Get the latest insights

Subscribe to our newsletter for investment updates and expert analysis.

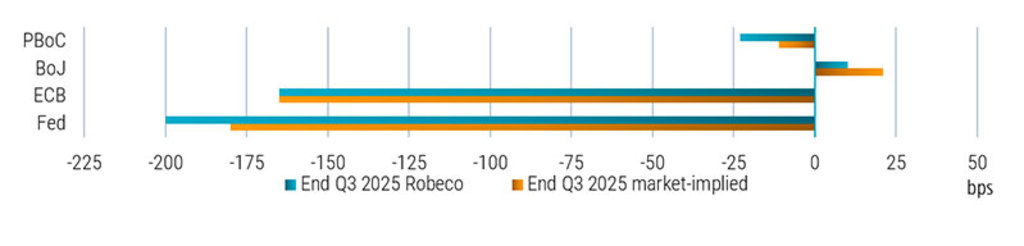

The pressure on the Fed and the ECB to ease policy has increased as inflation continues to cool and the employment outlook weakens.

While the Fed was hesitant to cut in early summer and the ECB was reluctant to ease policy, both central banks have now cut rates by 50 bps. They are clearly out of the starting blocks and looking ready for further easing. With leading indicators for growth or the labor market weakening on both sides of the Atlantic, the pressure to act has also become more acute. For both central banks we expect official rates to return to neutral by mid-2025.

While the PBoC took off from the starting blocks years ago, it has now shifted to full easing mode. ‘Enough is enough’— that is what Chinese policy makers must have thought after the ongoing economic and property market malaise and disinflationary trends. A package of stimulus measures was released at the end of September and more monetary easing is anticipated, judging from the policymakers’ rhetoric. At the least, we expect another 25-50 bps RRR cut by the end of this year.

The BoJ has initiated monetary tightening, but, contrary to the other three major central banks, does not feel the need for speed. Judging from recent comments by BoJ officials, near-term hikes or a path of aggressive policy tightening is unlikely. In fact, in our base case we don’t expect any additional hikes for the remainder of this year.

Source: Bloomberg, Robeco, based on money market futures and forwards, 3 October 2024

Subscribe to our newsletter for investment updates and expert analysis.