Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

Uncertainty about the global inflationary consequences of the trade policies of the new US administration is high.

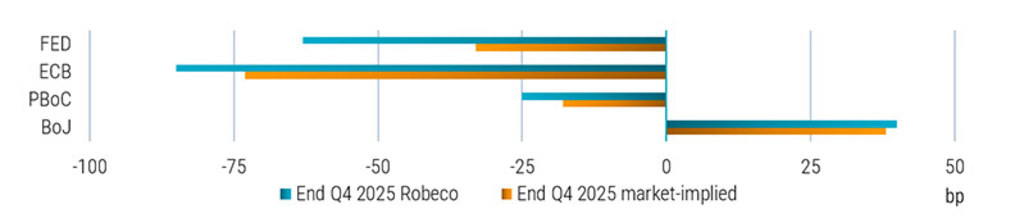

Against this backdrop we expect the key central banks to remain on separate lanes when it comes to their monetary policy settings in the months ahead.

The Federal Reserve seems to have adopted a wait-and-see stance as inflation remains above target and labor market conditions solid. But with the policy stance still viewed as restrictive, it retains an easing bias. Accordingly, and given the risk of a renewed rise in unemployment, our central scenario sees the Fed resume the descent back to ‘neutral’ by mid-year. The risk case is that imposed tariffs ignite inflation expectations, in which case a more prolonged pause beckons (the odds of the next move being a hike seem muted in our view).

Meanwhile, the ECB is sticking to a 25 bps per meeting cutting pace. And any tariffs imposed on Europe, on balance, will likely reinforce its ambitions to bring the depo rate back to 2% or below.

Elsewhere, the PBoC, despite earlier hints at further rate and RRR cuts, has steered money market rates higher to rein in the bond rally. In our view, the pledged easing will still be delivered, but timing remains uncertain and is being complicated by the tariff tussle between the US and China. Bucking the direction of travel of other DM central banks, the BoJ remains on a gradual hiking path – as Governor Ueda’s recent comments demonstrate –and is expected to deliver two additional 25 bps rate increases this year.

Source: Bloomberg, Robeco, based on money market futures and forwards, 20 February 2025

Subscribe to our newsletter for investment updates and expert analysis.