Latin American fintech: Thriving in a fast-changing environment

Fintech is disrupting financial services across the globe. Yet, when it comes to finding the most attractive fintech investment opportunities, it is best to stray off the beaten track. From this perspective, Latin American countries stand out as being particularly exciting. In these countries, fintech is not just disrupting incumbent service providers, but is responsible for technological leapfrogging and boosting financial inclusion.

概要

- Latin America has a large and growing population of new internet users

- The region's fintech ecosystem is growing quickly, particularly in Brazil

- The Covid-19 crisis has been more of a catalyst than a trend-breaker

The digitalization of financial services is transforming people’s daily lives across the globe. But it is especially impactful in emerging countries, where dozens of millions of new internet users get connected each year, fueling demand for faster and more efficient digital finance tools and services. China and India, for instance, have developed bustling local fintech ecosystems, which are world-class in terms of technological sophistication and an ever-increasing user base.

However, these two demographic giants are only part of the story. Latin America also stands out as one of the world’s most promising regions for fintech – not just for diversified tech giants venturing into the industry, such as Facebook, Google, or Apple, but also for a myriad of local niche and not-so-niche players.

The region is home to a population of roughly 450 million mobile phone users, which is expected to reach 484 million by 2025. Of these 450 million users, nearly 80% access the internet via their phone – a proportion that is forecasted to reach 87% by 2025.1 Yet, despite what these forecasts suggest, most of these countries remain relatively underpenetrated.

Brazil for example, by far Latin America’s most populated country, has an internet penetration rate of close to 70%, compared to roughly 87% in Western Europe and the US.2 Altogether, current figures represent enough users for fintech businesses to establish themselves in these countries and thrive.

But they also represent great potential for colossal growth going forward, as millions of younger internet users will join their connected Latin American cohorts. Ultimately, better telecommunication infrastructures and increasing internet access will be responsible for driving step function growth across the entire region for fintech.

Rather than gradually moving from coins and banknotes, to ATMs and checks, to credit cards and electronic payments over the span of several decades, new internet users will typically go straight from cash to digital wallets, as many of them will get a smartphone before they even open a bank account.

This radical switch from physical cash to digital payments is a good example of leapfrogging, where users are skipping the typical steps seen in developed markets and instead, are quickly making exponential progress through technology. Transformations can go faster since many of these countries do not have the legacy technology that needs to be disrupted.

Latin America stands out as one of the world’s most promising regions for fintech – not just for diversified tech giants venturing into the industry

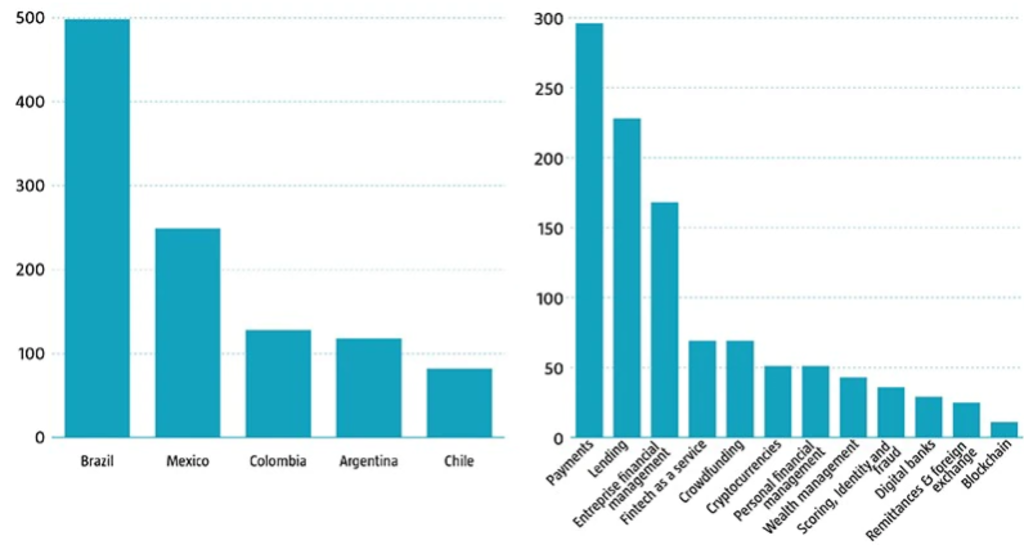

The Latin American fintech growth story is not just limited to Brazil. Several other countries in the region, such as Mexico, Colombia and Argentina, also have a large and fast-growing population of new internet users hungry for quicker and more efficient financial services. These markets have now reached sufficient traction for local tech and fintech ecosystems to emerge and prosper.

Figure 1: Overview of the Latin American fintech sector (number of fintech firms)

Source: KoreFusion, 2020 LATAM Fintech Report”, summer 2020

From agribusiness crowdfunding projects, to advanced financial reporting and compliance software, to domestic and cross-border remittances – the potential playing field for Latin American fintech ventures is wide open. This means countless business opportunities for those players able to seize them.

Over the years, hundreds of Latin American fintech firms have managed to achieve sufficient scale to start generating meaningful revenues. This means they are able to raise venture capital, or, in some cases, even go public. More than half a dozen local core ‘pure-play’ listed fintech companies currently exist in Brazil.

The recent popularity of Latin American fintech companies is also visible in venture capital (VC) flows. VC investments in the region have been doubling every year since 2016, reaching USD 4.6 billion in 2019 – of which USD 2.5 billion were invested in Brazil. Throughout that period, fintech remained by far the most coveted sector, luring 31% of all VC invested across Latin America in 2019.3

The recent popularity of Latin American fintech companies is clearly visible in venture capital flows

Bright prospects despite Covid-19

The Covid-19 crisis has put the sector under stress in some cases, curtailing demand for several fintech services and dampening investors’ appetite. However, the pandemic is also likely to create strong tailwinds for the industry in the long term. Prospects remain bright for the Latin American fintech sector and the growth potential of several businesses operating in the region is significant.

The Big Book of Trends & Thematic Investing

Footnotes

1Source: GSMA, 2019, “The mobile economy – Latin America”.

2International Telecommunication Union (ITU), The World Bank, data as of 2018.

3Source: LAVCA, Association for Private Capital Investment in Latin America, May 2020, “LAVCA’s Annual Review of Tech Investment in Latin America”.

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.