How capex holds the key to a self-sustaining economic recovery

Capital expenditure to fix supply shortages and meet burgeoning demand is seen figuring strongly in the post-Covid recovery.

まとめ

- Companies need to expand capacity to meet pent-up demand

- Rising unit labor costs incentivizes shift to capital-intensive production

- Capital expenditures ultimately lengthen the corporate earnings cycle

Companies are expected to invest heavily in new equipment and capacity as they seek to meet the pent-up demand released from economic reopening.

“The world is emerging from the pandemic, and much of the focus has been on the release of huge pent-up demand for goods and services that have been inaccessible for much of the past year,” says Peter Van der Welle, strategist with Robeco’s multi-asset team.

“But there is a bigger issue regarding the ability of companies to supply these goods and services, due to the supply side constraints that have emerged through economic reopening. We believe this is powering a resurgence in capital expenditure by companies, and those which are investing in new equipment to meet greater demand will be the more sought after stocks.”

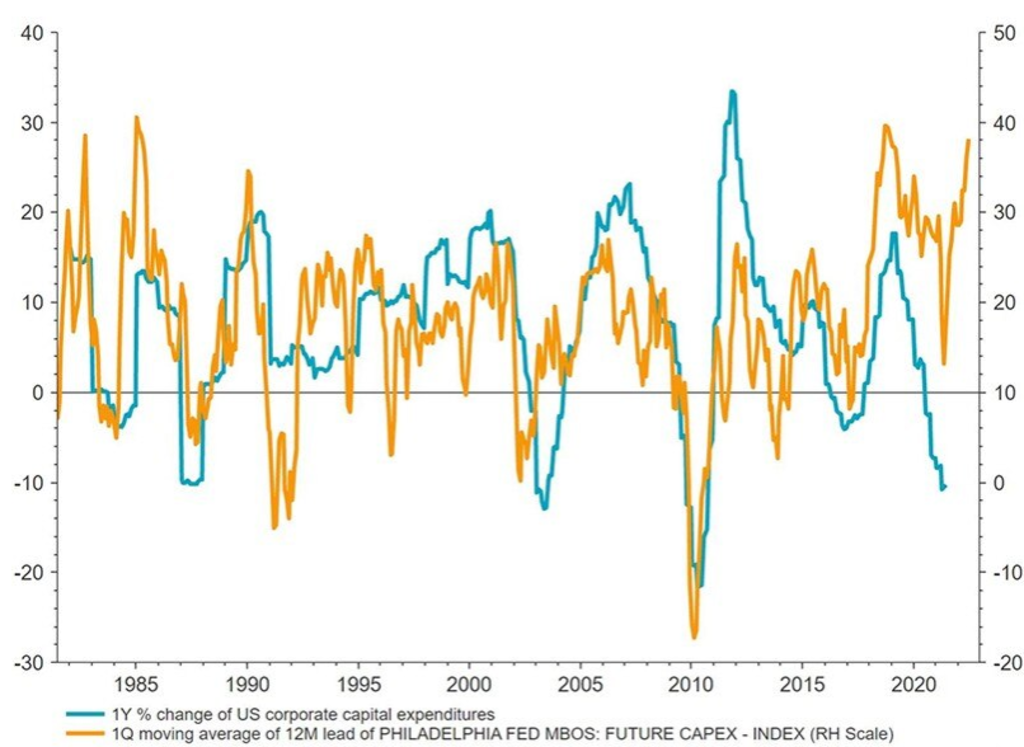

Van der Welle says this trend can already be seen in the US Federal Reserve’s Capex Intentions Index, which shows that steep year-on-year increases in capital expenditures are planned.

“So, that's promising for a near-term rebound in the capex cycle,” he says. “The market has already picked up on that theme because you can see a clear outperformance of capex-intensive stocks compared to the broader market year to date.”

Capex of US corporates (blue line) which plunged during the pandemic is expected to bottom out given a steep rise in future capex intentions next 12 months (orange line).

Source: Refinitiv Datastream, Robeco

Fiscal dominance

Van der Welle says five elements support the multi-asset team’s view that capex will rise from here onwards. “The first is the overarching macroeconomic picture in that we are increasingly moving towards an environment of fiscal dominance and away from one that has been monetary-led via quantitative easing,” he says.

“Central banks have pursued very easy monetary policies, but they have hit the nominal lower bounds with regard to policy rates.”

“This is a hard constraint because real rates are difficult for central banks to push even lower than they are nowadays, given the strong consensus among both central bankers and market participants that inflation is transitory.”

Big spending plans

For stimulus, fiscal policy is better suited to address the negative supply shock that Covid-19 has posed. Fiscal dominance can be seen in the huge infrastructure spending planned in the US, with the USD 1.9 trillion American Rescue Plan already in motion, and the USD 2 trillion American Jobs Plan going through Congress. In Europe, the disbursement of the EUR 750 billion EU Recovery Fund is due to start later in July.

“An era of fiscal dominance is able to say goodbye to the secular stagnation thesis, which holds that the economy is suffering from under-investment,” says Van der Welle. “Under-investment due to insufficient demand, which was the biggest problem after the global financial crisis, has become less likely.”

“We saw very subdued consumption growth both in the US and elsewhere between 2009 and 2019. That story is reversing in the US. Households’ income has been supported by fiscal policy during the Covid-19 recession, while burgeoning consumer demand in the reopening phase could prove to be more sticky as employment prospects continue to improve in the medium term.”

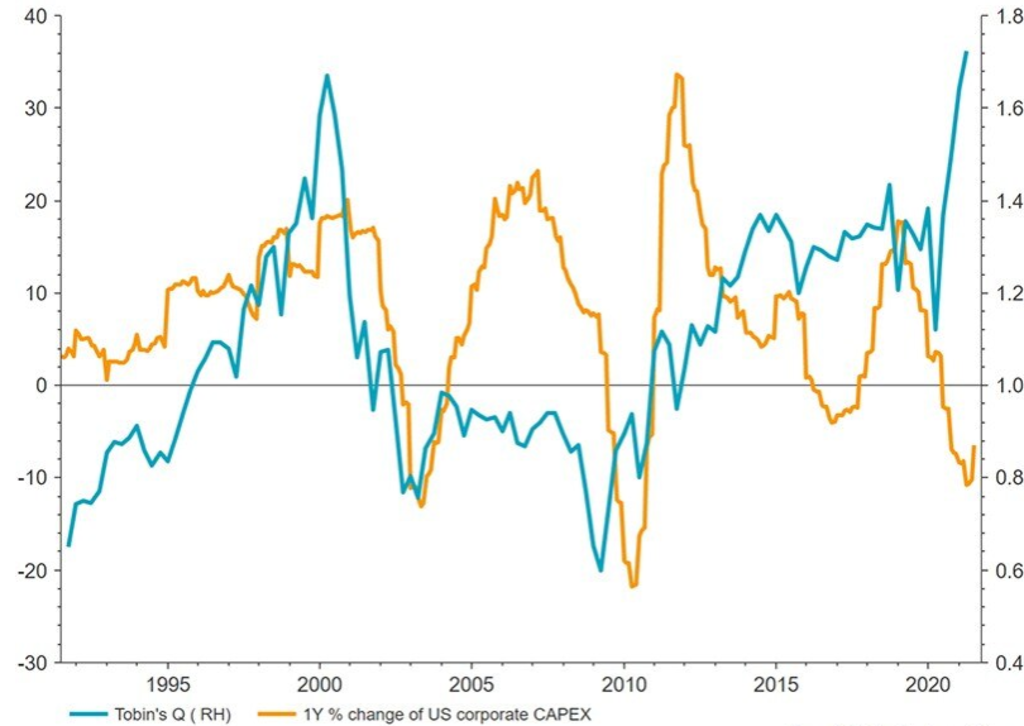

Tobin’s Q looks good

A third reason to expect higher capex is driven by ‘Tobin’s Q’ – the market value of a company divided by its assets' replacement cost. If this ratio is above one, then corporates have an incentive to invest directly in the underlying assets rather than buying another company at market value to acquire the same assets.

The Tobin’s Q ratio is currently at 1.7 for the US. “So it's very expensive to do M&A, and it is wiser for corporates to invest in the underlying capital goods themselves,” Van der Welle says.

“We should therefore expect a gradual move away from M&A activity towards companies making direct investments in capital goods.”

Tobin’s Q has reached 1.7 in the US as corporate capex starts to tick up

Source: Refinitiv Datastream, Robeco

Supply-side constraints

The fourth element is the severe supply-side constraints seen in the global economy, as capacity shut down during the pandemic.

“This is reflected in the ISM Prices Paid Index, which reached an all-time high in June in reflection of rampant shortages of raw materials and labor,” says Van der Welle.

“Clearly the issue today following the pandemic is not demand related, but supply related. This will also trigger more awareness to push the productivity frontier and incentivize capital expenditure.”

Less reliance on labor

The fifth element is the partial substitution from labor to capital in the US against the backdrop of lingering labor shortages.

“A decline in the labor force participation rate shows that people are not quickly returning to the labor force, as they have been disincentivized by the subsidies and pay checks they have gained from the stimulus plans, and/or structural changes in their work/life balance due to the pandemic,” says Van der Welle.

“When the cost of labor becomes more expensive, substituting labor with capital becomes more attractive for employers. Typically, the inflection point for capex intentions becoming positive is when unit labor costs rise by more than 2% year on year, which is the case today.”

Capex will lengthen the earnings cycle

Regarding earnings, there is a significant relationship between capex intentions and productivity, though the lag from intending to invest to actually getting a realized productivity gain is quite long – up to several years.

Higher capex that eventually brings higher productivity growth will sustain the earnings cycle, Van der Welle says. Higher productivity gives corporates more pricing power because they suppress unit labor costs, and that means profit margins can stay elevated for longer.

重要事項

当資料は情報提供を目的として、Robeco Institutional Asset Management B.V.が作成した英文資料、もしくはその英文資料をロベコ・ジャパン株式会社が翻訳したものです。資料中の個別の金融商品の売買の勧誘や推奨等を目的とするものではありません。記載された情報は十分信頼できるものであると考えておりますが、その正確性、完全性を保証するものではありません。意見や見通しはあくまで作成日における弊社の判断に基づくものであり、今後予告なしに変更されることがあります。運用状況、市場動向、意見等は、過去の一時点あるいは過去の一定期間についてのものであり、過去の実績は将来の運用成果を保証または示唆するものではありません。また、記載された投資方針・戦略等は全ての投資家の皆様に適合するとは限りません。当資料は法律、税務、会計面での助言の提供を意図するものではありません。 ご契約に際しては、必要に応じ専門家にご相談の上、最終的なご判断はお客様ご自身でなさるようお願い致します。 運用を行う資産の評価額は、組入有価証券等の価格、金融市場の相場や金利等の変動、及び組入有価証券の発行体の財務状況による信用力等の影響を受けて変動します。また、外貨建資産に投資する場合は為替変動の影響も受けます。運用によって生じた損益は、全て投資家の皆様に帰属します。したがって投資元本や一定の運用成果が保証されているものではなく、投資元本を上回る損失を被ることがあります。弊社が行う金融商品取引業に係る手数料または報酬は、締結される契約の種類や契約資産額により異なるため、当資料において記載せず別途ご提示させて頂く場合があります。具体的な手数料または報酬の金額・計算方法につきましては弊社担当者へお問合せください。 当資料及び記載されている情報、商品に関する権利は弊社に帰属します。したがって、弊社の書面による同意なくしてその全部もしくは一部を複製またはその他の方法で配布することはご遠慮ください。 商号等: ロベコ・ジャパン株式会社 金融商品取引業者 関東財務局長(金商)第2780号 加入協会: 一般社団法人 日本投資顧問業協会