Investissement dans la transition : quand l'alpha rencontre les objectifs climatiques

La thèse d'investissement concernant les leaders et les retardataires en matière de climat reste intacte, tant sur les marchés développés que sur les marchés émergents. Ce constat semble s'appliquer aussi bien aux industries peu émettrices que très émettrices, ce qui suggère que les leaders de la transition dans les secteurs très émetteurs pourraient générer de l'alpha en progressant plus rapidement que leurs homologues vers la neutralité carbone. Comme nous l'avons déjà indiqué1, l'investissement dans la transition climatique constitue une approche puissante pour atteindre les objectifs climatiques tout en générant des surperformances financières.

Résumé

- Les entreprises classées parmi les leaders en matière de climat surperforment encore les retardataires

- Les leaders peuvent bénéficier d'une utilisation efficace des ressources et d'un coût du capital moins élevé

- Les performances annualisées sur 3 et 10 ans montrent une rotation sectorielle

Le réchauffement climatique reste l'un des problèmes les plus graves de notre époque, en dépit des questions géopolitiques et économiques qui font la une des journaux. Ces dernières années, la transition énergétique susceptible de ralentir le réchauffement climatique a heureusement connu d'énormes progrès : niveaux records d'installations d'énergies renouvelables, retour en force de l'énergie nucléaire, efforts de décarbonation dans les transports, l'immobilier et les secteurs difficiles à décarboner, pour n'en citer que quelques-uns. Tous ces progrès ont même défié un environnement politique souvent erratique ou carrément hostile, et la cerise sur le gâteau a été un rebond des valeurs connexes en 2025.

Il est clair qu'il existe de nombreux exemples où les efforts de décarbonation ont progressé très lentement ou ont été nuls dans certains domaines, notamment l'éolien en mer, le captage du carbone et les aliments de substitution. Au bout du compte, c'est l'économie qui détermine le taux de réussite de toute solution climatique. Au lieu de projeter des courbes de coûts de décarbonation en chute libre, il est nécessaire d'adopter une approche plus équilibrée pour évaluer où se trouvent les véritables opportunités. Dans le prolongement de notre étude précédente,2, nous avons à nouveau testé notre thèse selon laquelle le parcours vers la neutralité carbone nécessite une approche largement diversifiée dans l'univers des solutions climatiques, axée sur les leaders de la transition dans les secteurs aussi à faible qu'à fort impact.

Dans la première partie de cet article, nous aborderons les différentes catégories de solutions climatiques et la manière dont elles se sont comportées ces dernières années en termes d'alpha. Dans la seconde partie, nous examinerons les performances des leaders et des retardataires de la transition.

Opportunités d'alpha dans les solutions climatiques

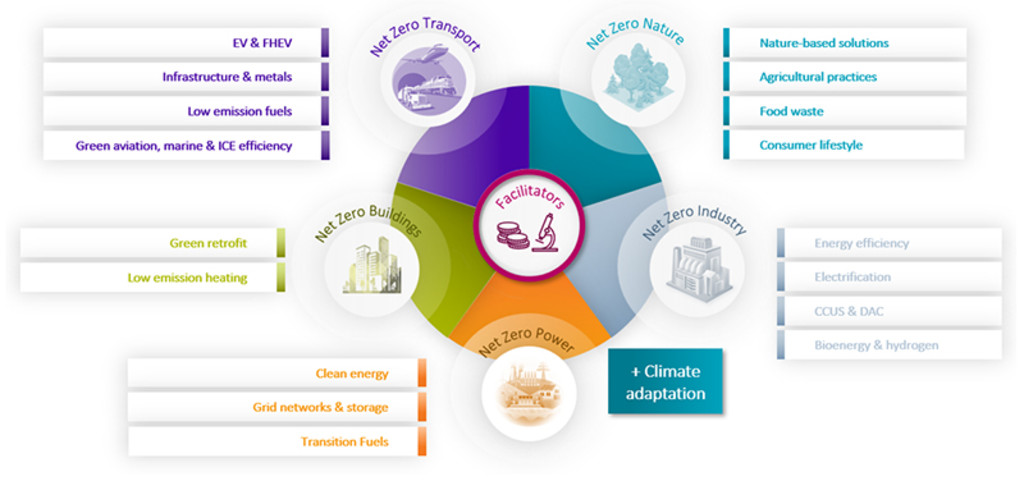

Les trajectoires de décarbonation diffèrent d'un secteur à l'autre en termes de rythme et de type d'investissement.3 Plutôt que de prendre position sur la meilleure trajectoire pour limiter la hausse de la température mondiale, nous menons des recherches approfondies sur l'univers climatique afin d'identifier les opportunités d'investissement les plus attractives dans diverses catégories de solutions climatiques essentielles à la décarbonation. Le Graphique 1 présente une vue d'ensemble.

Il est clair que le déploiement des capitaux ne sera pas synchrone entre les régions et les industries, bien qu'il soit essentiel que tous les secteurs contribuent activement à la transition de manière concertée. Par exemple, des cimentiers qui s'associent à des entreprises chimiques pour réduire le rapport clinker/ciment, et des entreprises de services aux collectivités qui se tournent vers des sources d'énergie bas carbone et des fournisseurs de technologies de captage du carbone.

Graphique 1 : Boîte à outils pour les solutions climatiques

Source : Robeco (2024), IIGCC (2022), McKinsey (2022), AIE (2023).

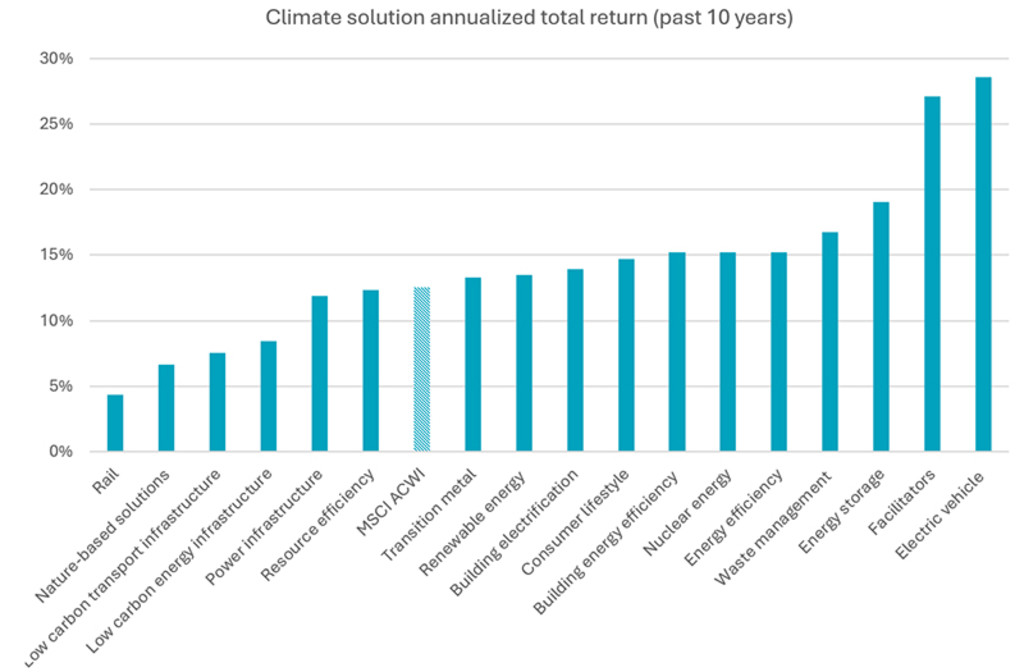

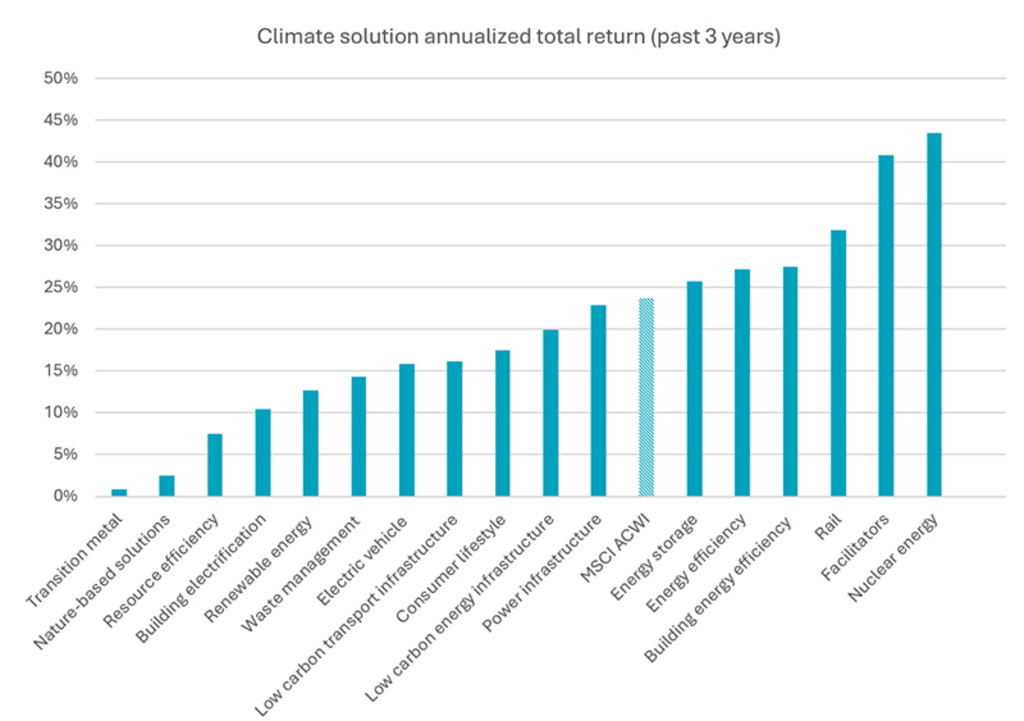

Pour trouver les domaines les plus prometteurs en termes de potentiel d'alpha, nous avons examiné un large éventail de solutions climatiques pour voir comment elles se sont comportées au fil du temps. Pour comparer les performances historiques de toutes les solutions climatiques, nous avons tenu compte de l'homogénéité de certaines solutions et les avons regroupées en 17 catégories sur la base d'une combinaison de types de solutions et de secteurs d'activité. Notre échantillon contient environ 690 titres considérés comme des fournisseurs de solutions climatiques sur les marchés développés et émergents. Nous avons calculé la performance totale annualisée de chaque catégorie de solutions sur les trois, cinq et dix dernières années, et comparé les performances à celles du MSCI ACWI pour les mêmes périodes. Nous pensons ainsi pouvoir appréhender la performance à long terme, sur l'ensemble du cycle, de ces solutions, mais aussi voir comment elles se sont comportées dans des contextes macroéconomiques différents dans le temps.

Il s'ensuit que les solutions incluant l'Efficacité énergétique des bâtiments, l'Efficacité énergétique,4, le Stockage de l'énergie, l'Énergie nucléaire et les Catalyseurs de la transition5ont surperformé le MSCI ACWI à la fois sur trois et dix ans (voir Graphique 2). Néanmoins, des solutions telles que les VE et la gestion des déchets, qui ont surperformé au cours de la période de dix ans, sont restées à la traîne ces des dernières années. Une telle divergence dans les performances historiques peut s'expliquer soit par la diminution du soutien réglementaire ou la perte de vitesse de la consommation (par exemple, les VE), soit par le manque de « couple » cyclique compte tenu de la solidité du marché actions (par exemple, les entreprises de gestion des déchets).

Les solutions climatiques qui se sont avérées plus résilientes à travers les cycles ont tendance à être de meilleure qualité et moins sujettes aux interférences réglementaires. Par exemple, les grandes entreprises technologiques représentées dans la catégorie des « catalyseurs de la transition » jouissent d'une forte compétitivité et dépensent beaucoup pour le développement de technologies propres dans l'ensemble de la chaîne de valeur.6 D'autres capitaliseurs de ce type peuvent, par exemple, être trouvés dans les catégories de solutions Efficacité énergétique (des bâtiments). Nous surpondérons donc structurellement les fournisseurs de solutions qui correspondent bien aux caractéristiques de qualité les plus corrélées à l'alpha sur le long terme.

À l'autre extrémité du spectre se trouvent les technologies propres et les solutions liées aux infrastructures. Il s'agit généralement d'entreprises qui opèrent dans un environnement hautement concurrentiel, sont plus sujettes aux itérations technologiques, ont une forte intensité capitalistique et/ou sont plus sensibles aux changements politiques. Dans le temps, les solutions fondées sur la nature, telles que les sociétés d'investissement forestier, ont également été mises à mal par la faiblesse des marchés finaux, en particulier l'immobilier résidentiel, qui a pesé sur la performance. Nombre de ces solutions jouent néanmoins un rôle essentiel dans la transition énergétique, mais elles ne sont pas toujours les candidates idéales dans lesquelles investir. Toutefois, si nous estimons qu'elles offrent un potentiel d'alpha sous-évalué, nous n'hésitons pas à investir dans ces domaines. Examiner l'univers de nos solutions sous divers angles est un moyen de trouver de l'alpha lorsque l'on investit dans la transition énergétique.

Il est intéressant de noter qu'au cours des trois dernières années, nous avons observé une forte surperformance de la catégorie Énergie nucléaire, car la prise de conscience qu'il sera de plus en plus difficile de parvenir à la neutralité carbone sans l'aide de l'énergie nucléaire alimente un regain d'intérêt pour ce segment négligé. L'amélioration de la performance de la catégorie Infrastructures électriques est également logique : sans les entreprises qui fournissent le matériel nécessaire, les lignes de transmission par câble et les équipements électriques connexes, l'objectif de neutralité carbone sera impossible à réaliser.

Graphique 2 : Performances historiques des différentes catégories de solutions climatiques

Les performances passées ne préjugent pas des performances futures. La valeur de vos investissements peut fluctuer.

Source : Robeco (2025), Datastream (2025).

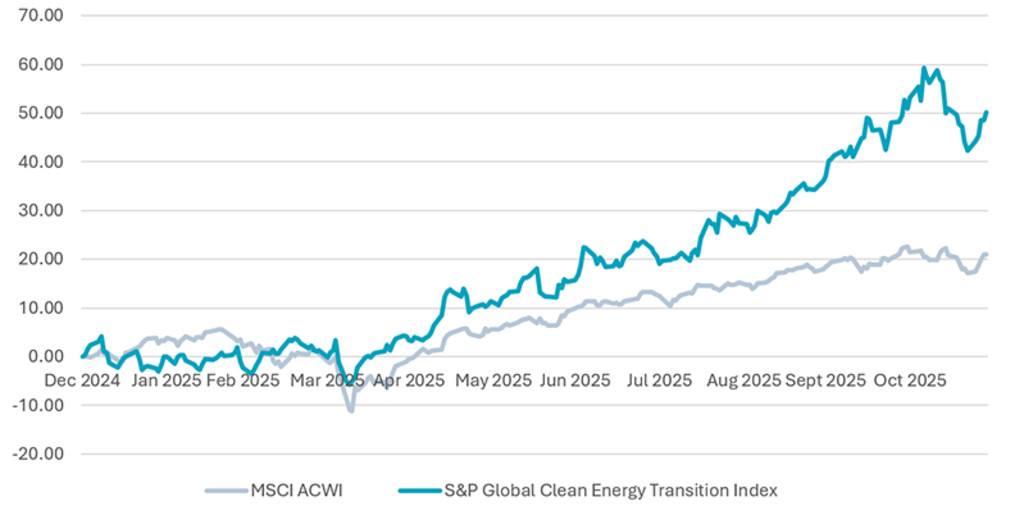

Pour ce qui est de l'avenir, nous laissons lentement dernière nous une période où les taux d'intérêt élevés posaient des problèmes de financement pour de nombreux projets d'infrastructure liés aux énergies renouvelables et pour les technologies de décarbonation en phase initiale. Les fondamentaux indiquant une croissance, combinés à un environnement de taux plus favorable et à une situation plus saine en termes de valorisations, annoncent la prochaine reprise de l'investissement dans le climat. Cette perspective est confirmée par le récent sentiment de marché à l'égard de l'investissement climatique (voir Graphique 3).

Graphique 3 : Performance relative de la transition vers les énergies propres par rapport au MSCI ACWI

Les performances passées ne préjugent pas des performances futures. La valeur de vos investissements peut fluctuer.

Source : Bloomberg (2025).

Global Climate Transition Equities D EUR

- performance ytd (31-1)

- 1,25%

- Performance 3y (31-1)

- 13,39%

- morningstar (31-1)

- SFDR (31-1)

- Article 8

- Paiement de dividendes (31-1)

- No

Opportunités d'alpha dans les leaders de la transition

Nous avons répété l'exercice pour les entreprises considérées comme étant les leaders de la transition climatique, c'est-à-dire celles qui donnent l'exemple en décarbonant leurs activités en vue de la neutralité carbone. Un leader de la transition serait par exemple un aciériste qui soutiendrait son objectif de neutralité carbone avec un plan d'investissement crédible de décarbonation l'amenant sur une trajectoire conforme à celle attendue dans son secteur, voire meilleure. Grâce à notre Climate Analytics toolbox, nous avons mis au point un cadre scientifique qui permet d'identifier ces leaders de la transition. Inversement, notre système de code couleur Climate Traffic Light, nous permet en outre de pénaliser les retardataires de la transition (c'est-à-dire les entreprises partiellement alignées ou non-alignées) en ne les incluant pas automatiquement dans notre univers d'investissement. Cela pourrait par exemple être une entreprise de machines industrielles qui ne propose aucun plan pour réorienter ses flux de capitaux vers les investissements requis pour s'aligner progressivement sur l'Accord de Paris dans au fil du temps.

Pour déterminer comment les profils de transition des entreprises sont associés à leurs performances historiques, nous avons divisé l'univers des 10 000 titres en deux groupes : les leaders de la transition et les retardataires. Il convient de noter qu'il peut y avoir un certain degré de biais du survivant dans l'échantillon de notre calcul de performance, étant donné que nous ne disposons que de l'évaluation du code couleur des entreprises pour le présent mais pas pour le passé. Néanmoins, étant donné que le profil de transition d'une entreprise peut être assez statique et qu'il s'agit d'un indicateur qualitatif, nous sommes d'avis que notre analyse fournit une valeur de référence pour les études futures.

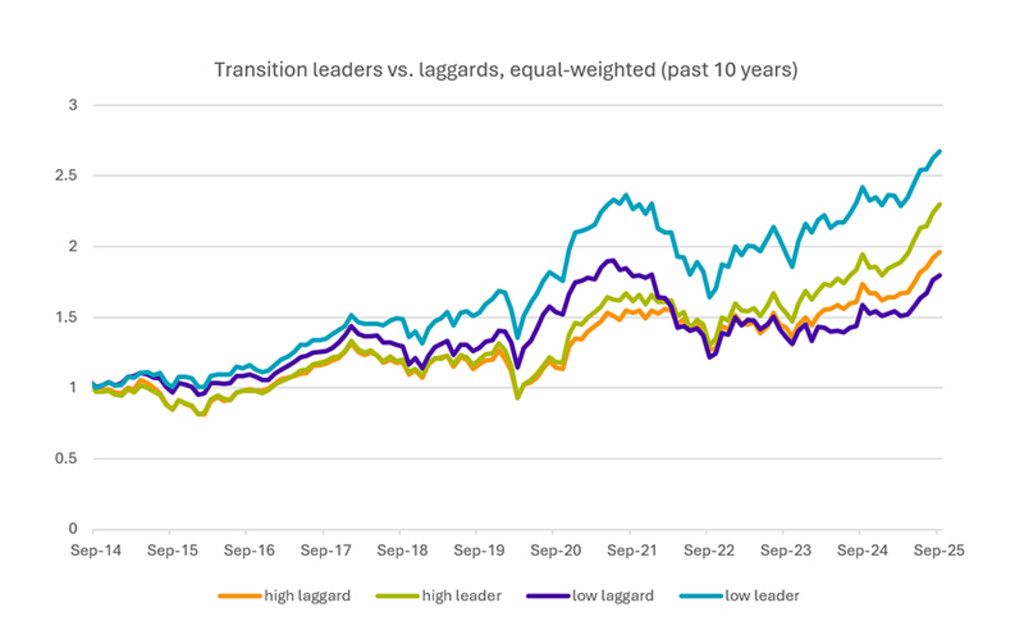

En comparant les performances équipondérées sur trois et dix ans des leaders de la transition par rapport aux retardataires (voir Graphique 4), nous constatons que les leaders de la transition ont surperformé au cours des deux périodes, et si l'on divise davantage les groupes en groupes à faible impact et à fort impact, les leaders de la transition à faible impact ont surperformé les retardataires à faible impact, mais aussi le groupe à fort impact. La divergence des performances historiques entre ces groupes pourrait bien être liée à une étude réalisée par l'équipe Actions quantitatives de Robeco sur les signaux d'alpha basés sur l'efficacité des ressources des entreprises.7 Celle-ci avait indiqué que les entreprises plus économes en ressources ne produisent pas seulement un alpha plus élevé que prévu par rapport à leurs homologues moins économes en ressources, mais qu'elles sont également associées à une réduction de l'empreinte environnementale globale d'un portefeuille.

Au sein de notre univers représentatif, plus de 80 % des entreprises des secteurs de l'énergie, des matériaux, de l'immobilier et des services aux collectivités (des secteurs traditionnellement plus lourds en termes d'actifs et dont la rotation des actifs est plus faible) sont considérées comme des entreprises à fort impact. En outre, une plus grande proportion d'entreprises à fort impact ne sont pas encore sur la bonne trajectoire pour s'aligner sur l'Accord de Paris. Investir dans les leaders de la transition climatique dans les secteurs très émetteurs nous permet de profiter du potentiel d'amélioration de l'efficacité des ressources, de la réduction de l'empreinte environnementale, ainsi que de l'amélioration de l'accès aux marchés financiers et de la réduction du coût du capital. Un aciériste qui viserait la neutralité carbone en investissant dans l'acier vert en utilisant, par exemple, des ferrailles recyclées, complétées par une technologie de captage du carbone et des énergies propres, correspondrait à ce cas de figure.

Graphique 4 : Performances historiques des leaders et des retardataires de la transition, par secteurs à faible et à fort impact

Les performances passées ne préjugent pas des performances futures. La valeur de vos investissements peut fluctuer.

Source : Robeco (2025), Datastream (2025).

Marchés développés contre marchés émergents

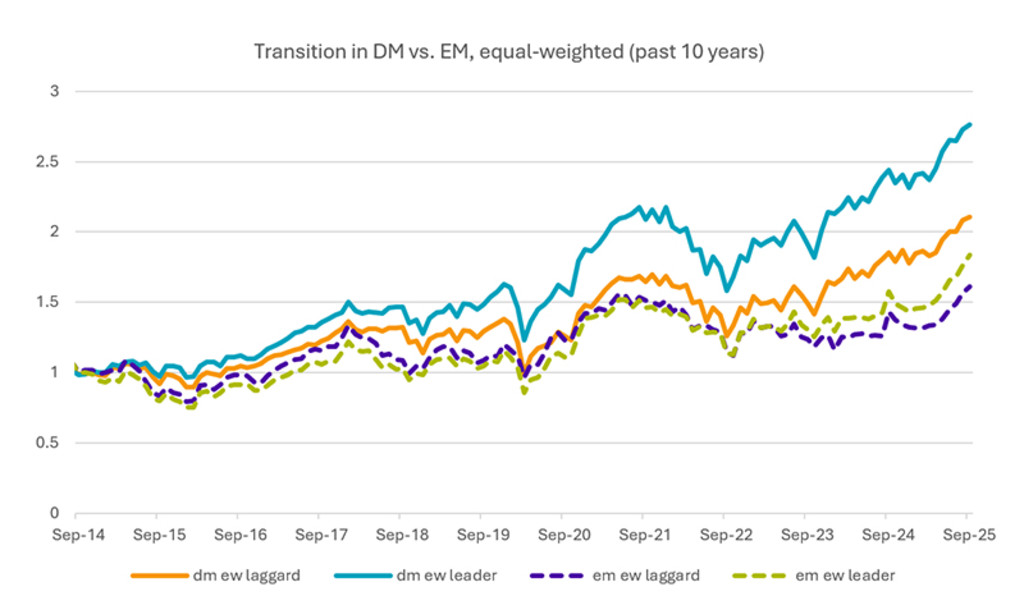

Nous avons également étudié la différence de performance entre les leaders de la transition et les retardataires, tant sur les marchés développés (DM) que sur les marchés émergents (EM ; voir Graphique 5). Il est intéressant de noter que, bien que les leaders de la transition tendent à surperformer les retardataires tant dans les marchés développés que dans les marchés émergents, les retardataires des marchés développés surperforment encore l'ensemble du groupe des marchés émergents. Nous reconnaissons que les biais sectoriels jouent un rôle à cet égard, les secteurs à faibles actifs et très rentables dominant l'univers des marchés développés.

À un niveau plus détaillé, la cohorte de titres la plus performante dans les marché émergents est celle des leaders des secteurs à faible impact. Dans le premier cas, il s'agit des grandes entreprises technologiques qui ont des projets ambitieux en matière de neutralité carbone et qui, pour la plupart, investissent massivement dans les énergies propres, ce qui constitue un effet secondaire positif des investissements importants réalisés dans l'IA gourmande en énergie. Les leaders notamment des secteurs à fort impact ont surperformé les retardataires à la fois des secteurs à faible impact et à fort impact.

Dans les marchés émergents, nous observons une relation similaire, étant donné la surperformance des leaders par rapport aux retardataires. Il est intéressant de noter que les données sous-jacentes indiquent une nette sous-performance des retardataires dans les secteurs à faible impact, alors que les autres cohortes ont affiché des performances similaires. Cela pourrait s'expliquer par le fait que les marchés émergents sont davantage axés sur les titres « Value » et dans lesquels les secteurs à fort impact, tels que les services aux collectivités et l'énergie, occupent historiquement une place beaucoup plus importante que dans les marchés développés.

Graphique 5 : Performances historiques des entreprises en transition dans les marchés développés par rapport aux marché émergents

Les performances passées ne préjugent pas des performances futures. La valeur de vos investissements peut fluctuer.

Source : Robeco (2025), Datastream (2025).

Dans l'ensemble, les résultats de nos recherches suggèrent que les leaders en matière de transition ont toujours surperformé les retardataires. Cela s'avère vrai non seulement pour les marchés développés et les marchés émergents, mais aussi pour les secteurs très émetteurs et les secteurs peu émetteurs. Ces observations confirment notre thèse selon laquelle investir dans les leaders de la transition climatique est un moyen intéressant de capturer de l'alpha, car ils ont également tendance à présenter des caractéristiques de qualité favorables souvent récompensées par le marché.

Conclusion

Comme le dit le proverbe chinois : « Le meilleur moment pour planter un arbre était il y a 20 ans, mais le deuxième meilleur moment est aujourd'hui. » Des progrès considérables ont déjà été faits dans la transition énergétique, mais il reste manifestement encore beaucoup à faire. Si l'objectif de 1,5 °C devient hors de portée, cela ne signifie pas pour autant que nous devrions jeter l'éponge sur des objectifs moins ambitieux. Les solutions techniques qui promettent d'infléchir rapidement les courbes de la neutralité carbone vers le bas finissent souvent par être des vœux pieux. Nous devons mieux équilibrer les investissements à court et à long terme et faire en sorte qu'ils soient guidés par l'économie, la sécurité de l'approvisionnement et l'efficacité technologique.

Comme dans tout cycle d'investissement, certains secteurs du marché seront florissants, tandis que d'autres resteront faibles pendant un certain temps. C'est précisément la raison pour laquelle nous plaidons pour une approche plus large dans la recherche de l'alpha. Conformément à la théorie de l'investissement, il est avantageux d'être exposé à un ensemble diversifié de solutions. Outre les entreprises qui fournissent des solutions climatiques, nous devons également reconnaître et récompenser les leaders de la transition qui réduisent déjà leur empreinte environnementale et alignent leurs stratégies sur les objectifs à long terme de l'accord de Paris. Nos conclusions suggèrent que ces entreprises peuvent être d'importantes sources de génération d'alpha sur le long terme.

La diversification, l'analyse fondamentale, la discipline de valorisation et la gestion du risque sont toujours valables, en particulier en ce qui concerne l'investissement climatique. Des business models sains restent très pertinents. La qualité est importante et, dans ce cadre, il convient d'être sélectif.

Footnotes

1 Climate leaders outperform the laggards as solutions firms struggle – Robeco – July 2025

2 Transition investing: Exploring alpha potential – Robeco July 2024

3 Charting a realistic path toward net zero – Robeco October-2023.

4 For example, more general industrial exposure outside of the specific Building category

5 For example, green capital providers, environmental consultancy firms and science hubs

6 Hey Big Spender: Powering the climate transition with capex investments – Robeco - October 2025.

7 Have your cake and eat it, too: Finding alpha in sustainability – Robeco - June 2023

Restez informé des derniers développements en matière de durabilité

Abonnez-vous à notre newsletter pour découvrir les tendances qui façonnent l'investissement durable (ID).