Upgrading the grid is an urgent global priority

A redesigned, rebuilt electricity network is a crucial enabler of the energy transition. In this insight we’ll describe the structure of a future grid, the emerging technology building blocks, and the status of this megaproject region by region.

概要

- Decaying electricity grids worldwide are inefficient and prone to failure

- Next generation grids will manage demand and support distributed supply

- The technology building blocks exist, but require massive investment

The energy crisis happening now in Europe and rippling across the world, in the midst of a record-breaking northern hemisphere drought, is a stark reminder that transitioning from fossil fuels to renewables is necessary from both an environmental and security standpoint. What is less well-known is that the crucial enabler of that transition will be the redesign and rebuilding of electricity grids sophisticated enough to accommodate more distributed power generation, and to dynamically manage demand. The International Energy Agency projects global investment in power grids needs to hit USD 820 billion per year by 2030, up from about USD 260 billion in 2020, if renewable energy projects required to limit global warming to 1.5 °C above pre-industrial levels are to be enabled1.

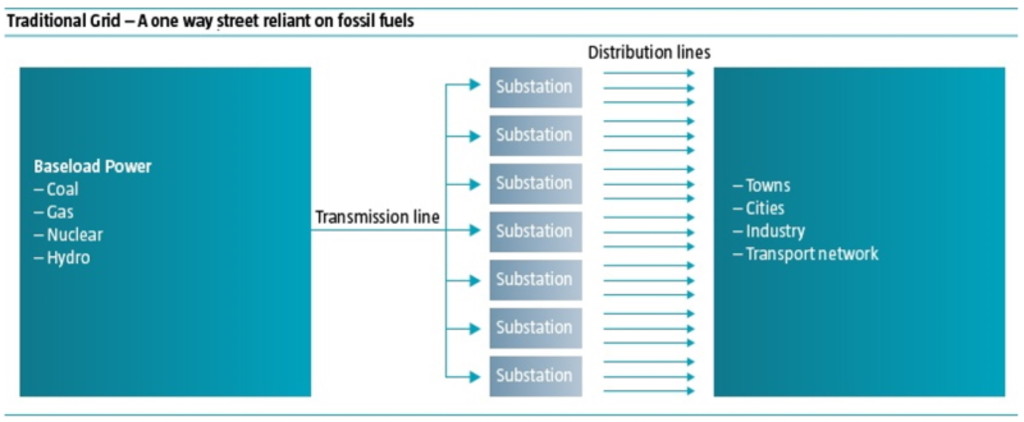

Existing grid design is based on primarily fossil fuel-powered generation capacity situated in well-chosen strategic locations and flowing one way to consumers. Fossil fuels like coal were plentiful and cheap and it was also manageable as you could switch generating capacity on and off relatively quickly. However, the infrastructure is aging and often unable to efficiently add new distributed supply, cope with extreme weather2, or accommodate new sources of demand like vehicle electrification.

What does the future grid look like?

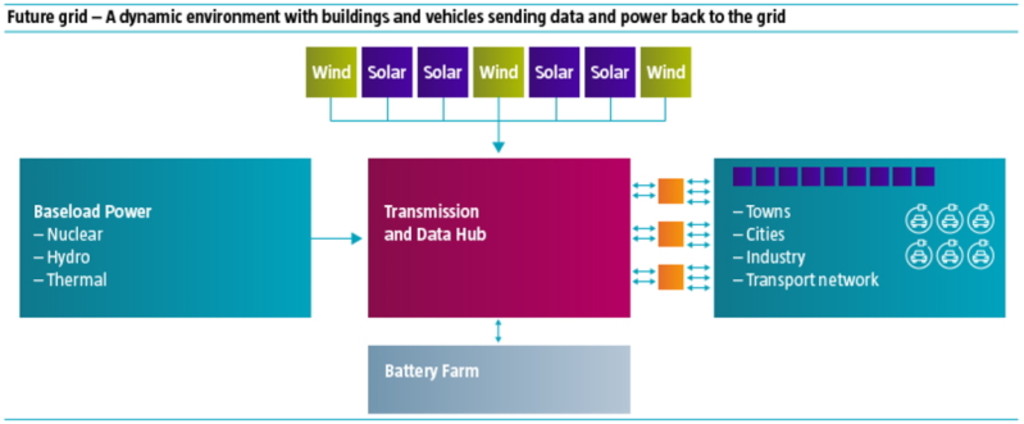

Future grid design will likely include some element of baseload power like hydro or nuclear that is not weather dependent in the short term. This is then augmented by renewable sources like wind and solar, on a vastly larger scale than currently installed. This will require new and replacement long-distance transmission lines, potentially from remote locations like offshore or desert areas, connecting to hubs that can convert the power to lower voltage for localized distribution.

Additional power will come from what were traditionally points of consumption like houses and factories via interconnectors feeding back into the wider grid. The increased complexity and horizontal integration of the grid will be managed by hubs with direct data transfer from points of consumption, or the 'grid edge'. If the utility has better information on end users' consumption as well as supply, power flows can be optimized in real time. Managing spikes in demand and bringing down peak load will provide immediate benefits in terms of cost and reliability, and help to justify the capex-intensive construction of new power lines.

獲取最新市場觀點

訂閱我們的電子報,時刻把握投資資訊和專家分析。

The state of play

Grid development is growing incrementally, as renewable energy sources come onstream, and to replace current aging infrastructure. As this decade progresses we expect more strategic involvement at Federal level in the US and EU level in Europe to build smarter, more efficient and resilient networks. While we have summarized the situation in the big three economic blocks below, the same urgency is driving policy elsewhere. For example, Australian national grid operator Aemo published its blueprint for a future grid3 in 2022, while Japan is redesigning its grid to reach renewable energy goals.4

Europe

Energy policy in Europe is currently in turmoil due to the sudden absence of Russian gas supply and the subsequent extraordinary spike in prices at the margin. Although there is significant short-term panic, and the likelihood of disputes between member states in the winter of 2022/20235, in the medium to long term this crisis is likely to be a positive catalyst for EU-wide integration of future grid development, expanding the ability to transmit power between member states.

China

China aims to significantly increase its power capacity by 2025 to 1.36 times that of 2020, and recognizes the need this creates for making the grid more flexible. Energy security concerns, the rapid addition of new renewable energy projects6 and the need to transfer power from the less populated west of China to the Eastern seaboard, are all factors driving grid investment.

US

Like Europe, the US grid has grown organically without Federal level planning. Recent legislation including the Infrastructure Investment and Jobs Act in November 2021 and the Inflation Reduction Act in August 2022 made some provision for grid investment, but this is far from the level of investment actually required, implying the onus will fall on the private sector. In particular there are no tax credits for transmission lines, and roadblocks to grid infrastructure like state-level planning permits remain a problem.

Future grid technology is already here

The global challenge of climate change has been resistant to technological solutions but the good news is that building the future grid is both practical and possible. Potential investable technologies include:

Next Generation Transmission infrastructure

Companies providing services for transmission line construction, operation and maintenance are anticipating higher order intake to connect new renewable projects to the grid. Due to the current level of underinvestment, the volume of essential construction projects is likely to continue to grow for years to come.

Smart metering

Smart meters provide utilities with actionable information on consumption and operation at the 'grid edge' and provide the end user with real-time feedback, enabling them to make more cost and energy-efficient decisions around consumption.

Existing smart meter manufacturers are also leading in provision of demand management solutions as they are already partners of utilities on the distribution side.

Virtual power plants

A virtual power plant (VPP) refers to a localized electricity grid with its own points of generation, consumption and storage. In an urban context, these might be roof-top solar panels, household appliances and electric vehicles respectively. It is a set of systems that optimizes and automates the generation, flow and consumption of electricity in complex use cases, such as residential areas or industrial sites.

Cybersecurity

Electricity grids are the largest 'cyber-physical' systems in the world, meaning access to the operating software can lead to direct control of physical assets. This is making cybersecurity investment an essential element of grid design and management.

The other facet of the grid that requires cyber safeguards is the electricity market itself. An interesting solution has emerged in Europe, where Transmission System Operators (TSOs) launched a 'crowd-balancing platform' called Equigy7 using private blockchain technology, facilitating the sale of excess electricity.

Conclusion

Building the future grid will take many years, perhaps decades. While some of the investment opportunities around the redesigned grid lie in the future, some companies including engineering and construction businesses, electrical component producers and utilities are already building the new grid brick by brick and cable by cable. These companies can look forward to many years of high and relatively uninterrupted growth, and thus provide investment opportunities right now.

Footnotes

1 https://www.bloomberg.com/news/articles/2022-09-06/world-spending-on-cables-will-have-to-rival-solar-and-wind-power?srnd=green

2 https://www.wsj.com/articles/chinas-scorching-heat-and-hydropower-missteps-test-nations-power-grid-11661514473?

https://www.wsj.com/articles/california-avoids-blackouts-by-texting-convincing-consumers-to-slash-power-use-11662658114?

3 https://www.theguardian.com/australia-news/2022/jun/30/what-australias-power-grid-urgently-needs-for-once-in-a-century-transformation-away-from-fossil-fuels?

4 https://www.reuters.com/world/asia-pacific/japan-considers-doubling-inter-regional-power-grid-boost-renewable-energy-2021-04-16/

5 Poland warns against plans for EU windfall levy on power producers - https://www.ft.com/content/6123bda2-12d7-48ae-a139-efd89f4a1034

6 https://www.bloomberg.com/news/articles/2022-09-13/china-rust-belt-province-plans-87-billion-clean-energy-overhaul

7 https://equigy.com/tso/

Important information

The contents of this document have not been reviewed by the Securities and Futures Commission ("SFC") in Hong Kong. If you are in any doubt about any of the contents of this document, you should obtain independent professional advice. This document has been distributed by Robeco Hong Kong Limited (‘Robeco’). Robeco is regulated by the SFC in Hong Kong. This document has been prepared on a confidential basis solely for the recipient and is for information purposes only. Any reproduction or distribution of this documentation, in whole or in part, or the disclosure of its contents, without the prior written consent of Robeco, is prohibited. By accepting this documentation, the recipient agrees to the foregoing This document is intended to provide the reader with information on Robeco’s specific capabilities, but does not constitute a recommendation to buy or sell certain securities or investment products. Investment decisions should only be based on the relevant prospectus and on thorough financial, fiscal and legal advice. Please refer to the relevant offering documents for details including the risk factors before making any investment decisions. The contents of this document are based upon sources of information believed to be reliable. This document is not intended for distribution to or use by any person or entity in any jurisdiction or country where such distribution or use would be contrary to local law or regulation. Investment Involves risks. Historical returns are provided for illustrative purposes only and do not necessarily reflect Robeco’s expectations for the future. The value of your investments may fluctuate. Past performance is no indication of current or future performance.