EUR returns from Jan 1986 to Dec 2014 for developed markets of the largest 3,000 stocks of all Broad Market Index constituents, ranked by Robeco’s distance-to-default factor, assuming a one-month holding period and ignoring transaction costs.

Financial distress is not the only risk flagged as a potential driver of the value anomaly. In one academic paper, the authors argue that the value premium reflects the compensation investors receive for taking on macroeconomic risk.3 In their study, they observed that value stocks have a high exposure to bond market variables that predict future economic activity. More specifically, they found that value stocks experienced negative cash flow shocks in economic downturns, and this coincided with periods of low returns for them versus their growth counterparts.

While numerous risk-based explanations do feature in the asset pricing literature, it is not widely accepted that the value premium is driven solely by risk factors. Indeed, numerous academics and practitioners have provided compelling evidence that suggests behavior, rather than risk, is the reason the value anomaly persists

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

Instead, the Value anomaly is rooted in innate human behaviors

According to the behavioral school of thought, human tendencies are behind the existence of the value premium. Many investors are lured by the appeal of companies with exciting growth stories and prospect of strong short-term returns, while being deterred by those that receive little fanfare or are unloved by the masses.

As explained by Andrew Lo in his book Adaptive Markets, “Intelligence is the ability to generate accurate cause-and-effect descriptions of reality” (or, simply put, narratives).4 This innate skill has been passed down through generations and contributed to the survival of humans throughout time. Therefore, people are hardwired to be favorably disposed to good narratives and they might struggle to overrule or ignore such a strong instinct.

In one paper, researchers discussed how value strategies outperform the market as they exploit the behavioral errors made by typical investors, and not because they are fundamentally riskier.5 They noted how private investors can extrapolate past growth rates of glamour stocks well into the future even though they are unlikely to persist. They could also equate well-run companies with good investments irrespective of price. Thus, their resulting optimism about glamour stocks and pessimism about their value counterparts give rise to the value premium.

By contrast, some investors take a conscious and rational decision to go against value.6 This perspective is also explored in detail in an academic paper.7 For example, the researchers state that professional investors have career concerns to consider over and above generating good long-term performance. Demanding bosses and clients also evaluate them on their short-term returns and their ability to beat benchmarks. Given these concerns, they could opt for more growth style-related approaches which are easier to sell, have more catchier narratives, and potentially offer strong short-term returns relative to ‘unloved’ value stocks.

In recent years, growth stocks with enticing storylines have become very popular investments. This is not surprising, especially with the current ease of investing, proliferation of indicators focused largely on attention-grabbing information (such as recent returns or stock popularity lists) and more visible marketing aimed at luring private investors. With these factors in mind, even the most seasoned investors can become susceptible to the ‘fear of missing out’. But such behavioral biases are likely to strengthen the value factor.

Even the most seasoned investors can become susceptible to the ‘fear of missing out’

Why hasn’t Value been arbitraged away?

As the value premium is rooted in rational and irrational behavior, the likelihood of it being eroded is fairly low. Indeed, it has been around for decades, giving arbitrageurs enough time to profit from it, yet it remains a fixture of global stock markets. In fact, recent developments, such as the rise of the retail investor, are likely to fuel behavioral biases that could result in the strengthening of the premium over the long run.

Moreover, harvesting the value anomaly can be a painful exercise. The experience of protracted underperformance is likely to shake out any investors with ‘weak hands’, which limits the risk of arbitrage. In fact, investors (humans) have the natural tendency to avoid pain and seek short-term rewards. Therefore, it is our hardwired human instincts that give rise to value premium.

In the next paper of this series, we will discuss the quality factor through the lens of behavioral finance. In the previous articles, we touched on low volatility and momentum.

Footnotes

1Fama, E. F., and French, K. R., June 1992, “The cross-section of expected stock returns”, Journal of Finance; Fama, E. F., and French, K. R., February 1993, “Common risk factors in the returns on stocks and bonds”, Journal of Financial Economics; Fama, E. F., and French, K. R., March 1995, “Size and book-to-market factors in earnings and returns”, Journal of Finance; and Fama, E. F., and French, K. R., December 1998, “Value versus growth: The international evidence”, Journal of Finance.

2 De Groot, W., and Huij, J., March 2018, “Are the Fama-French factors really compensation for distress risk?”, Journal of International Money and Finance.

3 Koijen, R. S. J., Lustig, H., and Van Nieuwerburgh, S., June 2017, “The cross-section and time series of stock and bond returns”, Journal of Monetary Economics.

4 Lo, A. W., April 2017, “Adaptive markets: financial evolution at the speed of thought”, Princeton University Press.

5 Lakonishok, J., Shleifer, A., and Vishny, R.W., December 1994, “Contrarian investment, extrapolation, and risk”, the Journal of Finance.

6 Blitz, D., November 2020, “Why I am more bullish than ever on quant”, Robeco article.

7 Lakonishok, J., Shleifer, A., and Vishny, R.W., December 1994, “Contrarian investment, extrapolation, and risk”, the Journal of Finance.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.