Nowcasting growth to enrich the factors used for government bond selection

We have added a quality measure for the selection of government bonds. It is constructed using nowcasting, to capture timely signals about economic growth.

まとめ

- Innovative method to capture timely signals about economic growth

- Enriching the factors used for government bond selection

- Its low correlation with existing factors enhances performance

Our multi-factor bond strategy uses well-known factors like value, momentum, low risk and quality to select government bonds and credits with superior risk-adjusted returns. The portfolio construction algorithm aims to efficiently harvest these factor premia while keeping the top-down risk profile in line with the index and ensuring a strong sustainability profile.

We now add a quality measure for the selection of government bonds. This measure uses nowcasting to capture timely signals from the plethora of macroeconomic data that are continuously released.1

Quality is widely used in equity and credit selection. It favors stocks and bonds of companies with strong fundamental characteristics like profitability. The equivalent characteristics for government bonds are country fundamentals associated with good returns from government bonds. Our research shows that the appropriate factor to consider is the quality of the macroeconomic environment for bond investors. Here, economic growth is one of the relevant fundamentals: bonds from countries with moderate growth are a better-quality investment than bonds from countries with an overheating economy.

Capturing the state of the economy

To select high-quality government bonds we thus want to compare the state of the economy across countries. There are some challenges to gaining timely data on the state of the economy, though.

The official data series for economic growth is GDP, a comprehensive measure of economic activity. The drawback of this series is that, for most markets, it is updated only quarterly, with a publication lag of at least a month. Moreover, the data is prone to substantial revisions. This means that a bond selection process in early July would either use first-quarter data, showing which economies were growing strongly four to six months previously, or would need to be delayed by a few weeks until the publication of the first estimates of second-quarter growth – and maybe even longer as these numbers might be revised later on.

Fortunately, many macroeconomic data series are released more frequently and with a shorter publication lag than GDP. However, these indicators typically relate only to specific parts of the economy. To get the full picture of the overall economy, it is necessary to combine several data series.

For this we use nowcasts, daily estimates of current growth based on a wide variety of data series. In early July, many data series give information about May, and some already for June; survey data can shed some light on what could be expected in July. This is an advantage compared to the traditional GDP numbers: by combining data series that are updated faster and more frequently, one can create a comprehensive measure of activity that leads the latest published GDP data by up to several months.

Capturing growth as quickly as possible

To ensure that the nowcast reflects changes in activity as quickly as possible, one further step is taken. As mentioned, the nowcast combines data from several data series. However, one does not have to wait for all data series to be published. When early data releases point to a slowdown in some parts of the economy, the linkages between different parts of the economy can be used to infer what this likely means for parts of the economy for which data has not been published yet.

A true nowcast uses a model of the relationships between these parts of the economy – a dynamic factor model – to ensure that all information is extracted from a data release: not only the explicit information about that part of the economy, but also the implicit information about related parts of the economy.

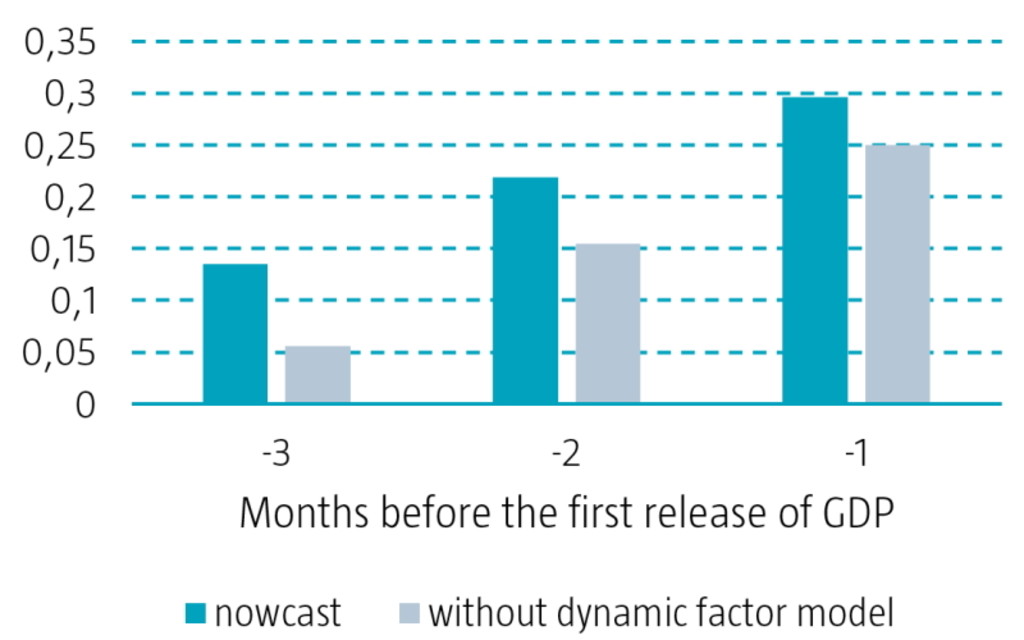

Figure 1 | Correlation to GDP-based rankings for nowcast, with and without dynamic factor model, 2008-2022

Source: Robeco

In our Multi-Factor Bonds strategy, we use the nowcast to differentiate between bonds from different countries, based on economic growth in these countries. Figure 1 shows how well we can rank countries based on growth, using the nowcasts available one to three months before the release of the official GDP growth numbers. To show the added value of the dynamic factor model, we compare the nowcast to a similar combination of data releases that doesn’t use a dynamic factor model. The ranking based on the nowcast correlates better with the ranking based on GDP growth than the ranking produced without the dynamic factor model. The ranking produced with the nowcast, three months before the GDP publication, is as accurate as the ranking produced without the dynamic factor model one month later.

Performance

Nowcasting can thus be used to get timely information on the state of the economy. But is this enough to select government bonds with superior risk-adjusted returns? To answer this question, we performed historical backtests. Ideally, we would only use nowcasts that had actually been published at that point in time, but these have a limited history. We therefore extend our dataset by using nowcasts that are carefully reconstructed. As this process requires a large variety of economic indicators, with their exact historical publication dates, there are limits to how far back in time one can go, and the backtest is therefore fairly short.

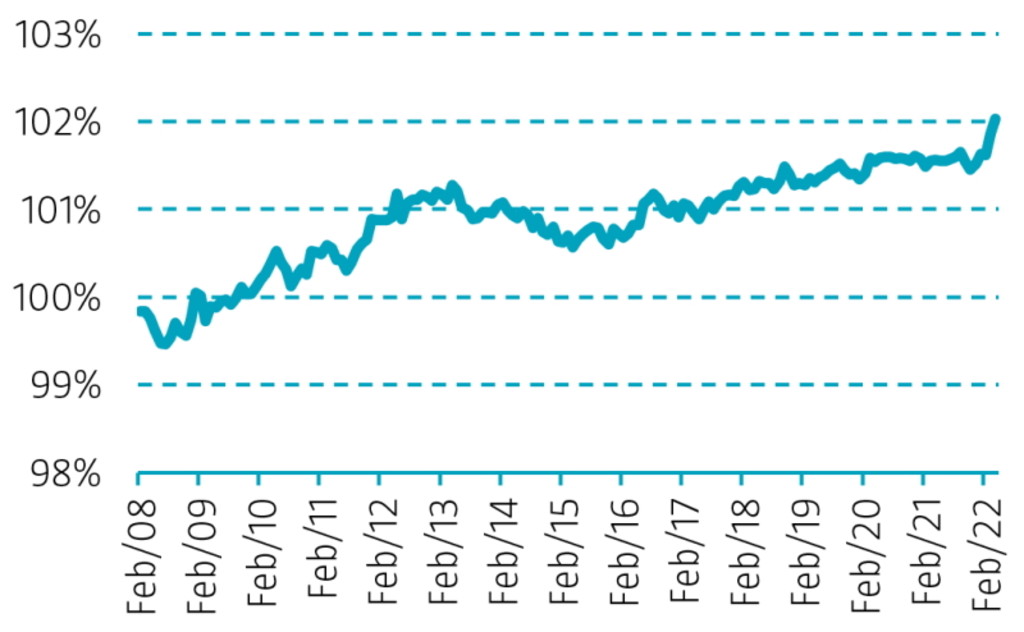

Figure 2 | Cumulative performance of government bond selection based on nowcast, 2008-2022

Source: Robeco

Figure 2 shows the cumulative performance of a long-short portfolio based on the nowcast. This portfolio has long positions in bonds from countries where growth is moderating and short positions in bonds from countries where the economy is heating up. The portfolio is rebalanced monthly.

We find that the nowcasts generates attractive risk-adjusted returns. Furthermore, this performance is largely uncorrelated with the factors we already use for government bond selection. It thus adds value to our multi-factor government bond selection. Out of prudence, we add this new quality measure with a somewhat lower weight than other measures, to reflect the shorter history over which we can assess its performance. For other factors we have much longer backtests, extending beyond 200 years. For deep-sample evidence on the existence of value, momentum and low-risk factors, please refer to Factor Investing in Sovereign Bond Markets: Deep Sample Evidence.

Conclusion

Bonds from countries experiencing moderate growth are a better-quality investment than bonds from countries with an overheating economy. To select high-quality government bonds, we thus want to capture differences in economic growth. Nowcasting allows us to do so in a timely manner.

Selecting government bonds based on this quality measure generates attractive risk-adjusted returns. Its performance is largely uncorrelated to that of the other factors. It thus adds value to our multi-factor government bond selection.

Footnote

1 This article is based on a more detailed paper by the same authors, entitled “Nowcasting growth: quality in bond selection”, July 2022.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会